Key Takeaways

As an insurance company investing alongside our clients in both core and specialty fixed income, Voya brings a unique vantage point to help insurers manage risk and uncover opportunities amid market volatility.

Insurers looking to mitigate the effects of a trade war on portfolios should consider U.S.-based assets such as commercial real estate.

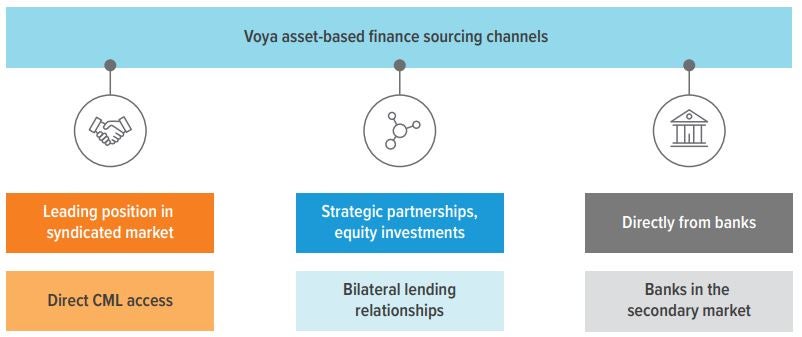

Private asset-based finance is here to stay, and we’re focusing on leveraging various partnerships and direct lending relationships to access a wider opportunity set to supplement our leading position in the syndicated private placement market.

Every resource committed to managing Voya’s insurance general account is extended to our insurance clients. Here are some strategies we’re using to navigate market uncertainty.

What should insurers take away from recent tariff-related market swings?

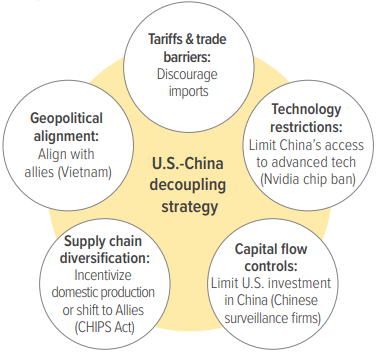

We believe that tariffs are just one part of a larger strategy to decouple the U.S. from China. From a geopolitical perspective, the takeaway from recent tariff-related market swings is that the United States is decoupling from China. In a bull case for U.S. markets, we renegotiate terms, and other countries outside of China reduce their barriers on U.S. goods and services. In a bear case, terms get renegotiated without us, and our trading partners find it more compelling to trade with each other than with the U.S.

As we have seen, the path to this decoupling with China has the potential to be extremely volatile (an understatement). And given that it’s reshaping the global economic order that existed for decades, we expect volatility to be with us for the foreseeable future.

So, from a portfolio management perspective, this means insurers should lean into the tools that provide liquidity and can help them capitalize on the credit curve and term structure steepening that will likely continue.

How is Voya positioning its insurance balance sheet to prepare for ongoing market volatility?

We are deploying a Treasury bucket to take advantage of market volatility. Since the historic repricing of interest rates in 2022, we have been opportunistic buyers of high-quality duration for several reasons. First, from a portfolio construction perspective, owning high-quality duration in the form of long Treasuries typically serves as a ballast for a portfolio in times of credit market stress, helping to smooth the bumps that could arise in the credit portfolio in a downturn. Second, increased volatility creates opportunities to tactically trade duration for insurance balance sheets, creating gains that can be redeployed to reposition the portfolio into higher-yielding securities (Exhibit 1). Third, once we generate a gain, we have greater flexibility to incur losses associated with trading out of issues and issuers where we have a less favorable credit outlook.

As of 04/17/25. Source: Bloomberg.

What can insurers do to insulate their portfolios from a trade war?

One way is by leaning into U.S.-focused assets that are less sensitive to global trade dynamics such as parts of the commercial real estate (CRE) market. Typically, commercial real estate lags the broader downturn in the economy given the presence of longer-term leases. Through the Covid environment, CRE corrected first given the secular pressures on retail and office and the broad-based impact of sharply higher interest rates in the inflationary aftermath. Lending in domestic-focused CRE markets today with lowered valuations can be attractive versus lending to global corporates at mid-cycle spread levels.

