In late 2025, Voya hosted its annual gathering of insurance company investors to discuss the big issues in insurance investing today. Here’s what was top of mind among your peers.

2026 Concerns

- Tight spreads: With risk disproportionally weighted to the downside in corporate bonds, how should portfolios be adjusted?

- Underwriting standards: Recent high-profile bankruptcies are putting renewed focus on manager experience and credit and collateral quality as debt supply continues to grow.

- Artificial intelligence: From increasing concentration and digital infrastructure overbuild to labor market displacement and potential obsolescence of some software business models, AI tended to be a source of stress rather than excitement.

2026 Opportunities

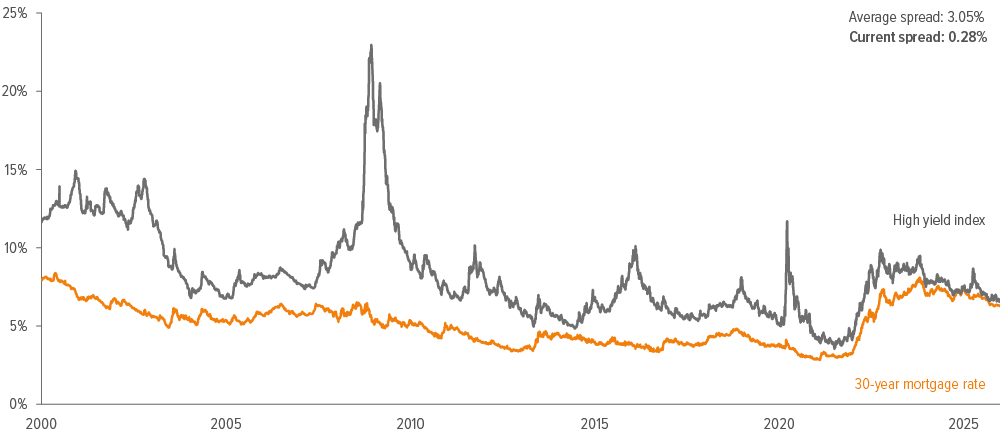

- Real estate: With corporate spreads at generational tights and equities at all-time highs, commercial real estate values are down an average of 20% — and the consumer mortgage borrowing rate is the same as speculative-grade corporate debt.

- Asset-based finance: The potential for spread premium and diversification from corporate credit are attractive to many insurance investors, but concerns exist around manager inexperience, reliance on forward flow agreements, and the consumer credit space.

- Private credit: While high yield direct lending is starting to look shaky, there are still opportunities in specialist funds and by using secondaries to access older vintages at a discount

Stay invested but stay cautious: the 2026 mantra

The prevailing attitude among our colleagues in 4Q was one of caution. Tight spreads and buoyant equity markets left many investors patiently looking for places to gain spread without taking on additional credit risk.

Investment grade corporate bonds have long been the “home base” of insurer portfolios, but with spreads having little room to tighten further the only debate is whether a dislocation would cause a widening of spreads back towards their 10-year historical mean, or whether there is enough money waiting in the wings that dip buying would cause those yields to snap back like they did around 2Q 2025’s tariff-announcement volatility.

“There are a lot of potentially underwater portfolios if yields spike up.1

As of 12/31/25. Source: FactSet, Voya IM. ICE BofA U.S. High Yield, as measured by yield to worst. Average 30-year U.S. fixed-rate mortgage.

We have a lot of corporate risk exposure and are looking to diversify into higher quality spread risk.

We always like to say that there are five ways an insurance portfolio makes money in fixed income: by taking credit risk, adding duration, increasing structure, embracing illiquidity, or increasing leverage.

We don’t see a lot of colleagues taking credit risk in this market. Quality duration has been hard to find, and high demand for longer-dated paper has meant that there’s often little pickup to be had for going out the curve.

What we are seeing is investors embracing illiquidity and/or structure as they cautiously shift allocations out of the corporate bond market. For investors that can’t take private assets, this has usually meant the CLO market and CMBS. For investors that can, it usually means increasing allocations to investment grade private credit and moving into asset-based finance.

Leverage has been popular as well, with a significant uptake in participation in FHLB spread lending programs.

You don’t know what you don’t know

I don’t think that I’m being paid for going down in capital structure. However, I do think I’m being paid for going more complex and more illiquid.

2025’s big investment hypes were AI and ABF, and investors greeted both with mingled interest and caution.

Most investors saw the appeal in ABF from a diversification and spread pickup point of view, and for the ability to access a wide range of duration and collateral types.

The caution came around the preponderance of new managers in the space, concerns over who to trust, nervousness around being tied to a manager’s forward flow agreements, and a desire to steer clear of (especially subprime) consumer credit. Even insurers owned by private equity companies expressed wariness over the double-edged sword of owned origination.

