Key Takeaways

A tight and narrow market for insurers. Corporate spreads remain near multidecade lows and public equities are increasingly concentrated, leaving insurers with a scarcity of compelling opportunities in the standard toolkit.

Select fixed income sectors offer tactical value. Commercial real estate, residential mortgages, and middle-market CLOs are paying attractive compensation for risk, with stronger structural support and better fundamentals than comparable public-market alternatives.

Private credit remains a durable long-term solution. Investment grade private credit and private asset-backed finance continue to provide attractive spread-to-public premiums, diversification, and a more reliable pathway to locking in long-term yield.

With traditional sources of yield and return sputtering, insurers must get creative when hunting for value.

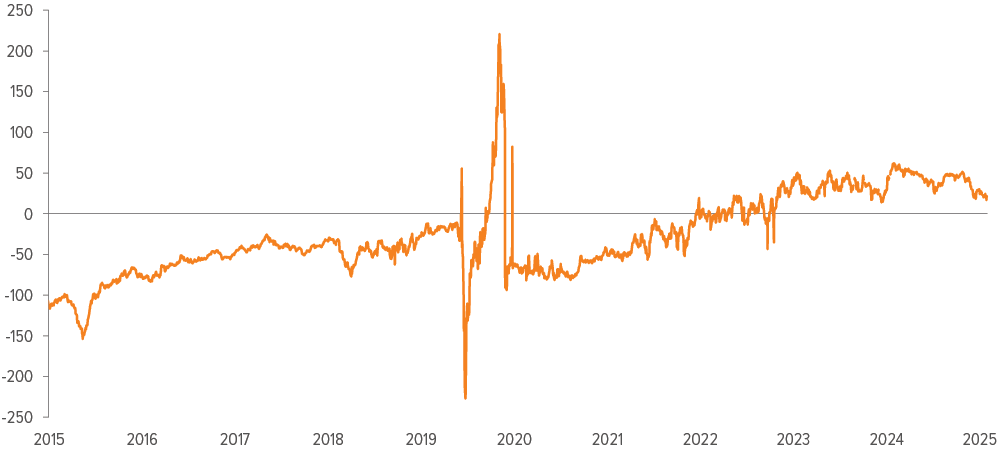

Corporate credit valuations remain relatively rich

Corporate spreads hit 27-year low

Recent headlines have zeroed in on mega-cap, cash-rich tech companies tapping the bond market to fund massive, long-duration AI buildouts. The burst of issuance briefly pushed corporate spreads wider as investors digested the scale and speed of these funding needs. Technical factors and the desire by insurance investors to lock in yield have not changed the bigger picture: spreads remain historically tight, hovering near their lowest levels in nearly three decades (Exhibit 1). Though IG corporates are a core component of insurance portfolios for duration needs and all-in yields remain attractive, we have positioned our insurance mandates in defensive sectors and up in quality given the tight spread environment.

As of 10/31/25. Source: Bloomberg.

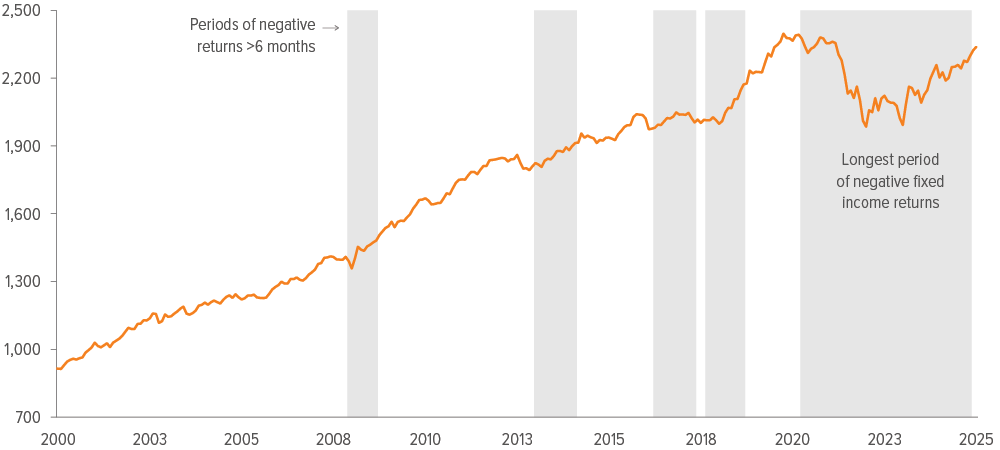

While IG spreads remain near historically tight levels , the broader public fixed income market still offers attractive absolute yields. Periods of negative returns in fixed income markets are rare and typically short-lived, so with valuations still discounted five years from the peak, the current market offers an attractive entry point for income-focused investors (Exhibit 2).

