Artificial intelligence is now a driving force behind market cycles, reshaping fixed income as tech giants seek financing for their historic capex boom. Here’s how it’s changing portfolios, risks, and opportunities.

Twenty years ago at Jackson Hole, economist Ed Leamer famously declared, “Housing is the business cycle.” For decades, housing’s sensitivity to interest rates made it the bellwether for economic turning points. When housing slowed, recessions often followed. But as we look at today’s market, a new engine is revving: AI and the capital expenditure boom it’s driving.

A new cycle emerges

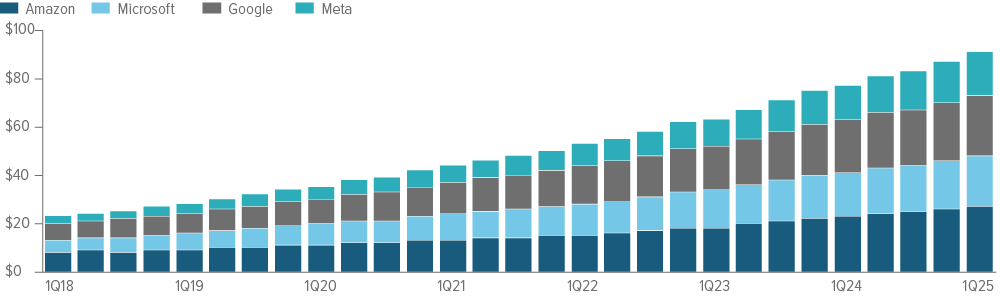

The U.S. economy is in transition. While housing and consumer spending remain key indicators, the scale and speed of AI-driven investment are rewriting the playbook. Tech giants are on pace to invest nearly $400 billion this year in AI infrastructure (Exhibit 1), with global capex expected to reach $7 trillion by 2030. This surge is not just about chips and data centers—it’s fueling demand for energy and supply chains, and it’s spilling into the bond market as companies tap debt to fund expansion.

As of 09/30/25. Source: Bloomberg, company reports, Voya IM.

What it means for fixed income markets

More issuance—and more demand

The massive buildout of AI infrastructure is driving hyperscalers to the bond market for additional sources of capital. Companies like Oracle and Meta are raising record sums in the bond market, with multi-tranche deals and longer maturities demonstrating investor appetite for the theme.

New sector opportunities

The surge in demand for AI capabilities will spill into every corner of fixed income, including corporate credit, private debt, asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). For example, utilities bonds are seeing renewed interest as data center demand drives up electricity usage, while ABS and CMBS markets are frequently being tapped to fund data centers.

New risks

With these opportunities comes a reminder of the importance of credit research and security selection. As with the internet buildout in the late 1990s, not every type of financing will be a winner. Overbuilding capacity is a risk, and tomorrow’s data centers may not need the same footprint as those built today.

How investors should respond

The surge in AI investment is more than just a tech trend—it’s a signal of a broader economic shift that could have meaningful implications for fixed income investors. As companies adopt AI to streamline operations, resulting productivity gains may help keep wage inflation in check. That, in turn, could ease pressure on central banks and influence the direction of interest rates.

At the same time, the capital required to build out AI infrastructure could reshape credit markets, altering sector risk profiles. In this evolving environment, the key is finding the right balance between emerging opportunities and potential risks. How can this be accomplished?

- Embrace active management to capture opportunities in new issue markets while avoiding risks associated with potential overbuilding.

- Watch for unintended concentrations. Diversifying across multiple fixed income sectors can help balance exposure to traditional sectors and emerging growth industries.

- Consider unconstrained strategies that are nimble enough to drive outperformance via security selection.

The business cycle’s engine has changed. Investors who adapt will be better positioned to tap into the opportunities of the new era.

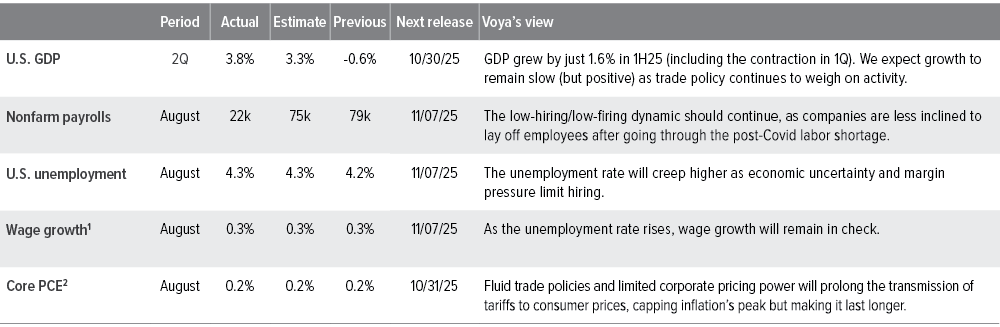

As of 09/30/25. Source: Bloomberg, FactSet, Voya IM. “Date of next release” depends on timely data releases from the federal government, which is currently in a shutdown. 1) Average hourly earnings (month over month). 2) Month-over-month data, personal consumption expenditures price index.

