Key Takeaways

Looking ahead, the defense sector seems to be facing a decade-long tailwind as a changing geopolitical landscape has increased necessity, while accelerating technological advances in AI and autonomy are snowballing innovation and interest.

Our focus is on defense companies operating in areas experiencing the most rapid budgetary expansion, including intelligence systems, missile defense, and next-generation platforms.

We expect sustained growth, led by tech-driven, software-enabled companies that embrace risk and manufacture high-volume systems—delivering force multipliers and driving the potential for outperformance.

The defense sector is undergoing a structural realignment, catalyzed by geopolitical volatility, technological disruption, and shifting transatlantic security dynamics.

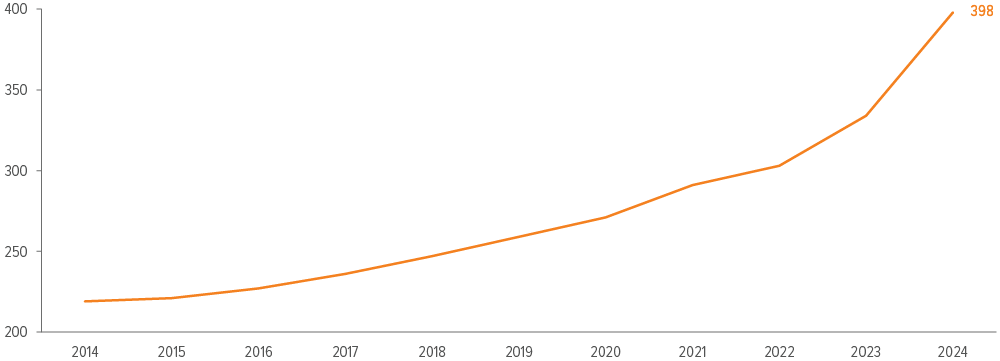

EU defense spending surges

In Europe, defense spending has been rising for 10 consecutive years and has reached historic heights (Exhibit 1). Between 2023 and 2024, they rose 19%. Expenditures as a percentage of the EU member states GDP rose from 1.6% in 2023, to 1.9% in 2024, and it expected to reach and estimated 2.1% in 2025.1 The absolute expenditures are expected to rise from $398 billion in 2024 to $442 billion in 2025.2

Germany’s €100 billion special fund and Poland’s commitment of over 4% of GDP to defense underscore a strategic pivot toward rearmament and modernization.3 This surge is not only a response to Russia’s aggression in Ukraine but also reflects growing concerns over the reliability of U.S. security guarantees.4 European governments are increasingly investing in indigenous capabilities, joint procurement, and strategic autonomy.

As of 12/31/2024. Source: Council of the European Union.

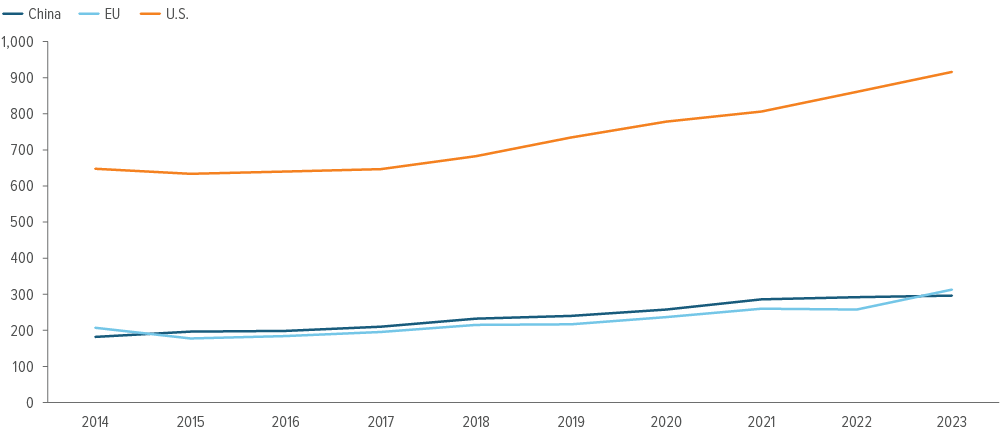

U.S. defense spending dwarfs other countries

While the EU defense expenditures are rapidly increasing, the U.S. budget stands at elevated levels with expenditures approaching $1 trillion and recent announcements suggesting additional growth (Exhibit 2).

