Key Takeaways

As fixed income allocations rise, investment grade (IG) private credit can reduce tracking error and concentration risk, especially in volatile markets, in a way that adding a third or fourth long-duration manager can’t.

IG private credit can also help preserve funded status due to its covenant protections, up-front yield premiums and additional non-coupon income.

With the average plan facing downward pressure on duration, IG private credit durations are an increasingly tight match to intermediate liability profiles.

As glide path triggers push overfunded plans into fixed income, many sponsors are diversifying beyond investment grade corporate bonds to better manage risk and volatility. Here’s why it helps.

IG corporate public bonds: Rising allocations, rising limitations

The goal of liability-driven investing (LDI) is to structure assets that keep pace with plan liabilities. However, the discount-rate-setting process prescribed by the Financial Accounting Standards Board makes it impossible to invest in a way that precisely tracks the movement in liability discount rates.

One of the more cumbersome issues is credit ratings migration. If a plan sponsor invests in the identical group of bonds used to create the discount rate (CUSIP match) and one of those bonds is downgraded, the portfolio will decline in value due to the downgraded bond’s wider spread—but the discount rate, when reconstituted, will have no memory of that bond. It is simply removed from the calculation once it does not meet the screening requirements.

The discount rate won’t account for the bond’s higher yield and the liability may in fact increase when a downgraded bond is removed from the universe. The liability discount rate is essentially unaffected by credit events.1

Another, increasingly acute issue is concentration risk. In the past few years, as better-funded positions have driven higher allocations to fixed income, plans face an uncomfortable level of concentration in investment grade public corporate bonds. With the top 100 issuers representing 68% of the index, it’s an issue that can’t be solved by allocating to multiple long-duration managers.2

To combat both of these risks, many corporate sponsors have implemented less traditional spread assets—the most popular being investment grade private credit.

But investment grade private credit offers much more than diversification.

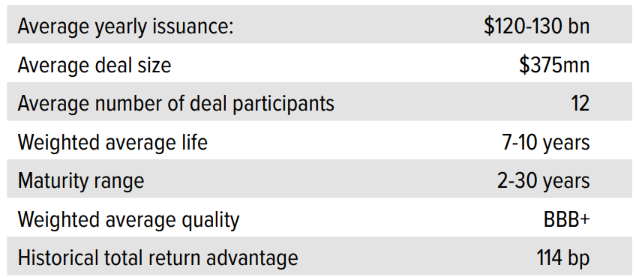

As of 06/02/25. Source: Voya IM estimates, BofA. Total return advantage measures up-front spread premium to similarly-rated public corporate bonds, plus non-coupon income, and impact of historically lower credit losses.

Why investment grade private credit?

Distinctive benefits, complementary nature

Of all the non-traditional asset classes, we believe investment grade private credit is the most natural fit within a liability-hedging portfolio, often serving as a gateway to alternative credit instruments.

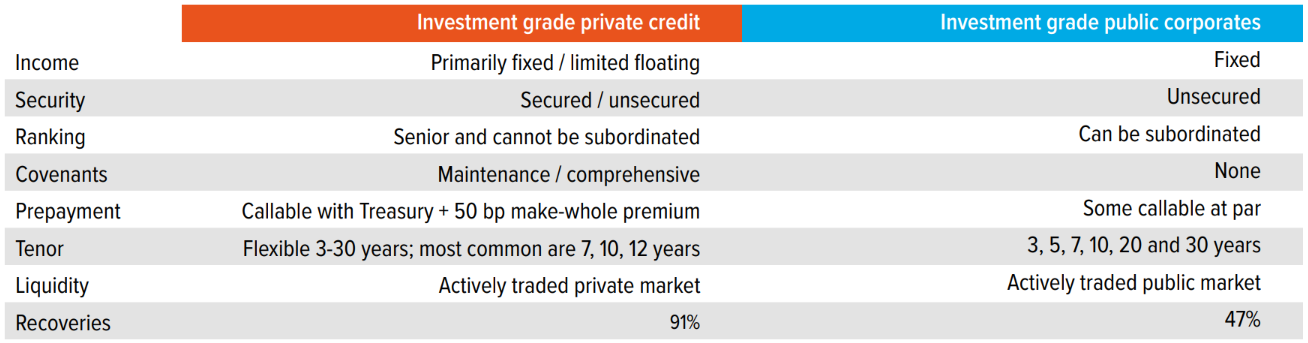

First and foremost, private placements are corporate spread products, so they track well to the discount rate required in pension liability valuation.

But there are also attractive benefits that distinguish investment grade private credit:

- A meaningful up-front yield premium, compared with similarly rated public corporate bonds of the same duration.

