While markets efficiently price each new batch of federal policy headlines, the longer-term consequences to some of these plans have important implications for the securitized investment landscape. One lens to evaluate these risks? ESG analysis.

Key takeaways

- Securitized credit tends to be less sensitive to headline-driven volatility than other fixed income asset classes, but this year’s policy developments are driving a shift in longer-term risks.

- Voya’s environmental, social, and governance (ESG) analysis spans collateral, deal structures, and parties tied to transactions, and it helps us successfully navigate potential policy and governance pitfalls.

- For example, recent subprime auto lender bankruptcies illustrate both the impact of federal policy on borrower segments and the need to carefully screen lenders for predatory or unsustainable lending practices—in other words, for governance.

- Federal policy is also driving positive developments in securitized credit through evolving societal and environmental opportunities as non-bank lenders and AI innovators test the limits of consumer credit, power, and electrification.

The shifting sands of U.S. policy

Almost a year into the new administration, markets have largely shrugged off initial policy changes. Yet new pockets of risk are appearing in both the broader economy and securitized credit.

Recent bankruptcies in the solar and subprime auto sectors and rising consumer finance complaints have been explained away as isolated incidents—but in each case, recent policy changes have played a major role. From tariffs and immigration to deregulation and renewable energy, federal actions are increasingly swaying both the economy and financial markets.

As can happen in times of change, rising risks in some areas are offset by opportunities in others. Technology-driven demand for energy has been one of the markets’ biggest growth themes, while the skyrocketing cost of electricity is contributing to a widening economic divide between income cohorts.

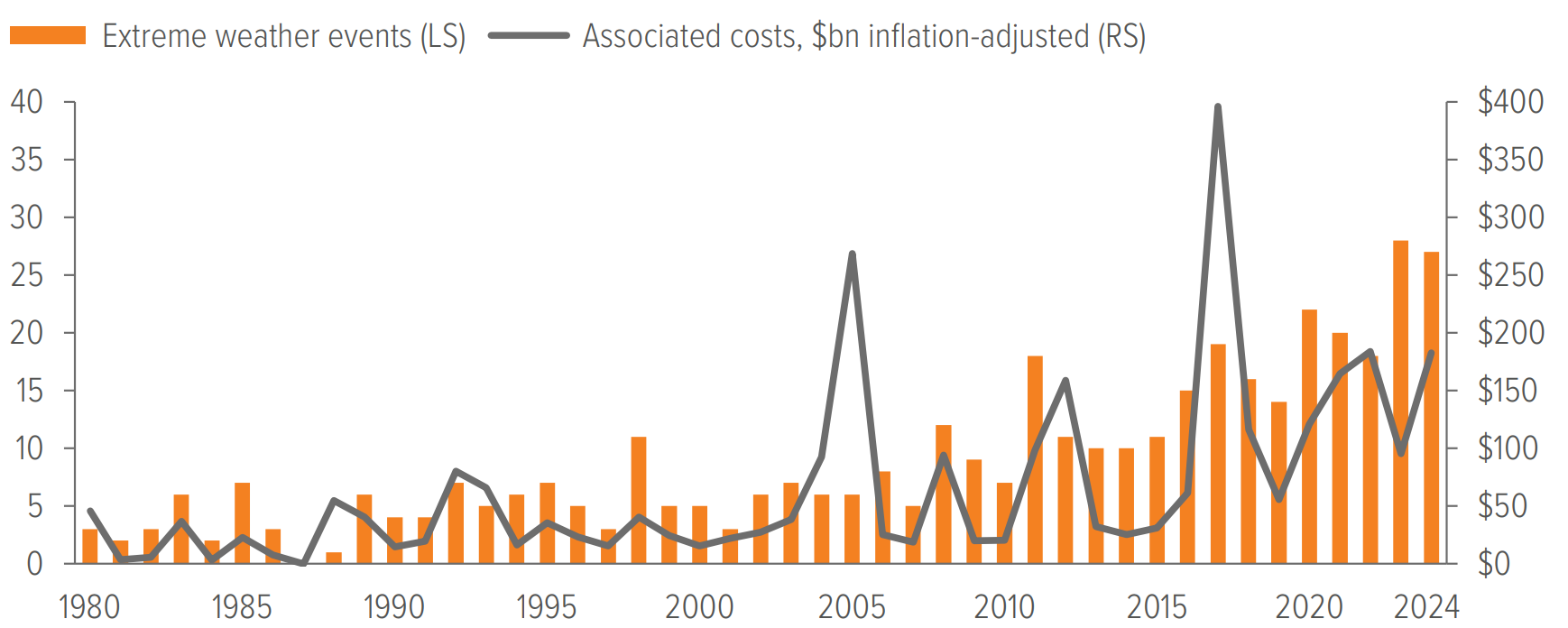

Meanwhile, a lack of proactive policy can also influence markets, as longer-term themes continue to play out—such as the rising frequency of extreme weather events associated with climate change (Exhibit 1).

Though securitized credit tends to be less sensitive to headline risk than other fixed income sectors, these policy shifts have amplified the value of differentiated research. In particular, our ESG framework guides our analysis of risks and opportunities from multiple angles: collateral, deal structure, and parties to transactions.

Beyond guiding our pursuit of relative value across securitized credit assets, our framework also helps us identify longer-term themes that can enhance investment performance. For example, we’ve capitalized on demand for power and electrification, targeted well-structured forms of sustainable consumer credit, and steered clear of troubled lenders— even those once touted as “impact” investments—when our ESG analysis flagged their lending practices as unsustainable.

As of 10/22/25. Source: U.S. National Centers for Environmental Information.

A note about risk: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below-market levels and extending the security’s life and duration while reducing its market value.

ESG investing risk: Environmental, social and governance (“ESG”) factors may impact the investment risk and return profiles of our investments. Integration of ESG factors into an investment process may cause a strategy to take risks or forego exposures available to strategies or products that do not consider ESG factors, which could negatively impact performance. There is no assurance that integrating ESG factors will be successful for an investment strategy. Past performance is no guarantee of future results.