In late September, Voya IM hosted its exclusive annual gathering of top corporate pension sponsors (with a combined AUM of over $400 billion) and consultants to discuss the big issues in private fixed income today. Here’s what they’re saying.

Key takeaways

- Most corporate defined benefit pension plans are embracing allocations to not just investment grade private corporate placements, but also asset-based finance, commercial mortgage loans, and infrastructure finance.

- Sponsors are attracted to private fixed income because of its potential to improve information ratios, income, and diversification in fixed income allocations.

- Investment grade private credit is already seeing meaningful adoption by 401(k) plans across stable value, white label bond options, and custom target date funds, and interest from defined contribution sponsors is only intensifying.

- On a relative value basis, commercial mortgage loans are among the most compelling plays in private fixed income right now—and they offer the potential to enhance total return and reduce volatility.

How much are plans allocating to investment grade private fixed income?

Most plan priorities generally remain a trio of out-earning liabilities, having the income to pay benefits, and minimizing surplus volatility—and investment grade private fixed income is seen as able to do all three.

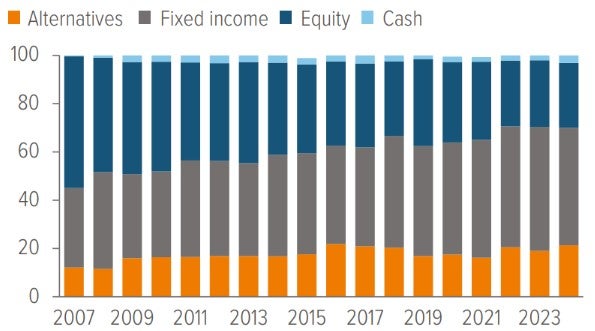

Investment grade private fixed income comprises four main asset classes: corporate placements, infrastructure finance, asset-based finance (ABF), and commercial mortgage loans (CMLs). While all tend to offer a total return advantage and diversification compared to investment grade corporate bonds, each has unique duration, amortization, collateral, and structural characteristics which can influence allocation decisions, as well as relative value considerations.

Plans vary wildly in their allocation levels, from a leading corporate plan whose fixed income allocation is more than half allocated to privates, to plans taking their first steps in the area.

As of 10/01/25. Source: 2025 Voya Corporate Pension Intelligence Report.

The ultra-tight spreads on long corporate bonds seem to be driving more and more plans into investment grade private fixed income, which is seen as offering the potential to consistently and efficiently outperform benchmarks without taking on additional risk. Sponsors see investment grade corporate spreads remaining tight, as inefficiencies in the public market which used to reward patient capital have mostly disappeared thanks to trading technology.

However, the investment grade private fixed income structural premium is not expected to follow public bond spreads down as borrowers remain willing to pay for customization, structure, privacy, and certainty of execution.

How are sponsors using investment grade private fixed income?

Sponsors see investment grade private fixed income as a way to earn extra spread, diversify, reduce volatility, improve information ratios, and—crucially—simplify.

Private options look especially attractive when compared to the public fixed income diversifiers to long corporates, which tend to have lower spread (convertibles) or lower duration (securitized credit).

Most plans at this point have allocations to corporate placements and infrastructure finance, but ABF and CMLs are becoming increasingly popular due to their highly differentiated collateral types.

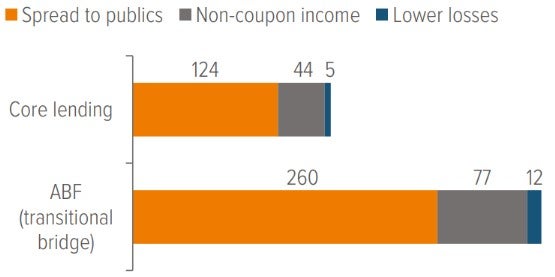

ABF can potentially offer high total returns for its amount of risk due to its structural and customization premiums, and its self-amortizing nature improves income. CMLs have the potential to reduce portfolio volatility and offer significant non-coupon income on top of their usual spread advantage.

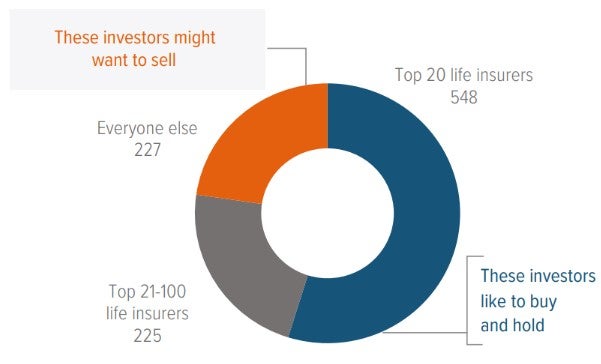

While ABF and CMLs can have more limited liquidity, corporate placements are considered liquid by most experienced private fixed income investors. Unlike private equity, most corporate placements can be sold quickly at market price, so it is possible to reduce weightings where necessary. Liquidity is also likely to rise further across ABF, infrastructure, and corporate placements as a widening investor base incentivizes secondaries trading desks and funds.

