Voya Liability-Driven Investing

Specialized expertise and extensive resources allow us to partner with clients at all stages of the de-risking lifecycle

We believe successful Liability-Driven Investing (LDI) portfolio management requires a comprehensive knowledge of actuarial sciences as well as a deep understanding of financial markets. This belief explains our multi-dimensional approach to LDI that combines a Liability Strategy Development team with a team of experienced portfolio managers.

Key Differentiators

Flexibility to Help Meet Plan Sponsors’ Evolving Needs Ability to pivot from asset management to completion, overlay solutions over the de-risking lifecycle |

Expertise in Specialty Fixed Income Sectors Successful track record of incorporating specialty asset classes like investment grade private credit and securitized assets in an LDI framework |

Liability Focused Risk Management is in Our DNA Voya Investment Management’s insurance heritage forms the foundation for our focus on risk management |

Explore our fixed income platform

Our extensive fixed income platform is powered by 250+ investment professionals, delivering single-sector and multi-sector institutional strategies to help you build portfolios designed to meet specific objectives across the risk/return spectrum.

Off-the-Shelf Solutions*

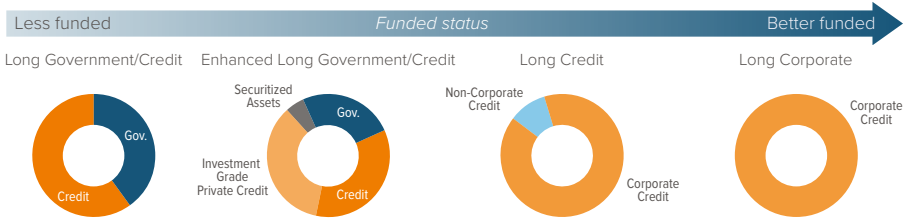

Voya offers plan sponsors a full suite of pension risk management solutions — from off-the-shelf strategies benchmarked to traditional market-based indices, to bespoke liability-matching portfolios with interest rate overlays.

* Representative allocations; actual portfolios may vary.

Bespoke Solutions: Tailored to Meet Specific Plan Needs

Our Liability Strategy team partners with clients to evaluate current plan conditions as well as end-state goals and objectives to develop and recommend strategies appropriate to achieve the desired objectives while balancing risk and return within the established risk profile of each client.

Complete plan diagnostics and analysis

Custom benchmark creation

- Blend of market-based benchmarks

- Liability-based solutions

Completion Portfolio Management

- Duration extension

- Key rate duration matching

- Interest rate hedging

Tailored reporting packages

- Summary plan overview

- Asset and liability highlights

- Asset and liability returns

- Funded ratio history and attribution

- Interest rate, curve, and quality hedge ratio analysis

Transition management as mandates evolve and benchmarks change

Featured Insights

Archived Insights

The following are historical insights based on market conditions at a point in time. Any forward-looking statements contained herein are based on information at the time. Current views, performance and portfolio information may differ materially from those expressed or implied in such statements. Voya IM makes no representation that past publications will be updated.

Managing Pension Risk & Liabilities

Best Practices in LDI

Get in Touch

Important Information

This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management (“Voya IM") considers reliable; Voya IM does not represent that such information is accurate or complete. Certain statements contained herein may constitute "projections," "forecasts" and other "forward-looking statements" which do not reflect actual results are based primarily upon applying retroactively a hypothetical set of assumptions to certain historical financial data. Actual results, performance or events may different materially from those in such statements. Any opinions, projections, forecasts and forward-looking statements presented herein are valid only as of the date of this document and are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Voya IM assumes no obligation to update any forward-looking information.

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. All security transactions involve substantial risk of loss.

Past performance is no guarantee of future results.