In the increasingly competitive and complex landscape for private credit allocations, private credit secondary strategies allow investors to achieve exposure to a diversified portfolio of high-quality deals via a single investment with the added benefit of potentially higher returns.

Executive summary

- Demand for private credit is soaring. The private credit asset class has experienced tremendous growth, with projections forecasting the space to reach $3 trillion by 2028.1

- The private credit secondary market is expected to grow. As allocations to private credit rise, more capital is locked in illiquid vechicles—and investors are increasingly turning to the secondary market for liquidity to help manage their cash flow requirements and broader asset allocation objectives.

- Secondary strategies offer key potential investment benefits. These include higher potential returns versus primary strategies, J-curve mitigation, and diversified exposure to a pool of high-quality, seasoned credit assets.

- Barriers to entry are high. Investing in secondaries requires deep sourcing, diligence, and operational capabilities. The growing transaction volume presents additional challenges as not every deal offers the same quality, transparency, or risk. The increasing need to distinguish between credits makes underwriting and selectivity even more critical. This demands deep market access, robust data, and specialized credit expertise, setting an even higher bar for participation.

Introduction: Secondaries are a critical release valve

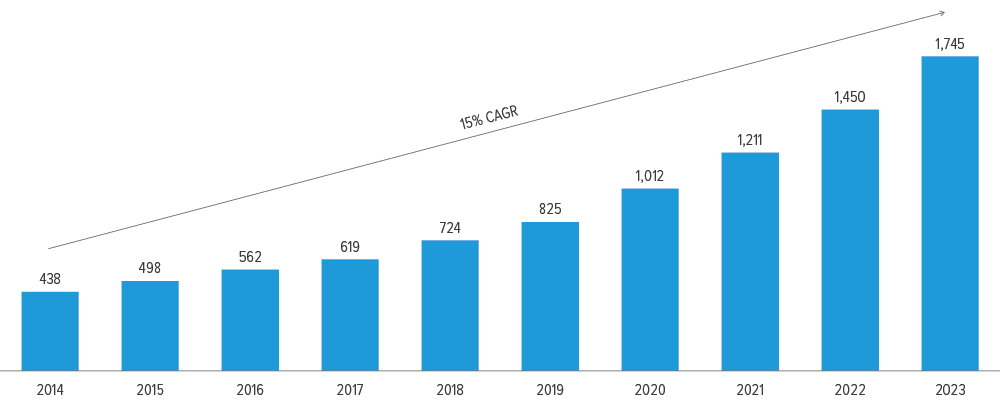

Private credit has grown into a cornerstone of modern corporate finance, providing tailored loans for leveraged buyouts, growth capital, and refinancings that were once the domain of banks. Since 2014, the private credit asset class has experienced tremendous growth (Exhibit 1), with projections forecasting the space to reach $3 trillion by 2028.1

As of 12/31/23. Source: Preqin.

As private credit has evolved and become a larger allocation across institutional investors, a natural byproduct has emerged: a secondary market that allows investors to transact existing loan portfolios as a whole or in specific parts. This growing market offers a powerful tool for enhancing portfolio liquidity, managing risk, and accessing seasoned credit assets.

What are private credit secondaries?

The journey of a direct lending investment begins with origination. Borrowers approach lenders for financing—whether to fund acquisitions, refinance existing obligations, or support growth. Once the capital is deployed, lenders and their investors receive interest payments and monitor performance throughout the life of the loan.

Such private credit allocations require investors to lock up capital in illiquid vehicles. However, investors still need to manage their cash flow requirements and broader asset allocation targets across equities, fixed income, and alternatives. This is where the secondary market comes in.

Private credit secondaries are transactions where investors transfer ownership of various exposures—whether interests in funds, individual loans, or portfolios—before they reach maturity. Investors can sell positions in certain funds or strategies where they are overweight and redeploy capital into others that better match their current portfolio objectives. At the same time, new entrants to private credit can use secondaries to establish exposure more quickly, bypassing long fundraising cycles and J-curves.

Against this backdrop, the secondary market has become a critical release valve, offering limited partners a path to liquidity and giving buyers access to seasoned portfolios with attractive yields.

