The U.S. natural gas industry has transformed into a global powerhouse—and it has further to go. A deep dive into the sector’s history, drivers, and debt financing landscape.

Made in America

Decades ago, there was a joke told in Houston bars of a geologist who returned home from a trip abroad seeking oil. In the debrief with her boss, she explained that she had both bad news and good news—the bad news was that she failed to find oil, but the good news was that she failed to find natural gas. Times have changed drastically since then. Thanks to technological innovation and robust demand for cleaner sources of energy, natural gas has become a major portion of the global energy diet.

In this Energy & Infrastructure Insight, we will explore the natural gas industry’s transformation from a series of localized markets limited by logistical constraints into a global trade that brings clean, affordable energy to the masses. We will provide a brief overview of the natural gas value chain, discuss how the proliferation of liquefaction technology enabled natural gas to become a global trade, and review how the shale revolution and other factors caused LNG to grow from a nascent commodity to a major portion of the global energy diet.

Background: the natural gas value chain

Before we dive into the history of gas markets and LNG, we think it is important to provide an overview of the historical natural gas value chain. By understanding the process by which natural gas is transformed from subterranean molecules to energy or feedstocks, we can better appreciate the immense value created by the liquefaction process.

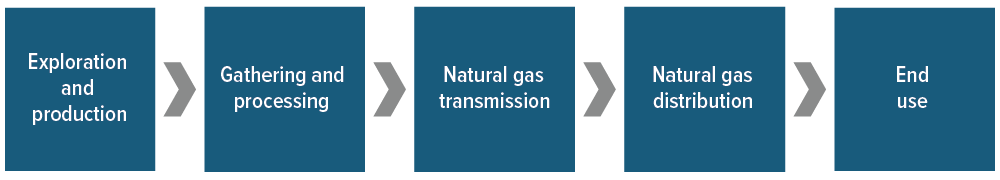

Historically, the natural gas value chain consisted of five steps (Exhibit 1).

Source: Voya IM.

1. Exploration and production: In this step, upstream energy companies explore subterranean geologic formations to discover hydrocarbon resources. Once a discovery is made, upstream energy companies develop the formations to extract natural gas resources. Natural gas can be produced by itself—frequently called “dry gas”—or can be produced alongside oil, often referred to as “associated gas.”

2. Gathering and processing: Once natural gas molecules accumulate at the wellhead, the gas is transported by a smaller, localized pipeline system to a gas processing center that services multiple wells. The gas processing center removes impurities, liquids and solids from the gas so that it meets specifications for transportation along a longer-haul transmission pipeline.

3. Natural gas transmission: After the gas has been processed, it is injected into a longer-haul transmission pipeline that connects gas supply basins to gas demand centers. The pipelines function in much the same way as the interstate road system in the United States, allowing large volumes to be transported over long distances between two major points.

4. Natural gas distribution: Once the gas reaches a demand market, it exits the transmission pipeline and is placed into an interconnecting natural gas distribution system. The natural gas distribution systems function much like state highways and surface streets, allowing the gas to reach its ultimate destination.

5. End use: When the gas has reached its destination, it is used for a variety of purposes, including heating, cooking, electric power generation, and as a feedstock for manufacturing the chemicals and fertilizers that make modern agriculture possible. The just-in-time nature of gas delivery allows many of the processes that underpin developed societies to take place reliably and safely.

While the planet has abundant natural gas resources, they are distributed unequally from a geographic perspective and not all resources are legally or economically accessible. Gasses also occupy more space than solids or liquids of a comparable energy content under normal atmospheric conditions and temperatures. As such, the trans-oceanic shipment of natural gas would be rendered uneconomic if natural gas were loaded onto vessels in its gaseous form. Similarly, the construction of long distance, sub-sea pipelines is prohibitively expensive.

The confluence of these factors historically made natural gas trading a regional market, unlike oil, which has been shipped internationally at a large scale since the late nineteenth century.

A tale of two cities

Much as the introduction to Charles Dickens’ A Tale of Two Cities paints a picture of stark contrasts, natural gas markets have historically been bifurcated into markets of oversupply and markets of undersupply. Markets with a surplus of natural gas enjoyed cleaner power generation, reliable heating sources, and an abundance of cooking fuel. Markets with deficits were forced to use other (often dirtier) sources of energy, including fuel oil and coal, to accomplish the same tasks.

Even in markets with abundant natural gas resources, natural gas was typically delivered just-in-time, given that it requires more space to store than coal or fuel oil. Despite both fuel oil and coal being dirtier than natural gas, their storability made them relatively attractive.

In the same way that the commercialization of jetliner travel more easily connected distant parts of the world, the commercialization of gas liquefaction technology connected regions boasting abundant natural gas resources with markets lacking domestic gas supply. Liquefaction also significantly improved natural gas’s storability.

Natural gas liquefaction is not a new process. In the 1600s, Robert Boyle and Edme Mariotte conducted experiments on the relationship between the pressure and volume of gases. In the late 1800s, notable British scientists Michael Faraday, James Joule and William Thompson (Lord Kelvin) were some of the first to experiment with temperature’s impact on the liquefaction of natural gases.

Voya underwrote its first infrastructure transaction in 1990 and, since then, the energy & infrastructure team has remained a core pillar of our investment grade private credit offering. We manage a circa $13 billion portfolio that focuses on single or multi-asset secured financings through a traditional project finance structure, plus investments in corporations whose business models have infrastructure characteristics. Since Voya began classifying deals into infrastructure, corporate, and ABF in 2002, the infrastructure team has maintained a zero credit loss rate—successfully preserving principal through commodity cycles, financial crashes, geopolitical shocks, and the pandemic, while also generating competitive returns. The team has deep sector experience across the energy and infrastructure landscape developed over multiple decades of transaction underwriting. It is our pleasure to distill that expertise into this series of educational insights for our current and prospective clients. |