As fully funded pension plans allocate more heavily into fixed income, they are embracing the diversification and yield benefits of investment grade private credit as never before. This is likely to be one of 2024’s bright spots—along with renewables infrastructure and mortgage derivatives.

Themes and opportunities for 2024

- 2024 is the year of LDI; we expect the bulk of pension plans to follow 2023’s pioneers into private credit, driven by a need for diversification beyond simply adding a third fixed income manager.

- Renewables infrastructure lending remains a standout in an uncertain economy, supported by the Inflation Reduction Act’s turbocharging of investment and asset values.

- High home loan rates are creating an unusually strong opportunity in mortgage derivatives, with interest-only securities hitting double-digit yields despite the lowest prepayment risk seen since the 1980s

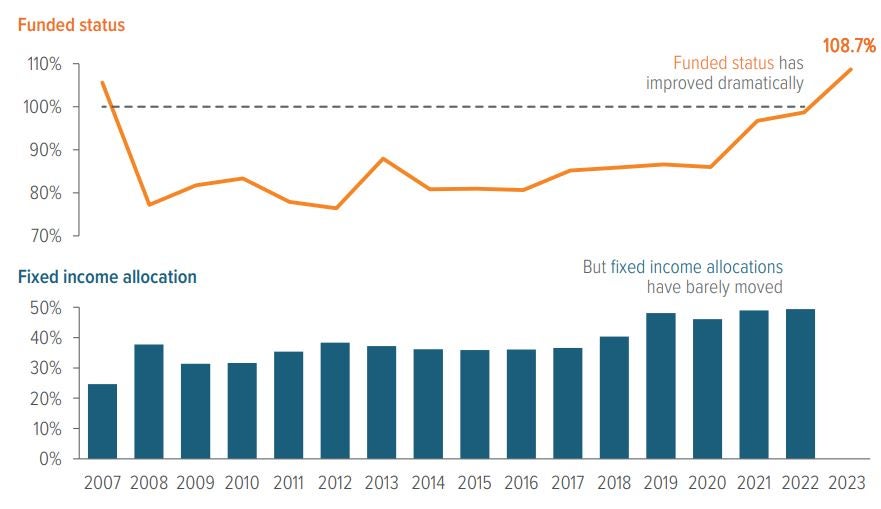

As of 09/30/23 (funded status intra-year estimate) and 12/31/22 (year-end reported funded status and allocations). Source: Company reports, Bloomberg, Voya IM. Analysis aggregates year-over-year assets, benefit obligations and asset allocations from 139 defined benefit pension plans in the S&P 500.

Pensions seek out alternatives

The average pension plan is closing out 2023 with a funded status way over 100%, yet with a fixed income allocation of just under 50%. That means next year will see a lot of plan sponsors looking to deepen and diversify their fixed income portfolios. Going out with an RFP for a third or fourth fixed income manager might make sponsors feel all warm and fuzzy inside, but it probably won’t accomplish much in terms of actual portfolio diversification. On a total return basis, there are only so many public credit strategies you can employ to try to beat the benchmark—and from an LDI perspective, using only public credit to hedge plan liabilities can introduce new risks, such as issuer concentration.

Investment grade private credit offers: 1) Meaningful diversification 2) Surprisingly good liquidity 3) Strong covenants 4) A sizeable yield premium.

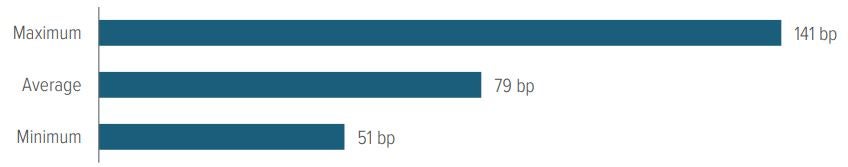

By contrast, investment grade private credit has a) a significant impact in reducing corporate name concentration risk in fixed income portfolios, b) surprisingly high liquidity (largely because 85% of the market is syndicated by intermediaries), c) far better covenants and downside protections than public investment grade bonds, and d) a yield premium to publics that hovers around 79 basis points for top-class investors such as Voya—the #1 private placement manager for external clients.1

95% of top life insurers and 61% of top P&C insurers have investment grade private credit allocations.

