The following are historical insights based on market conditions at a point in time. Any forward-looking statements contained herein are based on information at the time. Current views, performance and portfolio information may differ materially from those expressed or implied in such statements. Voya IM makes no representation that past publications will be updated.

Sponsors have waited over a decade for rates to rise and funded status to improve. Both have now occurred, pushing most plans over 100% funded, yet many still carry elevated allocations to equities and other risk-seeking assets. Here is why de-risking is now not just beneficial, it’s mission critical.

1. Securing the plan’s funded position is paramount

While yields are a boon to pension plans’ funded positions, they won’t last forever, and funded status can vanish just as fast as it improved. The last decade taught us well what declining rates can do in that regard— the outcome can be disastrous, especially if coupled with a drawdown in equities.

During the 2002 tech bubble and then again in the 2008 Great Recession, plans got hit with a 30% aggregate decline in funded ratio each time. In 2013, the Taper Tantrum offered an opportunity to de-risk, but many plans missed it. Aggregate funded status improved that year to 88%, up from 76% the year before (Exhibit 1). But sponsors did not make a meaningful move into fixed income and ended up paying the price, watching as funded status fell to 81% in 2014. Moreover, from 2013 to 2016, sponsors contributed $31 billion to plans net of service cost, representing 3% of the $1 trillion in assets for our S&P 500 data group as of 2012. Yet funded status remained stubbornly at 81% for years!

As of 09/30/23 (funded status intra-year estimate) and 12/31/22 (year-end reported funded status and allocations). Source: Company reports, Bloomberg, Voya IM. Analysis aggregates year-over-year assets, benefit obligations and asset allocations from 139 defined benefit pension plans in the S&P 500.

It was not until the latter part of the last decade that a clear trend of de-risking emerged. Starting in 2017, plans started shifting assets out of growth-seeking assets and into fixed income, partly to take advantage of tax changes in 2018 to secure contributions made, as well as to better align plan assets with liabilities, thereby reducing surplus volatility. This began a trend of improvement in, and preservation of, funded status.

It’s worth reiterating that risk and reward tradeoffs in pension investing are asymmetric. Any overfunded position is subject to burdensome excise tax for a full plan termination, and an underfunded position can reignite variable PBGC premiums and required contributions.

2. Current yield levels are too good to pass up

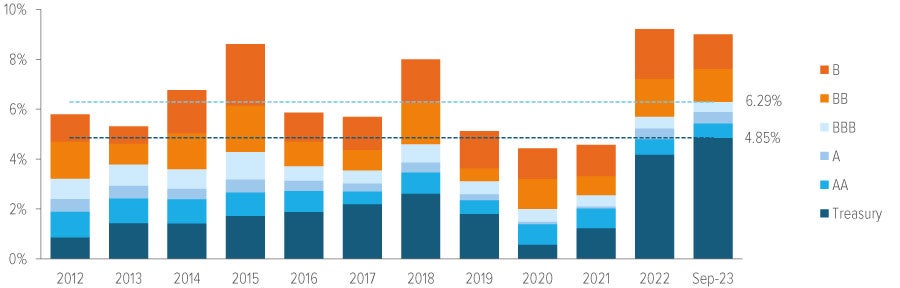

The good news is that sponsors can lock in yield levels they haven’t been able to access at any level of risk since 2007 (Exhibit 2). Higher-yielding fixed income is now close to, or on par with, the expected returns of most equities. Bonds’ inclusion in an asset portfolio is no longer a hindrance to the expected return on asset (EROA) assumption, and they carry a significantly lower risk profile, thus reducing surplus volatility.

Every pension plan is unique. Locking in current yields offers benefits to sponsors seeking longer-duration investments because their plan is open and accruing, as well as to those with a need for intermediateduration assets for their frozen plan. Many sponsors already know that liability driven investing can not only shield funded status, it can achieve strong returns with greatly reduced risk. But at these yield levels, sponsors can have their cake and eat it too: a de-risked asset portfolio with an undiminished EROA assumption to offset pension costs.

As of 10/01/2023. Source: Bloomberg Index Services Limited and Voya Investment Management. Treasury as represented by the Bloomberg U.S. Treasury Index. Yields by credit quality as represented by the Bloomberg U.S. Corporate Aa, A, and Baa sub-indexes, and the Bloomberg U.S. High Yield Corporate 2% Issuer Cap Index.

3. A fully evolved, easy-to-use LDI toolkit is now at every sponsor’s fingertips

Liability-driven investing has evolved markedly since it was born out of the ashes of the tech bubble and the Great Recession. Back then, blunt instruments such as STRIPS and long-duration investments (typically converted from core fixed income allocations) were used to crudely match liability duration, benchmarked to long credit or long government/credit indexes. “Completion” programs—designed to button up key rate duration mismatches between liabilities and assets across the curve—were in their infancy, since most plans were underfunded, not to mention underhedged. Duration was the key risk, not the shape of the yield curve.

Fast-forward 15 years, and plan sponsors are focused on risks that weren’t even on their radar when funded positions were lower. In addition to duration, curve and spread risk now also factor into the equation, along with the need to diversify the large slug of concentrated corporate credit positions that accumulated as plans shifted to fixed income. Market leaders such as Voya offer an array of innovative LDI solutions for plan sponsors. The applicable solution can be as simple as deploying a more efficient long government/credit strategy that blends investment grade private placements with public corporate bonds (See: Voya Enhanced Long Duration Government/Credit: A Five-Year Track Record to Celebrate).

There are also tailored DIY solutions inspired by insurance company best practices in managing reserves for annuities, such as including investment grade private placements, commercial mortgage loans and structured credit. These solutions not only help hedge duration and spread risk, but they also offer additional benefits such as issuer diversification and the potential for downside protection.

Each approach has been vetted, tested, and successfully implemented, and together they form a buffet of options to suit your unique needs.

Whether you are looking to annuitize or hibernate, you don’t have to do it all yourself. Contact Voya’s LDI team to learn how we can help you mitigate risks to your funded position.