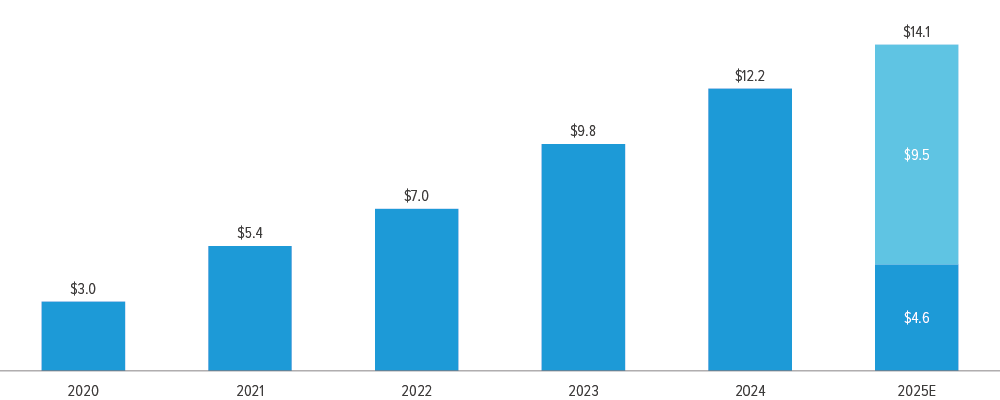

As of 06/30/25. Source: Campbell Lutyens, 1H 2025 Secondary Market Overview Report.

Secondaries come in two flavors

The two dominant transactions structures in private credit secondaries mirror those in the broader private markets: those led by limited partners (LPs) and those led by the general partner (GP).

- LP-led transactions

These are initiated by investors (LPs) looking to sell their interests in private credit funds. Motivations can range from the need for liquidity, to portfolio rebalancing, to a change in strategic priorities. Buyers who step into these positions gain exposure to a diversified pool of loans already originated, often at a discount, and with clearer visibility into performance.

- GP-led transactions

Here, the initiative comes from the general partner managing the credit fund. Rather than selling in the secondary market independently, the GP organizes a process—often involving the creation of a continuation vehicle—to provide liquidity options for existing investors while retaining certain high-quality assets in a new structure. This allows investors who want to exit to do so, while those who prefer to maintain exposure can roll into the new vehicle. Buyers, meanwhile, gain access to a curated portfolio of well performing loans.

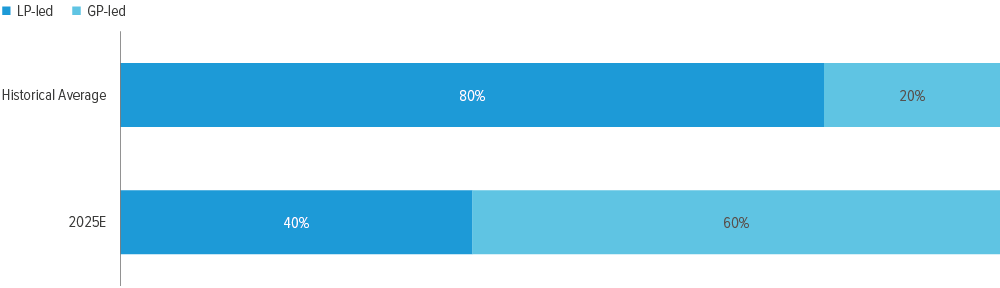

While transaction volume has historically been dominated by LP-led deals, GP-led deals are expected to account for 60% of volume in 2025, surpassing LP-led sales for the first time and marking a reversal of the historical market trend (Exhibit 3).

As of 06/30/25. Source: Campbell Lutyens, 1H 2025 Secondary Market Overview Report

Off-market access becomes more critical

Together, these structures provide a flexible toolkit. LP-led transactions make private credit commitments more tradable, while GP-led transactions create pathways to extend or reshape exposure to attractive loans. Both are responses to the same underlying trend: as private credit matures, investors demand ways to manage liquidity and tailor portfolios, rather than simply locking up capital for the duration of a fund’s life. However, these structures need to be carefully analyzed to make sure they are a simple transfer of exposure and not otherwise motivated.

In addition, as the secondaries universe continues to grow, the market is becoming more agented and competitive. Going forward, access to off-market and bilateral transactions is expected to be a critical component of identifying and capturing secondary market opportunities.

