The end of 1Q24 sees most mortgage derivatives coming off several strong months of performance. The market’s behavior has been largely consistent with the thesis we put forward last year: In the current environment of low prepayment risk, mortgage-related assets are cheap on both an absolute and a relative basis. While spreads on some mortgage-related assets have begun to tighten, we still see plenty of runway for new investment. Here’s why.

Historically low prepayment risk is enticing capital into mortgage derivatives…

Most U.S. homeowners—pretty much anyone who bought before the summer of 2022—are currently sitting on mortgage rates below 5%, and the idea of paying 7% on a new mortgage has exactly zero appeal. Despite the decline in rates from their peak last fall, prepayments on these low-rate mortgages have slowed to a lull not seen in decades due to the high cost of money and a slow winter real estate market.

The best-performing assets in our investment purview in recent months have been low-coupon interest-only (IO) securities. We see this as a sign of demand from new and returning investors, since these IOs are among the safest and simplest ways to capture spread in prepayment-sensitive assets. IO spreads have tightened a little, but we see more room for them to tighten further and for prices to go up.

We also think it’s likely that demand will start moving up the curve to IOs and inverse IOs (IIOs) with incrementally more complexity and prepayment risk. For some investors, these assets are more palatable now that expectations for fast and furious rate cuts have faded. For others, including ourselves, these securities present a welcome opportunity to capture strong carry backed by collateral with underappreciated protections from future refinancing waves.

…but not all pools are equally safe to swim in

Despite the appealing cheapness of the market, we would remind investors that mortgage-related assets are incredibly heterogenous, with each pool covering different loan sizes, coupons, ages, originators, servicers, guarantors, geographies, credit scores, loan-to-value ratios and more.

Prepayments are a real risk, and these pools’ characteristics have significant influence on how their prepayments react to external factors. Careful collateral selection is important to harvest the opportunities in these assets while steering clear of unwelcome surprises.

An example: The largest new issuance sector for IO/IIOs in recent months has been high-coupon GNMA pools, an area we have largely avoided. When mortgage rates fell from 7.75% to 6.75% late last year, the result for these high-coupon GNMA pools was staggering. Some pools prepaid at an annualized rate as high as 70%—in some cases, twice as fast as models predicted—resulting in a substantial contraction for that sector. |

An inefficient market and cheap MBS are keeping spreads wide, for now

The relative value of IOs and other prepayment-sensitive mortgage assets is driven by two main things. The first—and evergreen—reason is that they are byproducts of risk-averse investors’ efforts to shed unwanted exposure to prepayments.

This creates a natural ongoing supply of securities at relatively wide spreads, but the concentrated prepayment exposure is hard for most investors to absorb—very few asset managers have the deep and well-resourced teams of experts dedicated to this sector that we do.

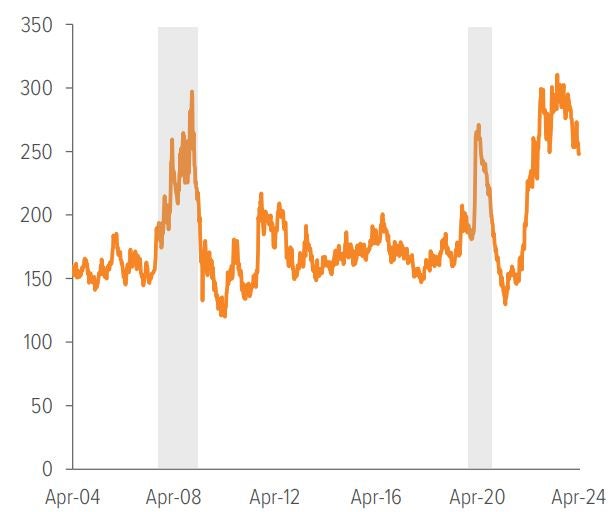

The second reason for the market’s current value is the cheapening of the underlying agency mortgage-backed securities (MBS) themselves. Spreads in MBS have become historically wide, partly due to a lessening of appetite from banks and the Fed, which are usually the market’s biggest buyers (Exhibits 1 and 2).

The Fed started buying agency MBS at the beginning of the pandemic in order to support the U.S. economy, adding about $1.2 trillion to its balance sheet over 18 months. It stopped buying MBS in September 2022 and since then has been letting its holdings passively pay down.

As for banks, they turned cautious even before March 2023’s wave of bankruptcies. Many banks have nonperforming assets on their balance sheets that they need to shake out, at the same time as Basel III’s increased capital adequacy requirements are coming into effect.

As of 04/15/24. Source: Federal Reserve.

As of 04/15/24. Source: Federal Reserve. Periods of recession are marked in gray.

Assets such as IOs and MSRs potentially offer sustainable investment opportunities in nearly all market environments, as well as low correlations to other asset classes

Bear in mind that while the current cheapness of the market is a historically unusual opportunity, it’s not the only opportunity—or even a time-limited one. Prepayment risk is unusually low, and agency mortgage-backed securities are unusually cheap, but IOs and mortgage servicing rights (MSRs)—both areas of core expertise for our mortgage derivative team— have offered sustainable investment opportunities for decades.

Mortgage-related assets such as these generally offer attractive yield to market-consensus prepayment assumptions, with substantial opportunities for investors to outperform by out-predicting prepayment models. That remains the same during times of high rates, low rates, and everything in between.

As such, mortgage prepayment strategies can have very low correlations with other asset classes, and they can be a useful addition to a portfolio looking to boost returns while diversifying away from credit and rate exposure.

A note about risk The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate below market levels and extending the security’s life and duration while reducing its market value. |