Investment grade private fixed income, especially via a comingled vehicle where third-party managers can make relative value decisions, is also seen as simpler and less time consuming than private equity.

As of 12/31/24. Source: Voya IM, CapIQ, Reg D filings. Assumes a $1 trillion total market size.

How are sponsors handling duration?

While ABF and CML spreads are attractive, their duration profiles still tend to be shorter than public diversifier options, and might not be long enough for many plans.

Core CMLs have seen their duration shorten (from 6.5 years in 2020 to around 5 years now) in parallel with commercial property leases dropping from 5-7 years to 3-5 years. ABF has attractive premiums due to its structural complexity, but much of it can be floating rate or possess short to medium duration profiles.

Sponsors tend to fill this gap by “renting duration,” which is buying additional duration via a dedicated long-duration strategy that specializes in the longer end of the private credit spectrum.

For example, Voya’s Enhanced Long Duration Government/Credit Strategy allocates about half its funds to investment grade private credit and CMLs alongside long corporate bonds and Treasuries. This enables it to have a 13-year duration profile similar to the Bloomberg Long Government/Credit Index, but with net returns that have consistently beaten that index.1

How soon until there are private asset options in DC plans?

Many 401(k) plans are already including investment grade private fixed income in stable value, white label bond options, and custom target date funds in order to provide diversification to bond funds invested entirely in public bonds, gain improved downside mitigation, and enhance overall yield.

Investment grade private fixed income has been embraced by DC plans ahead of other forms of private assets due to its more predictable liquidity profile, daily indicative NAV pricing, and the availability of 401(k)-friendly structures such as perpetual vehicles. Voya offers a scaled, perpetual comingled vehicle with highly competitive DC rates that several sponsors are already including in 401(k)s.

The biggest reluctance sponsors have about including private equity in 401(k)s is around private equity’s high fees, minimal liquidity, opaque pricing, and closed-end structure.

There’s a feeling that nobody has a firm answer yet on how private equity will work in DC plans, but there’s enough will to make it happen that solutions are likely to start appearing in the next 2-5 years.

Sponsors indicated that private equity secondary funds were the most promising products for 401(k) inclusion thanks to their ability to provide potentially better liquidity and diversified vintages. A select few DC plans have embraced REITs for similar reasons.

What are attractive relative value allocations in private fixed income right now?

Core CML offers some of the most attractive relative value in fixed income markets—while the S&P is up 75% since the pandemic, commercial real estate values are down 20%. Much of the commercial real estate market is trading below replacement cost, and when a real asset market becomes attractive for equity investors, it then becomes attractive for lenders.

As of 06/30/25. Past performance is no guarantee of future results. Investors cannot invest directly in an index. Proprietary ratings model used gross returns to map commercial mortgage loans to a corporate bond rating equivalent. Core Lending is for time period 01/01/02–06/30/25; Transitional Bridge is for time period 06/01/14–06/30/25. Lower losses to comparable public corporate bonds. Source: Voya Investment Management.

Even beyond the office story, residential housing unaffordability and high mortgage rates mean that submarkets where multi-family is undersupplied are attractive areas to lend right now.

It also helps that lending has become more disciplined: We estimate that average loan to value is now around 50-60% rather than 60-70%, and debt service coverage ratios are around 1.25-1.35x.

In short, values have already reset, and a noticeable influx of capital (especially money center banks) coming back into the market has made investors more confident.

Funds raised during the pandemic were overwhelmingly aimed at shorter-term opportunistic and value-add investments, and those funds are still sitting at 65% dry powder. Core, on the other hand, is only sitting on 15% dry powder—but half the money raised this year for CML investment has been core.2

For sponsors new to CML allocations, the current market environment offers a compelling opportunity to take first steps into an asset class that has the potential to increase total return, reduce tracking error, and diversify away from corporate debt.3

A note about risk: All investing involves risks of fluctuating prices and uncertainties of rates of return and yield. All security transactions involve substantial risk of loss.

Private credit: Foreign investing does pose special risks, including currency fluctuation, economic, and political risks not found in investments that are solely domestic. As interest rates rise, bond prices may fall, reducing the value of the share price. Debt securities with longer durations tend to be more sensitive to interest rate changes. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Other risks of private credit include, but are not limited to: credit risks, other investment companies risks, price volatility risks, inability to sell securities risks, and securities lending risks.

Voya Enhanced Long Duration Government/Credit Strategy: The principal risks are generally those attributable to investing in stocks, bonds and related derivative instruments, and short selling. Holdings are subject to market, issuer, credit, prepayment, extension, counterparty and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy may invest in mortgage-related securities, which can be repaid early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below market levels and extending the security’s life and duration while reducing its market value.