Available power is now a real chokepoint on the growth of much-needed data center capacity. As tech companies prioritize securing reliable electricity, there is a growing convergence between data center and power projects—and an exceptional opportunity for private capital.

Key Takeaways

- U.S. electricity demand—and prices—are growing at rates not seen since the 1980s, driven in large part by ambitious data center development plans and widespread AI adoption.

- Power is the key to scaling AI further, and the forecast shortage emerging in near-term availability is driving a rush for any and all energy solutions—and forging new partnerships between data center developers and power developers.

- Hyperscalers are prioritizing speed to market, which leads to an immediate need for billions of dollars of private infrastructure financing.

- Voya’s Direct Infrastructure Credit team has an established track record of financing critical infrastructure projects addressing energy and digital infrastructure needs, with longstanding partnerships with borrowers at the forefront of new generation development.

America’s power crisis

The past couple years have seen the slow-moving electric power sector, accustomed to decades of flat growth, have to quickly adapt to the “move fast and break things” ethos of Big Technology.

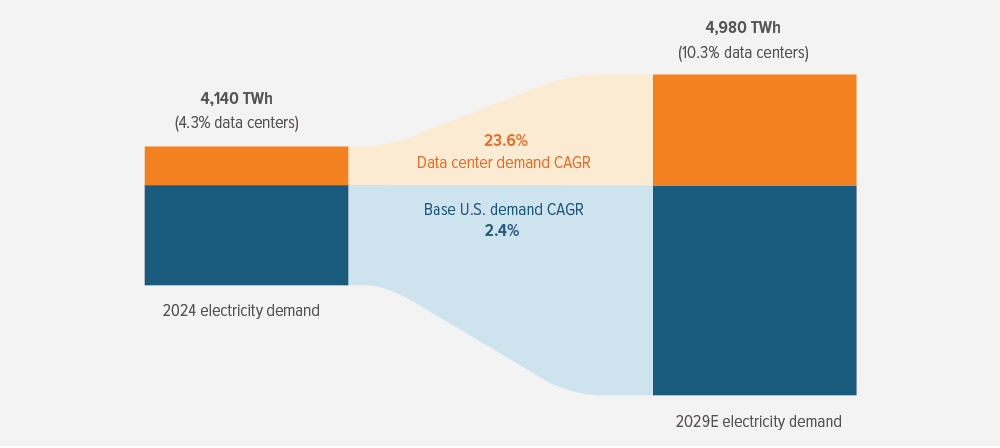

AI, the switch from cable to streaming video, crypto mining, and the increasing dominance of cloud computing have all meant that big tech companies are planning ever more data center capacity—and those data centers all need power. The U.S. is estimated to see overall electricity demand compound annual growth rate (CAGR) of 3.8% from 2024-2029, driven by a 2.4% growth in all other forms of power demand and a 23.6% CAGR in data center power demand (Exhibit 1).

The crunch is already here. Vacancy rates in data centers are practically nonexistent, hitting a record low 1.6% in the first half of this year; further, nearly 75% of newly completed colocation and hosting capacity was contracted before it was even available. The average asking rental rate for data center space in primary markets has risen 57% since 2021 (Exhibit 3).1

As the market responds with accelerating investment in data centers, power has emerged as the key constraint to future development. This critical bottleneck is affecting the infrastructure market in four significant ways:

- Data center developers and hyperscalers are increasingly choosing to directly procure power either via captive generation or power purchase agreements.

- Data center and power developers are focused on speed to market, which has resulted in continued demand for clean energy projects since they are the fastest to build and connect to the grid.

- Data center developers are pursuing partnerships with energy developers due to their experience siting and obtaining approvals for large power loads.

- Growth in digital infrastructure and energy projects require increased funding from private capital sources across the capital structure.

As of 09/11/25. Source: FERC, Grid Strategies, EIA, Goldman Sachs. Fun fact: data centers already consume as much energy as the entire state of California.

A note about risk: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.