Two final factors make 2024 the right time for pensions to move into private credit. First, the average duration of a pension fund is now around 8–11 years, which is right in the swing path of investment grade private placements (weighted average duration of 7–10 years). Second, most major players in the private credit market are moving to daily pricing in 2024.

In 2023, Voya’s LDI and alts teams helped several pension clients make their first allocations into investment grade private credit, real estate, and mortgage-related assets. The seal has been broken; the leaders are already allocating. Next year is the year the movement gains real momentum.

As of 09/30/23. Source: Voya IM, Bloomberg. Spread is measured against a broker-guided/Voya-recommended basket of investment grade public bonds that are equivalent in rating, maturity, sector and other specifics to each private transaction. Premiums are determined from Voya’s combined private credit investment pool, both general account and third-party strategies.

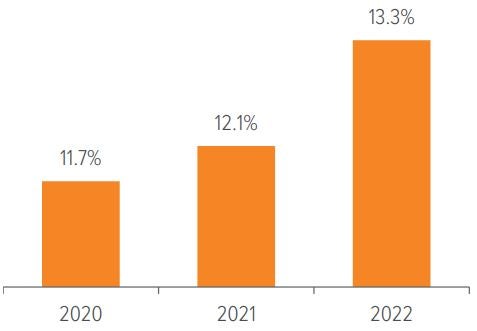

One reason I’m confident in calling this trend is I’ve seen it happen with insurers—which, like pension funds, are long-term, liability driven investors. Huge life insurers have always made private placements from their general accounts. But 2015–2020 saw an explosion—spearheaded by Voya—in third-party management of investment grade private credit strategies for insurers. Now, 95% of the top 100 life insurers and 61% of the top 100 P&C insurers have investment grade private credit allocations, and there is a robust and liquid intermediary syndication network for deals.2

As many sponsors decide to keep their pension plans on their balance sheet— hibernating them—they are learning from the insurance company playbook how to diversify their exposure to investment grade corporate bonds. This diversification is even more important for pension plans given the discount setting process used in valuing liabilities. And—as the insurance companies know—one of the most effective ways of achieving that diversification is to allocate to investment grade private credit.

As of 09/30/2023. Source: S&P Capital IQ, Voya IM.

Agented investment grade private credit issuance has tripled in the past 20 years, to $70–80 billion per year.3 Even with the constant influx of new investors into the asset class, we expect deal flow to remain strong, helped by banks’ retrenchment from medium-term corporate lending since the demise of Silicon Valley Bank. The great irony is that banks that still have a taste for investment grade private placements are now seeking out partnerships with major private credit funds (to remain involved in the sector without having to keep the loans on their balance sheets). But that is, as they say, a story for another newsletter.

Sunny days for solar panels

The IRA’s incentives are estimated to help more than triple U.S. renewable energy capacity by 2030.

I couldn’t be more excited about Voya’s Renewable Energy Infrastructure Debt (REID) team. Our strategy—which originates loans to renewable energy and sustainable infrastructure projects—was handed a gift with last August’s passage of the Inflation Reduction Act (IRA) by the U.S. government.

The short version of the story is that the IRA broadly stimulates the domestic renewable energy sector. Its tax credits benefit strategies such as ours via increased investment opportunities and expanded asset values.

