Key Takeaways

Deregulation: Reducing regulatory burdens can lower compliance costs, free up companies to innovate, and speed up M&A deals—all potential boons for the fast-paced tech industry.

Tax reform: Making the corporate tax rate reduction permanent could mean larger bids for acquisition targets, particularly for small caps, potentially leading to higher valuations.

Antitrust leniency: A softer touch to antitrust oversight can reduce barriers to large mergers and unlock lucrative M&A activity for capital markets companies.

Mergers and acquisitions were on the rebound even before Trump’s re-election bid, and they’re set to accelerate with the new administration’s softer regulatory stance. This could be a particular benefit to tech, investment banks and small caps.

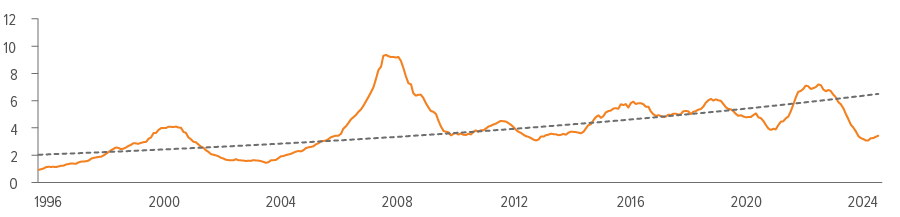

Regulatory policies play a big role in merger and acquisition (M&A) activity, and President Donald Trump has a history of implementing regulatory changes that have been beneficial for the M&A market. His re-election, together with an M&A market that was already poised for a rebound (see chart below), have many market watchers expecting an M&A surge in the coming years.

As of 03/24. Source: Dealogic, Morgan Stanley Research. Note: Exhibit shows trailing last-12-month (LTM) volume of global announced M&A, excluding withdrawn transactions.

This could benefit technology companies in particular—and since tech is the biggest component of broad benchmarks, we would expect a boost to the overall market as well. But there will also likely be other beneficiaries, including small cap firms that could be takeover targets as well as certain large cap multinationals (such as financials).

Here’s a look at Trump’s proposed policy changes, their implications, and how they could benefit companies looking to merge with or acquire other businesses.

Deregulation

Aggressive deregulation was a hallmark of Trump’s first term. His administration aimed to reduce the regulatory burden on businesses, arguing that excessive regulation stifles innovation and economic growth. Deregulation can translate into several benefits across sectors and market cap sizes:

- Reduced compliance costs. This is particularly beneficial for smaller tech firms that may not have the resources to navigate complex regulatory landscapes.

- Flexibility to innovate and adapt. Small caps can benefit significantly from this environment, because their ability to innovate can make them attractive takeover targets for larger competitors. It can also be crucial in the fast-paced tech industry, where pivoting quickly can be a significant competitive advantage.

- Streamlined approval processes that can speed deals through. Trump intends to replace key officials at the Federal Trade Commission and the Department of Justice, including the latter’s antitrust division. Under the current administration, these institutions have been more aggressive in scrutinizing M&A activity. Facing less regulatory scrutiny, companies may feel emboldened to pursue strategic acquisitions, which could benefit large multinationals.

Tax reform

Trump’s administration implemented significant tax reforms during his first term, including cutting the corporate tax rate from 35% to 21%. Trump has supported lowering the tax rate even further to 15% for certain U.S. manufacturers when Congress takes up tax reform in 2025. Even at 21%, the lower corporate tax rate has provided several benefits to the M&A market:

- Lower corporate taxes boost cash on hand. This increased liquidity can be used to finance acquisitions, making it easier for companies to pursue growth through M&A.

- More cash means bigger bids for acquisition targets. This can benefit both buyers and sellers in the M&A market: Higher valuations are more profitable for the companies being acquired, and a target-rich environment can help buyers get more deals done.

- A reduced tax rate for repatriated profits means more domestic investment. With companies incentivized to bring back profits held abroad, additional funds can be used for investments here at home—including M&A.

Antitrust leniency

While deregulation and tax reform can provide significant benefits, it’s important to consider the role of antitrust enforcement. In his first term, Trump and his administration took a mixed approach to antitrust regulation—generally showing more leniency than previous administrations, despite a few high-profile cases. Trump has indicated a willingness to be even more lenient during his next term in office, which could add to an overall beneficial environment for U.S. corporations:

- Fewer barriers to large mergers. A favorable antitrust environment can make it easier for large companies, particularly in the tech sector, to pursue significant mergers and acquisitions without facing as much regulatory pushback.

- Financials can unlock a significant revenue source. M&A and IPO activity is a lucrative business for investment banks, and we expect that less antitrust scrutiny by the FTC could unlock additional M&A activity and boost overall investment banking volumes. It’s difficult to estimate how much activity was “held back” by uncertainty, but it appears that a multi-year M&A cycle was already underway before Trump’s win. Back in March, Morgan Stanley equity analysts predicted that M&A volumes would rise 50% in 2024 versus 2023, thanks to an improving economic environment, a growing deal pipeline and fewer headwinds to corporate confidence.1

- M + A = compete + innovate. By allowing more M&A activity, the market can become more competitive, with companies striving to innovate to stay ahead. This can drive overall growth and advancement, particularly in the tech sector

The bottom line

Donald Trump’s re-election and his continued push for deregulation and tax reform could lead to positive outcomes for investors:

- Deregulation efforts, such as reducing compliance costs and streamlining approval processes, could benefit smaller tech firms and large multinationals.

- A further reduction in tax rates would improve cash on hand and boost bids for acquisition targets.

- A more lenient antitrust stance would lower barriers to large mergers, especially in the tech industry, and unlock significant revenue opportunities for financial institutions.

A note about risk

The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. More particularly, the strategy invests in smaller companies, which may be more susceptible to price swings than larger companies because they have fewer resources and more limited products, and many are dependent on a few key managers