Key Takeaways

Participants approaching retirement are asking their employers for help with retirement income planning due to low levels of confidence in their knowledge and ability to make decisions in this area.

A retirement tier includes the investment products and solutions within a defined contribution plan that can convert participant savings into retirement income and reduce financial stress.

We offer a three-prong approach for plan sponsors looking to establish, expand or rebrand their retirement tier.

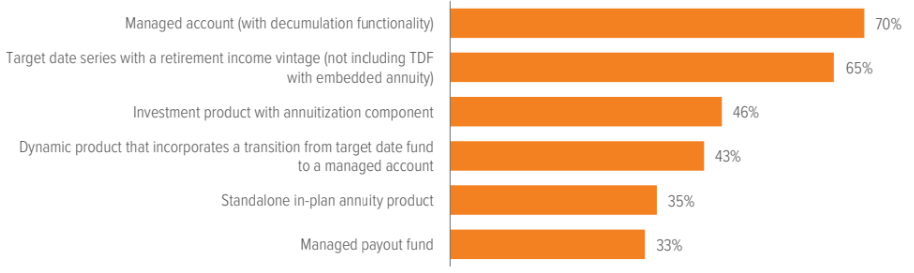

Decoding the decumulation phase requires a range of products and solutions to support participants who are approaching, entering and in retirement.

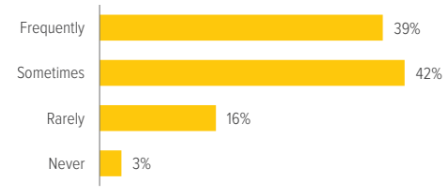

As workers approach retirement, their investment priorities change. They become less concerned with growth and more concerned with preservation of capital and generating income—and they’re looking to their employers for investment solutions that can help (Exhibit 1).

As of 12/31/24. Source: Cerulli Associate. The Cerulli Report: U.S. Defined Contribution Distribution 2024. See last page for additional disclosures.

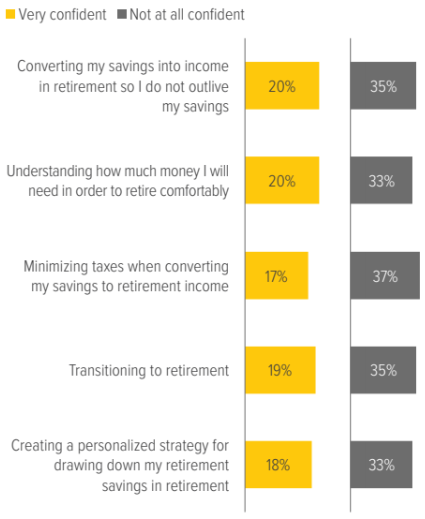

Voya’s research shows that most defined contribution (DC) plan sponsors agreed that recent legislation and an aging participant base have encouraged a strong focus on the need for retirement income products.1 We also know that participants report a relatively low level of confidence related to making retirement income-related decision (Exhibit 2).

Plan sponsors who want to help their participants with retirement income planning should consider adding a retirement tier to the plan. A retirement tier includes the investment products and solutions within a DC plan that address the unique income needs of participants entering the decumulation phase of retirement.

A comprehensive retirement tier may include investment options such as a target date fund suite with a retirement income vintage, and/or standalone investments in bonds, low volatility equities and stable value strategies in the plan’s core investment menu. These investment products can meet the income needs and align with the lower risk tolerance of older participants who don’t have the luxury of time to recover from market downturns. For participants with significant concerns about longevity, a retirement income solution that features a guaranteed product can help minimize the risk of running out of money.

Many DC plans don’t offer a retirement tier… or do they?

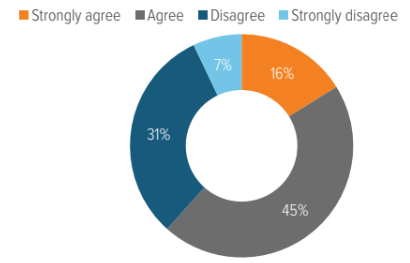

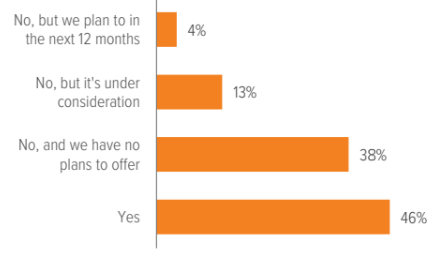

Two-thirds of DC plan sponsors agree that they want to retain retiree assets in the plan—yet more than half don’t offer a secondary investment lineup for retired participants (Exhibit 3).

