Interest-only securities offer attractive, high-single-digit unlevered yields to the market’s base-case prepayment expectation and stand to benefit from significant spread tightening as demand for the asset class increases amid limited supply.

Highlights

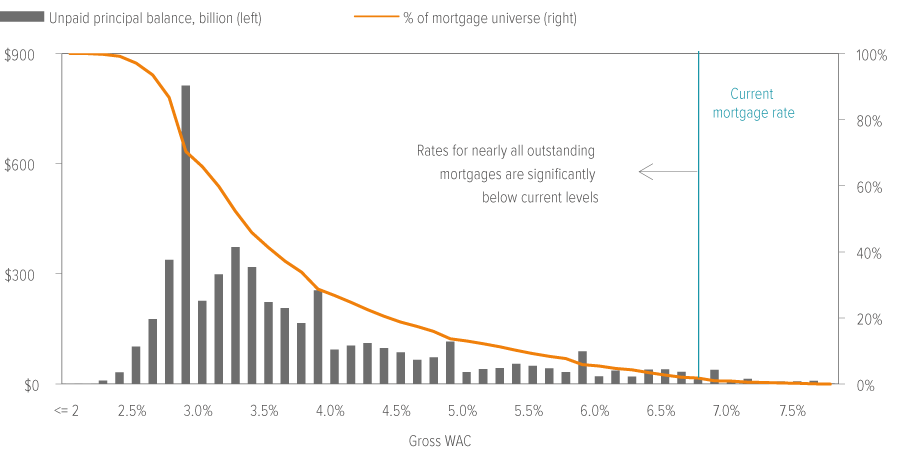

- More than 90% of homeowners have a mortgage rate under 5%, while the current national average for a 30-year mortgage rate is 7%.1

- At current mortgage rate levels, the threat of rate-driven refinancing is virtually nonexistent — an environment that significantly reduces the risk of investing in IOs.

- IOs offer attractive, high-single-digit unlevered yields to the market’s base-case prepayment expectation and stand to benefit from significant spread tightening as demand for the asset class increases amid limited supply.

The bumpy road to the current market opportunity

In 2021, a perfect storm of factors created one of the worst fundamental environments for interest-only securities (IOs) in decades. While mortgage rates had been low since March 2020, record-setting home price gains and increased loan origination capacity further intensified the refinancing wave. In addition, Covid-related forbearance led to levels of delinquency buyouts not seen since the aftermath of the 2008 housing crisis (and never seen in tandem with such rapid home price gains), further disrupting cash flow for IOs.

Fundamentals rebounded in 2022, but the market received another blow as historic negative total returns of broad fixed income benchmarks led to retail investors pulling assets from fixed income funds, forcing some money managers to raise cash by selling IOs regardless of fundamentals or valuations.

Today, the technical backdrop favors IOs and market fundamentals remain extremely attractive, presenting one of the most compelling entry points for IOs in more than 20 years.

On average, existing mortgages are more than 300 basis points below current rates, which eliminates the risk of rate-driven prepayments for a large percentage of outstanding mortgages, even if rates fall substantially from here.

Low risk: Rate-driven refinancing is virtually nonexistent

Prepayments hurt IOs because these securities have no claim to the underlying principal when it is returned — IOs only receive interest payments. When prepayment speeds are in line with market expectations, IO-focused strategies with interest rate risks hedged tend to perform well. On the other hand, when prepayments are faster than expected (like we saw in 2021), IO strategies suffer.

But when the threat of a sharp rise in prepayments is remote, the downside risk for IOs (and closely related investments such as inverse IOs and mortgage servicing rights) is significantly reduced — and this is exactly the environment we are in today. Mortgages originated from 2009 to 2021 represent the majority of the overall mortgage market, and almost none of these mortgage holders would save money by refinancing at current rate levels (Exhibit 1). On average, existing mortgages are more than 300 basis points below current rates, which eliminates the risk of rate-driven prepayments for a large percentage of outstanding mortgages, even if rates fall substantially from here. When overall prepayment rates are low, the uncertainty about prepayment speeds in the coming months tends to be correspondingly low. This dynamic creates an extremely favorable risk backdrop for IO investors.

