Key Takeaways

Investors in secondaries acquire private equity (PE) interests later in a fund’s lifecycle, when the underlying companies are generally closer to being sold, potentially providing liquidity shortly after investment.

A diverse mix of liquidity sources from thousands of portfolio companies can create an enhanced cash flow profile for secondaries, allowing for risk mitigation, supplemental gains and compounded returns.

Even in challenging macroeconomic environments, the diversification profile of a secondaries-focused strategy may boost distributions and liquidity compared to primaries.

Whether M&A or IPO activity is slowing or thriving, a strategy focused on secondary private equity may provide more stable cash flows compared to primary investments. However, the diversification of the underlying assets in the portfolio will likely play a key role in determining the level of cash flow.

What makes secondaries different?

Primary private equity funds can provide several benefits when compared with public market investing, but receiving cash flows early from an investment typically isn’t one. Since PE sponsors often focus on operational efficiency and value enhancement in the period immediately following the acquisition of a portfolio company, it may take several years before the company matures to a point where the sponsor will look to sell the business and distribute capital to limited partners.

However, secondaries investors acquire interests in PE funds that are further along in their lifecycles, typically after the investment period is well underway or even completed. It’s akin to skipping the opening act and arriving just in time for the main event! This timing works in favor of secondaries investors, as they can potentially benefit from the exit and realization phase of the underlying PE funds, when the sponsors are actively seeking to sell portfolio companies and distribute the proceeds to investors. Therefore, secondaries investors may start receiving distributions shortly after closing on their investment. For instance, since the inception of Pomona Investment Fund (PIF), the average time between an LP secondary transaction and the first distribution has been about two months.1

Where does liquidity for secondaries come from?

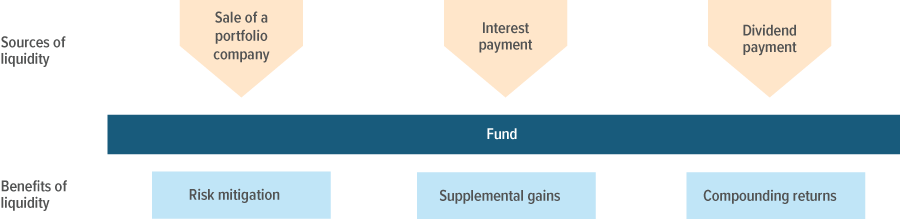

The sale of a portfolio company from an underlying fund (and the distribution of the proceeds to the limited partners) is one source of liquidity for secondaries. In PIF, such sales have accounted for more than 92% 1 of the liquidity generated by the portfolio since inception. The remaining liquidity consists of dividends, interest and other income. This diverse mix of sources can create an enhanced cash flow profile for secondaries, allowing for greater flexibility and potential return enhancement for investors.

Why is liquidity important?

The potential benefits of consistent cash inflows to investors include:

- Risk mitigation: Allows for effective risk management by reducing investment duration and realizing previously earned gains, which may enhance overall returns.

- Supplemental gains: Offers the potential for additional gains through the uplift in the value of a company at the time of exit. This may occur when a company is conservatively valued before its sale.

- Compounding returns: Specific to registered funds such as PIF, enables the continuous compounding of returns by reinvesting proceeds in new private equity interests, thereby maximizing the potential for long-term growth.

Based on the opinions and views of Pomona Capital, subject to change. For illustrative purposes only.

Liquidity, often even in adverse environments

Secondaries investors may own interests in hundreds of private equity funds, which in turn own thousands of underlying companies, increasing the potential for liquidity events. Even in extreme periods, such as when M&A activity is dramatically down or the IPO market is dormant, the diversification profile of a secondaries fund may result in distributions and liquidity.

Despite challenging macroeconomic environments, PIF’s portfolio has demonstrated resilience and has consistently generated distributions. With an average annual liquidity rate of 27%2 since inception, PIF’s strong liquidity profile results from a targeted approach of acquiring well-diversified portfolios managed by top-tier general partners with identified near-term liquidity.

A note about risk General risks to consider Secondary investments: The ability of the manager to select and manage successful investment opportunities, underlying fund risks; these are non-controlling investments, no established market for secondaries, identify sufficient investment opportunities, and general economic conditions. Primary investment: Identify sufficient investment opportunities, blind pool, the manager’s ability to select and manage successful investment opportunities, the ability of a private equity fund to liquidate its investments, diversification, and general economic conditions. Venture Capital: Characterized by a higher risk and a small number of outsize successes, has the most volatile risk/reward profile of the private equity asset class. Growth Equity: These companies typically maintain positive cash flow and therefore present a more stable risk/reward profile. Mezzanine Financing: Has the most repayment risk if the borrower files for bankruptcy and in return, mezzanine debt generally pays a higher interest rate. Leveraged Buyout: Generally exited through an initial IPO, a sales to a strategic rival or another private equity fund, or through a debt-financing special dividend, called a dividend recapitalization. Distressed Buyout: Offer the opportunity to invest in debt securities that trade at discounted or distressed levels with the potential for higher future value if the company recovers. General private equity risks Private equity investments are subject to various risks. These risks are generally related to: (i) the ability of the manager to select and manage successful investment opportunities; (ii) the quality of the management of each company in which a private equity fund invests; (iii) the ability of a private equity fund to liquidate its investments; and (iv) general economic conditions. Private equity funds that focus on buyouts have generally been dependent on the availability of debt or equity financing to fund the acquisitions of their investments. Depending on market conditions, however, the availability of such financing may be reduced dramatically, limiting the ability of such private equity funds to obtain the required financing or reducing their expected rate of return. Securities or private equity funds, as well as the portfolio companies these funds invest in, tend to be more illiquid, and highly speculative. An investor should consider the investment objectives, risks, charges and expenses of the Fund(s) carefully before investing. For a free copy of the Fund’s prospectus, which contains this and other information, visit us at www.pomonainvestmentfund.com. Please read prospectus carefully before investing. |