Key Takeaways

The sharp sell-off in interest rates since the start of the hiking cycle has created attractive investment opportunities for insurance investors, but liquidity strains have been common across the industry.

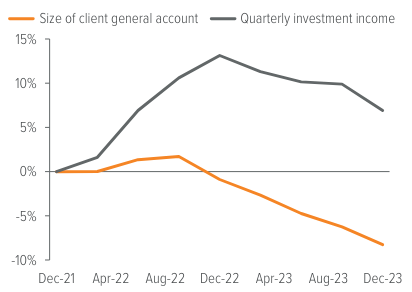

For a multi-sector insurance mandate we oversee, we have delivered higher gross investment income even as the portfolio size has shrunk materially due to business outflows. A flexible approach to portfolio construction has met enterprise liquidity needs, while growing earnings, managing income volatility, and controlling credit risk.

With public spread premia at tight levels, accessing private market credit premia in a de-risked, structured form (perhaps enhanced by modest external leverage) can drive attractive incremental investment returns.

An active core fixed income model can help insurers manage changing business conditions when unexpected macro volatility hits.

The benefits of actively managing core fixed income

For our insurance investment clients, we think about our role as working to deliver attractive risk-adjusted returns and income over a business cycle. In endeavoring to deliver that result, you want to have risk budget available to invest counter-cyclically, adding attractive spread premia when markets are pressured and pricing in recessionary outcomes. As yields in the industry’s investible opportunity set marched higher in the inflationary burst post-COVID, many insurance investors found themselves without one key ingredient to locking in higher yields: liquidity.

The title of this piece is a reference to the ubiquitous warning to passengers on the London Underground, but it is another phrase emanating from across the pond that is worth heeding here. Former wartime U.K. prime minister Winston Churchill famously declared that one should “never let a good crisis go to waste.” With fixed income markets under pressure in recent years, there has been an opportunity to buy bonds at deep discounts and the highest yield levels in a decade. However, many insurance companies have grappled with strained liquidity conditions. Whether annuity writers with lapses outpacing new business, P&C insurers impacted by inflation-influenced claims severities, or social inflation-impacted health insurers, there have been a series of drivers of tightened liquidity across the sector.

For a specific client account negatively impacted by liquidity outflows, we have been able to increase investment income since the start of the hiking cycle, even as the amount of assets we manage has declined due to liability outflows. For this client, liabilities have shortened, but we have been able to “mind the gap” and manage this evolving asset-liability match through active portfolio management. We entered into year-end 2021 with a negative duration gap at the edge of our target band, and added significant floating-rate assets over the next year as the evolving policyholder behavior of annuitants shortened the liability duration. Today, we are more closely matched than when the hiking cycle began—with a much higher portfolio book yield.

Source: Voya Investment Management.

Driving income higher by 7% over a two-year period, while the portfolio shrunk 8% without realizing losses requires a high-touch, multi-sector approach. In much of the post-financial crisis era, outsourced investment mandates have traded to the lowest cost providers and have therefore been managed more passively. Following the active/passive shift in equities, the dominant view was that core fixed income mandates were simply sources of beta to be accessed at the lowest possible cost. Unfortunately, for many who subscribed to that view, commoditized core fixed income strategies (meant to capture beta) have been slow to adapt to a rapidly evolving environment. The Churchillian desire to capitalize on a crisis went unfulfilled for these accounts. We believe in a higher touch, client focused core fixed income model that includes active repositioning to meet changing client needs over time. As we have seen in the past two years, a quickly evolving macroeconomic environment can lead to changing insurance company business conditions that require responsive active management of the investment portfolio.

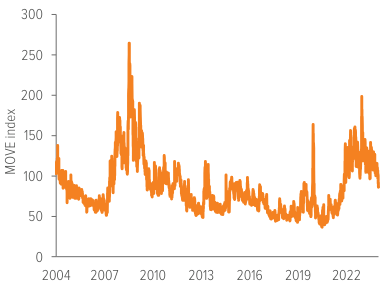

This rapidly evolving investment environment is reflected in a common measure of bond market volatility. The MOVE Index, a measure of U.S. bond market volatility that tracks options on interest rate swaps, has remained elevated at levels not seen persistently since the global financial crisis. This type of heightened market volatility is leading to greater performance dispersion among insurer portfolios. Since the first interest rate hike of this cycle on March 16, 2022, the MOVE Index has not closed before a reading of 86. This local low close is above the trailing 20-year average reading of around 85. Above average market volatility has persisted consistently for two years—creating risk and opportunity for insurers.

Source: Voya Investment Management, ICE, Bank of America, Bloomberg. The MOVE index is the Merrill Lynch Option Volatility Estimate and represents a market-implied measure of bond market volatility.