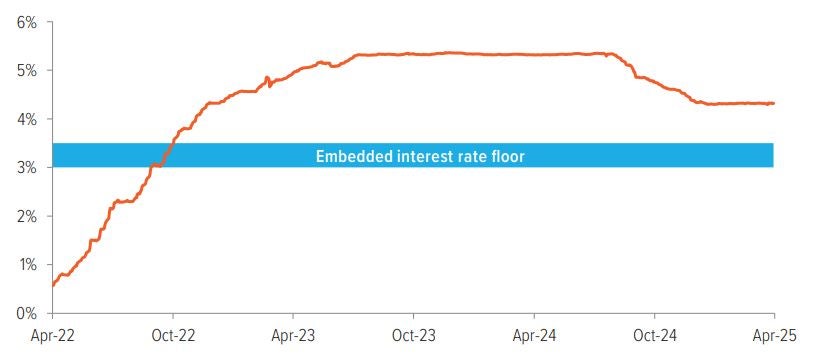

In today’s higher-rate environment, given the availability of short-term, fixed-rate financing, many borrowers are reluctant to lock in long-term, fixed-rate debt. That dynamic, along with the evolving role of regional banks, is creating opportunities in core floating-rate loans with embedded interest rate floors, which we are pairing with our Federal Home Loan Bank (FHLB) leverage program. This pairing creates a compelling structure: If short-term rates stay high, we earn attractive floating-rate income. But if rates fall sharply, our borrowing costs decline with them—and because our funding source has no floor, the spread actually increases in extreme cases (Exhibit 2).

We’re also seeing improved loan-to-value ratios as borrowers focus more on flexibility. While there has been some uptick in IO loans and less amortization built into structures, in many cases, borrowers are simply buying time—and for us, that means better structural protections, better underwriting terms, and the opportunity to build positions that can weather market volatility.

At the same time, we’re staying highly selective. We’re avoiding property types with indirect trade exposure—for example, industrial warehouses tied to import-heavy supply chains—and concentrating on assets where local demand, stable tenancy, and cash flow resilience drive value.

As of 04/17/25. Source: Bloomberg, Voya IM.

What other tools do insurers have to capitalize on volatility?

FHLB can help drive risk-adjusted returns. Adding durable, low-cost external leverage to lower-volatility assets via the FHLB system can be an attractive way to enhance risk-adjusted return potential, versus owning higher-volatility assets with more embedded leverage directly on insurance company balance sheets.

For the proprietary Voya balance sheet and for many of our third-party insurance clients, access to the FHLB system is first and foremost a source of contingent liquidity in times of market stress. Once enterprise risk management needs have been suitably addressed, a spread lending program can be conservatively sized to the amount of FHLB-eligible collateral available on the balance sheet. Applying leverage to core floaters in the commercial real estate market is just one example of the potential benefits. Another example is to add collateralized loan obligations at discount dollar prices given the recent spread widening in that space.