As of 10/31/25. Source: Bloomberg.

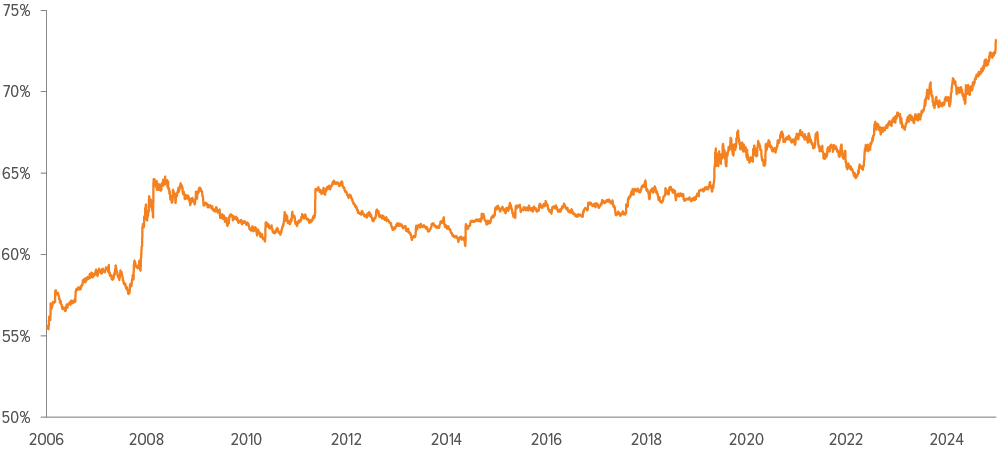

Public equity valuations are similarly stretched … and concentrated

Insurers that allocate to the public equity market face additional challenges. While headline equity index returns have been strong, they have been driven by an unusually narrow cohort of mega-cap leaders (Exhibit 3), undermining the diversification benefit benchmarked equity allocations typically provide. This dynamic raises tail risk and makes equity exposure potentially less compelling in capital-budgeting decisions relative to lower volatility alternatives.

As a result, insurance investors are increasingly reevaluating where—and how—they can source durable, risk-appropriate returns in a market that looks very different from decades past.

As of 10/31/25. Source: Bloomberg.

Where to look for value instead

Select opportunities in CMLs

Commercial real estate appears to have moved past the worst of the headline risk, with distress now better understood and largely priced in—yet property values remain meaningfully below their prior peaks, creating room for upside potential (Exhibit 4). However, selectivity is essential as there are still pockets of weakness in the CRE space.

We see value in smaller-footprint industrial assets, which benefit from tighter vacancies, limited new loan supply, and healthier tenant pipelines than the broader industrial market. These characteristics set the stage for more resilient cash flows and the potential for attractive rent growth as the sector continues to normalize.

As of 10/31/25. Sources: NCREIF, Bloomberg.

