Voya Financial, a trusted provider with expertise in benefits, savings, and investing, was at the forefront of creating one of the first target date funds to help individuals prepare for retirement. At this key milestone for Voya’s target date funds, our team reflects on the journey and looks at what lies ahead.

Special Contributor:

Amy Vaillancourt, President, Wealth Solutions

CIO Barbara M. Reinhard, CFA shares insights on the two-decade journey and what's next for retirement savings:

Key points

- Voya target date funds are designed to support successful retirement outcomes for defined contribution plan investors. Our portfolios invest more in equities in the early years of a plan participant's career gradually adjusting the mix toward more fixed income as retirement approaches.

- This higher allocation to equities in the first 20 career years allows portfolios the opportunity to compound equity returns, maximizing growth potential while retirement account balances are growing and receiving steady contributions.

- Our target date funds are built on a multi-manager active/passive blend approach to help take the guess work out of investing for plan participants. We favor active management in the less efficient asset classes where alpha is more likely to be captured.

- As one of the first target date fund managers, over the last 20 years we’ve adapted to market dynamics and participant behavior to offer lower-cost solutions that provide access to a broad range of asset classes.

- Looking ahead, we expect that plan participants will demand greater personalized retirement offerings, increased access to alternative and private asset classes, and more retirement income solutions.

Twenty years ago, the employee benefit landscape was very different than it is today. Investment solutions were limited, and employees did not have many choices to help prepare them for retirement.

Many workers who had expected to have a corporate pension plan for retirement found that their employers were freezing or closing defined benefit plans in favor of employee-savings defined contribution plans. In these plans, employees had to make their own investment decisions and allocate funds among the available options, which proved to be a daunting task. Additionally, new employees entering the labor force were just beginning to understand the importance of retirement savings, but they lacked guidance.

It was clear that a holistic solution was needed. In 2005, Voya introduced its first target date fund to take the guesswork out of investing and boost confidence for workers at every career stage. These funds offered a diversified and straightforward approach to investing, making it easier for participants to secure their financial future.

The following year, the Pension Protection Act was passed, allowing target date funds to be used as a qualified default investment alternative, giving plan sponsors a way to auto-enroll participants and supporting the growth and adoption of these types of retirement funds. The Pension Protection Act was a defining moment, as it established safeguards for employees in defined benefit and defined contribution retirement programs.

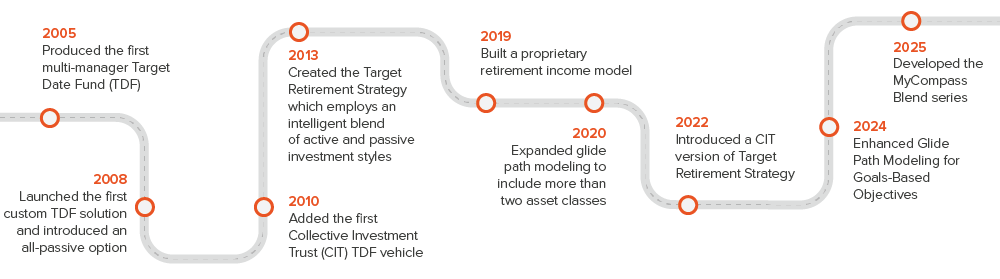

Over our 20-year journey, we’ve adapted to evolving participant needs, evaluating asset classes and markets with an aim of positioning our clients for success. Here we reflect on our successful journey and look ahead to the future of retirement savings and investing (Exhibit 1).

Voya's target date approach

Our investment team utilized a research-driven process to create Voya’s first target date fund. We evaluated data related to worker income, salary progression, and career longevity. Our work concluded with two key philosophies for retirement investing. First, we determined that the shape of the glide path (i.e., the evolution of the portfolio’s weights to equities and fixed income) is crucial. We found that higher allocations to equities are appropriate earlier in a worker’s career. As retirement approaches, higher allocations to fixed income and lower allocations to equities are advisable. Second, we realized that concentration of assets in a single investment firm or style could be detrimental. This led us to adopt a multi-manager approach to investing. These two conclusions shaped our distinctive approach to the initial design of our target date funds, and they remain at the heart of our retirement strategies today.

Sequence of returns underpins glide path design

Our glide path design is supported by academic research on sequence of returns” risk. This refers to the order in which investment returns, both gains and losses, occur over time. Investment losses are especially pronounced when negative market returns occur late in working years, as there is less time for the portfolio to recover and fewer working years to make contributions to the retirement plan. As such, participants at this stage benefit from a more conservative allocation to equities and higher allocations to a broad range of fixed income asset classes; the aim is to reduce portfolio volatility and protect accumulated wealth as retirement nears.

More equity early career, less equity late career

Supported by this research, Voya target date portfolios are constructed with higher allocations to equities in the first 20 years of a worker’s career. This provides the opportunity to compound equity returns and maximize growth potential while retirement account balances are growing and receiving steady contributions. During the last 10 years of a participant’s career, we emphasize a steeper glide path, which reaches its most conservative equity allocation at retirement (Exhibit 2).

Participants entering retirement are most vulnerable to an equity market decline. This is also when their account balances are at their highest, but those assets need to last for a long time (retirement can span several decades), and finding post-retirement employment can be challenging. Furthermore, high equity allocations near and in retirement can have a double-whammy effect: Withdrawing assets during a market downturn can be particularly damaging. Our glide path is designed to help mitigate these downside risks when participants are most vulnerable.

