A short primer on private placements.

A large and stable market

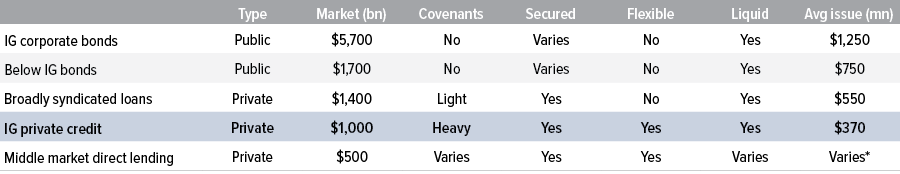

Investment grade private credit (PCIG) is a $1 trillion market used by nearly all life insurers and about half of pension funds as a substitute for IG corporate bonds to enhance diversification and yield. PCIG lending generally falls into three categories: corporate, infrastructure and asset-based finance.

As of 09/25/24. Source: Debtwire, Fitch, Morningstar, CDLI, BoA, Voya IM estimates. *The middle market is extremely heterogeneous but can be broken out into lower (tranche sizes < $100mn), core middle market ($100-500mn) and upper middle market (> $500mn).

Higher yields, lower credit risk

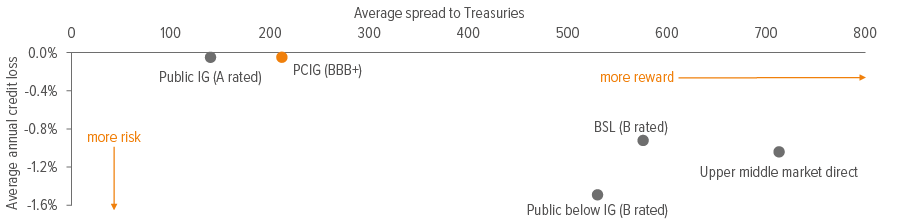

Of all the ways to loan long-term money to corporate borrowers, PCIG has historically been one of the least risky— loss ratings for BBB+ private placements are equivalent to higher-rated (A) public bonds. Investors have taken on less risk by adding PCIG to fixed income portfolios, while getting a roughly 100 basis point yield premium to equivalent public corporate bonds (including the spread and any back-end prepayment or amendment income).

As of 09/25/24. Source: Standard & Poor’s, Morningstar, BoA, CDLI, Society of Actuaries, Voya IM estimates. Average annual credit loss and average spread over risk free are measured over the 18-year period 01/01/05-12/31/22; spreads are tighter across the board at present.

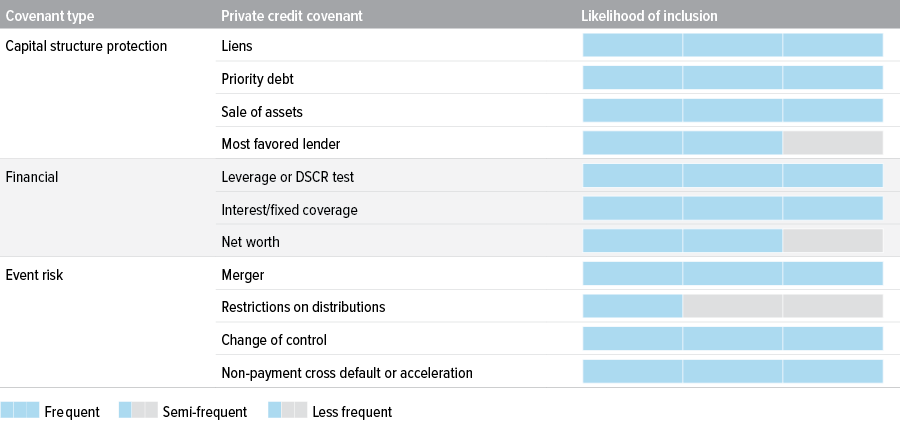

Covenants help mitigate potential risks

A big reason why PCIG has historically been good at protecting against loss is its heavy emphasis on covenants. Covenants are safeguards above and beyond securing debt on an asset.1 They’re meant to alert investors quickly in the event of an adverse turn in the company, but they also provide opportunities for non-coupon income, such as amendment fees, waiver fees, rate bumps and make-whole premiums.

Private placements offer valuable benefits to borrowers

Borrowers choose PCIG—which is more restrictive and expensive than either the public markets or the syndicated bank loan market—for three main reasons. 1) Confidentiality: Private companies want to keep their financials private, whether it’s a 100-year-old candy company or a new corporation created to hold the assets a public company is shedding in a sale and leaseback. 2) Creativity: The PCIG market will do non-standard tenors, delayed draws, custom amortization schedules, and highly complex legal and analytical work on asset-based finance that the public market and most banks won’t do. 3) Resilience: The private market stays open when public markets are in turmoil. Growth in PCIG issuance broadly tracks U.S. M&A growth, and generally rises in response to bank regulation—when banks have less capital to lend, the PCIG market steps up.

High demand can limit buying into PCIG deals …

85% of PCIG deals are agented, and unlike the middle market, there is no yield differential between agented and direct deals. The typical PCIG deal is about $370 million across 12 participants.2 These investors almost never get the full allocation they want, so they follow the credit actively and look to buy more if it becomes available. Thus there is plenty of sell-side liquidity, because demand for PCIG outstrips supply.

… But creates liquidity to sell out of them

There is a steady $4 billion of secondary PCIG trading volume a year, dominated by a handful of specialist firms, versus $70-80 billion of annual new issuance.3 Secondary market volumes aren’t larger because the pension funds and insurance companies who are the main investors in PCIG are happy to sit on their holdings for as long as possible and quietly outperform the benchmark. The driver of secondary PCIG volume tends to be M&A activity—firms selling or transferring entire portfolios post acquisition—or accounting and tax trades.

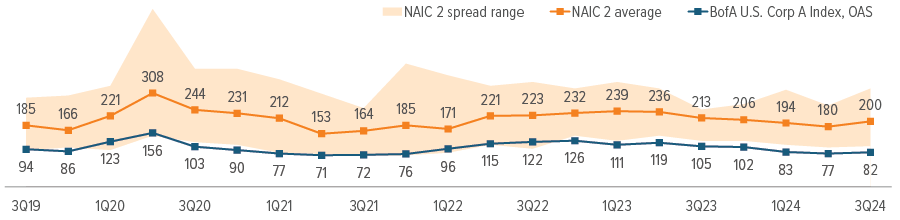

As of 09/30/24. Source: BofA.

Voya is a leader in private credit

Voya has been an active investment grade private credit lender for over two decades and is the largest private credit manager of third-party insurance assets.4 Our selectivity, size and reputation also mean that we have consistently achieved above-average spreads on deals.

For clients, this means we can provide better allocations across more deals from more sources than most of our peers. We have extensive experience working with clients new to the PCIG space as well as with seasoned PCIG investors seeking a more personalized experience along with better deal flow and allocations.

A note about risk

The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.