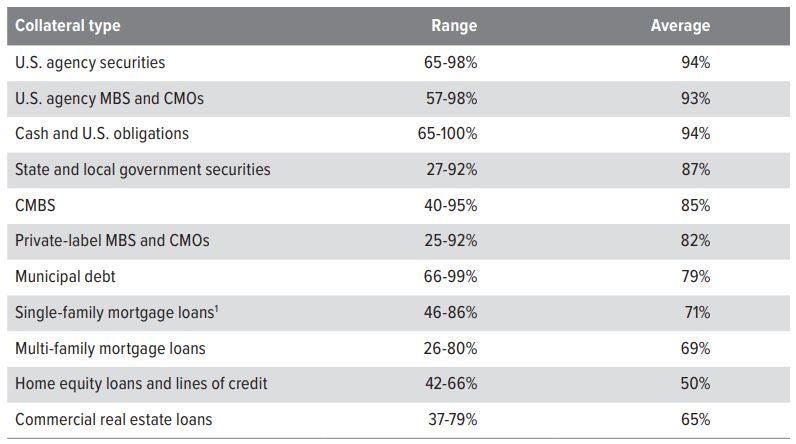

Aligning with the FHLB system’s mission to support housing markets and community development, eligible securities also include U.S. government-related securities, agency residential mortgage-backed securities (agency RMBS), select AAA rated non- agency RMBS, select agency and AAA rated non-agency commercial mortgage-backed securities (CMBS), residential and commercial mortgage whole loans, and certain municipal securities (Exhibit 3).

We can help insurance companies evaluate options for sizing a program within a given risk management framework and existing collateral base, designing a liability profile that provides an appropriate match with the asset profile.

1 Includes Federal Housing Administration and Department of Veterans Affairs loans. Source: FHLB Office of Finance, “Lending and Collateral Q&A”, 03/22/24.

How should insurers think about public credit in the current environment?

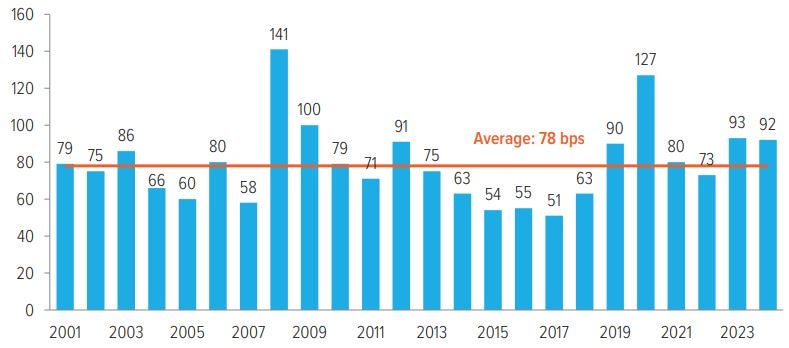

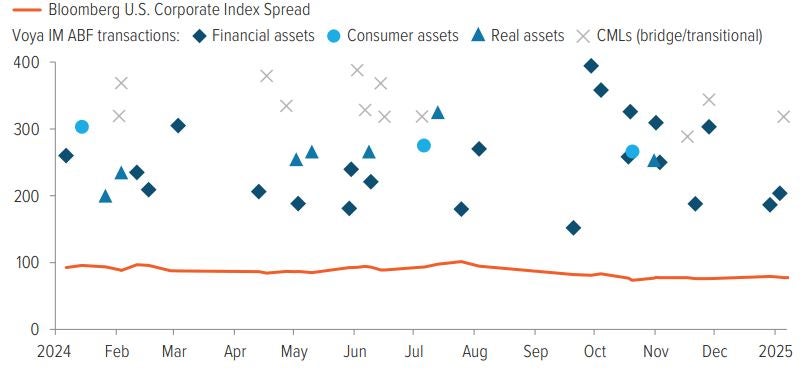

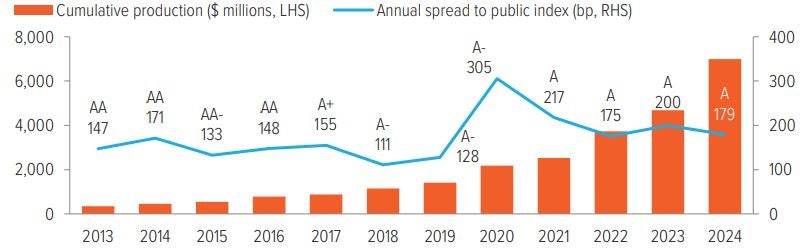

We think it’s prudent to add more private credit and get very selective with credit selection. Most insurance accounts have structural demand for corporate credit for both duration and diversification needs. Where we are able to do so, we have gradually shifted public credit allocations to the private credit market, where the spread-to-public (STP) remains attractive for locking in long-term yield (Exhibit 4). Further, in the event of an uptick in event risk due to debt-financed M&A, particularly in the diversified industrial space, we view private credit as relatively insulated by way of stronger covenants.

