The following are historical insights based on market conditions at a point in time. Any forward-looking statements contained herein are based on information at the time. Current views, performance and portfolio information may differ materially from those expressed or implied in such statements. Voya IM makes no representation that past publications will be updated.

Improved funded status is driving conversations around the inclusion of non-traditional fixed income assets in ALM modeling, including investment grade private placements, CMLs and CMOs.

Executive Summary

- Funded statuses improved significantly in 2021; money is in motion, shifting from equities to fixed income, and to insurance companies

- As fixed income allocations increase, plans are likely to expand into non-traditional fixed income assets

- American Rescue Plan Act (ARPA) is a distraction for all but the lowest funded plans

- The mulligan: lock in the gains this time; focus on de-risking, hedging, hibernation, diversification

What will plan sponsors do with their extra swing?

2021 — Let the credits roll

For equities, 2021 marked the conclusion of a performance hat trick, i.e., a third consecutive year of double-digit returns. However, unlike 2019 and 2020 when interest rates declined 100 bps and then a further 70 bps, respectively, this time interest rates increased as much as 40 bps, reducing liabilities by 3% to 5%. This, in tandem with equity returns, catapulted the average pension plan 8% to 10% higher.

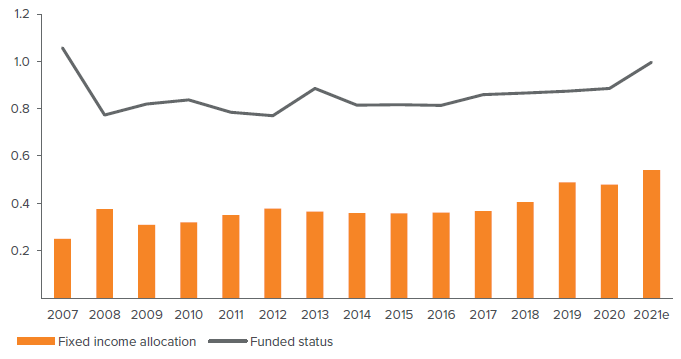

Source: S&P 500 companies’ 10-K filings, Voya Investment Management. As of 12/30/21.

Such an improvement in funded statuses have not been seen since the increase from 2012 to 2013, when the Taper Tantrum served up a similar rebound of 11%. Unlike 2013 – when plans retraced only a third of their losses incurred during 2008 – now plans have captured over two-thirds of the 2008 decline and are sitting atop their highest funded status level since the Global Financial Crisis.

ALM modeling that incorporates less-traditional asset classes such as investment grade private placements, CMLs and CMOs are the new terrain.

Many glidepath thresholds were breached during the back half of 2021, adding momentum to a shift in assets to fixed income that had modestly commenced in the last several years (Figure 1). We expect this shift to continue in earnest during 2022. Furthermore, hearty discussions were had around de-risking and re-evaluating Asset Liability Modeling (ALM) to accommodate this new plateau of funded status in a post-Covid, post-inflationary, and post-pension hibernation paradigm. Notable features of this new terrain are the incorporation in ALM modeling of less traditional asset classes such as investment grade private placements (IGPPs), commercial mortgage loans (CMLs) and collateralized mortgage obligations (CMOs). These asset classes are indispensable in hibernation strategies that endeavour to emulate the best practices of insurance companies that reserve for annuities. We fully expect robust discussions around securing gains and expanding the set of fixed income asset classes to continue well into 2022.

Annuitizations printed the second-best quarter since 2012

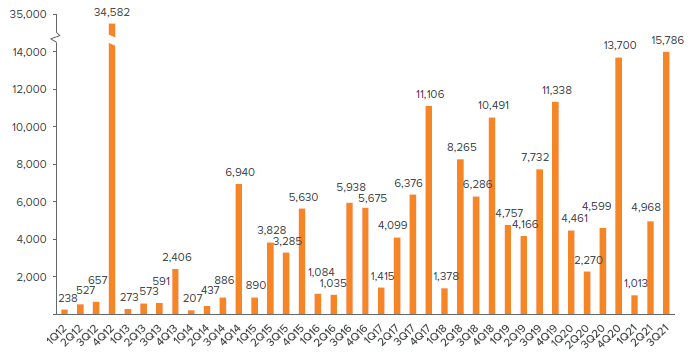

Not surprisingly, many sponsors decided that there was no better time than 2021 to head for the exits and transfer a portion of their book of annuities to an insurer. Due to the higher funded levels, less contributions were required to restore funded positions post transfer. This was manifest in the explosion of transfers from sponsors to insurers during 3Q21 when $16 billion in pension assets were transferred – the second largest quarterly volume since the watershed transfer of $35 billion during 4Q12.