- Additional, incremental non-coupon income from prepayment fees, amendment/waiver fees and coupon bumps.

- Covenant packages that may improve protection from downside credit events and help mitigate negative outcomes.

Insurance companies have successfully used investment grade private credit for decades, with allocations averaging more than 10% among the top 100 life insurers.3 Now, corporate pension sponsors are also buying up this asset class.

Increasingly, intermediate is the new long

Industrywide interest in private credit has also been spurred by shrinking plan durations. There are two main reasons that plans are shifting from long- towards intermediate-duration profiles: Frozen plans are in runoff mode, and higher rates are resulting in lower duration.

Most investment grade private credit hits squarely at the longer end of intermediate durations, positioning it as an increasingly central part of modern plan strategies.

While issuers in the investment grade private credit market typically issue notes with maturities of 3-30 years, the most common maturities are 7, 10 and 12 years. Thus, an allocation to investment grade private credit requires fewer duration adjustments to extract benefits.

Also, the attainable spread to public corporates tends to be higher in intermediate tranches than long ones, given the significant demand from life insurers for long-duration product. There has been a noticeable increase in intermediate and short-duration product available over the past couple years, thanks to an influx of new originators in private credit.4

As of 05/15/24. Source: Moody’s Default Trends and Rating Transitions report, Voya IM estimates.

As plans blow through glide path triggers and face downward pressure on duration, many sponsors are keen to expand into private credit rather than double down on the “usual suspects” in the public investment grade corporate market (especially given its recent volatility). But sponsors may not be sure where to begin—or how to optimize allocations.

Blended credit is here to stay—and Voya leads the way

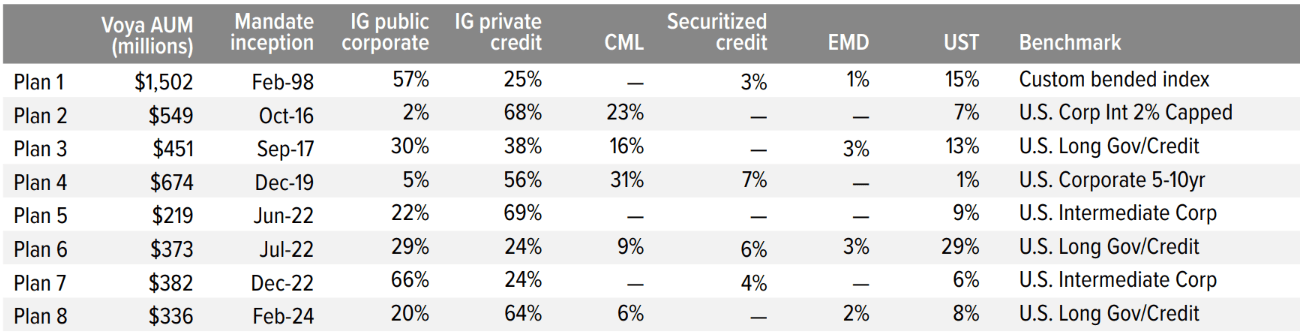

The Voya team has assisted a multitude of plans with incorporating investment grade private credit into an LDI solution—a process which varies greatly based on the plan’s situation and the sponsor’s goals. We have partnered some of the biggest corporate pension plans to design “blended credit” solutions—portfolios that blend investment grade public and private credit, along with other non-traditional credit assets such as commercial mortgage loans (CMLs) and securitized credit (Exhibit 3).

Voya is the largest manager of third-party insurance assets in the investment grade private credit market.5 As such, we (and our plan sponsor clients) have top-tier access to investment grade private credit syndications, club deals and direct opportunities.

In CMLs, our team of bottom-up investors focus on high-growth secondary markets (recently with very little office exposure), which has helped them post attractive returns even as industry peers struggled. The origination capabilities of these best-in-class alternative credit teams complement the creativity and research we bring to our customized plan solutions.

With this expertise backing us, Voya’s LDI Strategy Development team has assisted many sponsors in understanding the merit of both including investment grade private credit and other alternative credit sectors in hedging portfolios, right-sizing their position alongside public corporate bonds.

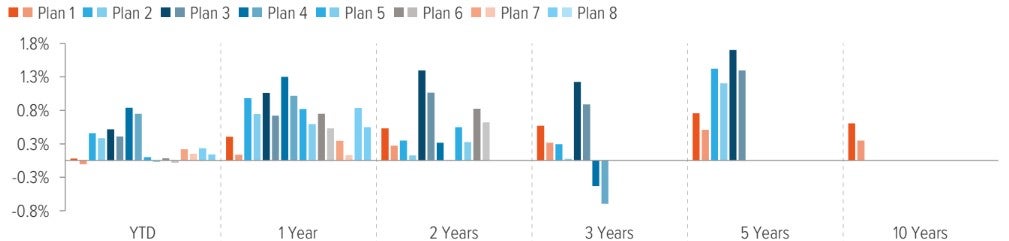

These multi-sector “blended credit” portfolios have done well across a broad range of plan benchmarks, duration needs and overall hedging objectives. Whatever a plan’s goals may be—and however they may shift—Voya can design a blended credit strategy to help achieve them.

