Key Takeaways

We’re increasingly finding opportunities in asset-based finance, taking advantage of attractive spread-to-public premia, diversifying collateral and desirable structural characteristics

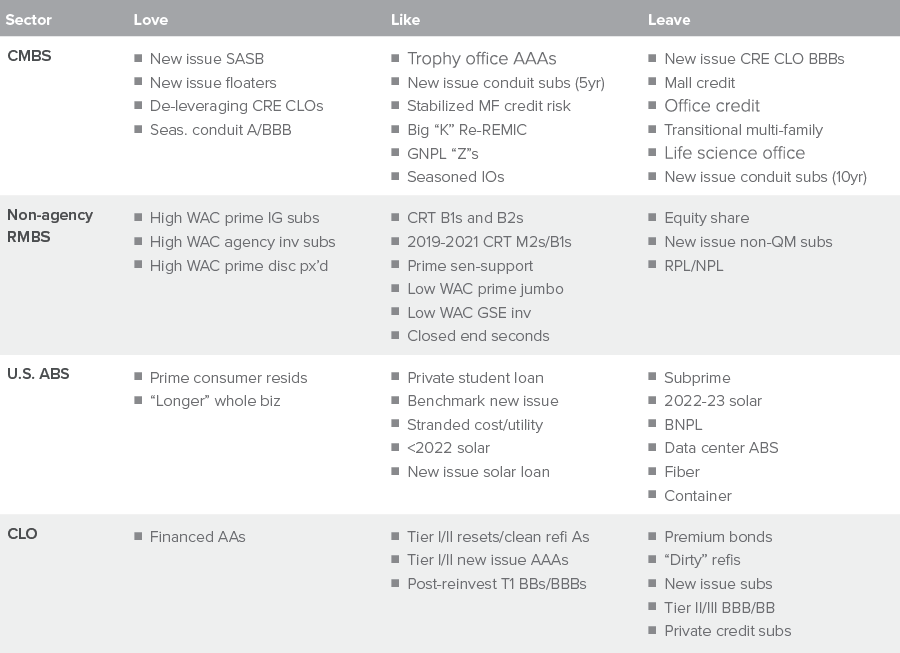

We favor securitized given tight corporate credit spreads, with particular focus on commercial real estate and residential mortgage markets. We are avoiding untested securitization models and newer consumer origination platforms.

Amid shifts in the backdrop, we continue to pursue active management in portfolios, generating income-accretive turnover frequently on a gain/loss, risk-and often duration-neutral basis.

The Fed is readjusting, the regulatory landscape is shifting and private equity is changing the game. No wonder our insurance clients have so many questions. Here’s how we make sense of it all.

Asset-based finance (ABF) is garnering a lot of attention. What’s Voya’s view?

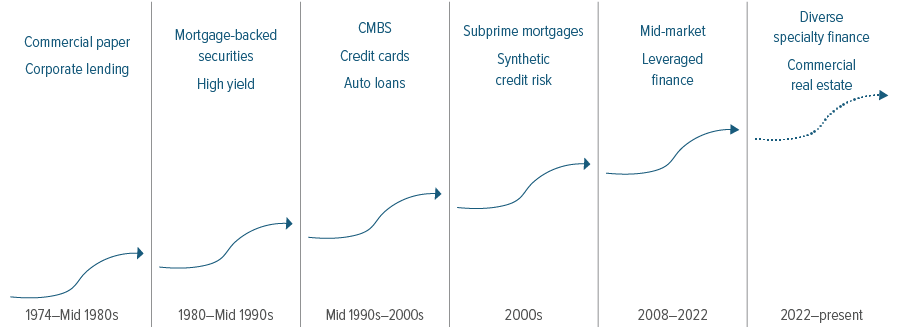

Voya is the largest manager of private placements for third-party insurance companies,1 and roughly 10-15% of that flow over time has been in syndicated asset-backed security (ABS) transactions.2 As disintermediation in the banking sector continues to unfold, lending that has typically been the domain of banking enterprises is finding its way to insurance company balance sheets (Exhibit 1). This includes a wider array of structured opportunities with attractive incremental spread-to-publics premia. Asset-based finance—broadly defined as private lending against diversified pools of contractual cash flows—is one such example.

Source: Oliver Wyman.

We’re excited about what we’re seeing in the space and expect to increase our allocation over time. We believe the industry will do the same. Sourcing is of particular focus, and we’re looking to access more private ABS and asset-based financing, both directly and through partnerships where we don’t own the origination channel and are able to be opportunistic and nimble in the face of evolving relative value. This includes:

- Bilateral lending relationships in the fund finance space

- Reimagining traditional relationships with specialty finance companies that we have in our corporate lending business that can create more ABS-like flow

- Strategic partnerships, or “clubbing up,” with other insurance companies

- Partnering with asset managers looking to lever their own underwriting and trade off some portion of their securitization best suited for an insurance company balance sheet

That being said, untested underwriting models concern me. We put a lot of emphasis on understanding the structural changes playing out in different lending markets and assessing whether an individual investment makes sense on a marginal investment basis. When an unestablished consumer lending shop with three people and a machine learning algorithm thinks it can extend credit to consumers better than traditional models can, we’re going to steer clear. Unsecured consumer loans extended to people that need to borrow at a high-teens percentage also don’t feel like a financial product with structural legs.

