With attractive yields, robust covenant protection, and ample liquidity, investment grade private credit is a growing favorite of both investors and borrowers. Here’s what you need to know.

Executive summary

Private credit is a $1 trillion, primarily investment grade fixed income asset class used by nearly all life insurers and about half of pension funds as a substitute for investment grade corporate bonds to enhance portfolio diversification and yield. There are three main types of private credit transactions: corporate, infrastructure and asset-based finance (ABF).

As the #1 private placement manager for external clients for three years in a row, Voya is highly experienced in helping new clients navigate this rapidly evolving asset class successfully.1

As of 05/31/25. Source: Voya IM estimates, Reg D filings, StoneCastle, BofA. Spreads calculated from the Voya Private Credit Strategy and General Account total production, 01/01/03-03/31/25.

What is investment grade private credit?

There are several types of private credit, including private placements, senior loans, distressed debt and mezzanine finance. Our focus here is on private placements, which are essentially long-term loans to corporations, 90% of which are investment grade.2

Functionally, private placements are a hybrid of a public bond and a traditional bank loan. They share characteristics with public bonds, including a fixed rate structure and term length. Similarities with bank loans include greater upfront due diligence, priority debt and financial covenant protection, and a more engaged relationship with borrowers.

These debt offerings are private because the notes are sold only to qualified institutional buyers (QIBs3 ) and, as such, do not have to be registered with the U.S. Securities and Exchange Commission (SEC). For purposes of this paper, the terms “private credit” and “private placements” refer to Regulation D securities4 and do not include securities issued under Rule 144A.5

At over $1 trillion, the aggregate market for private placements is significantly smaller than the U.S. public corporate bond market.6

However, the private placement market is currently in a dynamic growth phase, thanks to an influx of new originators, evolving investor demand, and a pullback in bank lending.

As well as overall market volume increasing, the private credit market is also seeing noticeable increases in average transaction size over the past few years, along with greater diversification of collateral, duration, and deal structure.

The majority of deals (85%) are marketed by intermediaries to either the entire market or a subset of the market. Only 10-15% of deal volume in the investment grade private credit market is direct, as few investors have the scale to commit to direct transactions when the average deal size is in the hundreds of millions.7

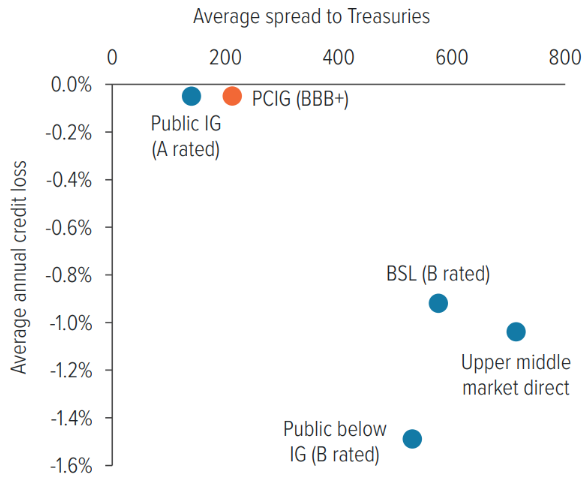

As of 03/31/25. Source: Standard & Poor’s, Morningstar, BoA, CDLI, Society of Actuaries, Voya IM estimates. Average annual credit loss and average spread over risk free are measured over the 18-year period 01/01/05-12/31/22.

A note about risk Private placements are generally investment grade assets, and like all investments, there are risks associated with investing in a portfolio of private placements. Risks described below are not all-inclusive, and before making an investment in a portfolio of private placements, investors should carefully consider such an investment. The primary risk to an investment in private placements is credit risk. Credit risk is the risk of non-payment of scheduled interest or principal payments on a debt instrument. In the event a borrower fails to pay scheduled interest or principal payments on its debt, a portfolio of private placements would experience a reduction in its income and a decline in market value. Private placements generally involve less risk than unsecured or subordinated debt and equity instruments of the same issuer because the payment of principal and interest on private placements is a contractual obligation of the issuer that, in most instances, takes precedence over the payment of dividends, or the return of capital to the borrower’s shareholders and payments to public bond holders. In the event of the bankruptcy of a borrower, a creditor could experience delays in receiving regular payments of interest and principal and may not receive the full repayment of its principal. Portfolios of private placements are also subject to interest rate risk. One risk related to interest rates is the potential for changes in the interest rate spreads for private placements in general. To the extent that changes in market rates of interest are reflected not in a change to the base rate, the U.S. Treasury, but in a change in the spread over the base rate which is payable on loans of the type and quality in which a portfolio invests, a portfolio of private placements could also be adversely affected. This is because the value of a debt is partially a function of whether it is paying what the market perceives to be a market rate of interest, given its individual credit profile and other characteristics. However, unlike changes in market rates of interest for which there is only a temporary lag before a portfolio reflects those changes, changes in a placement’s value based on changes in the market spreads on loans may be of longer duration. If spreads rise as described above, for example, in response to deteriorating overall economic conditions and/or excess supply of new loans, the principal value of private placements may decrease in response. On the other hand, if market spreads fall, the value of private placements may increase in response, but borrowers also may renegotiate lower interest rates on their debts or pay off their debts by refinancing at such lower rates. In that case, the borrowers would be required to pay a makewhole amount, which would mitigate the risk. Private placements trade in a private, unregulated market directly between loan market participants; although most transactions are facilitated by broker-dealers affiliated with large commercial and investment banks. As a result, purchases and sales of private placements typically take longer to settle than similar purchases of bonds and equity securities. In addition, because private placement transactions are directly between investors, there can be greater counterparty risk. Moreover, despite the increase in the size and liquidity of the private placement market, the market is still relatively illiquid, particularly when compared to the markets for bonds and equities. As a result, portfolios invested in private placements may experience difficulties and delays in purchasing or selling private placements, with resulting adverse impacts upon the prices obtained. During periods of severe market dislocation, such as occurred at the end of 2007 and during 2008, the market can experience severe illiquidity and significantly depressed prices. Finally, many borrowers are private companies and/ or companies that have not issued other debt that is rated by rating agencies such as Moody’s Investors Service, Standard & Poor’s, or Fitch Ratings. As a result, investment decisions related to private placements may be based largely on the credit analysis performed by the adviser to the fund or portfolio making the investments, and not on rating agency evaluation. This analysis may be difficult to perform. Information about a private placement and the related borrower generally is not in the public domain, since private companies and companies that have not issued public debt or securities are not subject to reporting requirements under federal securities laws. However, borrowers are required to regularly provide financial information to lenders, typically in much greater detail than is available in the public markets. Furthermore, information about borrowers may be available from other private placement participants or agents who originate or administer private placements. |