Key Takeaways

Voya Investment Management manages nearly $3 billion of spread lending programs for its proprietary balance sheet and select third-party clients.

The insurance portfolio management team at Voya IM has broad experience with spread lending programs, having managed programs through 7 of the 11 Federal Home Loan Banks over time.

We can help insurance companies evaluate options for sizing a program within a given risk management framework and existing collateral base, designing a liability profile that provides an appropriate match with the asset profile.

Adding durable, low-cost external leverage to lower-volatility assets via the FHLB system can be an attractive way to enhance risk-adjusted return potential versus owning higher-volatility assets with more embedded leverage directly on insurance company balance sheets.

Introduction

The Federal Home Loan Bank (FHLB) system, particularly its role as a provisioner of liquidity to its members in times of stress, came into focus in 2023 following the failures of Silicon Valley Bank (SVB), Signature Bank and First Republic Bank. All three banks served specific customer segments who had large proportions of uninsured deposits, making the banks particularly vulnerable to bank runs. As higher interest rates pressured the market value of the banks’ loans and securities and raised questions about their balance sheet health, the banks experienced rapid deposit withdrawals.

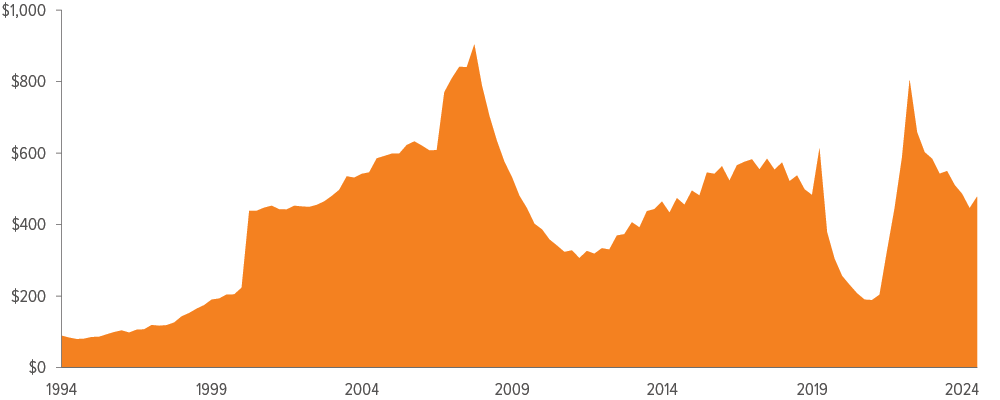

The liquidity pressure that the banking system faced was met in part by soaring advances from the FHLB system. After falling to a 20-year low in 2021, FHLB advances spiked in 2023 as strains among regional banks escalated (Exhibit 1). FHLBs proved themselves to be a crucial source of liquidity outside the Federal Reserve facility, issuing more than $300 billion in debt to other banks the week following the collapse of SVB.1

While there was no comparable uptick in liquidity demand from insurer members given their more stable liability profiles, the FHLB system once again demonstrated its utility as a provisioner of liquidity to stressed financial sector participants.

As of 06/30/25. Source: Bloomberg.

The FHLB system continues to prove its relevance

The FHLB system has been a reliable source of low-cost leverage for nearly a century. Established with the Federal Home Loan Bank Act of 1932, FHLBs have provided liquidity to member institutions to support housing and mortgage markets and to foster community investment and development. As the regulator for the FHLB system, the Federal Housing Finance Agency has undertaken a review known as the “FHLBank System at 100: Focusing on the Future.” The regional bank stress that coincided with this review only highlights the foundational purpose of the FHLB system as a reliable source of funding for its members.

