Credit spread tightening and U.S. pension plans: options for yield enhancement.

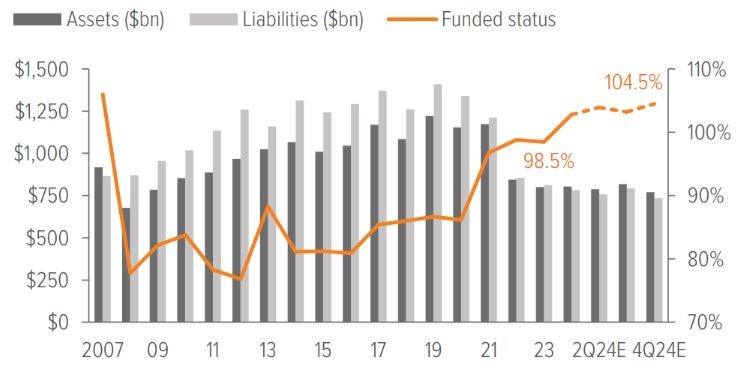

1 Growth asset return on the year was based on equity returns of 15%, while hedging assets (which match liability duration by design) netted a -10% return. After reflecting benefit payments and timing, total assets netted a return of roughly -4%.

2 Liabilities declined approximately 10% due to a 65 bp increase in rates with plan duration of 11 years, accounting for service accruals and release from benefits payments.

As of 12/31/24. Source: S&P, FYE 2023 company reports, Voya IM calculations and 2024 estimates assuming a 50/50 split in growth and hedging assets.

In the spotlight: Credit spread tightening in 2024 and U.S. corporate pension plans

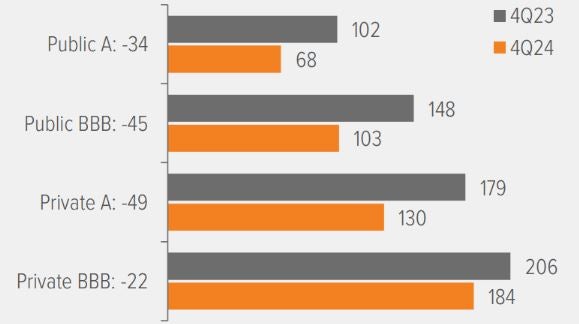

Public investment grade (IG) credit spreads continued to tighten during 2024, supported by a resilient economy, improved market sentiment, and a bull market correlation to higher equity valuations. This tightening has occurred across IG credit, but noticeably less so in the lower end of the IG private market. With public IG corporates priced so rich, here are a few things plan sponsors should consider.

IG public and private corporates: While IG public corporates have traditionally been the primary focus for pension plans, IG private corporates can also play a meaningful role. IG private corporate debt typically yields more than similarly-rated IG publics while also offering robust covenant packages that provide noncoupon income and downside risk mitigation. There is a compelling case to incorporate IG private credit in plans’ fixed income allocations, especially given current public IG spreads. Private BBB spreads in particular have stayed resilient, narrowing on average only 22 bp compared to public BBBs’ 45 bp contraction.

BBB bonds emerge as a favorable option: For funds not able to add private market allocations, it may be time to consider slightly more risk. BBB-rated bonds, which are the lowest tier of IG corporate bonds, were relatively attractive in 2024. In Q4, BBB bond spreads averaged 103 bp, compared to single A bonds at 68 bps. This wider spread makes BBB bonds a cheaper entry point with potentially better returns, while maintaining investment-grade status.

Fixed income manager role: While we do not advocate that pension sponsors engage in tactical trades, it is nevertheless crucial for their fixed income managers to be proactive and strategic. A multi-sector team such as Voya’s is capable across all dimensions of the IG universe, whether it be IG privates and publics or the array of IG-rated securitized bonds. The ability to nimbly move across these facets of fixed income investing is where alpha is harvested.

As of 01/08/25. Source: BofA U.S. Private Placement Market Snapshot, Federal Reserve. Publics are average ICE BofA A and BBB corporate index OAS per quarter; privates are average NAIC-1 (A-AAA) agented deal spreads and average NAIC-2 (BBB- to BBB+) agented deal spreads per quarter.

Notes on the fourth quarter of 2024

Discount rate increase of 65 bp resulted in a modest improvement in funded status during Q4. We estimate the funded status of extant pension plans in the S&P 500 increased from 103.2% to 104.5% during the quarter. The increase in the discount rate decreased liabilities more than the lackluster equity returns during the quarter for plans that are split 50/50 growth assets and hedging assets, which is the average allocation for plans in the S&P500.