Investment benefits

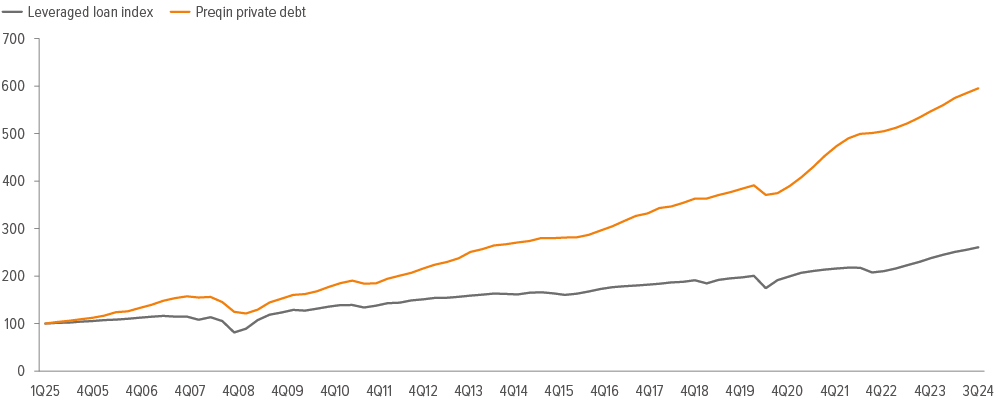

Secondaries deliver access to the same advantages that make the primary private credit asset class compelling: steady cash flow from interest payments, lower volatility than public markets, strong protections as senior secured lenders, and a history of attractive relative returns (Exhibit 4).

This is not an indicator of future results. Past performance does not predict future returns. A performance of the strategy is not guaranteed, and losses remain possible. Source: Preqin and Morningstar. For the period January 1, 2005 to September 30, 2024. The leveraged loan index is represented by the the Morningstar LSTA US Leveraged Loan Index, which derives its constituents from syndicated term leveraged loans that are held within top-tier institutional investor loan portfolios tracked by PitchBook LCD. The Preqin private debt index, a time-weighted return index that tracks the quarterly performance of global, closed-end private capital funds focused on private debt strategies. Past performance does not guarantee future results. Investors cannot invest directly in an index.

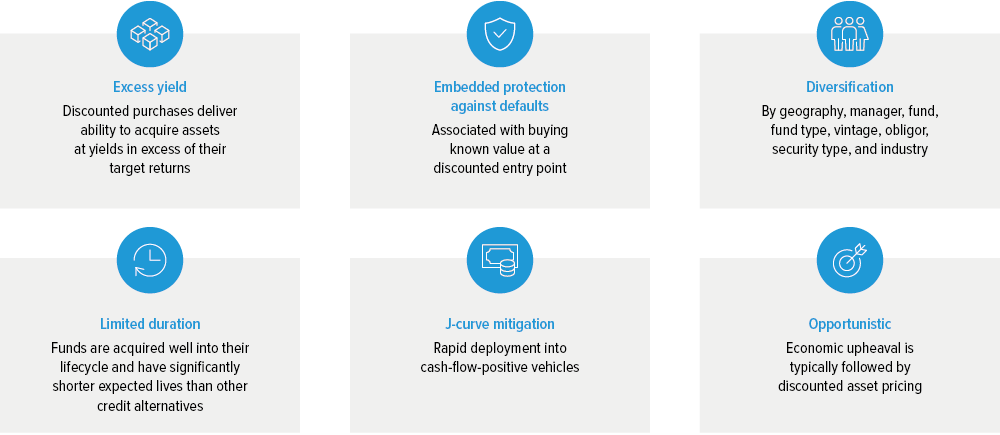

On top of these characteristics of the primary private credit asset class, secondaries add a distinct layer of potential benefits:

The role of discounts in private credit secondaries

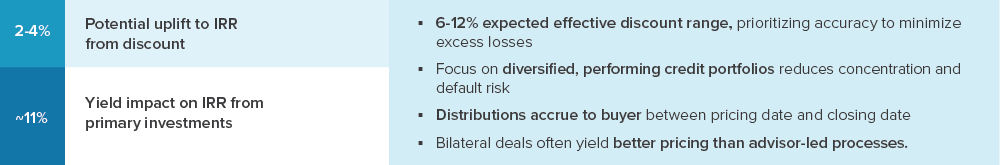

One of the key attractions of private credit secondaries is the opportunity to access potentially higher returns compared to primary fund commitments. In our experience, secondary investments in private credit often target 200–400 basis points above equivalent primary strategies, with the return premium largely driven by the ability to purchase interests at a discount to net asset value (NAV).

These discounts are an important component of how to align the reward and risk of a secondary position. With transparency into the seasoned loan book, experienced investors are able to price the underlying exposures in line with current market realities.

As Exhibit 5 highlights, the combination of negotiated NAV discounts and post-account adjustments is what gives secondary buyers the ability to access to high-quality credits at an attractive price. However, as the secondary market grows, diversification and bilateral negotiations are becoming an increasingly important component of securing discounts and increasing the probability of hitting return thresholds.

Source: Voya IM. For illustrative purposes only.

How to access the secondaries market

The private credit secondary market is highly intermediated and becoming increasingly competitive, with agents and brokers playing a central role in connecting buyers and sellers.