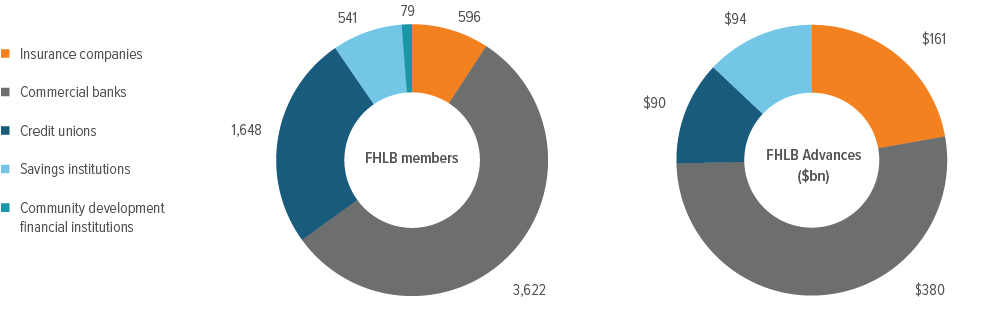

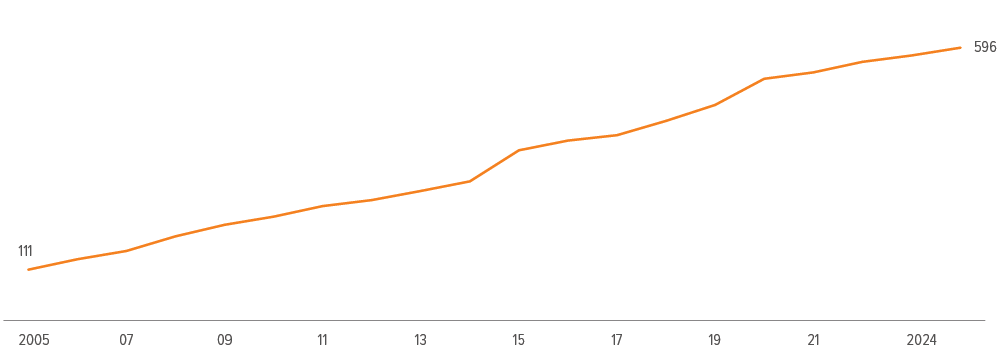

At the end of 2024, more than 6,400 financial institutions were members of the system, including 596 insurance companies (Exhibit 2). Although insurance companies still represent a minority of the bank-heavy membership roll, their number has steadily risen, reflecting the reliability of the FHLB system in times of market stress (Exhibit 3).

For the proprietary Voya balance sheet and for many of our third-party insurance clients, access to the FHLB system is first and foremost a source of contingent liquidity in times of market stress. This is apparently also the case for many insurance company members: Of the 596 insurers in the FHLB system, only 224 (38%) had advances outstanding at year-end 2024. As we saw with the banking sector stress in 2023, contingent liquidity is a key component of managing enterpriselevel risks. However, an appropriately constructed spread lending program can also enhance risk-adjusted returns.

As of 12/31/24. Source: Federal Home Loan Banks: Combined Financial Report.

As of 12/31/24. Source: Federal Home Loan Banks: Combined Financial Report.

Once enterprise risk management needs have been suitably addressed, a spread lending program can be conservatively sized to the amount of FHLB-eligible collateral available on the balance sheet. Since lendable values are a function of market value changes and the FHLB’s prescribed collateral haircuts, the capacity for a spread lending program can fluctuate over time with market conditions. Higher interest rates in recent years could have required members that were less conservatively positioned to source additional collateral at a moment when liquidity was most dear. Spread lending programs need to be suitably sized to account for swings in collateral value.

