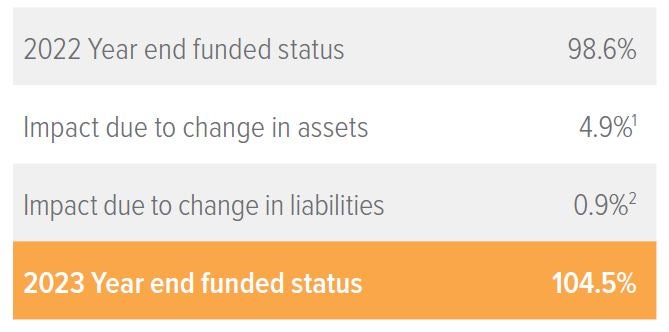

As of 12/31/23. Source: S&P, FYE 2022 company reports, Voya IM calculations and 2023 estimates.

1 Growth assets based on S&P 500 return of 26%; hedging assets (which match liability duration) had a 2% gain, similar to liabilities, by design, also reflecting benefit payments.

2 Liabilities increased 2% due to 19 bp decrease in rates and plan duration of 12 years, further adjusted for service accruals and benefits payments.

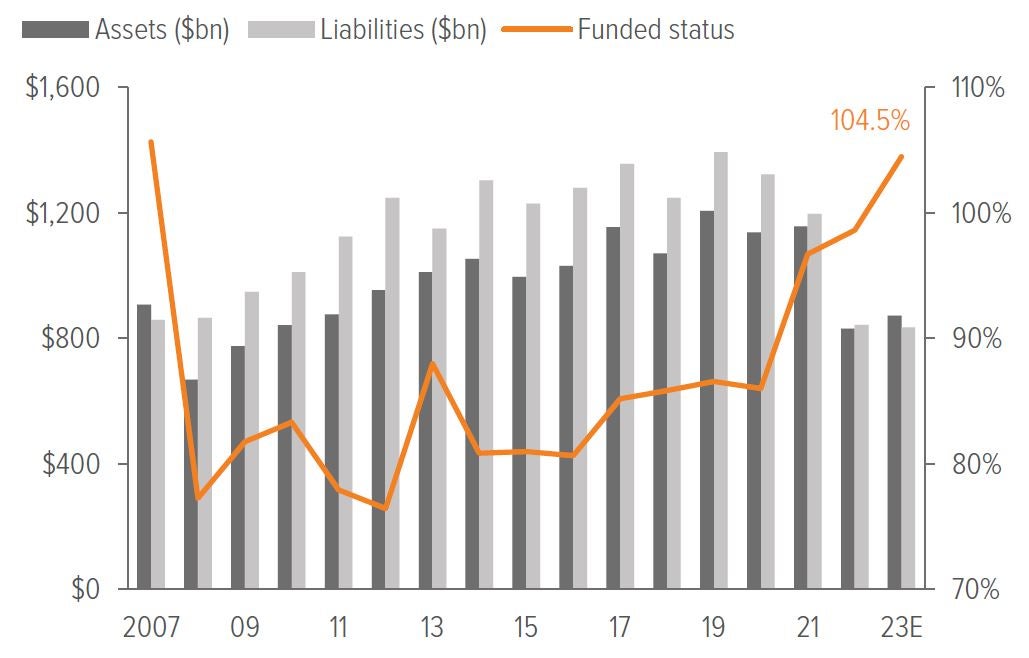

As of 12/31/23. Source: S&P, FYE 2022 company reports, Voya IM calculations and 2023 estimates.

Notes on the quarter

- A third consecutive year of improved funded status for U.S. pension plans. Plans are 105% funded, in aggregate, up from 99% the year before—and their highest funded level since the GFC.