In the following section, we illustrate one plan’s journey in detail, from portfolio design through ongoing performance and liability tracking.

As of 04/30/25. Source: Voya IM. CML is commercial mortgage loans, EMD is emerging market debt, UST is U.S. Treasuries.

As of 04/30/25. Source: Voya IM. Chart shows performance of plans from Exhibit 3 versus their stated benchmark. Solid bars are gross; shaded bars are net. For illustrative purposes only; these are not investable strategies, they are individual client pension plans. Past performance does not guarantee future results.

Case study: Diversifying an overfunded plan to reduce tracking error

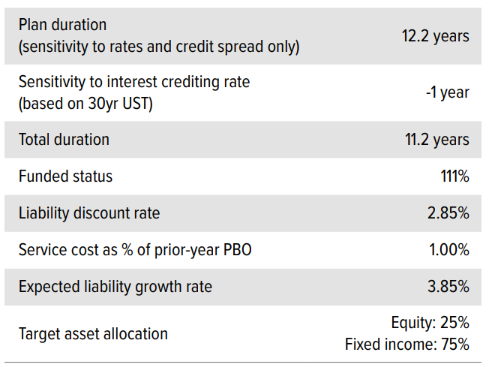

When we began working with this particular client in 2021, they had a plan that was 111% funded. Their main objective was to preserve their funded status and minimize the tracking error to the liability, without sacrificing yield or increasing concentration risk (Exhibit 5).

The client and their consultant approached us as they were preparing their annual asset/liability management (ALM) study to help with investment options and plan objectives.

Plan snapshot | |

Current state

| Investment Objectives

|

During a planning discussion with the client and their consultant, we discussed our proprietary LDI optimization tool and explained how we could use it to model the effects on the portfolio of including nontraditional fixed income classes at various allocation levels. We wanted to ensure all parties understood the modeling process, so we canvassed the group for specific asset classes to include.

To manage interest rate exposure, we recommended using Treasury futures and/or swaps, which are efficient at achieving the desired interest rate hedge ratio. The sponsor and consultant were happy to allow this.

Another factor we considered was that the overfunded position of the plan provided natural leverage: Every dollar in assets covered 11% more relative to a dollar in liabilities, allowing for more flexibility in their portfolio.

We determined that the portfolio contribution to duration must be within 10% of the duration of a custom benchmark, which was designed as a proxy of the liability. Lastly, we committed to achieving a weighted average investment grade rating (BBB-or higher) for the portfolio.

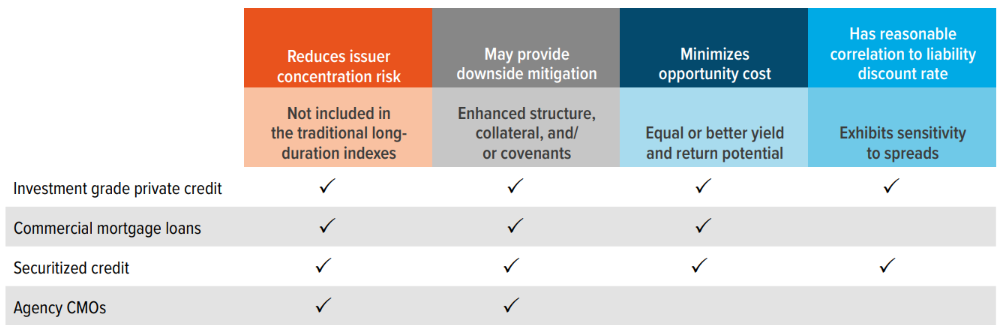

With these guardrails in place and the plan’s interest rate exposure hedged, the next step was to bring out our playbook of tried-and-tested alternative credit solutions. These solutions include investment grade private placements, commercial mortgage loans (CMLs), agency collateralized mortgage obligations (CMOs) and other securitized credit instruments—each of which address different plan goals (Exhibit 6).

For this particular plan we focused on investment grade private credit, CMLs and CMOs.

We then input the pension plan cash flows into our proprietary optimization tool. Its embedded asset correlation matrix enabled us to test how various combinations of nontraditional fixed income instruments could best assist the plan to reach its goal—minimizing tracking error between assets and liabilities.

We also supplied data and characteristics for investment grade private credit to the consultant so they could include it in their ALM study.

