Political brinksmanship over the debt limit is poised to push the Treasury to the edge. If 2011 is a guide, T-bill discounts could get wider into June, potentially causing ripple effects across markets.

What would happen if the US defaulted on its debt? For the first time in a decade, investors are taking the question seriously again.

In the years since 2011, when the government last flirted with default, the Treasury has come close to exceeding the debt limit on numerous occasions. Each time, Congress ultimately agreed on a temporary increase, essentially “kicking the can down the road.” And each time, markets became less stressed as investors learned to take the process in stride, growing more comfortable with the dance. This year may not go as smoothly.

Treasury Secretary Janet Yellen has indicated that a drop-dead date could arrive as early as this June unless Congress acts quickly. This is likely an early date, intended to pressure Congress to act sooner than later. The Congressional Budget Office (CBO) recently put a potential default date in the July to September range, depending on tax revenues around the April 15th and June 15th periods.

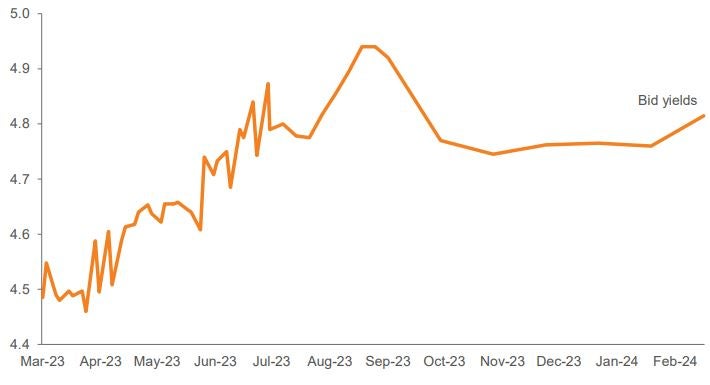

Markets are showing some mild stress around the CBO’s time frame. T-Bills and floating rate Treasury securities that mature between July and October are being offered up to 10 bp cheaper relative to other Treasury issues that mature outside of that period (Exhibit 1).

As of 03/07/23. Source: Bloomberg. Past performance does not guarantee future results.

How might a default play out? The first concern is how it would affect Treasury securities maturing at or shortly after the default window. More broadly, a default on any one issue could roil Treasury markets beyond those maturities and drag most other markets down with them.

The 2011 fiasco gives us a solid playbook to follow. As the potential default date drew near, several T-Bill issues within the possible default range briefly traded at a discount of 100–150 bp. True to form, other markets felt the heat, leading to across-the-board selling.

We believe the current political divide will take us close to the default edge, similar to what happened in 2011. As a result, we expect market dislocations to intensify into June if there is no resolution. Risk-averse investors may want to avoid Treasury securities with maturities within the possible range of default. Opportunistic investors may look to take advantage of any large market price swings. In the silver-linings department, this issue may be self-correcting, as market turbulence will add to pressure on Congress to arrive at a solution. In the meantime, keep your seatbelts fastened.