For our private credit holdings, we can look to the lessons of the Covid-induced market shock, when we were concerned that the restrictive covenants in privates may not be able to protect the downside in a dramatic shock to business fundamentals. However, what ultimately played out during Covid was that high-quality companies were provided a liquidity bridge. And while we expect there to be idiosyncratic stress in private credit, well-structured covenants will bring lenders to the negotiating table, and we believe our underwriting is going to do well in that environment.

Within public credit, uncertainty about the path forward for growth also increases the focus on active security selection in a credit portfolio. As credit curves have compressed across quality cohorts, we are tilting our allocations to be higher quality and in more defensive sectors in the tight spread environment, where reaching for risk in cyclical sectors isn’t adequately compensated. More specifically, we’ve emphasized rotating our portfolio out of issuers and sectors more highly exposed to the consumer and economic cycle and into defensive businesses that can withstand a market downturn. From a portfolio construction perspective, we want to own high-quality duration as ballast in case of a market downturn. With all-in yields attractive, we continue to add opportunistically there.

As of 12/31/24. Source: Voya IM and Bloomberg.

Is anything expected to change for private asset-based finance?

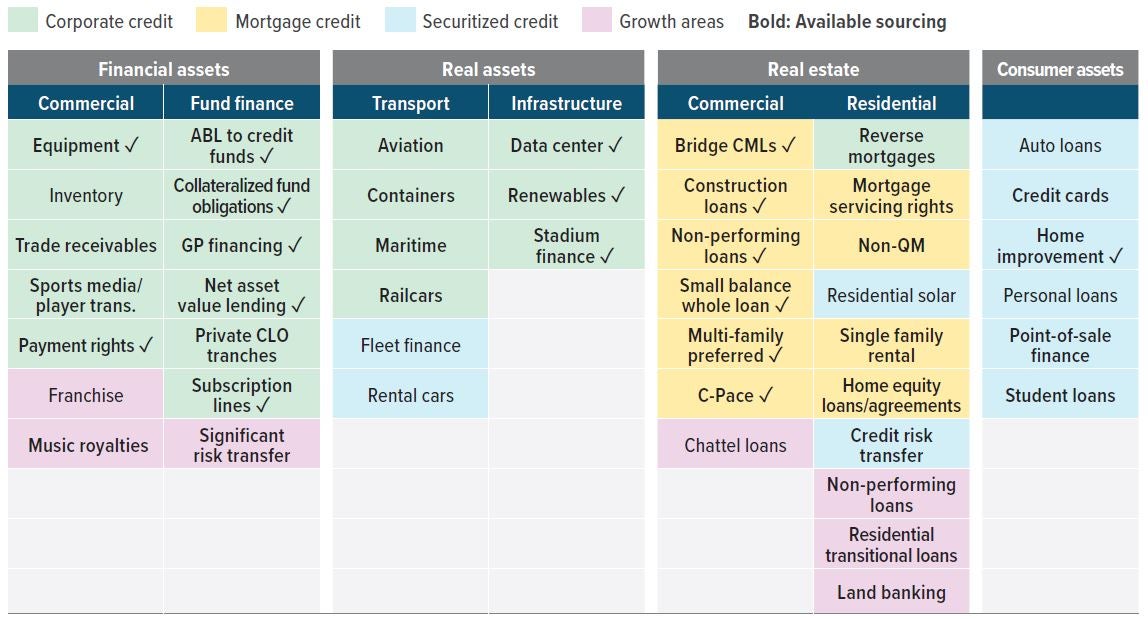

We believe private ABF is here to stay. We continue to be excited about what we’re seeing in the private ABF space and expect to increase our allocation over time. Against the backdrop of bank disintermediation, lending that has typically been the domain of banking enterprises is finding its way to insurance company balance sheets. These are often types of risks that Voya has experience underwriting, but the evolving opportunity set has led to an expansion in our deal sourcing. We are partnering with banks in new and unique ways, as well as with other aligned insurance asset managers, to source interesting deal flow for our balance sheet and for external clients (Exhibit 5).