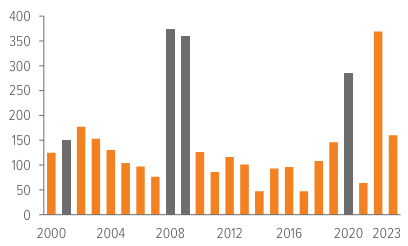

Maybe a more simplistic view of volatility shows the range between the lowest and highest yields for the investment grade corporate bond market since the turn of the century (Exhibit 3). Often a proxy for new money rates for insurance companies, yields available on investment grade corporate bonds have swung meaningfully. The last two years have seen the largest range of yields since the last three recessionary environments (denoted in gray). Insurers are experiencing recession-level yield ranges in a largely benign environment for corporate credit risk broadly.

Source: Bloomberg, Barclays, Voya Investment Management. Gray bars indicate periods of recession. Investment grade spreads represented by the Bloomberg U.S. Aggregate Corporate Index Average OAS.

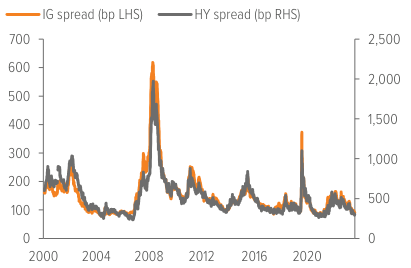

Finding value beyond public credit

While we have been able to create value in the more liquid portion of the portfolio as conditions have remained persistently volatile, there is also growing and expanding opportunity in less liquid asset subtypes. Public corporate credit spreads have moved back towards historic tights, but less liquid asset subtypes continue to offer interesting value. Exhibit 4 shows long-run graphs of investment grade and high yield corporate bond spreads, depicting today’s historically tight spread levels.

Source: Bloomberg, Barclays, Voya Investment Management. IG spreads represented by the Bloomberg U.S. Aggregate Corporate Index Average OAS. High yield spreads represented by the Bloomberg U.S. Corporate High Yield Index Average OAS.

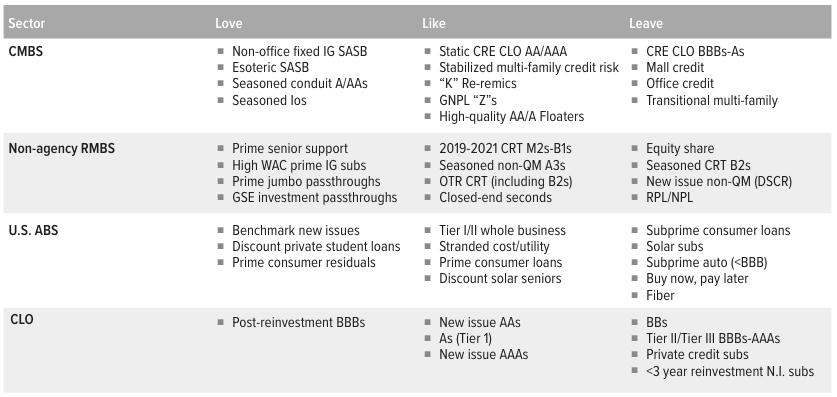

Building flexible multi-sector public fixed income portfolio is part of minding the asset-liability management gap. Driving part of the increase in investment yield depicted in Exhibit 1 has been a tilt towards pan-securitized. Offering a range of fixed and floating rate structures and attractive credit spread premia from the front-end to the belly, this diverse asset subtype has provided a host of compelling investment opportunities in an environment where the inverted yield curve has persisted. Exhibit 5 (aptly organized as love, like, leave) highlights the parts of the securitized market where we are currently finding attractive risk-adjusted spread… and where we are not.

Source: Voya Investment Management.

The environment of higher short-term yields and wider credit spreads than public corporate alternatives has created opportunities in securitized assets with attractive carry for low volatility, loss remote assets—assets we love. We think attractive returns are achievable without taking more exposure to stressed sectors, weaker credit collateral, and without accessing deeply subordinated tranches— assets we would leave.

Capturing attractive risk-adjusted spread premia in commercial real estate lending

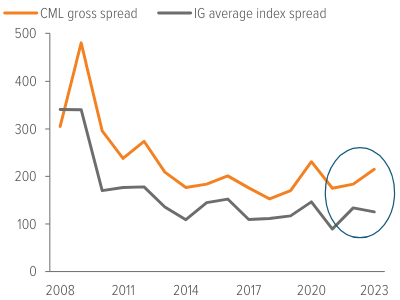

With public corporate credit spread beta feeling relatively rich, one place where risk-adjusted spread remains attractive is in commercial-real-estate-related risk. It is unique to see corporate credit spreads at tight levels when commercial real estate markets are in a recessionary environment. Exhibit 6 shows annual realized spreads of the Commercial Mortgage Loan Commitment report (constructed by the American Council of Life Insurers) versus this investment grade corporate bond index.

