Key Takeaways

The resurgence of union power is a growing trend, with workers organizing at the fastest pace in two decades.

Rising labor costs can have a significant effect on returns, with unionized companies facing additional expenses of about 10–15%.

Voya IM’s proprietary AI model helps detect changes in labor leverage that may pose potential risks to profitability or opportunities to generate higher returns.

With workers organizing at the fastest pace in decades, proactive analysis of labor cost trends can help identify potential risks and opportunities for generating alpha.

Why unions, and why now?

Today, workers have the upper hand. This isn’t always the situation, but the recent unemployment rate has consistently stayed below 4%—a level considered to be “full employment” by economists—due to a decrease in available workers and an increase in job opportunities. The pandemic has also prompted workers to advocate for safer working conditions, leading to a rise in unionization. This movement is reversing a long-term decline in worker rights as employees strive for higher wages, retirement and health benefits, and better working conditions.

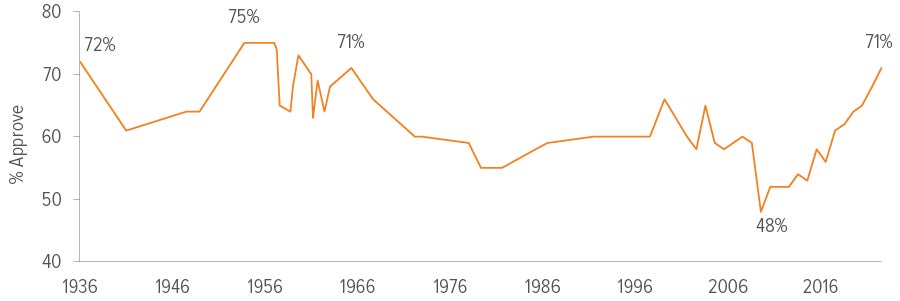

As of 8/30/22. Source: Gallup. Survey results for Gallup’s Work and Education survey are based on telephone interviews conducted August 1–23, 2022, with a random sample of 1,006 adults aged 18 and older, living in all 50 U.S. states and the District of Columbia. Respondents were asked this question: Do you approve or disapprove of labor unions?

In 2022, there was a significant increase in the number of workers joining unions, the largest in twenty years.1 This can be attributed to a growing gap between the number of available workers and the number of jobs in many industries, such as retail, service, health care, agriculture, transportation and warehousing. Moreover, public support for these efforts is currently at its highest point in almost sixty years, similar to levels seen when a larger percentage of workers were part of unions (Exhibit 1).

Although this trend has received attention for a few years, we believe that many analysts’ profitability models haven’t fully accounted for the additional cost pressure caused by union victories. This could lead to negative earnings surprises at some companies.

|

The recent United Auto Workers (UAW) strike centered on an undersupply of workers and poor working conditions. Union members gained more power and negotiated a 25% raise over four years, along with better retirement and health benefits. |

Union impacts are two-pronged

As investment managers, we’re interested in understanding how collective bargaining movements gain ground (from a macroeconomic perspective) and impact company profitability.

Macroeconomic consequences. Over the past couple of years, economic conditions—namely increasing interest rates, high inflation and geopolitical conflicts—seemed to resemble those of the 1970s. Another comparison has been made about union formations. In the 1970s, unions were at the height of their power; they gradually lost influence over the next four decades due to globalization and decreasing inflation.

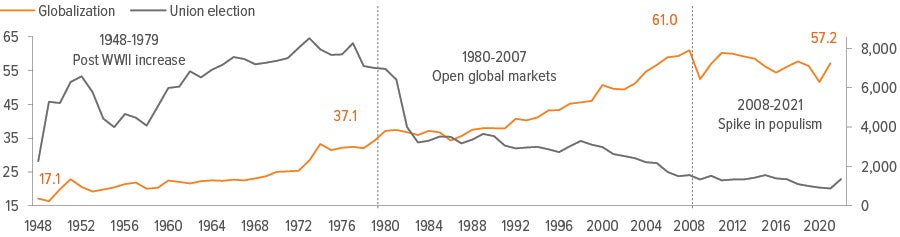

Not much attention has been paid to connecting the economic environment and the rise of collective bargaining, but we believe that the same factors that contribute to inflation also impact the bargaining power of unions. For instance, as globalization increased between 1980 and 2007, the number of union elections decreased. But as globalization retraced since the pandemic, elections suddenly rose (Exhibit 2).

So unions are becoming more relevant again, after a long period of decreased significance. This is due to a shift in the globalization trend, with supply chain redundancy, onshoring (or near-shoring) and tariffs coming together to change the previous pattern of change to disinflation. While advancements such as artificial intelligence may help increase productivity and counteract some of these inflationary effects, there’s still a high demand for workers. Labor force pressures may decrease slightly from current levels, but a declining workforce isn’t expected to be an issue in the short term.

Company-specific impacts. In the past 30 years, corporate profits rose due to the outsourcing of jobs, which led to lower labor costs. This was accompanied by financialization and lower interest rates. However, these advantages are now decreasing, and there’s an increase in worker collectives. Union workers cost companies an estimated 10–15% more than non-union employees.2 This increase in employee costs can also affect non-unionized companies, but to a lesser extent.3

As of 12/31/22. Source: Globalization is represented on the left axis by the trade openness index. Data from Our World in Data; World Bank; World Development Indicators; Doug Irwin, “The pandemic adds momentum to the deglobalization trend, “Peterson Institute for International Economics, 10/28/22. Labor representative elections data on the right axis is sourced from CRS analysis of NLRB union election data through FY 2022.

|

Costly walkouts for automakers The recent strikes cost General Motors an estimated $800 million and Ford an estimated $1.3 billion. Some predict that Ford will spend an extra $1–2 billion every year (about 1% of sales) for the next four and a half years on employee salaries, better retirement benefits and other contractual obligations. Ford suggested the deal would increase costs per automobile by $850–950 and shave margins by 0.6–0.7%.4 These costs aren't limited to the big three automakers. Spillover effects are being seen at non-unionized rivals as well. For example, Toyota gave its U.S. workers a 9% raise and other benefits after the announced GM, Ford and Stellantis union deals. |

Proactive understanding of labor cost trends correlates to alpha generation.