Source: Group Annuity Risk Transfer Survey, LIMRA Secure Retirement Institute.

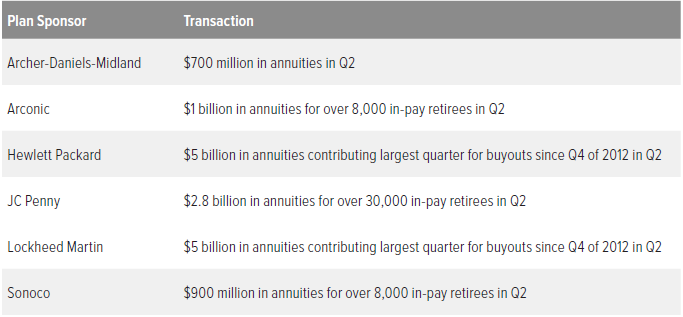

Buyouts ramped up during 4Q20, following the 2020 mid-year COVID malaise, but then stalled dramatically in 1Q21. Indeed, 1Q21 logged the lowest first-quarter buyout volume since 2015 – a 77% year-over-year drop. However, buyouts then came roaring back in the third quarter of last year. Several noteworthy deals during 2Q21 and 3Q21 speak to a who’s-who in the corporate landscape as transactions continue to become the norm. This occurred despite settlement accounting and optimism for a rising rate environment, but was also abetted by the extremely large capacity of insurers, which continue to supress pricing.

The table below highlights a few noteworthy transactions during 2Q21 and 3Q21. All indicators point to 4Q21 producing a sizable number of transactions, which may end up making 2021, in total, exceed every prior year since 2012, and perhaps even 2012 itself.

As transactions like these transpire, the work of the plan sponsor is far from over. The residual plan characteristics will change, which can be substantial, warranting a new ALM, a re-underwriting of growth seeking versus immunizing asset allocation and revisions to hedging assets to realign the key-rate durations of the assets to the prevailing cash flow characteristics that are laid bare once annuities are jettisoned. The remaining liability will typically have a greater concentration of active employees with longer dated cash flows, as well as other plan design characteristics coming to the forefront. These include cash balance and pension equity plan structures that will require greater focus and a unique set of hedging tools.

Then there was ARPA … a license delay?

Last year delivered pension reform with the passage American Rescue Plan Act (ARPA). While there were significant changes for multi-employer pensions, the impact for single-employer plans truly only benefited those already in dire straits. At its core, for single-employer plans, ARPA did two things: delay the phasing out of the 25-year smoothing of rates and change the amortization of a pension deficit from seven years to 15 years. It is these amortization pieces that mostly determine contributions.

However, ARPA did not change the liability as measured under Generally Accepted Accounting Principles (GAAP), which are used in 10-K filings and hedging strategies. It is also the GAAP measure that is the closest valuation to what an insurer considers for a pension risk transfer.

As a reminder, it was the Moving Ahead for Progress in the 21st Century (MAP21) Act of 2012 that ushered in the 25-year averaging of rates, resulting in rates over 300 bps above market. In effect, MAP21 artificially understated the liabilities used to determine contributions, which untethers any connection to markets, and largely eliminates contributions for almost all plans, save for the severely underfunded. Perhaps most importantly, ARPA does not impact the liability used to determine Pension Benefit Guaranty Corporation (PBGC) premiums. At a bare minimum, every sponsor should contribute to the level needed to avoid PBGC premiums irrespective of ARPA’s frail relief.