Source: The World Bank and Stockholm International Peace Research Institute

The vision for the U.S. defense is centered around cutting-edge technology and large-scale modernization to sustain global military superiority, particularly in competition with China, while focusing on homeland security threats.

One example of the quest for modernization is the space-based missile defense system Golden Dome that was announced in May 2025. Still largely in the conceptual and initial R&D phase, the Golden Dome is designed to leverage some past investments but will also use next-generation technology to defend against the evolving and complex threat landscape. It will require integration of power-hungry directed energy weapons, advanced sensors, resilient communication networks, and composite defensive platforms. Corporates and management teams are eager to capture this opportunity, and competition will intensify until the system moves from concept to reality.

A paradigm shift for the U.S. defense sector

For three decades, the sector has experienced significant consolidation, shrinking from roughly 50 to 5 major companies delivering to the U.S. defense apparatus. Contracting practices have favored the Primes through upfront funding allocations—supporting both top-line and margins—and increasingly flexible delivery terms, given the limited supplier base. Over time, this dynamic has also constrained the sector’s ability to recruit and retain top talent.

As the defense budget now prioritizes rapid innovation and high-tech, software-driven solutions aligned with private-sector capabilities, the DoD requires supply chains that are scalable, secure, and resilient. In response, there is a potential for an increasing number of spin-offs, partnerships, and government-backed deals, in combination with contracting structures that introduce more differentiated and balanced risk-sharing mechanisms.

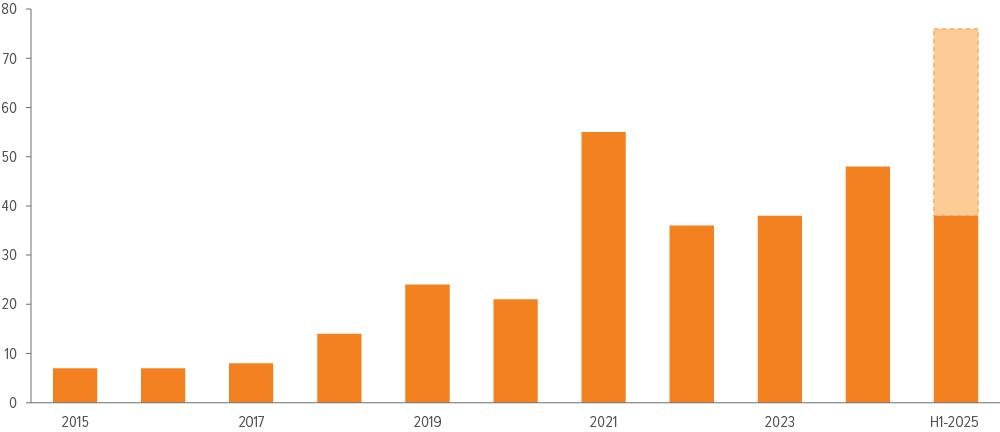

Private sector advancement

Private firms, focusing on AI-enabled systems, autonomy, and dual-use technologies that serve both military and commercial markets, have moved quickly and attracted billions in funding due to their agility and software-driven approaches. Among venture and PE backed companies with dual-use or defense applicability and relevance to national security, total private capital raised was up 32% from 2024, reaching $70B and DoD spending on the same companies more than doubled. With a longer time frame, Exhibit 3 below shows how venture investments (not incl. PE) have surged during the last decade. With increasing disruption and focus on defense tech, acceleration of private-sector innovation challenges incumbents and sets the stage for spin-offs, partnerships, and new operating models.

A wave of spin-offs and deals?