Collateral

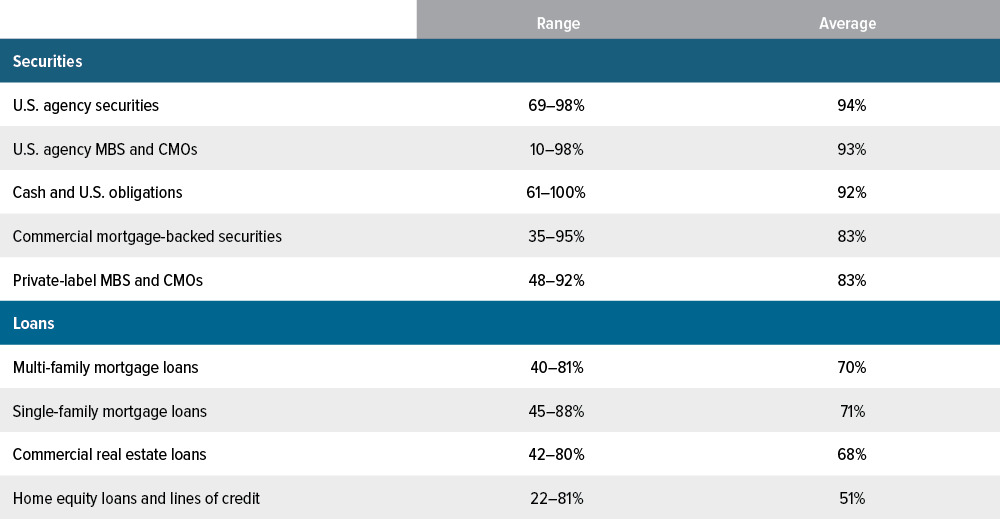

Fortunately, many of the investments that insurance companies already make in the normal course of managing their general account assets are available as potentially eligible collateral to be pledged against FHLB advances. Aligning with the FHLB system’s mission to support housing markets and community development, eligible securities include U.S. government-related securities, agency residential mortgage-backed securities (agency RMBS), select AAA rated non-agency RMBS, select agency and AAA rated non-agency commercial mortgage-backed securities (CMBS), residential and commercial mortgage whole loans, and certain municipal securities (Exhibit 4).

As of 12/31/24. Source: Federal Home Loan Banks: Combined Financial Report.