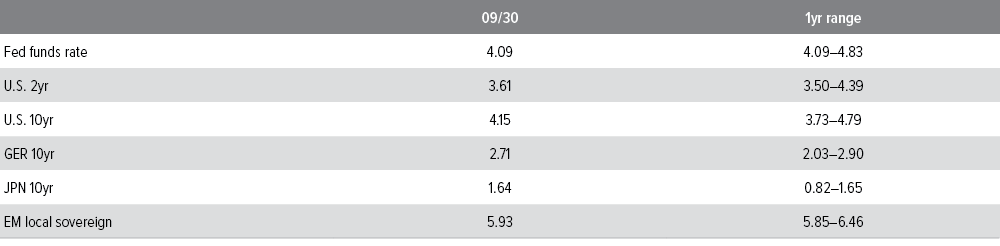

As of 09/30/25. Source: Bloomberg, JP Morgan, Voya IM. See disclosures for index information. Past performance is no guarantee of future results.

Sector outlooks

- Corporate earnings for 3Q25 are projected to be strong, with overall earnings growth estimated at 7.8%. The technology and financial sectors are expected to lead the gains, while energy and health care may report declines. More pronounced tariff impacts may flow through this quarter.

- September supply of $212bn was 61% higher than average and well above expectations.

- We continue to keep IG risk low, as spreads have moved back within a few basis points of the tightest level for the year given continued solid fundamentals. From a sector perspective, we prefer financials and utilities over industrials.

- Given favorable 3Q25 earnings outlooks and the low default rate, high yield is positioned to continue to trade sideways in the near term.

- From a fundamental perspective, the backdrop is moderating due to a slow degradation in corporate fundamentals, primarily in those companies exposed to lower-end consumers.

- The magnitude of uncertainty in the market backdrop favors defensive business models and balance sheets, particularly at compressed spread levels.

- The overall carry should continue to boost performance on both a total return and excess return basis, and we are continuing to pay close attention to the evolving developments on the policy and macro front.

- The primary market was busier in September, coming off the seasonally slow August.

- Loan borrowers, especially lower-rated and highly leveraged issuers that have faced the immediate transmission of higher rates, should experience some reprieve as rates decline.

- Despite the potential for more market volatility on the horizon and technical moves in the mortgage space, we believe carry remains attractive.

- Overall, fundamentals and a favorable technical backdrop are expected to bolster agency mortgage returns going forward, and the Fed rate cut provides a strong technical tailwind for levered players in the space.

- However, near-term performance can easily be swayed by large one-off trades from fast money and/or international investors.

- Elevated real yields and softer domestic conditions suggest that many EM central banks have room to continue cutting rates, but external factors may limit their flexibility.

- Corporate fundamentals remain resilient, and financial policy remains prudent.

- EM corporates are expected to be indirectly impacted by tariffs through global growth, inflation, and commodity prices. We expect direct impacts to be limited.

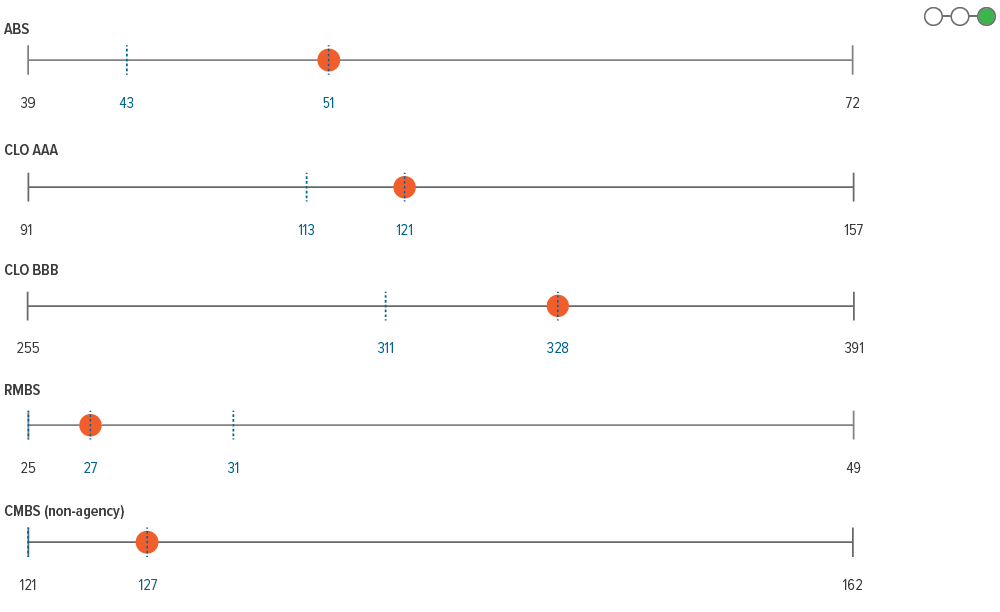

- At a time when corporate credit spreads are tighter than ever, securitized markets offer attractive relative value.

- Following modest outperformance for ABS in September (which we anticipated), we moved our outlook to negative in October due to a saturated market, despite generally solid fundamentals.

- Broadly speaking, the lower-rate environment should support CMBS and RMBS. We are bullish on CMBS, as improving fundamentals, still-impressive new issue dynamics, and attractive valuations remain intact, though the space seems to be taking a breather with spreads easing a bit. Meanwhile, strong mortgage credit fundamentals and improved valuations should enable RMBS to overcome pockets of weakness emerging in the housing market.

- In the CLO space, we maintain a heavy bias toward high-quality managers and strong underlying collateral pools.