As defense priorities pivot toward speed, software centric innovation, and resilient supply chains, we see a structural opening for spin-offs, JVs, multiple consolidation pathways, and hybrid public–private financing models.

Spin-offs and JVs are gaining momentum as units operating independently often attract higher growth multiples and lower costs of capital. At the same time, several consolidation pathways are likely to emerge, including:

- Large publics acquiring smaller privates with differentiated technologies

- Mid-caps acquiring privates to accelerate vertical integration

- Private for private combinations forming “Private Primes”

The government’s shift from traditional procurement to a co-investor seeking participation in upside—while remaining the sector’s primary customer—raises new questions around governance, incentives, and risk allocation. On the other hand, the more vertical and nimble operations created through spin-offs and targeted M&A could help accelerate innovation and improve competitiveness in attracting specialized talent.

Strategic partnerships and exports

International partnerships are also increasing, driven by supply chain stress, heightened global threats, and opportunities arising from localization and co-production initiatives with key allies. These collaborations enable more specialization and solutions tailored to specific environments, since it improves the understanding of the end-user and, while also serving as a strategic placement of supply and value chains. As Europe is developing its defense capacities, they are still heavily dependent on imports from the U.S. as well as technology transfers and partnership agreements with major U.S. companies. At the same time, the U.S. is facing stretched production lines for high-demand equipment and is strategically shifting emphasis towards facilitating greater allied capabilities, not only as customers but also as co-producers and research partners.

U.S. defense companies are also deepening ties with the Middle East. The partnerships and deals include shared production of advanced weaponry, cyber solutions and AI integration. The Middle Eastern states’ motivation is to reduce reliance on single suppliers, build technical capacities, and ensure resilience against geopolitical shocks.

For the U.S. defense companies, the partnerships are of strategic nature and a way to:

- Conduct joint research, increase production, and improve technology transfers.

- Build out new supply chain and localization agreements, with co-investment in manufacturing, electronics, and next-generation systems like directed energy and counter-drone solutions.

- Pair EU and Middle East capital and manufacturing with US defense technology, focused on NATO and bilateral agreements.

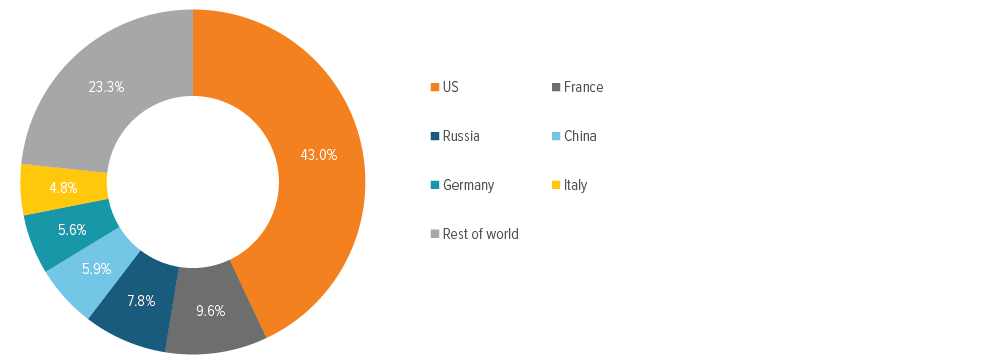

Source: Data from Stockholm International Peace Research Institute.

To some degree these efforts build on the US’s position as the world’s leading defense exporter attributed to a growing 43% of global exports between 2020 and 2024 according to Stockholm International Peace Research Institute. Given this scale, U.S. companies are likely to remain dominant suppliers of weaponry and defense systems over the next decade, even as they expand their partnership structures and common capabilities.

Spill-over effects and innovation for the larger economy

Increased focus on AI, cyber, and advanced technological development—such as advanced sensors, resilient communication networks, drones, and satellites—is likely to create spillover effects between public and private markets, and potentially across industries.

Some innovations originally developed by the defense industry include the internet, satellite-based GPS systems, and microwaves. These examples highlight how military-driven R&D can transform civilian sectors.

