The following are historical insights based on market conditions at a point in time. Any forward-looking statements contained herein are based on information at the time. Current views, performance and portfolio information may differ materially from those expressed or implied in such statements. Voya IM makes no representation that past publications will be updated.

Funding ratios rose again in 2022, putting plan sponsors in another surprisingly strong position. But with critical decisions looming, de-risking and diversification are paramount.

Pension plan funding just keeps getting better

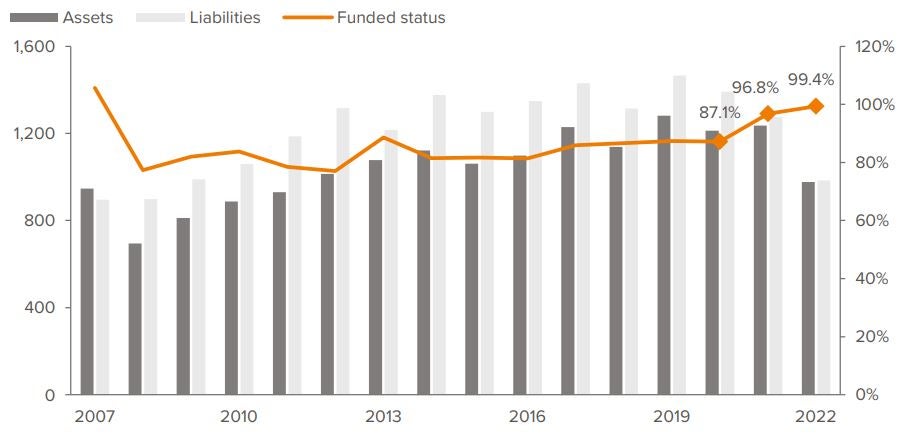

The investing world has closed the books on one of its worst years in history — yet remarkably, defined benefit corporate pension plans are in stronger shape than ever. Though assets dropped sharply, liabilities fell even further. As a result, S&P 500 corporate pension sponsors added 3 percentage points to their funded positions in 2022, following a 10 percentage point increase in 2021.

The question, once again, is how to lock in funded improvements. Against a long-awaited backdrop of higher interest rates, and considering all the news of the past year, here are key takeaways of our 2023 outlook:

- De-risk, like yesterday. Corporate plan sponsors must optimize asset allocations to secure their stronger positions by shifting to fixed income and liability-driven investing (LDI) strategies.

- To annuitize or do it yourself, that is the question. Many corporations are pondering a transfer of liabilities and assets to insurers, either in total with a complete plan termination, or in tranches, such as retiree-only blocks. The rush to the exits is likely to continue in 2023. But beware of possible higher costs of annuitizing, capacity considerations and industry scrutiny.

- The UK’s LDI crisis won’t reach the US. In 2022, the UK pension scheme crisis made LDI investing a household acronym, but the media’s conflation of leverage with LDI was disingenuous, and risks were limited to UK. Sponsors, advisors and asset managers have kicked the tires on the use of derivatives in the US and concluded that they are still useful to LDI strategies. (Further reading: Why US corporate pension plans won’t be importing the UK’s LDI fiasco)

'22 in review

Rising rates were key to improved funding positions

Investors spent a decade waiting for rates to rise, and 2022 finally gave it to them in spades. Rates rose higher than stocks declined, and due to the inverse relationship between rates and liability valuation, liabilities decreased more than the decline in assets. This translated into modest improvement in funded positions (Exhibit 1).

The industry also experienced second-order effects from rising rates, including declining plan durations. The FTSE Pension Discount Rate had a roughly 230 basis point increase for a short-duration plan. During the year, average durations for pension plans declined by at least two years, while longer-duration plans may have dropped by nearly three years. This brings many plans closer to, or within the realm of, intermediate credit, prompting many sponsors to explore investments in the 5–10 year duration range.

It’s also important to note that what goes up can very well go down, and interest rates are no exception. Interest rate risk is a significant risk in pension investing. For unhedged plans, declining rates can wreak havoc, just like they did in the last decade. Perched at funded status levels not seen since the 2008, sponsors have little incentive for taking unrewarded risk by continuing to pursue growth assets in what is essentially a non-profit pension subsidiary of the corporation. Any drawdown and/or declining rates result in onerous variable PBGC premiums — which in 2023 amount to 5.2% of unfunded deficits — and have the potential to trigger contributions. Sponsors that duration match assets to liabilities will better weather any future storms.

As of 12/31/22. Source: Voya Investment Management.

For sponsors still facing a shortfall, consider changing IRS methodologies

Rates may have risen for accounting measures, but the IRS liability didn’t decline commensurate with assets because the calculation is based on the 25-year interest-rate average. As a result, some pension plans may now be required to contribute, as the funded status used to determine minimum required distributions may have dropped by as much as 20%. Additionally, if funded status dropped below 80%, it could cause benefit restrictions such as prohibitions against lump sum payments, as well as additional PBGC 4010 filings.

But there’s good news. Sponsors have the option to change their IRS methodologies to a more market-based measure of liability. There may be no better time than right now for sponsors to make this move as they de-risk their plans on their accounting measure. A better alignment with the accounting measure — marking-to-market for plans that are on track or already fully hedged and de-risked — should reduce volatility on the IRS measure. The past year has laid bare the nonsensical disparity between asset smoothing (2 years or less) and smoothing of rates for liability valuations (25 years). However, structuring assets to match the liabilities through LDI and switching to mark-to-market IRS measures is truly the optimal way to “smooth” assets relative to liabilities. Such a holistic view of assets and liabilities together should result in fewer surprises.

