Key Takeaways

What happened: The One Big, Beautiful Bill (BBB) phases out clean energy investment and production tax credits by end 2027, much earlier than the Inflation Recovery Act’s plan.

The impact: We expect this to result in intense investment activity by developers as they rush to start construction in order to secure tax credits for as many projects as possible. Medium-term projects may need to raise their electricity sales prices and cut capex costs to compensate.

The demand factor: Rising U.S. electricity demand growth, renewable energy projects’ ability to adapt to changing economics, and gas turbine supply constraints help mitigate any adverse impact of Federal subsidies ending.

The newly-passed budget bill’s early sunset of clean energy investment tax credits will likely fuel a near-term spike in renewable energy infrastructure deal flow. Longer-term impact is mitigated by renewable generation’s historically-observed ability to adapt to changing project economics, and the U.S.’ surging electricity demand growth.

The BBB: What happened

The 2022 Inflation Reduction Act (IRA) extended and restructured existing clean energy investment tax credits (ITC) and production tax credits (PTC) on zero-emission generation and storage facilities.1 These credits were due to sunset in 2032, or when the U.S. Treasury Secretary determined that the country had achieved a 75% reduction in greenhouse gas emissions from the production of electricity compared to calendar year 2022, whichever is later.

The One Big Beautiful Bill Act of 2025 will sunset the ITC and PTC much earlier. Nothing changes for projects that begin construction within 12 months of the bill’s enactment as they will be grandfathered in no matter when they become operational. All other projects must begin operation by end of 2027 in order to be eligible.

The ITC, explained

The ITC, the most relevant tax credit for renewable energy infrastructure lending, allows a project to generate a transferable tax credit based on a percentage of its eligible investment costs. It was originally enacted in 1978 for a flat value of 10%, then raised to 30% in 2005.

The ITC was modified and/or extended in 16 different budget bills before the IRA. Most recently, the Consolidated Appropriations Act of December 2015 added a gradual step-down in credit value from 30% in 2018 to 10% in 2022. This phaseout was modified and extended in the 2018 and 2021 budget bills.

The IRA attempted to create a stable, long-term structure for existing clean energy tax credits that would shield them from the whims of Congress. Enactment of the BBB is a challenge, but tax credit policy volatility is something with which the renewable energy industry has decades of experience.

Impacts of the tax credit change

The aftermath of the BBB is likely to cause an intense near-term spike in renewable energy project activity as developers and sponsors rush to start construction in order secure the ITC for as many projects as possible.

This will also cause a significant increase in renewable energy infrastructure lending deal flow for the next 12 months and beyond, with follow-on opportunities to invest in projects as their construction is completed and they go into operation.

Medium-term projects unable to meet the new ITC deadlines may need to adjust their economics in order to be viable. The expected adjustment will be higher negotiated long-term electricity sale prices (PPAs) with utilities and large corporates, as well as more efficient pricing from suppliers that comprise project capex.

The demand factor

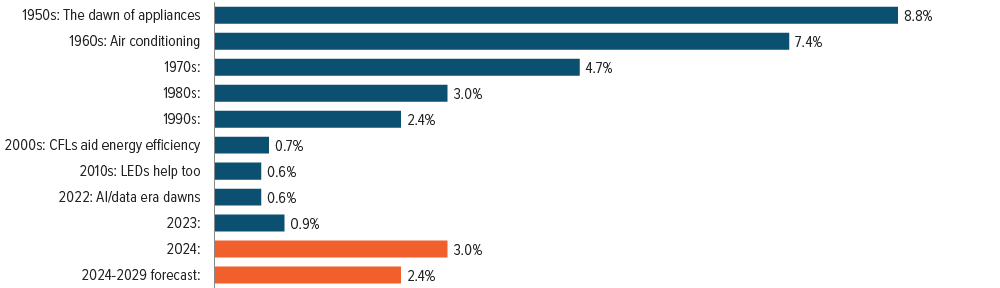

Regardless of the Federal tax benefits available to renewables projects, the U.S. is currently experiencing a level of electricity demand growth last seen in the 1980s (Exhibit 1). Utilities have been caught on the back foot by the sudden rise in power demand, and they need reliable power. Forecasts show potential power shortages nationally, due to onshoring of manufacturing, growth of data centers, retirement of coal plants, and more.2

The market share of renewable energy sources has grown consistently over the last two decades, even when it was more expensive than conventional power sources (Exhibit 3).

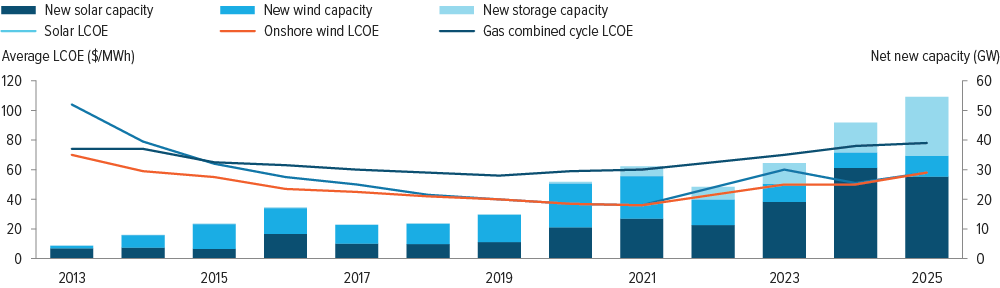

Today, however, the costs of battery storage and solar panels have fallen to the point where renewable generation and storage is increasingly competitive with—if not cheaper than—combined cycle natural gas on an unsubsidized basis (Exhibit 2).3

The average turnkey price of battery electricity storage systems has fallen 54% over the past two years, from $356/kWh to $165/kWh.4 This is especially important as the growth of co-located and standalone battery storage installations increases utilities’ ability to rely on solar and wind as baseload.

As of 12/31/24. Source: Grid Strategies, FERC.

As of 06/10/25. Source: Lazard LCOE+ 2025

Even in Texas, where the Electricity Reliability Council of Texas (ERCOT) is estimating an 8% compound annual growth rate in peak electricity demand between 2024 and 2031, the majority of forecast new capacity is solar and storage.5

While the Energy Information Administration reports 19 GW of combined cycle natural gas capacity is scheduled to come online by 2028, only 4 GW is currently under construction. Expansion of natural gas generation capacity is currently limited by severe supply chain constraints. There is a reported waitlist of five years for gas turbine deliveries, along with sharp increases in project costs.6

We expect that the renewable energy project market will successfully adapt to the medium term phase-out of Federal tax benefits, as it has adapted to tax credit changes before, and that renewable generation will continue to grow its status as a core element of the U.S. power mix.

As of 07/07/25. Source: Lazard LCOE+ June 2025, EIA.

A note about risk: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.