The effects of higher labor costs vary among companies. Some can counteract the increases, but others may face significant challenges. One potential long-term consequence could be a decrease in growth due to a lack of investment in innovation. The big three Detroit automakers struggled for many years due to legacy pension plans and retirement benefits, which made it difficult for them to invest in new ideas, causing them to fall behind their competitors who weren’t burdened with these costs. Similarly, persistently high labor costs could impede growth and result in lower equity returns.

According to a 2009 research report from the National Bureau of Economic Research, the impact of unionization on stock returns may vary depending on the union’s success rate. On average, when a union wins an election, there’s a negative effect on equity returns of 10–14% over the next 15 months. 5 This decrease in stock value can be attributed to a combination of the union’s wage demands (8%) and inefficiencies caused by the union (2%). The study, which covers a period of almost 40 years (1961–1999), suggests that stocks prices decline because investors are slow to adjust. We believe this phenomenon still occurs. The study also found that union wins resulted in a decrease in company growth, which may not have been immediately apparent but became noticeable over time.6

To clarify, this isn’t a criticism of unions, companies with organized workers, or those who engage in collective bargaining. Instead, it’s about recognizing what may impact stock returns. Being mindful of the potential effects of increased labor bargaining power within a company can result in more informed investment choices.

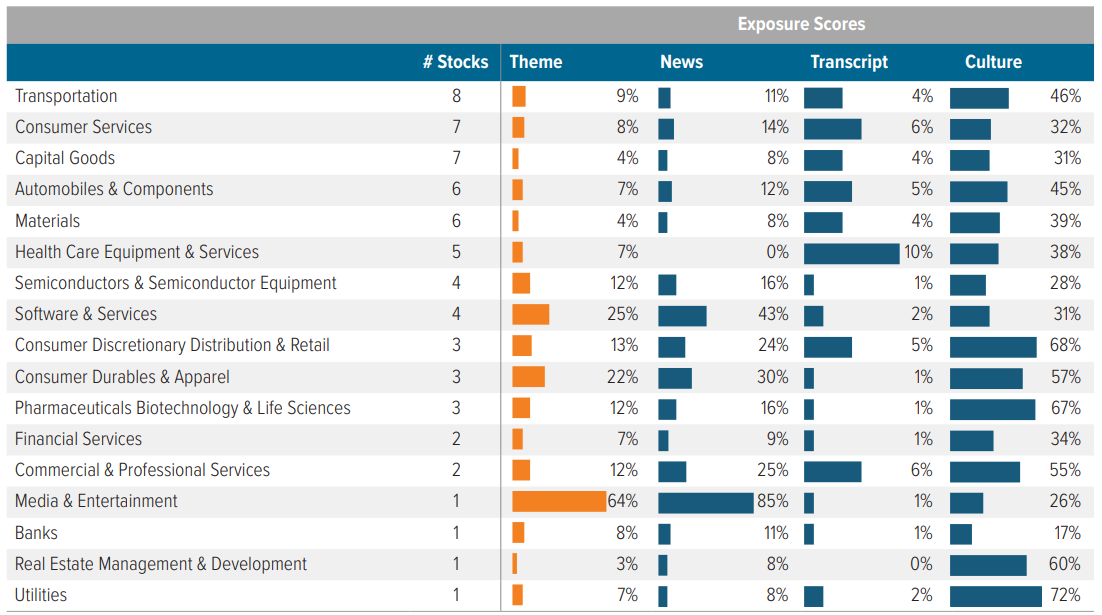

At Voya IM, we’ve developed a model that helps us identify factors, such as labor costs, that could impact our portfolio companies. This proprietary culture model employs natural language processing to find sectors, industries and companies exposed to unionization by combing through news articles, earnings call transcripts and other data sources to identify these connections (Exhibit 3). Once pinpointed, our analysts dig into the company’s operations to assess the impact of higher structural labor costs. Then they determine whether and how a company could potentially offset elevated costs through revenue and expense levers.

This approach demonstrates our use of quantitative investing, where we combine advanced machine intelligence with human insights to pursue what we call “collaborative alpha.” We believe this marks the new forefront of active investing

Source: Voya IM. For illustrative purposes only.

|

A note about risk The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. Artificial intelligence (AI) including natural language processing, machine learning, and other forms of AI may pose inherent risks, including but not limited to: issues with data privacy, intellectual property, consumer protection, and antidiscrimination laws; ethics and transparency concerns; information security issues; the potential for unfair bias and discrimination; quality and accuracy of inputs and outputs; technical failures and potential misuse. Reliance on information produced using AI-based technology and tools should factor in these risks. When using a quantitative model, including those that utilize AI, as part of an investment strategy, please note data imprecision, software or other technology malfunctions, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively affect performance. Furthermore, there can be no assurance that the quantitative models used in managing a strategy will perform as anticipated or enable the strategy to achieve its objective. |