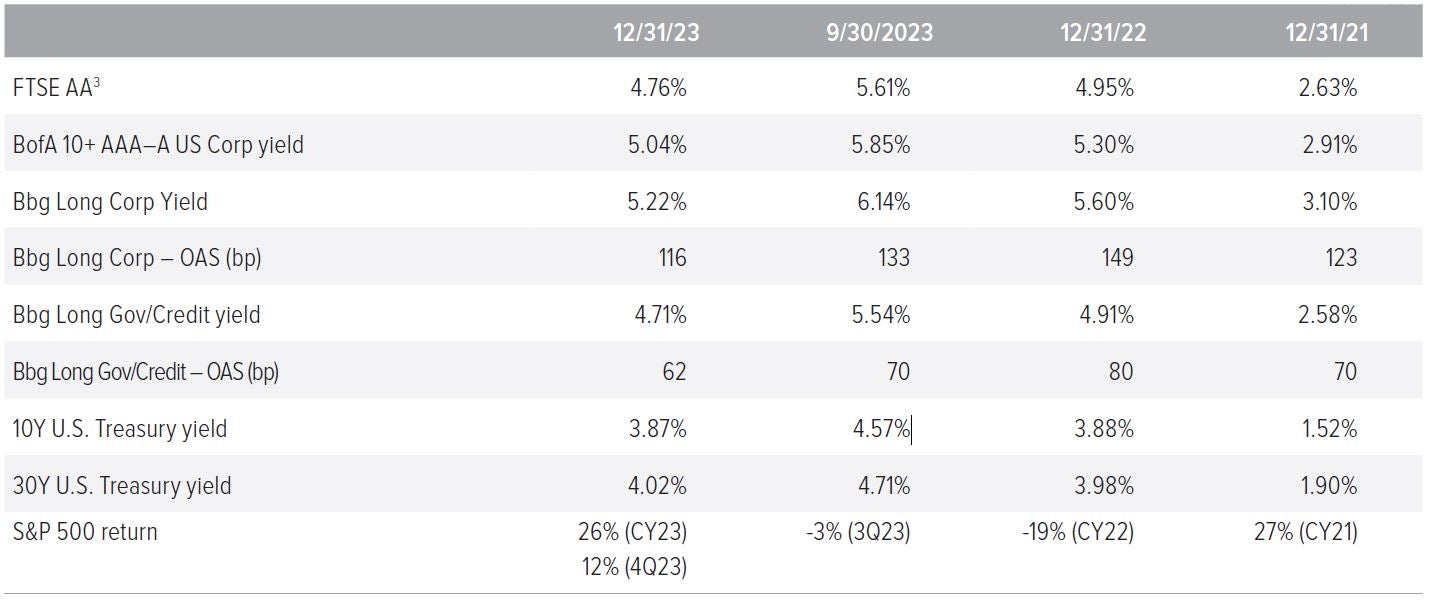

- The treasury curve was largely unchanged in 2023, with the 10yr UST making a round trip, finishing 1 bp lower than a year ago, the 30yr UST increasing a mere 3 bp, and a mostly parallel shift lower during Q4.

- Credit spreads narrowed even more. The net result was a decrease in the discount rate of 19 bp on the year, most of it from a fall of 85 bp in Q4. For a plan with a duration of 12, this translates to a 2% increase in liability during 2023. However, this was more than offset by a release from liabilities through benefit payments that were twice as large as the service accrued during the year.

- U.S. equities had total returns of 26% for the year and 11% for the quarter, significantly contributing to the improved funded position.

In the spotlight: Harbinger or anomaly? IBM re-opens its pension plan. IBM’s decision to re-ignite accruals in its DB plan comes on the heels of several consecutive years of surplus. In 2022, this was significantly aided by a $16bn annuitization, the second largest on record. That annuitization alone contributed 7% of the plan’s 9% improvement in funded status that year, causing it to finish 2022 at 117%. (Typically, an annuitization further improves an overfunded plan’s ratio.) Most sponsors with such a surplus would pursue a full plan termination, but not IBM. In an act perhaps as opportunistic as it is paternalistic IBM re-opened its DB plan, injecting diversification for participants and reducing the investment risk they bear. This was done with the added elegance of the DB accrual functioning as a “swap” for the DC contribution. We applaud a thaw in DB pensions and believe that, with a fully-hedged program and a diversified portfolio, the pension headaches of past decades can largely be avoided. |

Source: FTSE, Barclays Live, ICE Index Platform, S&P. 3) See back page for index definitions.

3 Based on FTSE’s “short” duration plan, approximately 11.4 years.

|

The year ahead: Which way will rates go is anyone’s guess. Is the Fed poised to turn the corner? Perhaps. Many are pricing in rate declines, which would deteriorate funded status for unhedged plans. Uncertainty continues to pervade markets around factors such as inflation, recession, elections, and global conflicts. Yet most plan sponsors are starting the year at a funded level not seen since 2007. The only infallible approach here is to secure funded positions by de-risking and diversifying portfolios. Always be de-risking.

A note about risk Examples of LDI (liability-driven investing) performance included in this material are for illustrative purposes only. Liability valuations can increase due to falling interest rates or credit spreads, among other things, as the present value of future obligations increases with falling rates and falling spreads. Liabilities can also increase due to actual demographic experience differing from expected future experience assumed by the plan’s actuary. Diversification neither assures nor guarantees better absolute performance or relative performance versus a pension plan’s liabilities. In addition, investing in alternative investment products such as derivatives can increase the risk and volatility in an investment portfolio. Because investing involves risk to principal, positive results and the achievement of an investor’s goals are not guaranteed. There are no assurances that any investment strategy will be profitable on an absolute basis or relative to the pension plan’s liabilities. Information contained herein should not be construed as comprehensive investment advice. For comprehensive investment advice, please consult a financial professional. |