Source: American Council for Life Insurers, Voya Investment Management. CML gross spreads represented by the annual realized spreads of the Commercial Mortgage Loan Commitment report constructed by the American Council of Life Insurers. IG spreads represented by the Bloomberg U.S. Aggregate Corporate Index Average OAS.

Last year, the average spread on CML commitments widened out from 184 bp over similar maturity Treasuries for full-year 2022 to 215 bp for full-year 2023. Average spreads on the IG index tightened last year, rallying from 130 bp at year-end 2022 to just 99 bp at year-end 2023. This rising spread premia for commercial mortgage loans in 2023 came with improved structure and a generally shorter weighted average life.

Since the end of 2019—the last full year of commercial mortgage loan production before the pandemic—the average spread on commercial mortgage loan commitments for the insurance industry was just 170 bp. Spreads for 2023 were 45 bp higher at a similar leverage level, albeit on nearly 30% less volume. Comparatively, public IG spreads averaged 117 bp in 2019 and 125 bp in 2023. Currently, IG spreads sit below the tightest levels we saw in 2019.

Collecting liquidity and credit premia in private credit

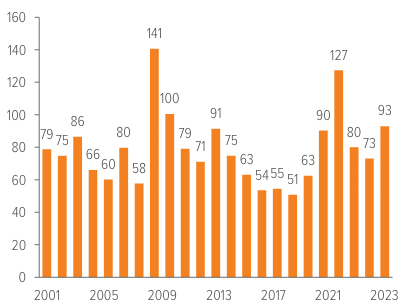

Part of the large spread premia available in commercial mortgage loans is compensation for their lower liquidity. Another area where we commonly glean spread premia is investment grade private placements. In our more than two-decade history of committing to investment grade private placements, 2023 saw the fourth widest spread-to-publics on record. The spread versus the comparable bond in 2023 was 93 bp (roughly doubling the spread on the broad public index today). This 93bp incremental spread premium was the widest spread-to-public premia outside of the COVID-impacted 2020 production and the global financial crisis-impacted 2008 and 2009 production.

There was a noted disconnect between public and private investment grade credit markets in 2023. Spread-to-public comparables for private assets tend to move pro-cyclically—widening as public spreads widen and tightening as public credit spreads tighten. Over the course of the year, public credit spreads tightened meaningfully while private market spreads remained wide. This widening differential was likely driven by the differences in demand for the more global public fixed income market and the more insurance-heavy private placement buyer base. As insurance companies saw liquidity pressure, demand slackened for private credit while the global public corporate credit market maintained a voracious appetite for dollar-dominated yield.

Source: Voya Investment Management. Data presented is based on assets held across proprietary insurance portfolios of Voya Financial and/or those managed for external clients of Voya Investment Management. Past performance is no guarantee of future results.

Summary

As we think about delivering for our clients, we know we need to do these three things well:

- Actively manage our core fixed income allocation

- Capture attractive risk-adjusted spread premia in commercial real estate lending

- Collect liquidity and credit premia in private credit

While some insurance companies have been dealing with liquidity pressure—including those with disintermediation risk working to “mind the gap”—we have still been able to capture attractive liquidity premia in commercial real estate lending and private credit. Leaning into liquidity risk for balance sheets facing manageable liquidity risk requires an active approach to core fixed income. Having those managers work in tandem can create real value for insurance company balance sheets.

A note about risk The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity, but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more-sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. High-Yield Securities, or “junk bonds”, are rated lower than investment-grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Foreign investing does pose special risks, including currency fluctuation, economic and political risks not found in investments that are solely domestic. Emerging market securities may be especially volatile. Investments in Mortgage-Related Securities involve exposure to prepayment and extension risks greater than investments in other fixed-income securities. The strategy may use Derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Investments in commercial mortgages involve significant risks, which include certain consequences that may result from, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market, and other exogenous economic variables. All security transactions involve substantial risk of loss. The strategy will invest in illiquid securities and derivatives and may employ a variety of investment techniques, such as using leverage and concentrating primarily in commercial mortgage sectors, each of which involves special investment and risk considerations. Other risks include but are not limited to: Credit Risks; Credit Default Swaps; Currency; Interest in Loans; Liquidity; Other Investment Companies’ Risks; Price Volatility Risks; Inability to Sell Securities Risks; U.S. Government Securities and Obligations; Sovereign Debt; and Securities Lending Risks. |