Investment opportunity set

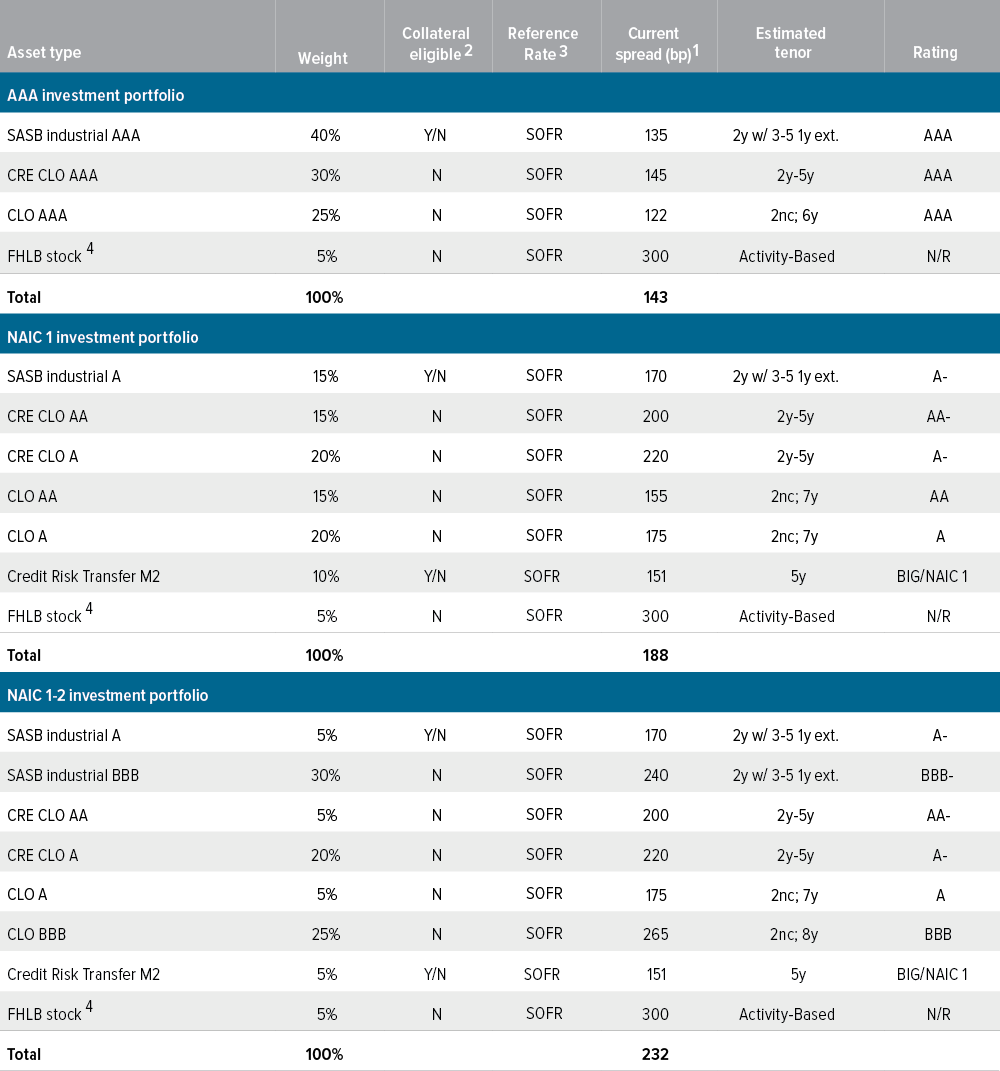

Once a program is appropriately sized to on-balance-sheet collateral—leaving a cushion for contingent liquidity needs and market fluctuations in lendable value—an insurance company is ready to build a spread lending program. Voya IM runs its programs floating-to-floating, taking advances that fluctuate with the short-term financing costs of the FHLB system and buying floating-rate assets. The desire to operate in a floating-rate manner leads to a tilt towards securitized assets, which are a textbook diversifier from insurers’ corporate-credit-heavy fixed-rate portfolio. Furthermore, portfolios may be constructed to meet a variety of risk appetites (Exhibit 5).

As of 09/30/25. Source: Bloomberg, J.P. Morgan, Wells Fargo, Voya IM. Reference rate is SOFR on new production and Libor (with fallback language) on seasoned collateral.

1 Data as of 09/30/2025. Source: Voya Investment Management, Bloomberg, JP Morgan, Wells Fargo.

2 Y/N: Eligibility requirements differ by bank.

3 Reference index is SOFR on new production and LIBOR (w/fallback language) on seasoned collateral.

4 Select bank dividend spread on SOFR.

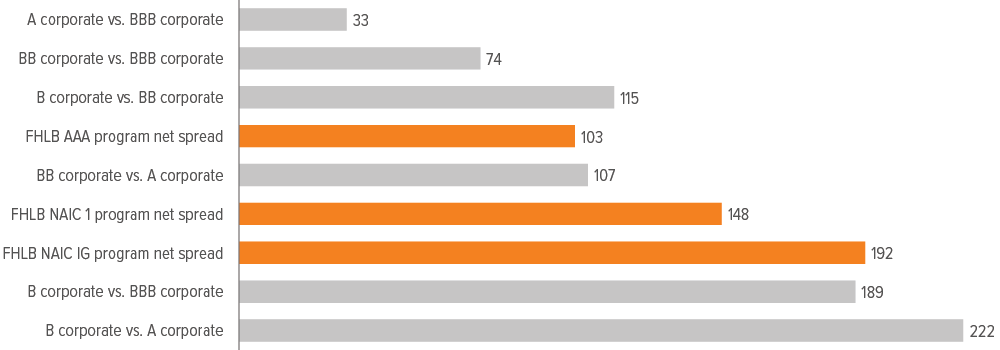

Financing rates can differ slightly between FHLBanks, across tenors, and based on the reference rate and reset dates. For purposes of this paper, we assume investors take advances for a three-year term (roughly the average life of the reinvestment portfolios). We also assume the advances are based on a spread over the SOFR (roughly a 40 bp spread in the current market environment). Subtracting that spread from the total indicated above, we estimate a potential spread pickup of 103 bp for the AAA investment portfolio, 148 bp for the NAIC 1 portfolio, and 192 bp for the NAIC investment grade portfolio (Exhibit 6).

As of 10/31/25. Source: Bloomberg Indexes, Voya IM.

In short, insurance companies can borrow in secured form from a government-sponsored entity at attractive financing rates and purchase high-quality, capital-efficient, loss-remote securities. This arrangement compares favorably with other risks insurance companies can take to earn the same level of spread premium. For example, FHLB programs can generate sizeable spread premia compared with the incremental spreads that can be achieved by moving down in credit quality in the corporate bond market, taking on risk via inherently higher-levered companies.

Part of the compensation in this floating-to-floating program (in addition to credit risk) comes from the fact that bondholders have sold call options to issuers. A typical collateralized loan obligation (CLO) has a two-year call option, capping some of the upside from tightening spreads. A typical floating-rate single-asset, single-borrower commercial mortgage-backed security (SASB CMBS) may have a two-year term with three to five one-year extension options. Voya IM retains the option to call its FHLB advances at their monthly or quarterly reset dates with no prepayment penalties, allowing these programs to adapt their borrowing profile to changes in the average life of the asset portfolio as the moneyness of these call options changes in different market environments. While keeping a reasonable match between assets and liabilities is appropriate risk management, the FHLB system’s long-tenured history of durable financing makes rolling these advances highly likely as long as suitable collateral is available.