The long version goes like this. The IRA— passed in August 2022, so the economy is just starting to feel the effects—is possibly the most important climate legislation ever enacted. Some industry and government sources forecast that the IRA will result in over $600 billion in investment in the renewable energy sector and the addition of over 500 gigawatts (GW) of annual clean power generation by 2030. This will more than triple existing U.S. renewable energy capacity, which was 243 GW of cumulative operating capacity at the end of 3Q23.4

The IRA promotes investment in domestic renewable energy production facilities by enhancing their federal tax benefits. It gives a 30% investment tax credit available over the next 10 years (or an energy production tax credit, if more valuable), which can be supplemented up to 50% by add-ons such as higher domestic content, strong labor standards and plant location. The IRA also expands tax benefits to categories of renewable energy previously excluded, such as standalone battery storage and clean hydrogen.

Noteworthy for tax-conscious investors is that the IRA also increases project sponsors’ ability to monetize the tax benefits they earn, newly allowing such credits to be more readily transferrable to investors. The effects of the law have only just begun to percolate through the renewables industry, and we expect the IRA to contribute positively to REID deal flow and asset values.

Mortgage derivatives in the spotlight

My totally unbiased opinion is that Voya has probably the best mortgage derivatives team in the market. They’ve been at it for over 30 years, and they reliably turn in very attractive risk-adjusted returns. So when they say to me, “There’s a historical opportunity in interest-only and inverse interest-only securities,” I listen.

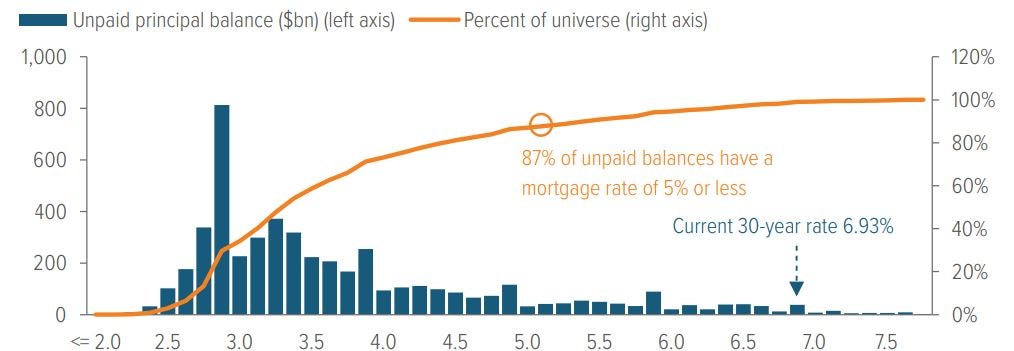

We all know it’s a terrible time to be a homebuyer. Mortgage rates are around 7.29%, which feels even more awful when you consider that 90% of outstanding mortgages (by value) have rates under 5.5% (Exhibit 4). But that’s exactly what makes it a great potential entry point for mortgage derivatives.

As of 11/22/2023. Source: Fannie Mae, Freddie Mac, Voya IM.