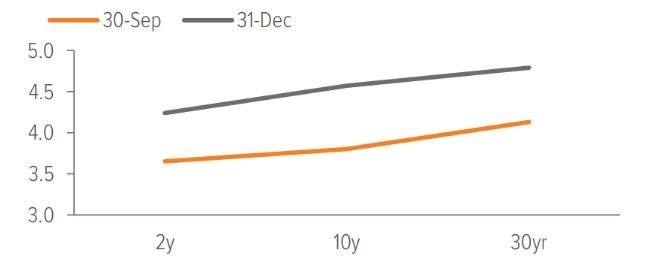

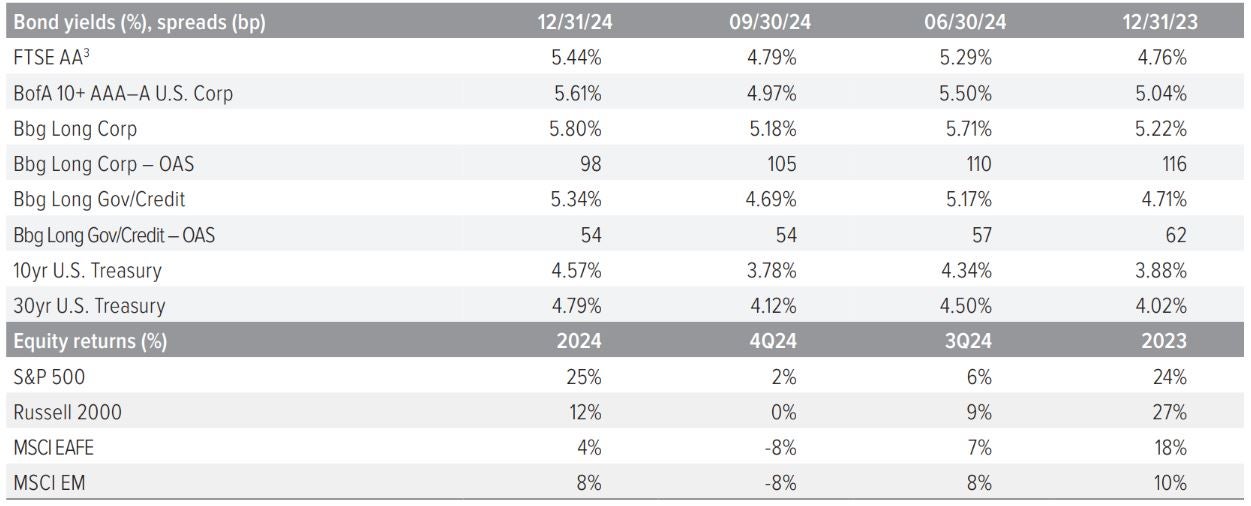

The Treasury curve shifted higher during Q4, steepening more on the short end than the long due to 10yr yields rising the most. The 10yr UST increased by 77 bp during the quarter, more than the 2yr UST (up 59 bp) and the 30yr UST (up 66 bps) and causing the yield curve to become convex. The upward shift in the yield curve suggests that investors were demanding higher returns for both short-term and long-term investments, due to expectations of rising inflation and fewer Fed rate cuts in 2025.

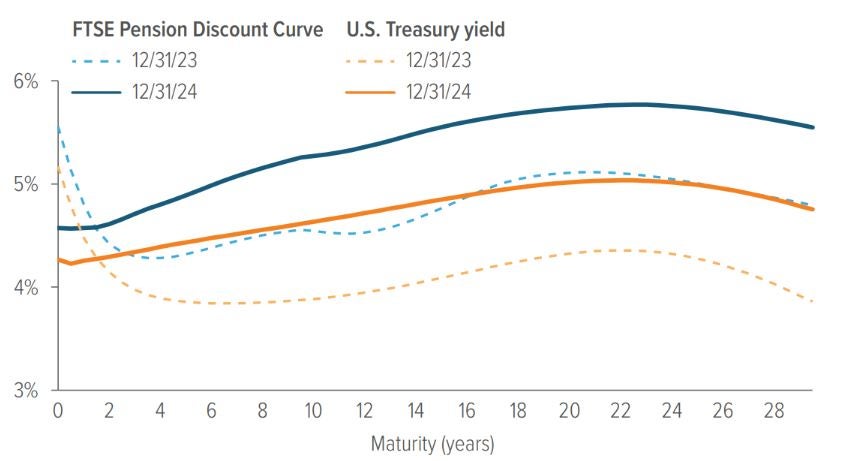

Credit spreads narrowed further, finishing the quarter at levels not seen in decades. The broad corporate index OAS ended the quarter 9 bp lower at 80 bp, and 18 bp tigher on the year. The net result of rate and spread movements during the quarter was a 65 bp increase in the FTSE Pension Discount Rate for short-duration plans. For a plan with a duration of 11 years, this translates to a roughly 7% decrease in liabilities, due primarily to changes in rates and to a far lesser extent spread tightening.

Our representative equity portfolio had a total return of -1% in Q4, which was overshadowed by liability gains due to higher discount rates. For this purpose, we use a mix of S&P 500 (45%), Russell 2000 (25%), MSCI EAFE (20%) and MSCI EM (10%), reflecting the breadth of equity holdings in most plans.

Spot rate curves

- The U.S. Treasury spot rate curve is flatter than the FTSE pension discount curve as of 12/31/2024.

- For the 15-year tenor, the U.S. Treasury spot rate is higher as of 12/31/2024 vs. 12/31/2023.

- Similarly, for the 15-year tenor, the Aa-rated corporate bond spot rate is higher as of 12/31/2024 vs. 12/31/2023.

Source: ICE Index Platform, FTSE pension discount curve.

Source: FTSE, Barclays Live, ICE Index Platform, S&P, MSCI, Russell. See back page for index definitions.

3 Based on FTSE’s “short” duration plan, approximately 10.9 years.

A note about risk

Examples of LDI (liability-driven investing) performance included in this material are for illustrative purposes only. Liability valuations can increase due to falling interest rates or credit spreads, among other things, as the present value of future obligations increases with falling rates and falling spreads. Liabilities can also increase due to actual demographic experience differing from expected future experience assumed by the plan’s actuary. Diversification neither assures nor guarantees better absolute performance or relative performance versus a pension plan’s liabilities. In addition, investing in alternative investment products such as derivatives can increase the risk and volatility in an investment portfolio. Because investing involves risk to principal, positive results and the achievement of an investor’s goals are not guaranteed. There are no assurances that any investment strategy will be profitable on an absolute basis or relative to the pension plan’s liabilities. Information contained herein should not be construed as comprehensive investment advice. For comprehensive investment advice, please consult a financial professional.