As of 12/31/24. Source: Cerulli Associates in partnership with the SPARK Institute, The Cerulli Report: U.S. Retirement Markets 2024; Voya Investment Management, 2025 Survey of the Retirement Landscape.

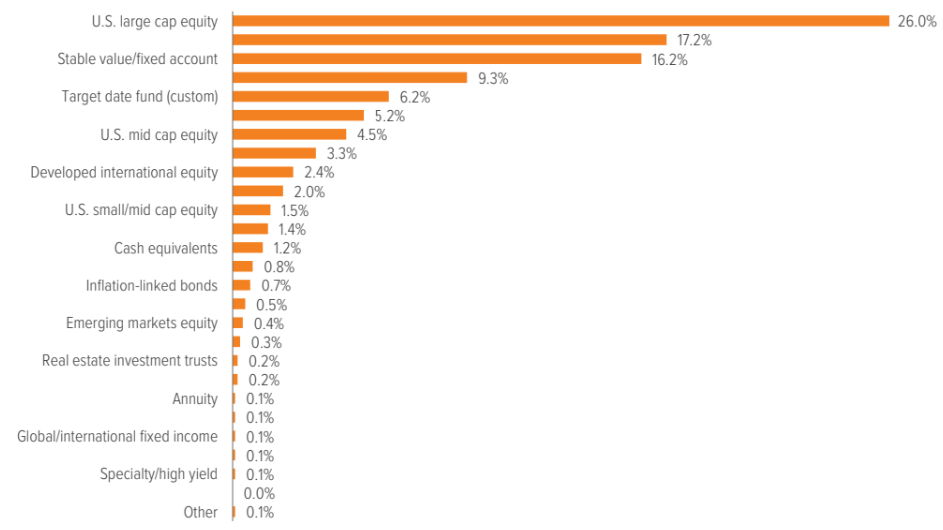

However, a secondary investment lineup isn’t necessary to establish a retirement tier. In fact, nearly all DC plans have a retirement tier; the sponsor either doesn’t realize it or doesn’t market it as such. The key investment options in a retirement tier include those that are typically offered in many plans’ core menu (Exhibit 4).

As of 12/31/24. Source: Cerulli Associates. The Cerulli Report: U.S. Defined Contribution Distribution 2024.

How can sponsors establish or expand their retirement tier?

In our view, sponsors should take a three-pronged approach to establishing, expanding or rebranding a retirement tier in their plan.

1 QDIA: Promote target date funds to older participants and retirees

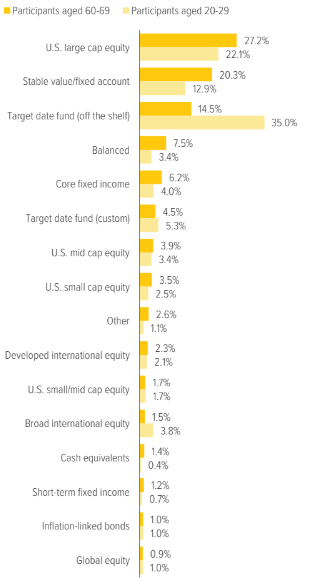

Target date funds have exploded in popularity since their inception, with the number of DC plans offering them rising from 42% in 2006 to 84% in 2020.2 One leading reason for their ubiquity is that nearly 90% of plans with a qualified default investment alternative (QDIA) use target date funds as the default investment.3 However, research shows that older participants are less likely than their younger counterparts to invest in TDFs—possibly because their participation in the plan predates the introduction of TDFs. Furthermore, when this population takes the DIY approach to investing, their allocations to equities may not be appropriate for their risk tolerance and time horizon. (Exhibit 5).