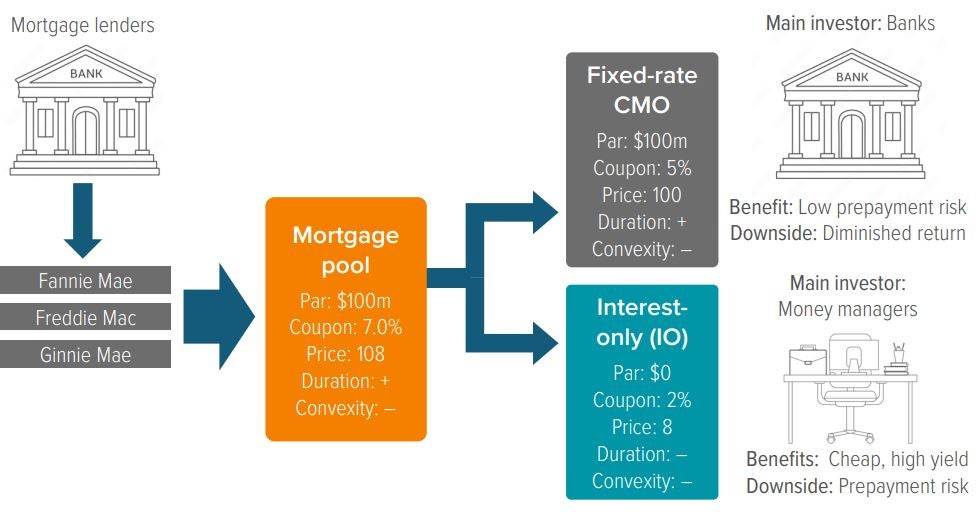

Interest-only (IO) and inverse interest-only (IIO) securities aren’t derivatives in the “synthetic equity product” sense. These instruments carry the leftover cash flow when an investor converts a mortgage pool priced above par into a lower-coupon CMO (Exhibit 5). These byproducts have no real investor base, so they tend to be cheap.

IO and IIO yields are currently around 10% on a hold-to-maturity basis.

But right now, IOs and IIOs are historically cheap: Yields are currently around 10% on a hold-to-maturity basis over a broad range of prepayment assumptions, including market consensus. These securities have minimal credit risk because they’re derived from residential mortgages backed by Ginnie Mae, Fannie Mae and Freddie Mac. And, thanks to the current mortgage rate environment, their prepayment risk is at a historical low.

Source: Voya IM.

Let’s unpack this: The biggest risk for an IO or IIO is that people pay off their mortgages early, because when they do, the interest-only cash flow stops. But these securities’ sensitivity to prepayments can also be a benefit—prepayments coming in 1% slower than expected can add 1% to the yield of the IO for the rest of its life, which tends to be 5–10 years.5 Some ambient level of prepayment can be expected in any market environment, but the biggest driver of prepayments is the opportunity for homeowners to save money by refinancing their mortgages. Annual prepayment rates hover around 4–9% of outstanding principal until homeowners can save 50 bp on their mortgage rates, and then they skyrocket.

As shown by Exhibit 4, even if mortgage rates fell 200 bp over the next year, it wouldn’t cause overall prepayment speeds to increase much, since so few mortgages are outstanding with rates above 5.5%. Put another way, mortgage derivative values are more decoupled from the next rate move than they have been in decades. Plus, when you buy an IO, you know the coupons of the mortgages it is derived from. IOs based on agency-backed mortgages with rates of 2⅞%—the coupon with by far the largest amount of outstanding mortgage principal—just… aren’t going to see refinancing in this market. And the remaining incentives to prepay—selling a house to move for a new job, cashing in on home equity, and so forth—are much more stable and predictable.

Where Voya’s mortgage derivatives team adds value to this story is that, for them, that market consensus 10% yield is just a starting point. Our team’s core expertise is in advanced, detailed fundamental and quantitative modeling of prepayment behavior across borrowers. They work to unlock relative value by examining which subsets of borrowers are likely to prepay faster or slower than market expectations.

Our mortgage derivative team’s core expertise is in unlocking relative value via advanced analysis of prepayment behavior.

This is very different from how other market participants look at IO and IIO securities, because 1) out-of-the-box prepayment models are broadly available and pretty good; 2) most investors don’t allocate enough to mortgage derivatives to make further, bespoke research worthwhile; and 3) IOs and IIOs are so cheap that it kind of doesn’t matter. But our team can zero in on an IO composed of, for example, mortgages from a state that just passed a tax on mortgage refinancing. If we notice it’s not trading at any sort of premium despite the slightly lowered prepayment risk, we buy and hold it to maturity, squeezing out every last drop of extra yield.

Three for the road

It’s been a long, strange year in the markets. While I don’t see things clearing up completely in 2024, there are compelling alternative strategies which are in large part insulated from—or even beneficiaries of—macro uncertainty. Renewables infrastructure, mortgage derivatives, and investment grade private credit are all likely to gain momentum next year. The time to look at them is now.

Risks of Investing Investment grade private credit and renewables infrastructure debt: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. Mortgage derivatives: The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below market levels and extending the security’s life and duration while reducing its market value. |