The strong fundamentals of IOs are not just a function of mortgage rates; the other strong headwinds that the sector faced in 2021 have also reversed. Coming off record employee headcount in the mortgage origination industry, headcounts are now reducing the industry’s capacity to solicit borrowers into new mortgages. In contrast to the record home price gains of recent years, home prices have largely stagnated over the past year and a half, reducing cashout refinancing and housing turnover. The re-emergence of home equity lines of credit and second lien mortgages as alternative ways to tap into home equity have further dampened these sources of prepayments. Delinquency buyouts have fallen below pre-Covid levels.

Source: CPR & CDR. Data as of 6/30/2023. Conventional headline rate is based on the 30-year conventional mortgage rate and is sourced from Freddie Mac: https://www.freddiemac.com/pmms.

Strong upside potential: Positive carry and market technicals favor IOs

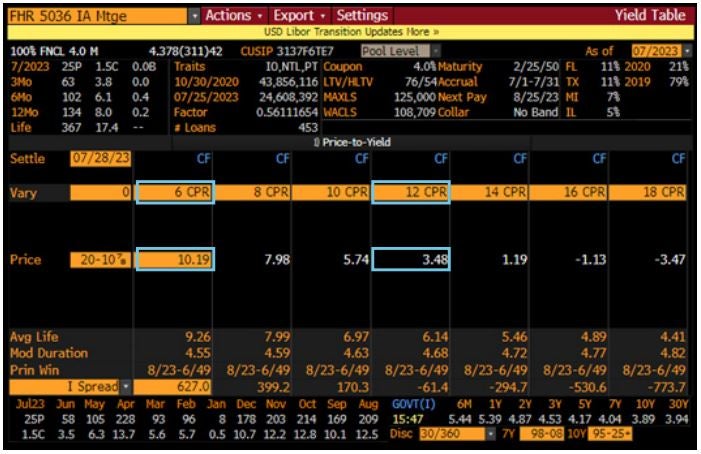

Bond investors use a metric called the conditional prepayment rate (CPR) to estimate prepayment speeds. CPR measures the percentage of mortgage balances that are paid back ahead of schedule on an annualized basis. A higher CPR means faster prepayments (and lower values for IOs). With rate-driven refinancing risk near zero and aggregate prepayment speeds in the mid-single digits, IOs offer significant positive carry. Exhibit 2 is an example of an IO security backed by mortgages with a 4.37% average coupon.

At the price this security recently traded, it offered a 10.19% yield at a 6 CPR, which was its average realized prepayment speed over the prior six months. Even if prepayment speeds were to double to 12 CPR (a very unlikely scenario in the current environment), the yield would still be 3.5%. Investing in such securities with interest rate risks hedged controls for a primary factor that could someday drive faster prepayments, further enhancing the risk profile. It is striking that IO spreads remain in this context, similar to where they stood at the peak of the 2020–21 refinancing wave, despite the dramatic reduction in prepayment risk.

As of July 2023. Source: Bloomberg and Voya Investment Management.

At the price this security recently traded, it offered 10.19% yield at a 6 CPR, which was its average realized prepayment speed over the prior six months. Even if prepayment speeds were to double to 12 CPR (a very unlikely scenario in the current environment), the yield would still be 3.5%.

Looking ahead, we expect investor demand for IOs to increase as prepayments stay at historically low levels. When IOs have offered such attractive carry in the past, this has often proven to be a catalyst for money managers to show more interest in the sector. Demand could also be stoked by the fact that most mortgage pools in today’s market trade at discount dollar prices and thus benefit from fast prepayment speeds. IOs, which benefit from slower speeds, can reduce the overall prepayment risk of a broader mortgage allocation.

At the same time, the supply of new IOs has ground to a halt because there are very few premium-priced mortgage passthroughs. IOs are made as a byproduct of the broader CMO creation process; stripping some interest off of a premium-priced mortgage pool allows bankers to create a par-priced CMO with lower prepayment risk to satisfy risk-averse investors’ demand for such securities. With few premium-priced mortgage pools, there is very little reason to create new IOs — even less so when banks (which are a common source of CMO demand) have had diminished appetite for mortgages in the wake of bank failures earlier this year.

Until mortgage rates fall substantially, the supply of newly created IOs will likely remain very low. In past episodes following sharp increases in the mortgage rate, similar demand and supply technicals have created significant spread tightening (even driving option-adjusted spreads on IOs negative), which creates suggest strike upside for IOs in addition to their positive carry.

With attractive yields, strong upside potential and limited downside risk, we believe IOs are a compelling investment opportunity for investors looking to increase risk-adjusted returns.