Fixed income is as enticing as ever for pension plans

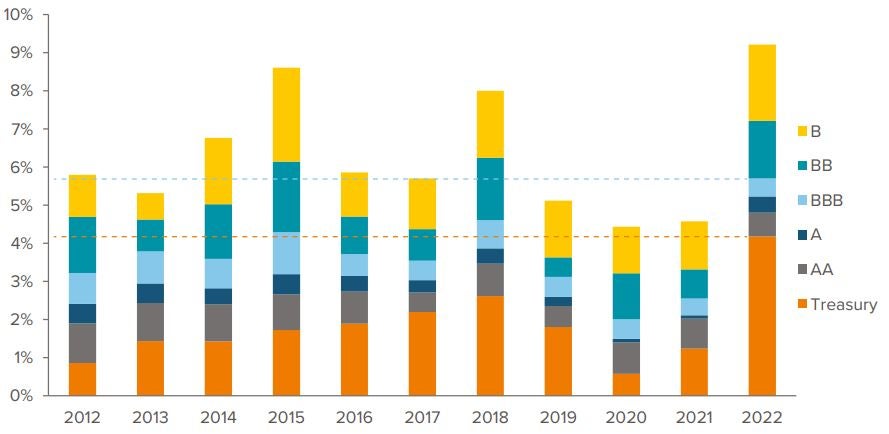

As many of our clients know, our mantra is “Always Be De-risking.” This year, it’s more true than ever. Yields are at levels not seen in almost two decades (Exhibit 2), which means sponsors can easily meet their expected return on asset (EROA) objectives without resorting to equities and their inherent volatility. This allows for a lower tracking error to liabilities. For the most part, asset liability modeling (ALM) studies will naturally gravitate to these higher-yielding, low-risk asset classes over equities. Sponsors don’t need to run sophisticated models to know the benefits being able to buy and hold investment-grade bonds at a 5% handle.

As of 12/31/22. Source: Bloomberg Index Services Limited and Voya Investment Management. Treasuries represented by the Bloomberg US Treasury Index. Yields by credit quality represented by the Bloomberg US Corporate Aa, A and Baa subindices and the Bloomberg US High Yield Corporate 2% Issuer Cap Ba and B subindices. The blue dashed line represents the Bloomberg US Corporate Baa Index yield as of 12/31/22, and the orange dashed line represents the US Treasury Index yield as of 12/31/22.

As we expect to see many sponsors increase their fixed income allocations during the year, active management is critical. Passive strategies will not be as discerning, especially with the telegraphed recession and downgrades priced in. During 2022, pension plans used rallies to reduce exposure to risk assets. In 2023, we expect spread widening to result in selective buying and redeployment out of cash.

Annuitization: A record year for pension risk transfer

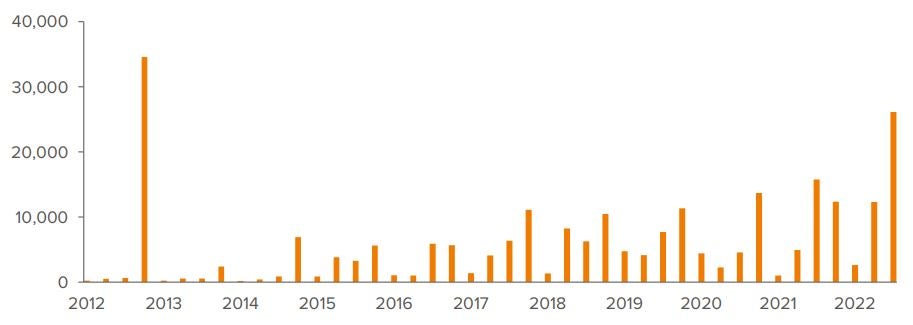

With the improvement in funded status in 2021 and 2022, sponsors found their way to the exits in droves. A walloping US$41 billion in annuitizations during the first three quarters of 2022 surpassed the full-year record $35 billion set in 2012, with General Motors accounting for $25 billion and Verizon the rest.

As of 09/30/22. Source: LIMRA.

Notable transactions include Lockheed Martin, which released a sequel to their $4.9 billion pension risk transfer in 2021 with another $4.3 billion at the end of the second quarter in 2022. Both deals with annuity provider Athene. In September, IBM transferred $16 billion in a deal split with insurers Prudential and MetLife. It covered 100,000 retirees, accounted for more than half of the third-quarter annuitization in dollar terms and was the second-largest buyout in history.

As we wait for the fourth-quarter tally, typically released in February, we expect total annuitizations for 2022 to easily top $50 billion. There will likely be more to come in 2023. Many sponsors have already begun their annuitization journeys, which can take 6–18 months to complete. As such, the full view of annuitizations, due to the remarkable funded status improvement of 2021, has yet to emerge.

Despite new insurers entering the annuity market to take on these pension promises, it appears that buyout pricing is increasing, at least according to the Milliman Pension Buyout Index. However, anecdotally, and perhaps contingent on each deal’s specifics, transactions are clearing at below par to an accounting liability. Another headwind to annuitization is the scrutiny of insurers — especially recent entrants — backed by private equity firms. While it does not appear this will put the brakes on annuitizations in the next year or two, it intensifies the debate seen in trade magazines as well as the mainstream financial news.

Key takeaways

- 2023 will be a pivotal year for corporate pension plans, with money moving from risk-seeking to fixed income, and from sponsors to insurers.

- De-risking and diversification are paramount. At these elevated rate levels, sponsors can then take a wait-and-see approach.

- Sponsors must decide if annuitization or DIY management (arguably a cheaper alternative) is right for them.

- Diversification is the lynchpin of flexibility — whether the goal is achieving a superior risk-adjusted return and low tracking error to liability, or transferring pension promises to an insurer.

- Don’t forget: Always Be De-risking.