For older workers who may have been contributing to the plan for decades, target date funds are relatively newer products. Therefore, sponsors must ensure this population understands the benefits of investing in a target date fund; namely, that it’s designed to be a one-choice investment solution that provides a well-diversified, professionally managed portfolio and maintains an appropriate level of risk based on the target date. If the target date suite includes a retirement income vintage, sponsors should also promote that feature.

As of 12/31/22. Source: Public Retirement Research Lab, EBRI, NAGDCA. Percentages are dollar-weighted averages. A target date fund typically rebalances its portfolio to become more focused on income as it approaches and passes the target date of the fund, which is usually included in the fund’s name. Not all participants are offered all investment options.

2 Core investment menu: Broaden the options

DC plans typically adopt a multi-fund, multi- style approach for the equity options in the plan’s investment menu—but many don’t allow for the same diversity in fixed income. Adding a stable value fund or additional bond fund options beyond the typical U.S. investment-grade category can benefit older participants and help them avoid overexposure to equities. High-dividend equity funds and managed volatility funds that can balance equity exposure with less risk are also worthy of consideration for the core investment menu.

As of 12/31/22. Source: Public Retirement Research Lab, EBRI, NAGDCA.

3 Retirement income: Consider ways to help retirees prevent savings depletion

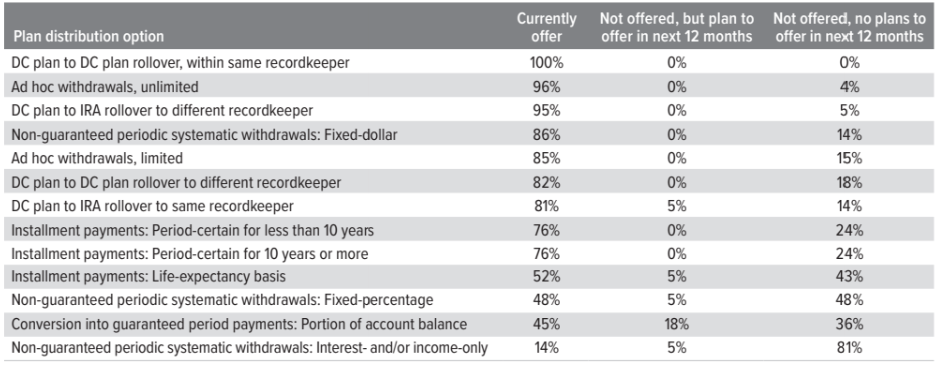

Modifying the plan’s distribution methods can help older workers with retirement income planning, as many plans don’t offer retiree-friendly options. While most plans allow installment payments over a specific period or ad-hoc withdrawals, fewer offer in-plan options that help retirees establish a stream of guaranteed payments to reduce the risk of savings depletion (Exhibit 7).

Helping retiring participants make the best decisions about what to do with their plan assets is important for a few reasons. First, lump-sum distributions aren’t reversible; once the money is distributed, it can’t be moved back into the plan. Second, participant assets that are distributed no longer benefit from the plan’s fiduciary oversight, creditor protection and generally lower costs than assets that are rolled into individual retirement accounts (IRAs).

As of 12/31/24. Source: Cerulli Associates in partnership with the SPARK Institute. The Cerulli Report: U.S. Retirement Markets 2023. Respondents were asked “Which of the following options does your firm offer or plan to offer on your DC recordkeeping platform to retired/separated participants that qualify for penalty-free plan distributions?” Respondents were asked to select all applicable options. Respondents indicate that limitations on ad hoc withdrawals are typically only put into place by the plan sponsor, not the recordkeeper.

Next steps

|

A note about risk: There is no guarantee that any investment option will achieve its stated objective. Principal value fluctuates and there is no guarantee of value at any time, including the target date. The “target date” is the approximate date when an investor plans to start withdrawing their money. When their target date is reached, they may have more or less than the original amount invested. Stocks are more volatile than bonds, and portfolios with a higher concentration of stocks are more likely to experience greater fluctuations in value than portfolios with a higher concentration in bonds. Foreign stocks and small- and mid-cap stocks may be more volatile than large-cap stocks. Investing in bonds also, entails credit risk and interest rate risk. Generally, investors with longer timeframes can consider assuming more risk in their investment portfolio. Guarantees are based on the claims-paying ability of the insuring company.