As of 07/31/21. Source: Voya IM.

As of 04/30/24. Source: Voya IM.

Four model portfolios for achieving sponsor objectives To demonstrate the effect of private fixed income assets on portfolio tracking error, we have used the Voya LDI optimizer to create four model portfolios with varied allocations to investment grade private credit, CMOs and CMLs.

As of 07/31/21. Source: Voya IM.

As a result of the ALM study, the consultant recommended a reduction in growth-seeking assets from 25% to 15% and an increase in fixed income allocations to 85%. They approved the inclusion of investment grade private credit, with a limit of 25% of the market value of the fixed income allocation. Although the optimizer suggested inclusion of CMLs, the client decided to wait before considering a second alternative credit allocation.

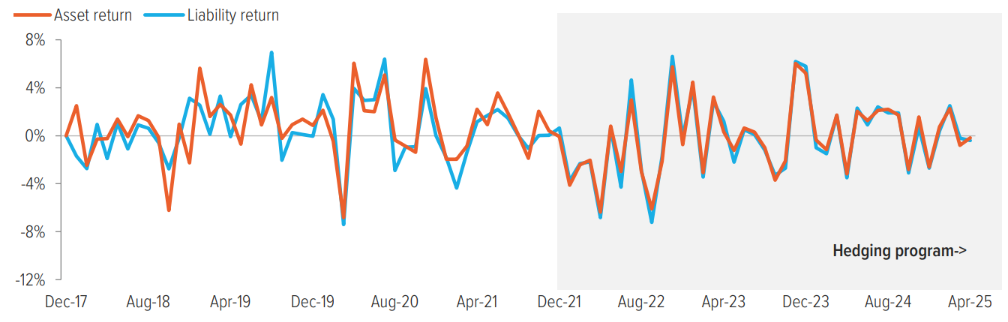

Prior to the start of our hedging program in 2022, the client’s assets did not track well to the liability. This contributed to funded status volatility and tracking error.

After February 2022, with the consultant’s recommended asset allocation shift and our hedging program implemented, the portfolio moved in lockstep with the liability (Exhibit 7).

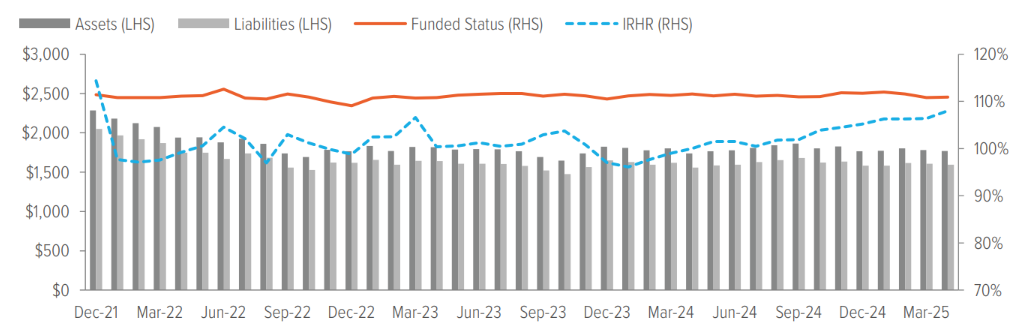

The portfolio had also done an excellent job of preserving funded status, which was the client’s ultimate objective. Funded status at the implementation date of Voya’s diversified LDI program in February 2022 was 111.4%. As of April 30, 2025, it stood at 110.9%. The interest rate hedge ratio (IRHR) was actively managed and range-bound within +/- 7% (Exhibit 8).

This case study is for illustrative purposes only and not a guarantee of any future results.

At Voya, we regularly collaborate with plan sponsors to determine whether investment grade private credit is appropriate for them, and at what level it should be employed relative to other strategic allocations.

Our solutions team looks forward to discussing how LDI can help you reach your plan objectives.

As of 04/30/25. Source: Voya IM

As of 04/30/25. Source: Voya IM. For illustrative purposes only; this is not an investable strategy, it is a client pension plan’s asset growth relative to liability growth.

A note about risk Please note that liability valuations can increase due to falling interest rates or credit spreads, among other things, as the present value of future obligations increases with falling rates and falling spreads. Liabilities can also increase due to actual demographic experience differing from expected future experience assumed by the plan’s actuary. Please keep in mind that diversification or broad asset allocation, in and of itself, neither assures nor guarantees better absolute performance or relative performance versus the pension plan’s liabilities. In addition, investing in alternative investment products (e.g., derivatives) can increase the risk and volatility in an investment portfolio. Since investing involves risk to principal, positive results and the achievement of an investor’s goals are not guaranteed. |