Source: Voya IM. For illustrative purposes only.

Where are we seeing the best ABF opportunities today for the Voya GA?

The CRE and residential mortgage sectors remain appealing, in our view. We believe securitized credit generally offers better spreads than corporate credit, especially in commercial and residential mortgage markets. Financing has opened up in recent months, creating healthy issuance in CMBS. There’s also been more two-way flow in real estate assets, which is creating greater financing needs. The residential mortgage market is still reasonably attractive, and we believe mortgage-related assets could do well here.

As of 01/24/25. Source: Voya IM.

Are there any areas of ABF that we’re avoiding?

We avoid investments tied to assets with concerning underwriting models. We put a lot of emphasis on understanding the structural changes playing out in different lending markets. For each investment, we assess whether it makes sense on a marginal basis. When an unestablished consumer lending shop with three people and an algorithm thinks it can extend credit to consumers better than traditional models, we’re steering clear. Unsecured consumer loans extended to people that need to borrow at a high-teens percentage also doesn’t feel like a financial product with structural legs.

In addition, consumer-oriented loans could feel pressure in an environment where consumer defaults pick up due to economic strain caused by the administration’s trade policies.

What if market uncertainty causes private deal flow to stall?

At Voya, we’re able to lean on our strong sourcing network. In periods of more limited deal flow, Voya and our clients have historically benefited from our strong specialty fixed income franchises with deep, all-weather sourcing relationships. For example, having a three-decade history in the syndicated private placement market has allowed us to build strong relationships with agented banks, and those relationships have supported our deal flow. Over 2024, the Voya Private Credit Investment Grade team deployed nearly $7 billion for clients at an attractive STP (spread to public), relative to historical averages. We are also an active player in the secondary trading market for private credit, having purchased nearly $1 billion for clients in the secondary market over the past three years.

Source: Voya IM.

For clients in similar situations, we have been advising them to evaluate whether their managers have the right sourcing relationships. In the recent environment, we have even worked with some clients/prospects with slow deployment to expand their origination pipeline by having Voya manage a mandate that doubles down on deals that they may already be underwriting and acquiring, either through their internal team or another external manager, to ensure they are not getting cut back too much on allocations.

As of 12/31/24. Source: Voya IM.

Preparing portfolios for ongoing volatility

Voya is positioning for a new volatility regime. Amid the market stress, we are focused on the important role of duration in portfolios, assets less sensitive to global trade dynamics, and gradually shifting into private credit (in favor of public credit). Adding durable, low-cost external leverage to lower-volatility assets via the FHLB system can be an attractive way to enhance risk-adjusted return. In addition, non-bank lenders have increased market share in lending activities that were traditionally the domain of banks, providing a very attractive opportunity in ABF that is well suited for insurance company balance sheets.

A note about risk: The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Foreign investing does pose special risks, including currency fluctuation, economic and political risks not found in investments that are solely domestic. Emerging market securities may be especially volatile. Investments in mortgage-related securities involve exposure to prepayment and extension risks greater than investments in other fixed income securities. The strategy may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and could have a potentially large impact on performance. Investments in commercial mortgages involve significant risks, which include certain consequences that may result from, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market, and other exogenous economic variables. All security transactions involve substantial risk of loss. The strategy will invest in illiquid securities and derivatives and may employ a variety of investment techniques, such as using leverage and concentrating primarily in commercial mortgage sectors, each of which involves special investment and risk considerations. Other risks include, but are not limited to: credit risks; credit default swaps; currency; interest in loans; liquidity; other investment companies’ risks; price volatility risks; inability to sell securities risks; U.S. government securities and obligations; sovereign debt; and securities lending risks.