1Q23 was marred by significant volatility in the banking sector, as the collapse of Silicon Valley Bank, the rescue of First Republic bank and the purchase of Credit Suisse by UBS put depositors in a panic and investors on a flight to quality.

Notes on the quarter

- 1Q23 was marred by significant volatility in the banking sector, as the collapse of Silicon Valley Bank, the rescue of First Republic bank and the purchase of Credit Suisse by UBS put depositors in a panic and investors on a flight to quality.

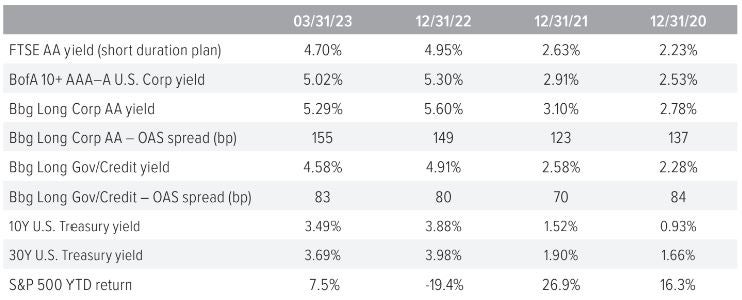

- The yield curve steepened, with the 10Y UST and 30Y UST declining40 bp and 30 bp, respectively, on the quarter.

- Credit spreads widened, resulting in a decline in discount rate of 20–30 bp. For a plan with duration of 12, this translates to a 3% increase in liability.

- The S&P 500 had a total return of 7.5% for the quarter.

- IG private placements were unperturbed by the lack of issuance in the public markets: 1Q23 was an unprecedented quarter in which IG public corporate issuance was remarkably low. while private placements a popular DI diversifier, showed no sign of slowdown. (Source: Barclays Live, Bank of America.)

Source: Voya IM calculations, FTSE, S&P.

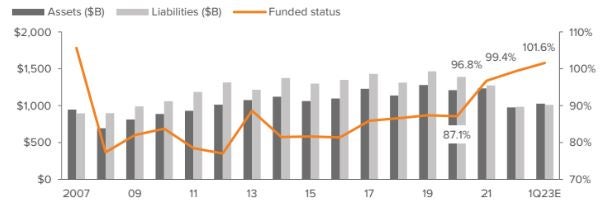

As of 03/31/23. Source: Milliman, S&P, 10-K data, Voya IM.

Source: FTSE, Barclays Live, ICE Index Platform, S&P. Investors cannot invest directly in an index and index performance does not reflect management fees or transaction costs associated with some investments. See back page for index definitions.

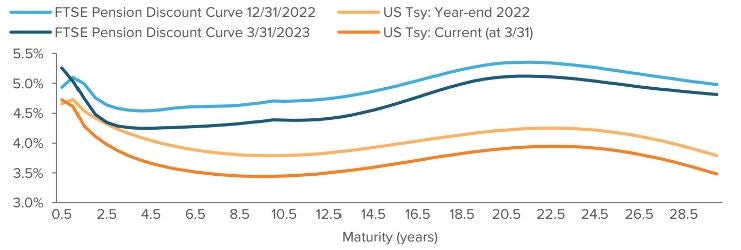

Source: ICE Index Platform, FTSE Pension Discount Curve

- The U.S. Treasury spot rate curve is flatter than the FTSE pension discount curve as of 3/31/2023.

- For the 15-year tenor, the U.S. Treasury spot rate is lower as of 3/31/2023 versus 12/31/2022.

- Similarly, for the 15-year tenor, the AA-rated corporate bond spot rate is lower as of 3/31/2023 versus 12/31/2022.

|

A note about risk Examples of LDI (liability-driven investing) performance included in this material are for illustrative purposes only. Liability valuations can increase due to falling interest rates or credit spreads, among other things, as the present value of future obligations increases with falling rates and falling spreads. Liabilities can also increase due to actual demographic experience differing from expected future experience assumed by the plan’s actuary. Diversification neither assures nor guarantees better absolute performance or relative performance versus a pension plan’s liabilities. In addition, investing in alternative investment products such as derivatives can increase the risk and volatility in an investment portfolio. Because investing involves risk to principal, positive results and the achievement of an investor’s goals are not guaranteed. There are no assurances that any investment strategy will be profitable on an absolute basis or relative to the pension plan’s liabilities. Information contained herein should not be construed as comprehensive investment advice. For comprehensive investment advice, please consult a financial professional. |