A few investors wished for an easier way to get involved in investment grade private assets—the ability to make a single allocation that would cover infrastructure, ABF, and private corporate placements.2 Several also mentioned preferring to partner with managers who were also insurers, rather than a manager who wasn’t committing capital from their own balance sheet.

It seems that the constant barrage of pitch decks is wearing on people, and there’s starting to be pushback on manager experience, underwriting track record, and ability to source high-quality assets in an increasingly competitive atmosphere. Investors are also cautious about mega-managers, as huge internal capacities raise questions about underwriting standards.

In short: ABF interest is high, but investors are not rushing in to allocations.

As of 12/31/25. Source: Center for Public Enterprise. Figures are estimates and based on public filings.

An ABF startup came in with good credentials. We asked about risk, and the firm replied that the Fed will bail out this category, which proved them not to be the right manager.

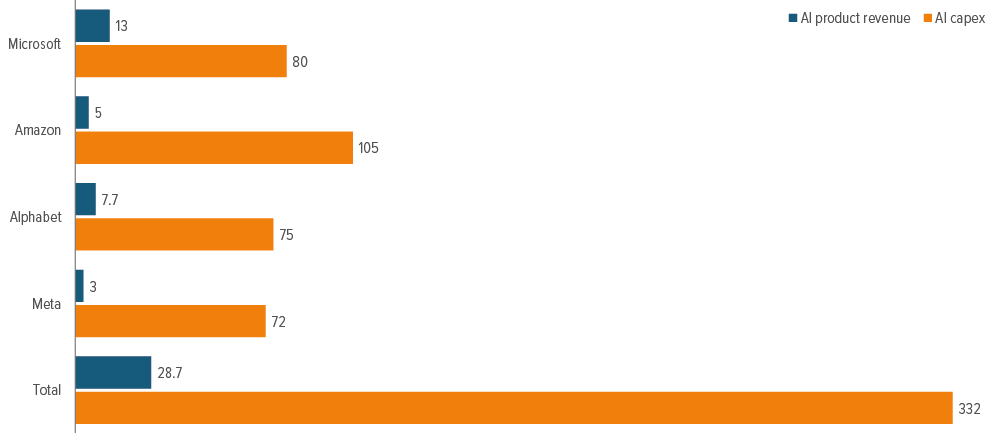

AI was a source of concern for many in 4Q. The increasing concentration of the stock market into big tech names and the circularity of many AI deals made many investors nervous.

Even investors who are positive over AI acknowledge there are certain business models and sectors that could be made obsolete by it, such as certain software-as-a-service businesses, and they are carefully working through how that may impact their portfolio holdings.

When we look at AI, we look very closely at the company and sectors as we are wary of a bubble.

There’s also the potential economic impact of AI—how disruptive will it be on white collar jobs before its efficiency benefits appear? In a labor market where tech jobs are already trending downwards and blue-collar employment is shrinking, what might AI-driven job displacement do to consumer spending?

On the private asset side, attitudes towards digital infrastructure and data center project finance were split between attraction and concern, with some investors keen on this fast-growing new space and others seeing it as potentially having hidden risks that are being glossed over. There’s a concern that some managers are slacking on underwriting in the rush to get access to deals—and that those managers’ core infrastructure funds could be used as a dumping ground for the subsequent debt issued.

There is a broad sense that there’s an element of bubble in all this (Exhibit 2). Once again, insurance investors are tending to be cautious about the way they’re entering these newly-huge investment areas in order to avoid speculative risk: “You don’t know what you don’t know in new asset classes.”

PIK your poison

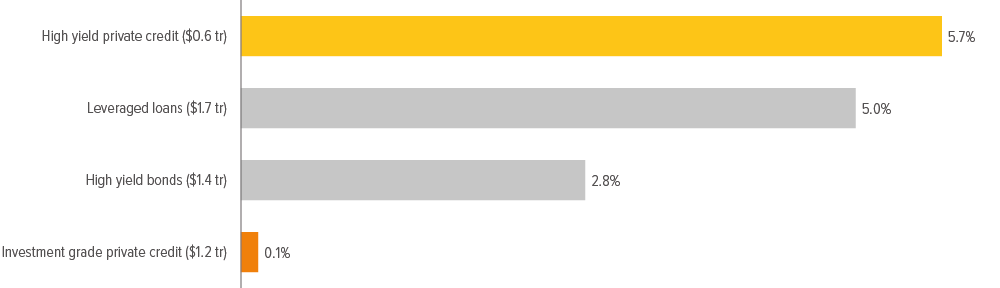

Much-publicized bankruptcies in mega-managers’ high yield direct lending portfolios have also led investors to take much harder looks at those portfolios, and the asset class in general (Exhibit 3). Beyond a handful of focused, specialized funds, very few investors expressed excitement about high yield direct lending—there’s a pervasive feeling that too much money is chasing too few borrowers, resulting in complacent underwriting and too many concessions.