Sponsors who view ARPA as chance to extend their timeline and take on more risk to earn their contributions in the equity markets are simply using it as a delay the inevitable. To use an analogy, this is tantamount to paying the minimum balance on a credit card – but with an even more perverse twist: the credit card companies now offer its debtors the option to pay a lower minimum balance for longer (ARPA, in effect). In doing so they pay more interest (PBGC premiums are the analogue here). The financially prudent approach is to pay the entire credit card bill every month rather than take what little money debtholders have and attempt to earn back their deficit day-trading on a smartphone app.

Using ARPA to take on more risk and earn contributions in equity markets simply delays the inevitable. Better to ignore ARPA and make the necessary contributions to avoid PBGC premiums altogether.

What to expect when you’re expecting in 2022

The enormity of all that 2022 promises to plan sponsors is on a scale of luxury not seen for over a decade. Perched above the funded status fray of the last fourteen years, there may appear to be only but a few headwinds in the year ahead. However, prudence is of utmost importance as this may all become as ephemeral as the Taper Tantrum of 2013. And, unlike 2013, we find ourselves in a still-present global pandemic, a labor market upheaval in recovery, incredibly volatile equity markets, partisan gridlock, and geopolitical risks to consider.

Nevertheless, we expect fading COVID-related fears will increase services spending as demand for inflated goods recedes and total activity becomes sufficient to drive robust labor demand. Workers will gradually continue to re-enter the workforce as excess savings and fiscal stimulus diminishes. That said, we do think that the labor participation rate will not fully recover to pre-pandemic levels, at least not this coming year.

Innovative sponsors may realize superior carry-to-volatility ratio achieved in the intermediate part of the curve versus long duration.

Global inflation – accentuated by energy and commodity prices – will peak in early 2022, but the rate of decline will vary across economies. Inflation in the U.S. is likely to decline only gradually, and could remain above the U.S. Federal Reserve’s target, as wage-driven services inflation and rising shelter costs offset a retracement in COVID-driven goods inflation. The Fed will accept above-trend inflation as long as core inflation is decelerating and real wages are rising. The combination of pent-up demand for services, spending of excess savings, and inventory restocking will support growth in the near term. The durability of global growth will benefit from multiple drivers, including a more balanced Chinese economy and enhanced U.S. and European investment.

Relatively full asset valuations are supported by above trend growth and positive fundamentals, but the limited upside will increase the need for downside protection. As public health, inflation and growth variables conspire to impact central bank policy, periodic episodes of volatility will provide tactical market opportunities, with a bias towards being long credit risk versus duration risk.

With rates hikes on the horizon – as supported by the recent jobs report – less hedged sponsors may view the rates landscape as increasingly amenable to pension deficits. They may be tempted to double-down despite a decade filled with missteps and lessons on the asymmetry inherent in pension investing – all downside of PBGC premiums and contributions, and no upside due to Internal Revenue Service’ excise tax on overfunded plans.

Investors should resist the desire to make a call on rates and prudently follow their glide paths and ALM output as they shore up their defenses. We predict a continuation of the shift from equites to long duration fixed income as sponsors book their pension funded status on their 10-Ks and disclosures, and turn to reallocations informed by ALM. Ironically, buying up long duration fixed income assets may modestly restrain the forecasted steepening of the U.S. Treasury yield curve, but investment grade (IG) credit supply is also of no concern, as there has been record issuance in the last several years and we expect it to continue unabated.

Diversification and intermediate credit to the fore

There will be continued attention and action in intermediate credit, both in IG public and IGPPs. And not just for shorter duration plans, but also for those that realize the superior carry-to-volatility ratio that can be achieved in the intermediate part of the curve versus long duration, where slight moves higher in rates or spreads can easily erase gains.

To borrow a golf term, this group will use their mulligan wisely, especially if they build on a foundation of traditional LDI assets complemented with nontraditional diversifying asset classes such as IGPPs, CMLs and CMOs (for more on this see our paper Diversification, A Dynamo for LDI).

As for those plans that are fully hedged and de-risked, their chief financial officers and treasurers will sleep soundly, not worrying about rates as they hibernate their pension plans with a portfolio of well-diversified assets shielded against downgrades, defaults, and concentration risk via asset returns that mirror liability returns.