In this way, by selling call options to bond issuers, FHLB programs can generate additional compensation. Though this does mean absorbing some cash flow variability, the effect can be easily offset by the liability-side flexibility provided by optionality on FHLB advances.

As market conditions have evolved, we have considered adaptations to our traditional floating-to-floating spread lending program. Elevated short-term rates and a still relatively flat term structure have kept funding costs above historical averages. While the coupons on our floating-rate assets have risen as well, we have considered using excess cash flow or bond liquidations of lower-yielding fixed-rate securities outside the program to pay down advances and thereby increase overall net investment income for the enterprise.

Given this curve structure and heightened interest rate volatility, we have also considered changing our philosophy on always retaining prepay flexibility. Rising realized interest rate volatility has increased the value of interest rate options. By entering into intermediate-tenor advances that are “put-able” at the option of the FHLBank, we could greatly lower financing costs versus current spot floating rates or even similar- tenor Treasuries.

By selling that option to the Bank in exchange for lowered financing costs, the borrower would be exposed to rates moving sharply lower and the contract staying outstanding. However, we are expecting any drop in rates to be more gradual amid uncertainty around Fed policy and inflation dynamics.

Avoiding mistakes

For insurance companies, the business model is predicated on using investment leverage to drive returns to equity. The FHLB system offers an even lower-cost source of funding than the implicit or explicit crediting rate on many insurance products. Despite the funding advantage, not all insurers have been successful with their spread lending programs. Errors have been made in ascertaining the appropriate level of credit risk, managing the collateral risk, and managing the mark-to-market risk on both the reinvestment portfolio and the collateral portfolio.

Credit risk: Voya IM prefers to add leverage to low-volatility assets in its spread lending programs. Some investors take on too much credit risk in their programs, leading to credit losses that overwhelm the incremental spread premia of the program. Other market participants target a certain return on capital (i.e., returns in excess of the returns on existing business units). They end up solving for the “right” level of spread, which can lead to “reaching for risk.” Part of the Voya approach is adding leverage to lower-risk, loss-remote assets in lieu of owning higher-risk assets in unlevered form. A spread lending program should be thought of as a complement to an existing investment opportunity set and designed to drive risk-adjusted returns, not simply as a means of adding risk outright.

Collateral risk: Thinking of the FHLB spread lending program as a separate business line can complicate the separation of the FHLB collateral backing the advances and the FHLB reinvestment portfolio. This can lead some market participants to use advances to further add securities that can be pledged as collateral. In times of stress, credit rating downgrades can make these securities ineligible to be pledged. A program that should be used to bolster enterprise-level liquidity may then be a drag on liquidity as money needs to be redirected to purchase additional collateral or the program needs to de-lever in a period of spread widening.

Mark-to-market risk: A well-underwritten spread lending program should allow portfolio managers to withstand market volatility. However, acute market stress (Covid shock, global financial crisis) can increase portfolio unrealized losses. Participants in spread lending programs need to have the fortitude to maintain (or expand) the program during market dislocations, relying on a “through the cycle” approach to underwriting the associated fundamentals. Investors that eschew the preferred floatingto-floating program structure and buy fixed-rate assets that are swapped back to a floating rate also introduce markto-market volatility on the interest rate swaps. A seasoned program with laddered advances and securities of varying spread durations can limit this mark-to-market volatility.

Path forward

If you are looking to start an FHLB spread lending program, we would welcome the opportunity to share our experience and take you through the process in a step-by-step manner. This would include:

- Working together to discuss the program with the sales team at your affiliated FHLBank, potentially leveraging existing relationships of personnel at Voya IM

- Understanding the collateral guidelines of your FHLBank and evaluating options for sizing a program for your existing collateral base

- Discussing the current market investment opportunity and the possible range of expected economics and returns on capital

- Designing a program given varied funding opportunities and reinvestment options

- Understanding your overall risk management framework and relevant limits to settle on a size for the program and a risk profile for the asset portfolio

- With all of the above in mind, designing a liability profile that provides an appropriate match with the asset profile

We look forward to leveraging our long history of managing FHLB reinvestment portfolios for the benefit of our insurance clients.