The dry powder, limited opportunities, and searching for what’s rational feels eerily familiar.

As of 12/19/25. Source: Fitch Ratings, Voya IM. Figures include unplanned PIK and stressed extensions.

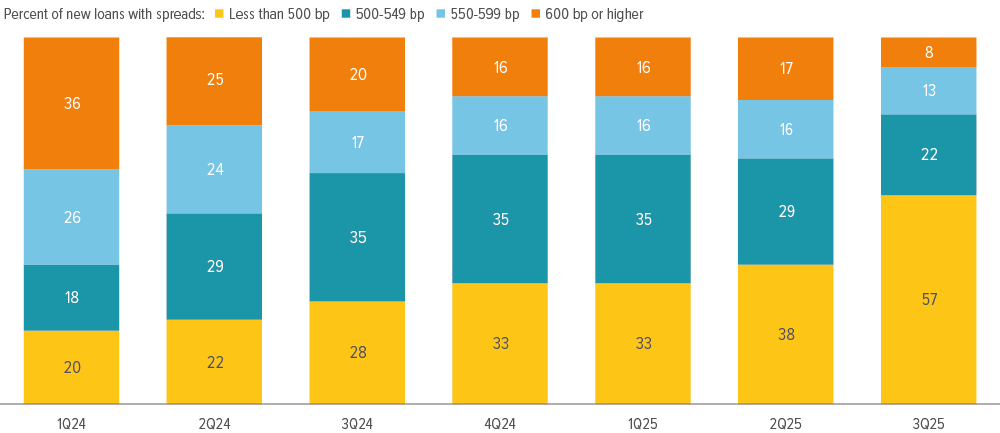

The situation isn’t likely to improve, given that early 2025’s changes in bank regulations has brought a return of banks to the leveraged lending markets, creating significantly more competition (Exhibit 4). Just as banks were disintermediated by private credit due to restrictive post-2008 lending regulations, those banks are re-intermediating themselves now that those regulations have been relaxed.

Increasing leverage in high yield direct lending funds was another concern mentioned by several investors—but it also leads to the asset class’s two most interesting opportunities: fund finance and private credit secondaries.

High yield direct lending funds are relatively new, and the open secret in the market is that some of these funds misjudged how long the lifetime of their fund should be. They took the private equity model of seven years and copy-pasted that to credit, then they had a four-year investment period and kept recycling capital. Now these funds are finding themselves with private equity problems: Instead of being all done at the end of year seven when LPs are expecting their money back, these funds have 40-60 investments still in them.

Everyone is chasing asset growth and fees, and the best protection is investing alongside someone’s balance sheet.

As at 11/30/25. Source: Configure Partners.

This, along with investor liquidity needs, has created a large appetite for both asset-based loans to these funds, and GP- and LP-led secondary sales.

On the secondary side, investors are getting access to diverse portfolios of seasoned loans made at higher spreads from older vintages with less lender oversupply, all at an NAV discount. Given the other big open secret—huge, closed-end high yield direct lending funds are essentially beta— getting that beta at a discount can lead to outperformance versus peers who have gone in as primary LPs. It also can mitigate manager risk because secondary funds take from a spectrum of managers, while primary LPs are stuck with one manager.

Asset-based loans to credit funds are another attractive outgrowth of the current direct lending situation, and a sector in which Voya has over 20 years of underwriting experience. These loans are secured on fund assets, with conservative loan-to-value (LTV) ratios and embedded cash sweep features if an LTV limit is breached (or if time- or diversification-based criteria exceed defined thresholds). There is also a set percentage of cash flows (such as on exits) that must be applied towards debt repayment as assets are realized. They tend to be medium duration (4-5 year weighted average life) and tranched, with an A/AA piece around 250 over SOFR and a BBB piece around 400-450 over SOFR.

We see opportunities in bridge loans and fund finance.

The return of real estate

The second half of 2025 was noticeably different from the past couple of years in both commercial and residential real estate, with transaction and production volumes surging back towards healthy levels, while spreads stayed attractive and the potential for valuation decreases diminished (Exhibit 5). This has helped pull a number of investors back into real estate.

CMLs can be tough for some credit investors to get their head around. There’s a misapprehension that commercial mortgages are all long-dated instruments, when actually the weighted average life of core CMLs tends to be around five years. Newer investors also often fixate on one idiosyncratic property (usually a troubled landmark office building in a primary market) and hold it as a proxy for the entire CML market.

We don’t have any commercial real estate on our books right now. We’ve been trying to add to it.