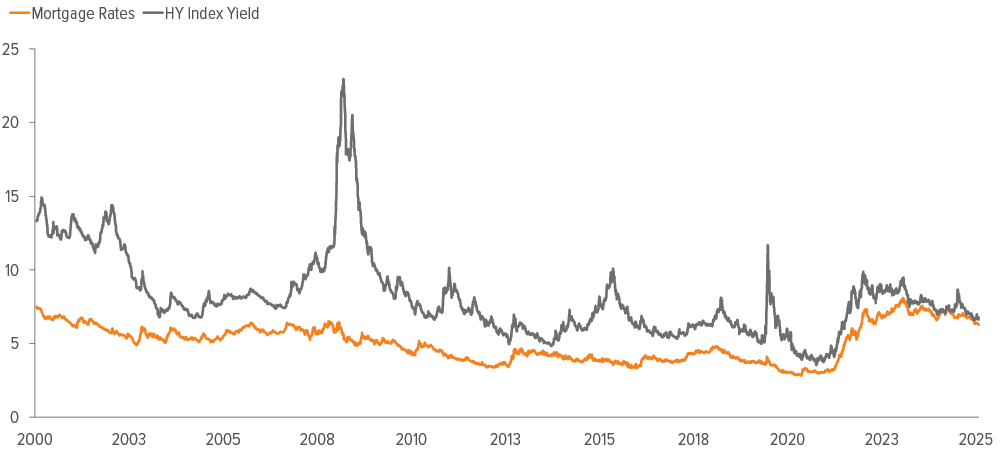

Mortgages over corporates

Any insurer considering a move down the credit spectrum in public markets should take a close look at Exhibit 5. Today, 30-year mortgage rates sit remarkably close to yields on below-investment-grade corporates, a dynamic that rarely occurs and one we haven’t seen in 25 years. And while yields are similar, the underlying credit risks could not be more different.

Prevailing conforming mortgage rates reflect the generally sound, secured credit risk of the average U.S. consumer borrowing against their home—in addition to market conditions and agency guarantees. High-yield corporates, by contrast, reflect the unsecured financing cost of highly leveraged issuers—incorporating capital allocation decisions, refinancing risk, event-driven leverage changes, and management behavior.

When yields converge (Exhibit 5), the question becomes simple: which form of credit risk would you rather own?

As of 10/31/25. Source: Bloomberg.

The case is also strong when comparing agency MBS to investment-grade corporates. The spread between the two remains unusually wide (Exhibit 6), even though agency mortgages benefit from explicit or implicit government guarantees that largely eliminate credit risk.

As of 10/31/25. Source: Bloomberg.

And while it’s true that mortgage-backed securities come with embedded optionality— borrowers can refinance if rates fall and MBS duration can extend in a rising rate environment—the market may be overstating that risk today. A significant share of U.S. homeowners hold pandemic-era mortgages with coupons well below current levels, meaning their incentive to refinance is limited. With that optionality effectively out of the money for much of the borrower base, insurers are being paid a premium to take rate-and prepayment-driven risk in a sector characterized by deep liquidity and the ability to position around evolving borrower behavior. Moreover, prepayment risk is also prevalent in the HY corporate market as callable structures give issuers optionality to refinance debt should rates fall.

Taken together, these comparisons highlight a compelling opportunity: mortgages offer high-quality spread in places where corporate credit—both IG and HY—is offering historically thin compensation for risk.

