Insurance Companies

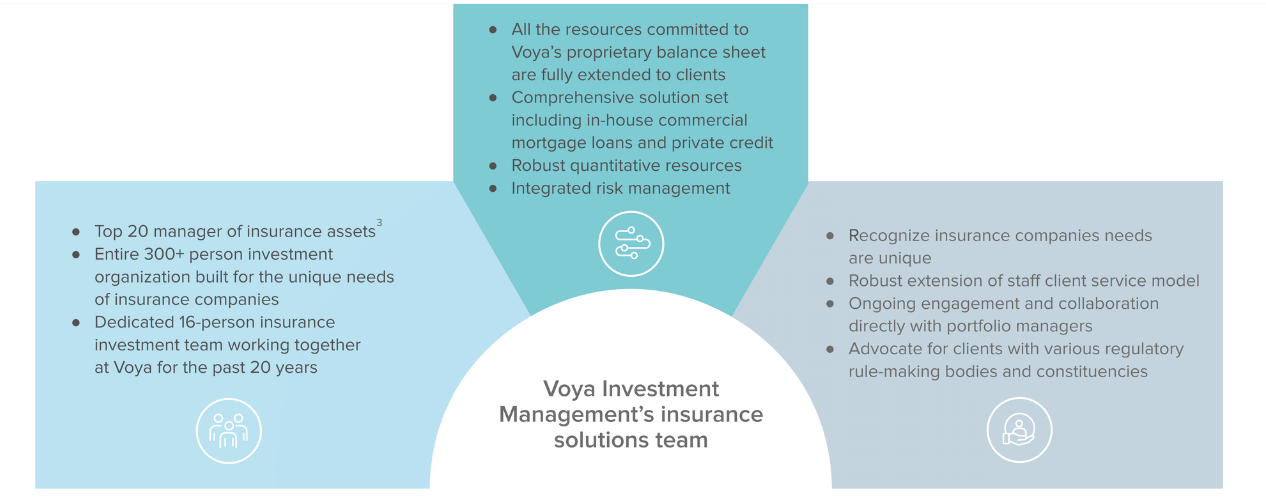

Voya Investment Management’s insurance solutions team focuses on helping to guide, build, and manage customized investment solutions for insurance companies.

Our Philosophy

With over 40 years of insurance asset management experience globally, we are committed to being a reliable partner for our clients. We focus on delivering capital efficient investment solutions through a cross-functional, collaborative process led by our specialized Insurance Portfolio Management team (IPM), with clear accountability, speed to implementation, and connectivity to support expertise.

The client is at the center of all that we do. Our experienced insurance solutions team acts as a center point of contact for each client, in order to bring the best of Voya to each organization.

Experienced provider of customized investment solutions to insurance companies

Specialized Market Expert

|

Custom Solutions Provider

|

Committed Partner

|

Insights & Resources

About the Team

Contact Us

Awards & Recognitions

Insurance Investors’ Real Estate Manager of the Year

Insurance Investors’ Private Markets Manager of Year

In 2024, Voya Investment Management (Voya IM) was named Insurance Investors’ 2024 Real Estate Manager of the Year & Insurance Investors' 2024 Private Markets Manager of the Year. Submissions are judged on multiple factors, including solutions offered and evolution of the investment track record (ex. holdings, styles of investing), that demonstrate the fund manager’s focus on innovation and evolution in their management approach. Submissions were evaluated on a scale of 1(weak) -100(excellent). To participate, a firm must provide any return data for its track record. Voya IM did not pay a fee to be considered for the award but did pay a $300 fee to receive the award. Awards and/or rankings are not representative of actual client experiences or outcomes and are not indicative of any future performance.

1 As of 09/30/24.

2 Pensions & Investments, “The Largest Money Managers,” 2024 Survey based on assets as of 12/31/23.

3 DCS Financial Consulting, Clearwater Analytics based on assets as of 12/31/23.