Voya Machine Intelligence

Welcome to the Third Wave of Investing

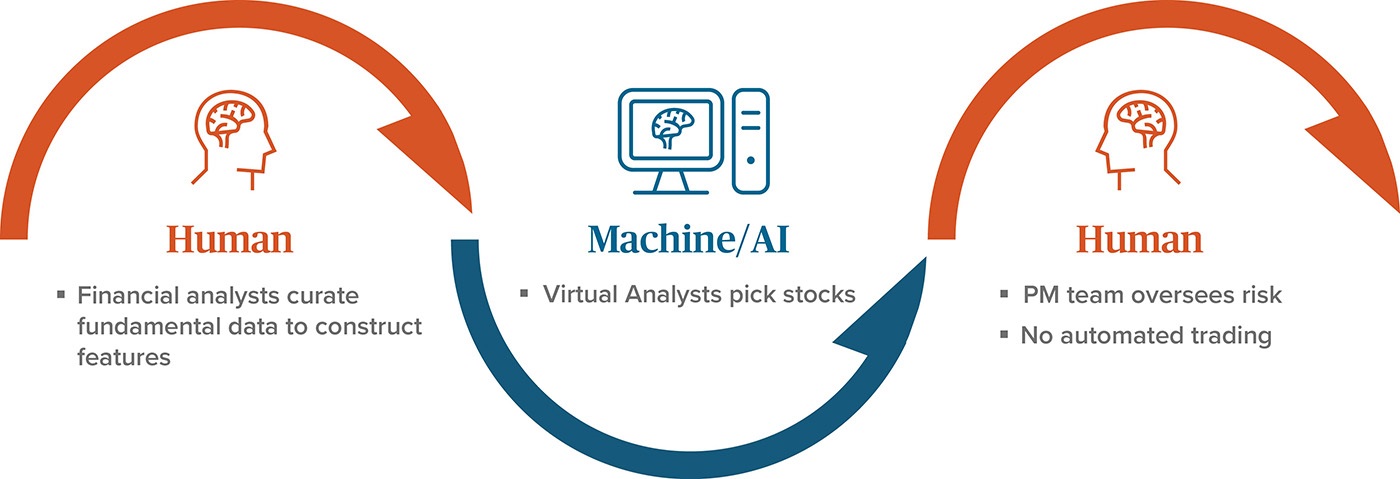

Imagine if we could combine the depth of fundamental analysis with the breadth of quant research—and turbocharge it with machines that can make faster, smarter decisions. We call this Voya Machine Intelligence (VMI), applying machine learning to investment decisions, enhanced with human insight and traditional quant methods.

Voya Machine Intelligence Value Proposition

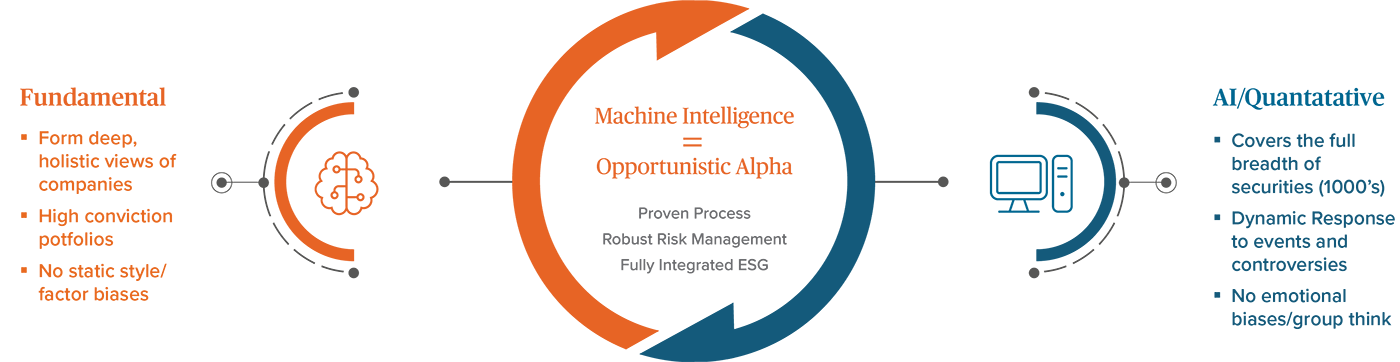

We believe in our ability to deliver consistent outperformance with high active share and low correlation to equity markets resulting in high idiosyncratic alpha.

We bring machine intelligence to fundamental equity investing: combining the depth and rigor of fundamental investing with the breadth of quant and scalability of Artificial Intelligence (AI).

Key Differentiators

A Differentiated Approach

The Machine Intelligence team has 10+ years working together, focused on delivering consistent outperformance with high active share and low correlation. We call it Opportunistic Alpha.

Voya Machine Intelligence Products / Strategies

WisdomTree US AI Enhanced Value (AIVL)

WisdomTree International AI Enhanced Value (AIVI)

Related Insights and Resources

Additional Resources

- Article: Gareth Shepherd on Barron's | How Voya Is Blending AI With Humans to Pick Stocks

- Video: Machine Learning & Asset Management | SALT iConnections New York 2023

- Video & Paper: Exploring Where and How NLP is Transforming the Buy and Sell-Side

- Video: Take ESG Integration to the Next Level

- Video: Rise of the Machines in Active and ESG Investing | SALT NY 2022

- Video: Why VMI is a Game-Changer for Investors?

- Video: Take ESG Integration to the Next Level

- Video: The Future of VMI: Opening the Black Box

- Video: Utilize Machine Learning for Superior Stock Selection

Behind the Markets Podcast with Gareth Shepherd

"In the new world, applying machine learning, we build the machines, but the machines themselves are interrogating the data and learning the rules of the game directly."

- Gareth Shepherd, PhD, CFA, Co-Head of Voya Machine Intelligence

- Chrissy Bargeron, CFA, Client Portfolio Manager

Get in Touch

At Voya Investment Management, a heritage of partnership and innovation serves clients at every step. Put the best team behind you with Voya’s leading investment advice: solutions built on research and adapted to your needs.

Fill out the form below or contact a Voya Machine Intelligence Client Portfolio Managers directly at voyaimmachineintelligence@voya.com.

Meet the Team

Past performance does not guarantee future results. All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. All securitytransactions involve substantial risk of loss. Voya Investment Management has prepared this commentary for informational purposes. Nothing contained herein should be construed as (i)an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed hereinreflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based onmanagement’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from thoseexpressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions,(2) performance of financial markets, (3) interest-rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations, and (6) changes in the policies of governments and/orregulatory authorities.