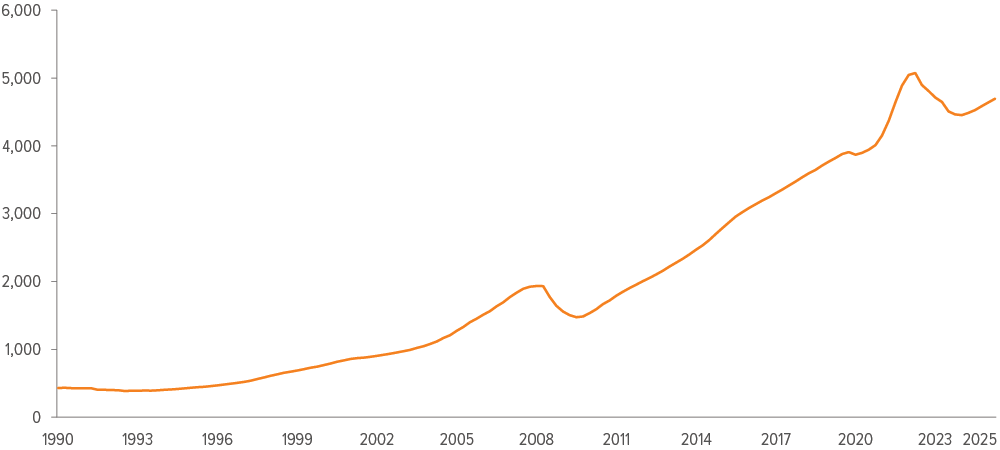

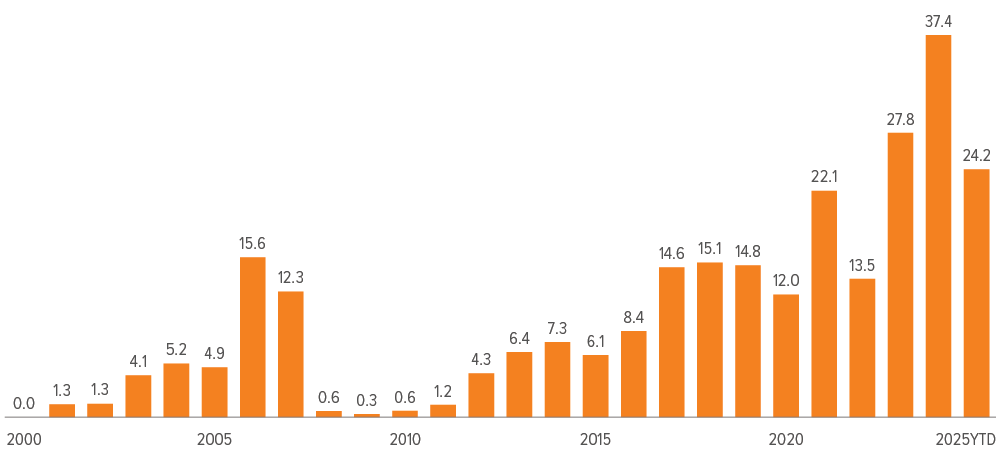

CLOs: A more attractive avenue to credit risk

As prospective public credit and equity returns look less compelling, high-quality CLO tranches where there are credit and structural enhancements—particularly in the middle-market space—offer an attractive way to take credit exposure. These securities provide strong risk and capital adjusted spread premia, robust credit enhancement, and diversification across hundreds of underlying loans rather than the idiosyncratic risk of a single corporate issuer. At the same time, issuance has expanded steadily (Exhibit 7), giving investors greater ability to be selective across managers, deal structures, and collateral quality. The relative value of middle-market CLOs remains compelling even after accounting for forthcoming rate cuts, as prospective yields adjusted for the forward curve compare favorably to fixed rate assets.

As of 11/01/25. Source: J.P. Morgan.

Where the opportunity becomes especially compelling is for insurers who invest in public equities. With major equity indices increasingly dominated by a handful of mega-cap tech names, traditional indexed equity allocations offer diminishing diversification benefits. Redirecting a portion of that public equity exposure to high-quality middle-market CLO tranches delivers income in place of capital appreciation but also materially lower volatility and diversified exposure to private credit. In a market where equity leadership has narrowed and valuations have stretched, this shift improves portfolio balance and lowers volatility.

For life insurers less predisposed to public equities, MML CLOs offer a capital-efficient way to significantly enhance spread while adding diversification and structural credit protection to an IG-heavy portfolio.

Private credit continues to deliver

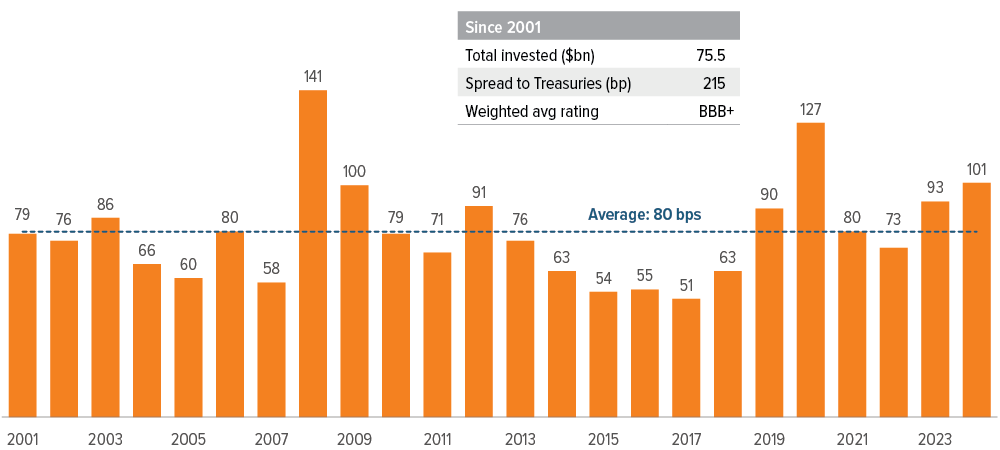

Investment grade private credit avoids the headlines

Recent media attention around the First Brands, Tricolor, and Renovo defaults paints a picture of broader risk across the full spectrum of private credit markets. However, so far, the bad loans that have made headlines have been in the upper middle market and the broadly syndicated bank loan market. Investment grade private credit is its own separate beast, with strict underwriting standards that tend to be among the most rigorous in all of lending.