What emerges in the next decade is still up for debate, but it will likely relate to advancements in AI, autonomous systems, cyber, quantum computing, hypersonics, and advanced materials. These technologies have multiple applications and are likely to benefit commercial sectors like manufacturing and energy. These are the same areas as we see partnerships between the U.S. government and corporates. For example, corporates are providing AI-driven national security modernization solutions to defense and intelligence agencies and integrating classified data for improved decision-making and targeting.

Strategic positioning in defense and security innovation

Our focus is on defense companies operating in areas experiencing the most rapid budgetary expansion, including intelligence systems, missile defense, and next-generation platforms. In our view, these companies are well-positioned to support evolving national security needs and deliver long-term value through innovation and operational scale.

We are particularly constructive on the development of hypersonic and Directed Energy Weapons (DEW), Unmanned Aerial Systems (UAS) and electric propulsion, Vertical Take-Off and Landing (VTOL) aircraft and space-based capabilities. The shared enabler is AI and increasing autonomy, embedded across all systems for improved decision-making, speed, safety and scalability. It enables autonomous flight, targeting, predictive maintenance, and coordination. In addition, all the technologies rely on advanced materials, power systems, and software integration and aim to improve precision, survivability, and operational flexibility.

The different technologies can also leverage synergies and coexist in different parts of the broader defense system. For example, electric propulsion is used across air, sea, and space domains. It delivers significantly higher energy efficiency and power density compared to traditional systems, enabling operations with reduced acoustic and thermal signatures for UAS and VTOL platforms. It also supports next-generation naval vessels that require massive onboard power for directed energy weapons and advanced sensors.

In space, rocket reusability is a key enabler of commercial and defense expansion, cutting launch costs and boosting cadence. Electric propulsion extends satellite maneuverability and mission life, critical for resilient communications and missile defense. The ability of electric propulsion to reduce acoustic and thermal signatures, increase endurance, and power energy-hungry systems makes it a key enabler for integrated, multi-domain defense modernization.

Similarly, layered defense systems strategies, space-based sensors and communication networks, enable hypersonics for offense and DEWs for countering drones or missiles. The technologies are also complementing each other, where, for example:

- UAS & VTOL provides air mobility, transportation, information gathering and monitoring.

- Hypersonics can be leveraged for strategic deterrence and strike capability.

- DEW and used for point defense and electronic warfare.

- Investment in the space domain improves global surveillance and missile defense.

The technologies also vary in maturity, cost, and complexity. For example, UAS and VTOL platforms are commercially viable today, offering relatively lower-cost, scalable solutions for both military and civil applications. In contrast, hypersonics and space systems represent longer-horizon plays, characterized by high capital intensity. While, however, hypersonics remain in advanced R&D phases, space systems are partially deployed but progressing rapidly, driven by rocket reusability, proliferated satellite constellations, and missile defense initiatives.

A long-term investment theme

Big picture

- A constructive macro backdrop—shaped by necessity, geopolitical tension, and accelerating technological innovation—positions the defense sector for both disruption and sustained growth.

- With AI and autonomy at the forefront of modernization agendas, opportunities span near-term and long-horizon technologies.

What we’re monitoring

- Key risks remain tied to policy uncertainty and structural realignment within the industry, which could challenge some incumbent defense providers, but the long-term structural trends for defense remain solid. The defense theme in our portfolios

- Against this backdrop, we are actively expressing the theme across our equity portfolios, leveraging developments in the United States, Europe, and globally.

- We expect long-term growth in businesses advancing AI and autonomy, enhancing drone capabilities, delivering precision solutions, and strengthening intelligence systems, while also expanding into the space domain.

- Our exposures align with structural shifts in defense spending and national security priorities, particularly in the U.S., where budget allocations increasingly favor advanced technologies and strategic capabilities.

A note about risk: The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer, and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. Smaller companies may be more susceptible to price swings than larger companies, as they typically have fewer resources and more limited products, and many are dependent on a few key managers.