Where are the best opportunities in securitized?

When you look across the credit field, a lot of sectors are trading near historically tight levels. Investment grade corporate bond spreads are inside of 80, which is the tightest level since March 2005.3 High yield and leveraged loans are slightly less unattractive, but those sectors have been tightening as well (Exhibit 2).

As of 10/31/24. Source: Bloomberg. IG represented by the Bloomberg U.S. Corporate Index. HY represented by the Bloomberg U.S. Corporate High Yield Index. See endnotes for index definitions and additional disclosures.

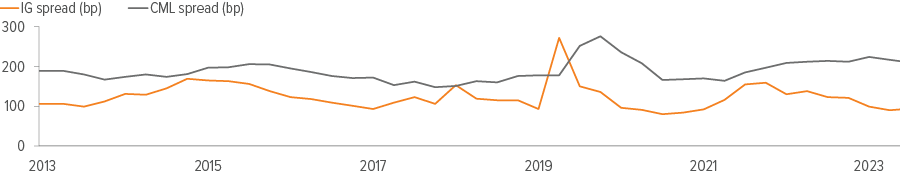

By contrast, the commercial real estate market has been starved for credit, so CRE-related credit looks attractive. Annual realized spreads of the commercial mortgage loan (CML) commitment report constructed by the American Council of Life Insurers typically trend above corporate spreads, compensating for their lower liquidity. Yet CML spreads have remained elevated in the face of richening public corporate credit beta (Exhibit 3).

As of 06/28/24. Source: American Council for Life Insurers, Bloomberg. CML spreads represented by the annual realized spreads of the Commercial Mortgage Loan Commitment report constructed by the ACLI. IG represented by the Bloomberg U.S. Corporate Index. See endnotes for index definitions and additional disclosures.

Financing has opened up in recent months, creating healthy issuance in commercial mortgage-backed securities (CMBS). There’s also been more two-way flow in real estate assets, which is creating greater financing needs. The residential mortgage market is still reasonably attractive, and we believe mortgage-related assets are going to do well here. Both the Federal Reserve and banks have curtailed their appetites for agency mortgages, having been among the biggest buyers a few years ago, allowing insurance companies to be a marginal provider of capital at higher yields and spreads. We are reasonably constructive on residential housing, where the backdrop is driven by a lack of supply and where we expect consumer mortgage rates to fall from current elevated levels.

Areas we think insurers should avoid include investments with untested securitization models and some of the new consumer origination platforms.

As of 10/02/24. Source: Voya IM. ABS: asset-backed security. CLO: collateralized loan obligation. CMBS: commercial mortgage-backed security. CRE: commercial real estate. NPL: non-performing loan. REMIC: Real Estate Mortgage Investment Conduit. Re-REMIC: A REMIC made from another REMIC. RMBS: residential mortgage-backed security. RPL: re-performing loan. SASB: single asset single borrower. WAC: weighted average coupon.

What are Voya’s views on regulatory changes affecting equity residual tranches?

While a blunt pronouncement, we generally support the National Association of Insurance Commissioners’ (NAIC) initiative. Admittedly, the increase in the charge on equity residual tranches from 30% to 45% creates challenges in assessing the relative value of investment opportunities governed by the change. A venture capital equity fund with a single investment would generate a 30% capital charge, for example. Structural inefficiencies are an immediate result, which insurance companies will likely manage around.

But the focus on capital-efficient structures is unlikely to change. I think we’ll see the market gravitate towards a model where rated feeders are not completely stapled together, and there may be flexibility in where that residual is held. In many of the structures today, the residual tranche can be owned within an affiliated entity, such as a non-regulated non-operating company. This might offer a way to work around the increase in capital charges in a way that is favorable to regulators who see that “first loss” piece leave regulated balance sheets.

How are you balancing gain/loss management in the current environment?

High interest rate volatility has created tremendous opportunity for insurance companies to realize gains, and we have taken advantage of the backdrop to generate income-accretive turnover in our client accounts.

To put this in context, the Bloomberg U.S. Long Credit Index generated total returns of around 20% during two very short periods: October 2022 to January 2023, prompted by the U.K. pension crisis, and the market surge during the fourth quarter of 2023, after the Fed signaled it was done tightening.4 These are absolute returns—not annualized returns—highlighting the value that can be created in the more liquid, high-quality portion of an insurer’s portfolio through active repositioning.