Insurance companies have a structural need for corporate credit to meet duration and diversification objectives. While negative headlines and rising credit risk in broader private markets has drawn attention, investment-grade private credit remains a compelling complement to public markets—offering not only attractive spreads but also covenant protections that provide meaningful downside defense in a more challenging credit environment (Exhibit 8).

As of 06/30/25. Source: Voya IM. Notes on 2008 and 2009 data: 2008 reflects production efforts through first 8 months of 2008 because new production was shut down after August 2008. Production efforts commenced in August 2009. Data presented is based on assets held across proprietary insurance portfolios of Voya Financial and/or those managed for external clients of Voya Investment Management. Past performance is no guarantee of future results.

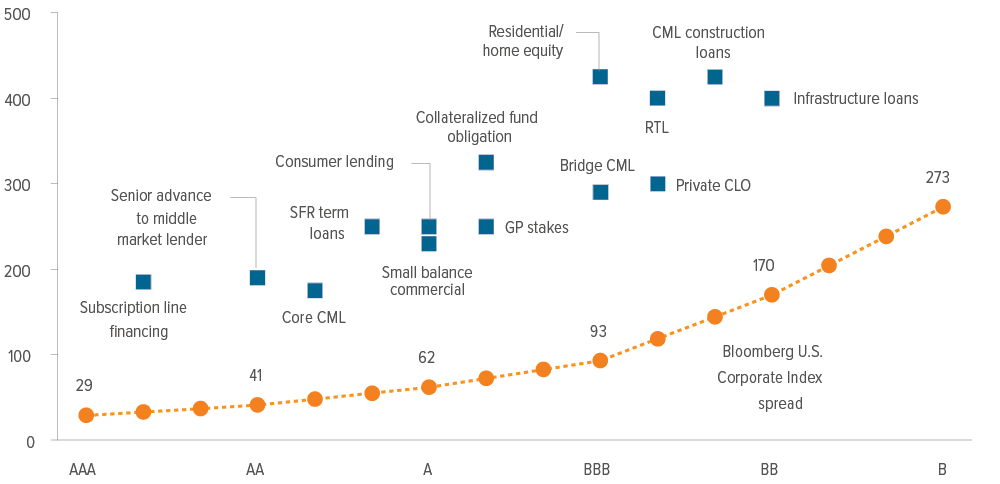

Asset-backed finance

We continue to be excited about the private ABF market (Exhibit 9) and expect to lean into this space over time. Against the backdrop of bank disintermediation, lending that has typically been the domain of banking enterprises is finding its way to insurance company balance sheets. We find opportunities in CRE and residential mortgage sectors to be particularly appealing.

As of 08/22/25. Source: Bloomberg, Voya IM.

Conclusion

With corporate spreads still pinned near historic lows and public markets increasingly driven by a narrow set of mega-cap names, insurers are being pushed to the margins to find real value.

In our view, the most compelling opportunities today lie in select pockets of CRE, where fundamentals are stabilizing and valuations remain well below peak; in mortgages, which offer yields comparable to high-yield corporates but with fundamentally different— and often more attractive—underlying risk; and in middle-market CLOs, which deliver diversified credit exposure and stronger structural protections than traditional public credit.

And while private credit has faced its share of negative headlines, the investment-grade private credit market remains fundamentally sound, continuing to serve as a cornerstone allocation for insurers seeking durable yield, structural strength, and long-term portfolio resilience.

A note about risk: The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. High yield securities, or “junk bonds,” are rated lower than investment grade bonds because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Foreign investing does pose special risks, including currency fluctuation, economic and political risks not found in investments that are solely domestic. Emerging market securities may be especially volatile. Investments in mortgage-related securities involve exposure to prepayment and extension risks greater than investments in other fixed income securities. The strategy may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and could have a potentially large impact on performance. Investments in commercial mortgages involve significant risks, which include certain consequences that may result from, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market, and other exogenous economic variables. All security transactions involve substantial risk of loss. The strategy will invest in illiquid securities and derivatives and may employ a variety of investment techniques, such as using leverage and concentrating primarily in commercial mortgage sectors, each of which involves special investment and risk considerations. Other risks include, but are not limited to: credit risks; credit default swaps; currency; interest in loans; liquidity; other investment companies’ risks; price volatility risks; inability to sell securities risks; U.S. government securities and obligations; sovereign debt; and securities lending risks.