Exhibit 2: Voya’s target date path glides from aggressive to conservative

From early career through retirement

Multi-manager, blend approach

While TDF investors prefer a ‘multiple asset manager approach’, both TDF owners (96%) and TDF non-owners (72%) desire a broad range of asset classes.1

A key differentiator that set us apart early on was our multi-manager approach to target date design (Exhibit 3). Instead of offering funds from just one investment firm, which could expose our plan participants to years of underperformance by a single manager, we decided it was optimal to use our manager research and selection team to carefully curate a diverse roster of managers. The criteria for selecting managers included a strong emphasis on cost efficiency, diversification, and the ability to add value in specific asset classes.

Our team also discovered that not all asset classes are well suited to active management. A blended target date fund can add value by employing active strategies in less efficient asset classes, such as fixed income and non-traditional investments, where the success rate in enhancing returns has been higher. For efficient asset classes, such as U.S. large cap equities, we opt for passive investing. We have found that our blended approach helps mitigate risk and diversify our portfolios. This gives us the flexibility to adjust our investments over time, adding or removing managers and styles as needed, to achieve the best results for our participants.

Exhibit 3: Voya’s multi-manager, blend approach helps mitigate risk and diversify portfolios

A comprehensive menu of asset classes, styles, and managers

What we’ve learned along the way

Proliferation of available asset classes

The set of asset classes that can be included in a target date fund today is much broader than when we first started. However, just because an asset class is available doesn't necessarily mean it should be included in a target date portfolio. We have stringent diversification tests and are only interested in asset classes that enhance the overall risk and return profile for our participants.

For example, early on, we recognized the shift in international markets from burgeoning to truly investable, and we split emerging from developed international equities to give greater degrees of freedom for our investment teams to generate alpha. Over the years, we also built out fixed income asset classes, with allocations to Treasury inflation-protected securities (TIPS), international fixed income, and securitized credit, as these markets became ripe for investment.

Over time, our investment teams have also eliminated asset classes from our target date funds. After conducting an in-depth research project on commodities, we found returns were heavily influenced by economic growth in emerging markets, and far less of a hedge against inflation than some believe. This led us to remove commodities from our target date funds in 2018.

Going forward, we will continue to evaluate our asset class lineup. (For example, we have begun to explore the inclusion of alternative and private asset classes.)

Incorporation of CITs

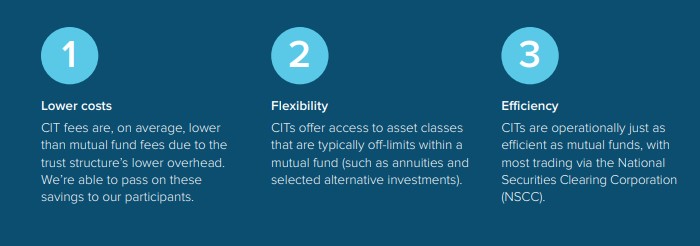

In 2010, we added the first collective investment trust (CIT) to our investment offering. We were an early adopter of this vehicle because of its benefits, specifically:

Voya IM and Voya Wealth: An unrivaled partnership

Within Voya Wealth, our teams strive to turn financial wealth into retirement income. Aligning with our role as a recordkeeper, we focus on understanding participant behavior and preferences so that, together with Voya Investment Management, we can provide the most beneficial retirement solutions for employees.

What’s on the horizon?

The rise of automatic enrollment in 401(k) plans has contributed to the popularity of target date funds, as these plans make TDFs the default investment choice. According to Voya’s “Survey of the Retirement Landscape: Plan Sponsors Sentiments,” many sponsors see target date funds as a foundational component of retirement plans. In fact, 61% of the total plan sponsors in our survey offer target date funds. Among medium- and small-plan sponsors, nearly 72% offer target date funds to their employees. We expect adoption of TDFs to continue to rise.

92% of owners say the target date fund increases their confidence in achieving a successful retirement.2

Meanwhile, participant preferences and new legislation are shaping the industry in other ways. We see three key trends:

- Personalized, holistic in-retirement offerings. Participant-centric solutions with investment options and guarantees tailored to individual preferences rather than one-size-fits-all products, will continue to gain traction. We believe participants will demand guidance on how much to put into a guaranteed product and what is a safe amount to withdraw.

- Consistent philosophy among fund options. There's a growing trend towards coordinating the philosophy between the standalone DC menu and target date funds, which are receiving the lion's share of DC flows. One shift will be away from active and towards passive and blend products to reduce costs and optimize return potential.

- Alternative and private asset classes. Depending on the passage of proposed legislation, we expect a greater adoption of alternative and private asset classes to enhance diversification and address the evolving needs of plan participants.

Meeting the needs of plan participants

Plan participants are at the center of every decision we make. The retirement landscape is constantly evolving, and we will continue to adapt our target date funds based on data and research to better understand pre- and post-retirement trends and participant behavior. Additionally, we are always seeking ways to help plan providers engage participants through communication strategies that help them navigate the challenges of investing for various career horizons.

We are proud of our track record in target date investing and look forward to the next 20 years.

98% of TDF owners agree that messages related to saving early and/or the importance of taking advantage of the employer match would be helpful.3

A note about risk: There are no guarantees a diversified portfolio will outperform a non-diversified portfolio. Diversification does not guarantee a profit or ensure against loss. Past performance is no guarantee of future results. Inherent in all investing are the risks of fluctuating prices and the uncertainties of rates of return and yield. A target date is the approximate date when investors plan to start withdrawing their money; principal value fluctuates and there is no guarantee of value at any time, including at the target date. Price volatility, liquidity and other risks accompany an investment in equity securities of foreign, smaller capitalized companies. International investing poses additional, special risks including currency fluctuation, economic and political risks not found in solely domestic investments. For investments in emerging markets, such foreign investing risks are generally intensified.