As demand from banks and other real money investors returns (and money market demand wanes), agency mortgage-backed securities are poised to benefit.

With the S&P 500® Index reaching all-time highs and credit spreads near multi-year tights, investors may be seeking diversified sources of value.

The solution may lie within agency mortgage-backed securities (MBS), a relatively overlooked sector in the current market climate where technical tailwinds are building and creating an attractive potential investment opportunity.

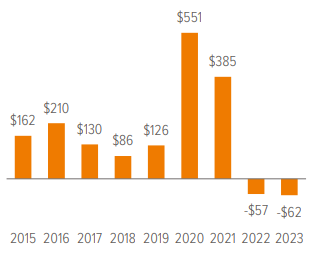

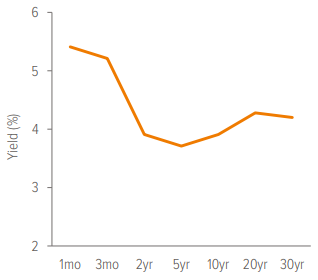

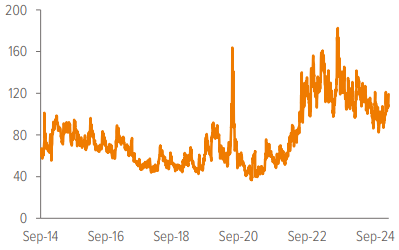

One major factor driving this potential is the return of demand from banks and other real money investors to the sector. Banks have traditionally been a significant source of demand for MBS but have scaled back their purchases in recent years due to the inversion of the U.S. Treasury yield curve, interest rate volatility, and regulatory uncertainty (Exhibits 1-3).

However, with Federal Reserve Chair Jerome Powell’s recent announcement that the time has come to start cutting rates, funding costs are expected to drop, and the Treasury yield curve is expected to steepen. This makes agency MBS more appealing from a net interest margin (NIM) perspective, and banks may begin to increase their purchases once again. In addition, rate volatility is likely to decrease and upcoming refinements to the Basel III regulations should provide greater clarity for banks—potentially driving further demand for MBS.

As of 08/21/24. Source: Morgan Stanley Research estimates.

As of 08/30/24. Source: U.S. Department of Treasury.

As of 09/04/24. Source: ICE BofA. The Merrill Lynch Option Volatility Estimate

(MOVE) Index reflects the level of volatility in U.S. Treasury futures and is

considered a proxy for term premiums of U.S. Treasury bonds.

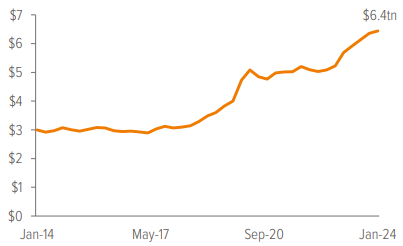

As of 09/13/24. Source: Board of Governors of the Federal Reserve System (U.S.).

Dollar amounts shown are not seasonally adjusted.

An additional source of demand that could support agency MBS is a potential increase in fixed income fund inflows. As the Fed begins to ease interest rates and the Treasury yield curve steepens, assets are expected to flow out of money market funds. This could result in an increase in demand for duration-sensitive sectors like MBS. With money market fund assets already at a staggering $6 trillion (Exhibit 4), any shift in demand could significantly impact the MBS market.

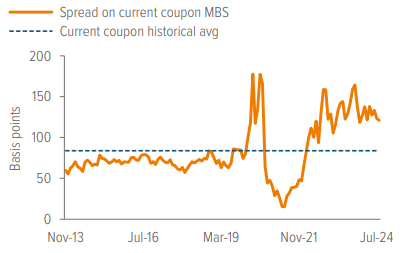

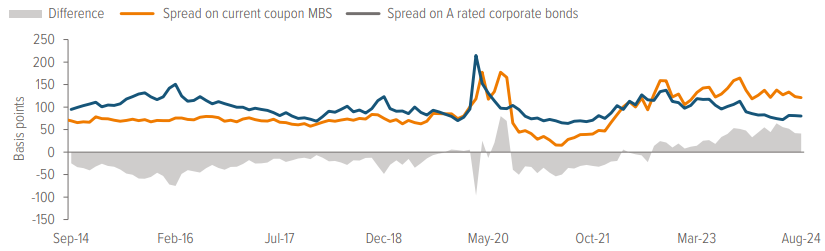

Among high-quality assets, the government guaranteed agency MBS sector is one of the most compelling sources of risk-adjusted returns as spreads remain wide both in a historical context as well as relative to high-quality corporate bonds.

As of 08/30/24. Source: Bloomberg Index Services Ltd.

As of 08/30/24. Source: Bloomberg Index Services Ltd. Spread on current coupon represented by the Morgan Stanley 30-Year Conventional Current Coupon ZV indicator, which represents the zero volatility spread for the hypothetical $100-priced 30-year conventional mortgage over time.

In conclusion, the combination of these technical tailwinds and potential market shifts paints a promising picture for agency MBS. As demand from banks and other real money investors returns and money market fund demand falls, the sector could see an increase in value. This presents an attractive opportunity for investors to diversify their portfolios and potentially earn a steady stream of income from the mortgage payments of American homeowners.

Voya’s approach to GNMAs

With a track record spanning over 30 years, the Voya GNMA Fund, Class I (LEINX) is one of the oldest funds investing in MBS. The investment team’s process encompasses a wide array of top-down and bottom-up inputs, both fundamental and technical. The Fund seeks to deliver attractive income and returns by favoring GNMAs that can better withstand the impacts of shifting interest rates and prepayment volatility.

A note about risk

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. You could lose money on your investment and any of the following risks, among others, could affect investment performance. The following principal risks are presented in alphabetical order which does not imply order of importance or likelihood: Credit; Derivative Instruments; Environmental, Social, and Governance (Fixed Income); Interest Rate; Liquidity; Market Disruption and Geopolitical; Mortgage-and/or Asset-Backed Securities; Other Investment Companies; Prepayment and Extension; Portfolio Turnover; Repurchase Agreements; Securities Lending; U.S. Government Securities and Obligations; When-Issued, Delayed Delivery and Forward Commitment Transactions. Investors should consult the Fund’s Prospectus and Statement of Additional Information for a more detailed discussion of the Fund’s risks.