For platforms with deep relationships, the ability to source off-market deals is an advantage. In many cases, before they contact agents to tap the secondary market on their behalf, secondary market sellers bring opportunities to the investors they know and trust to transact reliably, quickly, and at scale. Strong relationships mean better visibility into deal flow and early looks at transactions before they are widely shopped.

Effectively accessing the secondaries market as a buyer requires extensive industry relationships and specialized expertise. Among other things, active buyers must:

- have the requisite relationships to source quality opportunities

- have sufficient information about the current performance and future prospects of a private credit fund to adequately price the investment

- be an acceptable buyer of that private credit fund such that its general partner will consent to the transfer of the selling limited partner’s interest

Without deep relationships and alignment of interest, it’s hard to even get a seat at the table, let alone win and close secondary deals in an increasingly competitive market environment.

Conclusion

A secondary strategy can be an attractive way to add diversified private credit exposure:

- Seasoned, senior middle-market loans

- Shorter durations (2–3 years)

- Mitigates J-curve effects

- Potentially stronger risk-adjusted returns vs. primary strategies

While secondary market strategies offer many potential benefits, hurdles remain for many interested investors. Access to the most desirable deals is often restricted to large, established private credit investors, and minimum per-deal investment levels are high, meaning that establishing a diversified private credit portfolio can require significant allocations of both capital and time. In our view, private credit platforms with long-standing track records and experience across various economic cycles are well positioned to capitalize on the current opportunities in the secondary market.

We welcome the opportunity to discuss how a private credit secondary strategy aligns with your strategic asset allocation. Please contact our team to learn more.

A note about risk: Risks described below are not all-inclusive, and before making an investment in a portfolio of private placements, investors should carefully consider such an investment.

The primary risk to an investment in private credit secondaries is credit risk. Credit risk is the risk of non-payment of scheduled interest or principal payments on a debt instrument. In the event a borrower fails to pay scheduled interest or principal payments on its debt, a portfolio of private placements would experience a reduction in its income and a decline in market value.

Private credit secondaries generally involve less risk than unsecured or subordinated debt and equity instruments of the same issuer because the payment of principal and interest on private placements is a contractual obligation of the issuer that, in most instances, takes precedence over the payment of dividends, or the return of capital to the borrower’s shareholders and payments to public bond holders. In the event of the bankruptcy of a borrower, a creditor could experience delays in receiving regular payments of interest and principal and may not receive the full repayment of its principal.

Portfolios of private credit secondaries are also subject to interest rate risk. One risk related to interest rates is the potential for changes in the interest rate spreads for private credit in general. To the extent that changes in market rates of interest are reflected not in a change to the base rate, the U.S. Treasury, but in a change in the spread over the base rate which is payable on loans of the type and quality in which a portfolio invests, a portfolio of private credit could also be adversely affected. This is because the value of a debt is partially a function of whether it is paying what the market perceives to be a market rate of interest, given its individual credit profile and other characteristics.

However, unlike changes in market rates of interest for which there is only a temporary lag before a portfolio reflects those changes, changes in a credit’s value based on changes in the market spreads on loans may be of longer duration. If spreads rise as described above, for example, in response to deteriorating overall economic conditions and/or excess supply of new loans, the principal value of private credit may decrease in response. On the other hand, if market spreads fall, the value of private credit may increase in response, but borrowers also may renegotiate lower interest rates on their debts or pay off their debts by refinancing at such lower rates. In that case, the borrowers would be required to pay a make-whole amount, which would mitigate the risk. Private credit trades in a private, unregulated market directly between loan market participants; although most transactions are facilitated by broker-dealers affiliated with large commercial and investment banks. As a result, purchases and sales of private credit typically take longer to settle than similar purchases of bonds and equity securities. In addition, because private credit transactions are directly between investors, there can be greater counterparty risk.

Finally, many borrowers are private companies and/ or companies that have not issued other debt that is rated by rating agencies such as Moody’s Investors Service, Standard & Poor’s, or Fitch Ratings. As a result, investment decisions related to private placements may be based largely on the credit analysis performed by the adviser to the fund or portfolio making the investments, and not on rating agency evaluation. This analysis may be difficult to perform.

Information about a private credit and the related borrower generally is not in the public domain, since private companies and companies that have not issued public debt or securities are not subject to reporting requirements under federal securities laws. However, borrowers are required to regularly provide financial information to lenders, typically in much greater detail than is available in the public markets. Furthermore, information about borrowers may be available from other private placement participants or agents who originate or administer private placements.