But that’s the problem: You can’t buy the market. You can buy funds based around a sector, such as multi-family or industrial— just don’t expect the sector as a whole to do well. Take Dallas: giant industrial spaces of 0.5-1 million square feet have high vacancies right now in part due to tariffs, but pre-existing small bay industrial is doing great. There are always properties somewhere that are doing great, if you have the skills to find them.

You need managers who can go into extremely granular detail into sub- and micro-markets, property vintage, quality, and so forth, looking for pockets of growth—and who can shift seamlessly between sectors if spreads get tight on loans to any one particular asset class, such as what’s going on in multi-family right now.

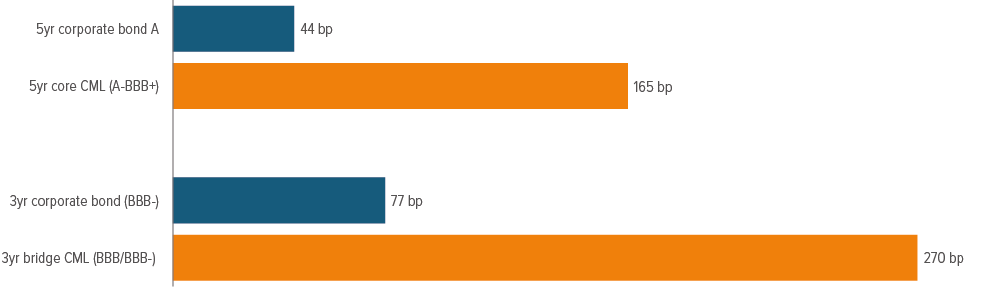

Right now, the falling rate environment has incentivized borrowers—even in the core space—to push downward even further on duration, and reward lender flexibility with excess yield. So investors with ready capital have been able to take advantage of a record summer in 2025 for loan signup plus the ability to seize shorter-term opportunities, which have helped private asset investors pick up around 110-130 bp over similarly rated investment grade corporate bonds (Exhibit 5).

We have a 20% allocation to CMLs and I think that’s a competitive advantage for us.

As of 1/8/26. Source: Voya IM, Bloomberg. CML spreads represent averages; spreads tend to range 20-30 bp on either side of each number depending on the individual loan.

Investors able to invest more risk have been embracing shorter-duration bridge loans, transitional loans, and construction lending, while investors with more conservative liability profiles have been re-entering core CML and resi-mortgage. Where does that leave investors unable to take private assets? On the commercial side, there’s plenty of paper available in the securitized market at a range of quality levels.

On the residential side, there’s a potentially interesting allocation for investors in search of a mix of diversification, duration, and excess return: good old agency mortgage-backed securities, plus Voya’s specialist agency mortgage derivative strategy.

Voya brings deep experience and specialized expertise in managing an agency mortgage derivative strategy that delivers targeted exposure to prepayment risk—an exposure that is structurally uncorrelated with the corporate credit and CRE risks that dominate most insurance company portfolios. The strategy leverages Voya’s long-standing, research-driven approach to uncover value in segments of the market that most investors overlook, creating a differentiated, low-volatility return stream.

Importantly, the strategy is straightforward to own in fund form on Schedule BA, making it an efficient way to add uncorrelated alpha potential while diversifying away from the concentrations inherent in traditional insurance portfolio allocations.

Voya has had an allocation to the mortgage derivative strategy in our general account for almost 30 years now; it’s one of our evergreen allocations.

Conclusion: Patience, selectivity, partnership

Nobody is thrilled with the state of the markets right now. Overall, investors seem to be using this environment to closely re-examine both allocation plans and manager relationships.

There are interesting opportunities out there, and very often they represent net new areas of investment—and as such they are being approached cautiously and selectively.

At Voya, we are investing our general account alongside our clients. As you look into what’s next in 2026, we’re facing the same conundrums and asking the same questions that you are.

Let’s find the solutions together.

The right partners, and patient capital, have never been more important.

A note about risk:

Insurance core fixed Income: The principal risks are generally those attributable to bond investments. Holdings are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy may invest in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below-market levels and extending the security’s life and duration while reducing its market value.

Investment grade private credit: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. High yield securities,, or “junk bonds”, are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. The strategy may use Derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on performance. Foreign Investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic. Risks of foreign investing are generally intensified in Emerging Markets. As Interest Rates rise, bond prices may fall, reducing the value of the share price. Debt Securities with longer durations tend to be more sensitive to interest rate changes. Other risks of the Fund include but are not limited to: Credit Risks; Other Investment Companies’ Risks; Price Volatility Risks; Inability to Sell Securities Risks; and Securities Lending Risks.

Commercial mortgage loans: All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. Investments in commercial mortgages involve significant risks, which include certain consequences as a result of, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market and other exogenous economic variables. The strategy will invest in illiquid securities and derivatives and may employ a variety of investment techniques such as using leverage, and concentrating primarily in commercial mortgage sectors, each of which involves special investment and risk considerations.