At a time when corporate credit spreads are tighter than ever, securitized markets still offer attractive relative value. Our take on how to approach it: add diversification, pick your targets, and take some calculated risks.

Executive summary

- We expect volatility to remain low and liquidity to stay high in securitized markets as trade policy friction loops less directly into our consumer and U.S. real estate-focused sectors. Conversely, the “OBBB” and efforts to deregulate are clear positives for risk-taking in securitized.

- Key segments of the securitized credit investor base are likely to remain motivated risk-seekers, with insurers and money managers craving the yield premiums and lower volatility that securitized credit can deliver. Banks are a potential source of demand upside as deregulation efforts start to have impact.

- Broadly, we favor the middle of the securitized credit capital stack, BBB+ to A, navigating between safer but duration-heavy AAAs and the riskier cash flows at the low end of the market.

- At the sector level, we’re most bullish on commercial mortgage-backed securities (CMBS); the sector is early in its credit cycle, new issuance is hot and spreads still have room to tighten.

- The collateral for collateralized loan obligations (CLOs), leveraged loans, are seeing defaults increase from various pressures, while base rates remain high.

- High rates keep prepayments and home price appreciation subdued in non-agency residential mortgage-backed securities (RMBS); we’re mostly seeing technical opportunities, as new issuance remains sporadic.

- We are staying opportunistic in the vast universe that is asset-backed securities (ABS), but we are cautious about lower-income cohorts, which face increasing economic stress.

Why securitized credit?At Voya, we view securitized credit as an evergreen portfolio allocation. Its historic spread premium to, and low correlation with, other assets gives it one of the best fixed income risk/return profiles of the past 10 years. Our target allocation remains approximately 50% of investors’ non-core fixed income portfolio. For a deeper dive into the asset class, please see our Guide to Securitized Credit and our Glossary of Securitized Credit Terms. |

Snapshot: Securitized credit now

Relative value in a shifting market

Built on a bedrock of consumer borrowing, household formation, and real estate, securitized credit has always moved to the beat of Main Street more than Wall Street. It is only indirectly affected by tariffs, the budget deficit, and geopolitics. Even a few rate cuts aren’t likely to significantly change risk appetites.

While the securitized market’s low correlation to other fixed income sectors supports a long-term allocation to the asset class, it has more recently manifested in a tactical relative value opportunity. As policy headlines that caused gyrations in financial markets in April are increasingly discounted, broader higher-beta bond market spreads have moved tighter and tighter, showing elevated volatility along the way.

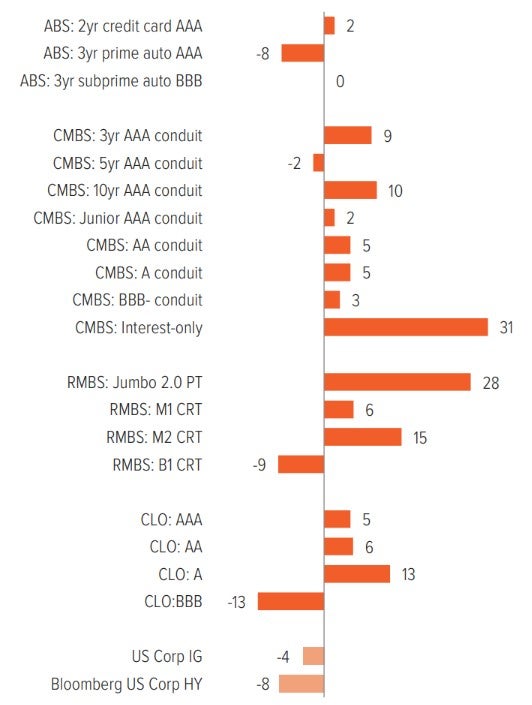

Meanwhile, securitized markets have behaved true to their low-beta form as spreads have lagged, leaving most flat to a little wider year to date (Exhibit 1). This has helped preserved securitized’s relative value, and, with the policy narrative shifting favorably, the market offers a range of interesting opportunities to improve risk-adjusted portfolio returns.

A healthy market with attractive opportunities

So, volatility across securitized market sectors has stayed relatively low this year—which you’d expect, given the Main Street bias mentioned above and disconnected from policy headlines. At the same time, liquidity in the sector has been strong and deep, especially in primary issuance.

As of 07/31/25. Source: Voya IM, FRED.

A note about risk: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below-market levels and extending the security’s life and duration while reducing its market value.