We present key trends from 130 defined benefit pension plans to help sponsors determine where they’re ahead of the curve–and where they’re behind it.

Executive summary

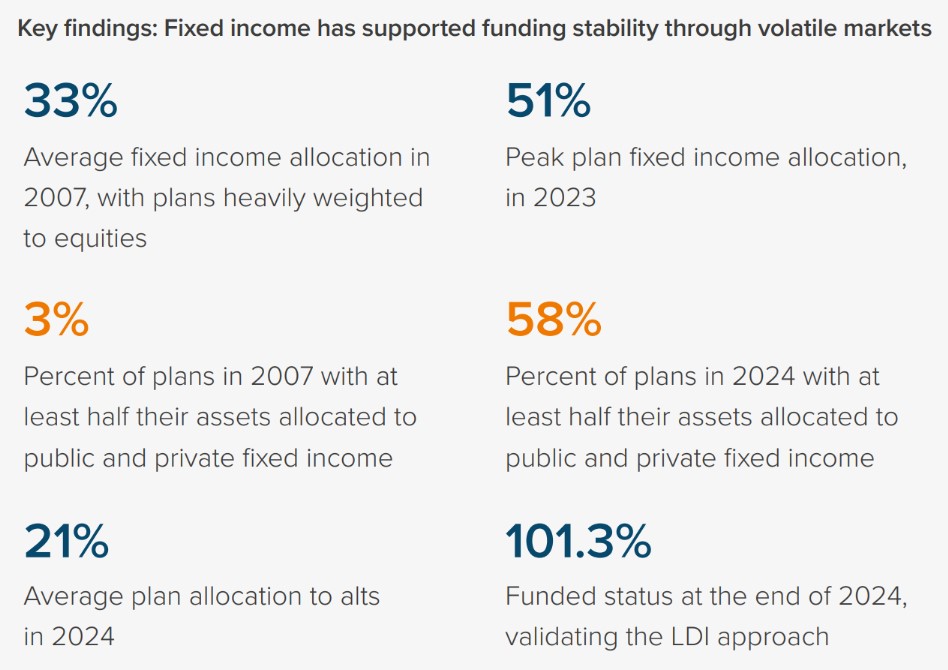

Voya’s annual pension survey looks at the defined benefit plan performance of 130 S&P 500 companies from 2007 through 2024, analyzing key characteristics such as asset allocation, funded status, net asset returns versus liability returns, discount rates, expected return on assets.

By investigating the links between asset allocation trends, funded status improvement, contribution, service accruals, and expected versus actual return on assets, the study evaluates fixed income’s role within a liability-driven investing (LDI) strategy in mitigating funded status volatility and interest rate risk.

Company inclusion methodology for pension analysis

This study examines 130 companies in the S&P 500. Requirements for inclusion are as follows:

- Must be an S&P 500 company as of 12/31/2024

- Must have a defined benefit pension plan with assets greater than $100 million

- Must have a fiscal year that concludes on December 31

Must have continuously disclosed pension data in their annual 10-K filing from 2007 through 2024 Unless stated otherwise, our analysis is in the aggregate. For example, total assets and liabilities are the summation of all 130 corporations’ assets and liabilities (as if they represented one big pension plan).

A note about risk: Examples of LDI (liability-driven investing) performance included in this material are for illustrative purposes only. Liability valuations can increase due to falling interest rates or credit spreads, among other things, as the present value of future obligations increases with falling rates and falling spreads. Liabilities can also increase due to actual demographic experience differing from expected future experience assumed by the plan’s actuary. Diversification does not ensure better absolute performance or relative performance versus a pension plan’s liabilities. In addition, investing in alternative investment products such as derivatives can increase the risk and volatility in an investment portfolio. Because investing involves risk to principal, positive results and the achievement of an investor’s goals are not guaranteed. There are no assurances that any investment strategy will be profitable on an absolute basis or relative to the pension plan’s liabilities. Information contained herein should not be construed as comprehensive investment advice. For comprehensive investment advice, please consult a financial professional/