Consistent with a more active approach, we typically use gains to offset losses. Hypothetically, that can mean taking gains in the long end and offsetting with losses in the belly with like risk. For example, you could realize a 6-point loss in a 3-year-duration security with a market yield 200 bp higher than its book yield, offset by the same gain in a 12-year-duration security that has rallied 50 bp. Pairing those two trades together in equal size could create a gain/loss-neutral transaction that picks up 75 bp.

How much illiquidity is too much?

Enterprise liquidity risk management is important for any financial institution. For an insurance company, it involves maintaining a balance between liquid and less liquid assets, tailored to the liability structure of the company. In my view, insurance companies, with their focus on investment grade securities, often keep too much available liquidity on hand. This is especially true relative to commercial banks whose liabilities are mostly demand deposits (which move quickly in times of stress) and whose primary assets are below investment grade commercial loans.

The regional banking crisis in 2023 reminded us of some key considerations regarding liquidity that should underpin any strategic and tactical asset allocation decision. First, assets traditionally deemed liquid can actually be quite illiquid in times of stress. During 2023’s regional banking crisis, for example, the Bloomberg U.S. Corporate Index’s spread increased from around 115 bp in mid-February to around 165 bp in mid-March.5 That 50 bp selloff in spreads is greater than the worst single-year loss rate (0.4% in 2008) for investment grade corporate bonds of our careers (1983-2023).6 Over a very short period, investors were getting paid more per year than the worst one-year loss rate on IG credit assets. This was a historically outsized move that represented widening illiquidity premia in addition to increased credit risk.

Meanwhile, assets traditionally viewed as illiquid are becoming more liquid. This is the case for private credit, where secondary trading has increased and a rise in securitization of various underlying risk premia is increasing liquidity overall.

We typically advise clients to maintain some component of their asset allocation in highly liquid assets, paired with access to contingent liquidity sources. This incremental leverage can take the form of a repo program, advances through the Federal Home Loan Bank system or, for some insurers, uncollateralized funding agreement-backed notes.

How can clients with long-duration liabilities capitalize on floating-rate opportunities?

This was a common question from clients during the Fed’s tightening cycle and throughout the historically long period of yield curve inversion.

Our preferred way to take advantage of floating-rate opportunities is to add floating-rate liabilities, which can come in the form of FHLB advances. An insurer could also take out a funding agreement-backed note and swap it to floating. In addition, they could consider rolling repo to the extent it fits within their broader enterprise liquidity framework.

Options that don’t incur incremental leverage might include barbelling a position in floating-rate assets with intermediate- or longer-duration securities, or running a temporary asset/liability mismatch. Our current bias is to start to fade allocations to floaters in these examples, given the start of the Fed’s easing cycle.

What is the future role of private equity in the insurance landscape?

Looking into 2025, we will almost certainly see continued growth in private-equity-backed insurance companies and growth in PE’s market share in annuity origination. Further out, however, a key question is whether these companies will keep using the money they raise to reinsure blocks from legacy insurance riders. This is a mature space with a lot of competition, which means we’re going to see deals that result in lower expected internal rates of return to the equity. I expect the private equity industry will subsequently evolve from trying to reinsure legacy books into models focused on new writers of fixed indexed annuities and relatively simple annuity products.

Much of the growth in annuity origination by private equity sponsors has been driven by desire to grow a private credit platform. Like many insurance companies, the liability side of Voya Financial’s balance sheet has been reshaped by private equity. On the investment management side, we are creating adjacencies with PE sponsors in the current environment, where we can partner on direct origination. This includes areas such as asset-based finance, as we previously discussed, where it makes sense for our own proprietary capital and for our third-party clients as well.

Summary

With an eye on the changing insurance landscape, here are (arguably) the top takeaways for our clients. We would be happy to dive deeper into any of these topics with you, and we invite you to let us know if there are any other ways in which we might share our expertise.

- We’re increasingly excited about asset-based finance, focusing on utilizing various partnerships and direct lending relationships to access a wider opportunity set.

- The CRE and residential mortgage sectors remain appealing, with robust issuance and growing financing needs.

- We’re generally supportive of recent regulatory adjustments affecting equity residual tranches, but the focus on capital-efficient structures is unlikely to change.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Foreign investing does pose special risks, including currency fluctuation, economic and political risks not found in investments that are solely domestic. Emerging market securities may be especially volatile. Investments in mortgage-related securities involve exposure to prepayment and extension risks greater than investments in other fixed income securities. The strategy may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and could have a potentially large impact on performance. Investments in commercial mortgages involve significant risks, which include certain consequences that may result from, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market, and other exogenous economic variables. All security transactions involve substantial risk of loss. The strategy will invest in illiquid securities and derivatives and may employ a variety of investment techniques, such as using leverage and concentrating primarily in commercial mortgage sectors, each of which involves special investment and risk considerations. Other risks include, but are not limited to: credit risks; credit default swaps; currency; interest in loans; liquidity; other investment companies’ risks; price volatility risks; inability to sell securities risks; U.S. government securities and obligations; sovereign debt; and securities lending risks.