Key Takeaways

Electricity demand in the U.S. is set to skyrocket, driven by AI’s seemingly bottomless demand for power—and the grid is straining to catch up.

For credit investors, direct lending to solar (and storage) is one of the most attractive ways to play the rush into big data, with double-digit yield potential.

For more risk-averse investors wanting to plug in, our investment grade private credit team is seeing attractive opportunities across both natural gas and renewable energy sources.

The most interesting angle on AI’s growth for credit investors may well be in energy transition. Here’s why—and how to play it.

Energy transition: An electric opportunity

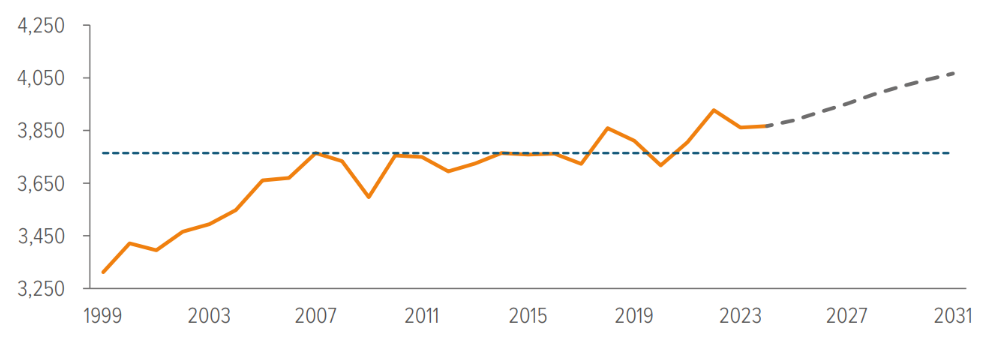

American power demand has been broadly flat since the global financial crisis. But for the past few months, a bunch of very serious, staid government and industry agencies have been quietly saying “oh no” to themselves as they total up future U.S. electricity needs.

And when folks like the North American Electric Reliability Corporation say, “Electricity peak demand and net energy growth rates…are increasing more rapidly than at any point in the past three decades,” well, it’s time to listen.1

There are a number of factors driving this demand boom—electric vehicles, the surge in industrial real estate adding load to the grid—but the biggest single factor is data centers.

As of 06/15/24. Source: Energy Information Administration’s Electric Power Monthly.

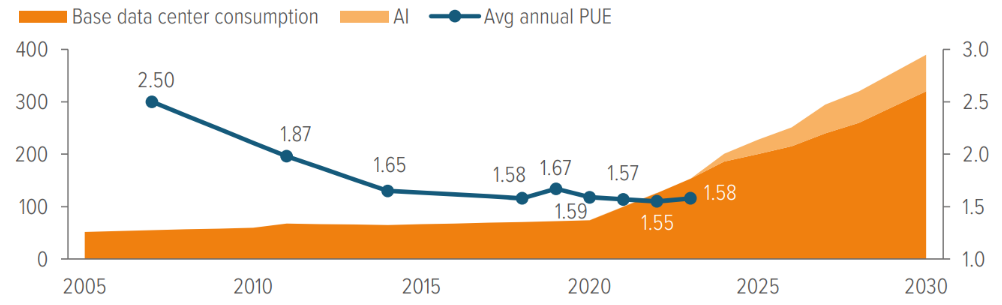

As of 06/15/24. Source: International Energy Agency, Uptime Institute, BCG, Electric Power Research Institute, Lawrence Berkeley National Laboratory, Voya IM estimates.

I know it seems kind of crazy. We’ve been moving to the cloud for years now. Surely this should have happened already, right? Well, yes and no. It did happen, but while it was happening, computing became way more power efficient—so overall data center power demand stayed broadly flat until the pandemic (Exhibit 2).

Data center efficiency is measured via a metric called power usage effectiveness (PUE). A score of 1 is an unattainable state of perfection, with every bit of energy going toward computing. Average data center PUE got better every year until about 2018, but it’s been rangebound ever since.

Now, data centers are hard at work installing GPUs to handle the needs of big data and AI. Thing is, a GPU takes up to 15x the power of a CPU.2 The standard measure of data center infrastructure is the rack: a 19” wide metal cabinet with slots for up to 42 servers. The amount of power used per slot is known as rack density, and it’s a good proxy for measuring how overall power needs of data centers are growing. The current rack density of hyperscalers is estimated at 36 kW now and is forecast to rise to 50 kW by 2027—and for GPU-only racks, 80-100 kW.3 Your average non-hyperscale CPU-based data center is still rattling along at 12 kW per rack, but even that’s set to increase.4

On the macro side, our estimates of how much power data centers are going to need are pretty solid, because when a data center project is started, the developer calls up the local utility and says, “Hey, I’m going to need 300 MW of power pretty much 24/7 starting next year,” and the utility says, “Oh shoot, okay, fine.”

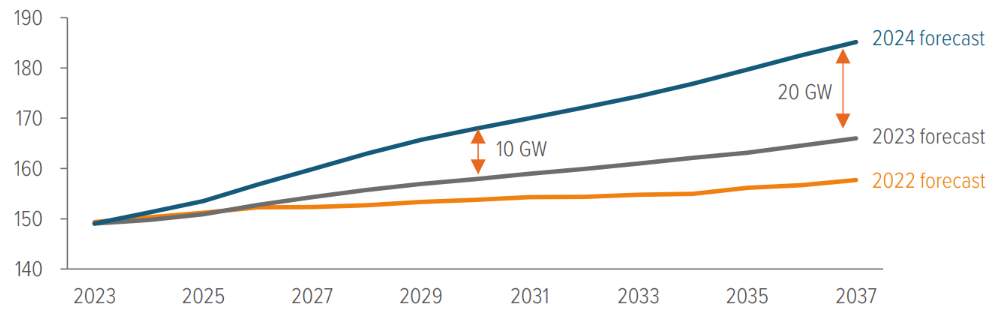

And then the utility turns around to the public and says, “Remember we told you in 2022 that peak demand was going to grow 0.4% per year in the next five years, and then last year we revised it up to 0.8%? Actually, it’s going to grow 1.6%.” (Exhibit 3).

Right now, according to Cushman & Wakefield, U.S. data centers create 16.8 GW of peak demand, and there’s another 25 GW in development.5 To put that in perspective, the entire state of New Jersey’s net summer capacity is only 16.7 GW.6

As of 06/15/24. Source: PJM. PJM stands for Pennsylvania-New Jersey-Maryland Interconnection and includes those states as well as Ohio, Virginia, West Virginia, Delaware, large parts of Kentucky, and bits of North Carolina, Illinois (Chicagoland), Indiana, and Michigan. Crucially, PJM (via subsidiary Dominion Energy) provides electricity to the biggest concentration of data centers in the U.S., which are spread across three counties in Northern Virginia. Dominion’s current peak load is 22.8 GW (15% of PJM’s total peak demand), estimated to rise to 42.8 GW (23% of total) by 2037.

That’s the demand story. Now let’s look at supply. First, there’s 90 GW of generation capacity being retired—mostly old coal and natural gas plants, which tend to be too far into their decommissioning to make it cost-effective to change direction on them.7

The EPA has essentially torpedoed the possibility of new natural gas baseload capacity thanks to a whole bunch of new regulations—which are going to get the daylights litigated out of them, but that doesn’t help anyone in the short term.

At the same time, the Inflation Reduction Act’s energy transition incentives were finalized by the IRS in March (it only took 20 months), and the Federal Energy Regulatory Commission’s new rules meant to speed the interconnection process went into effect in April.

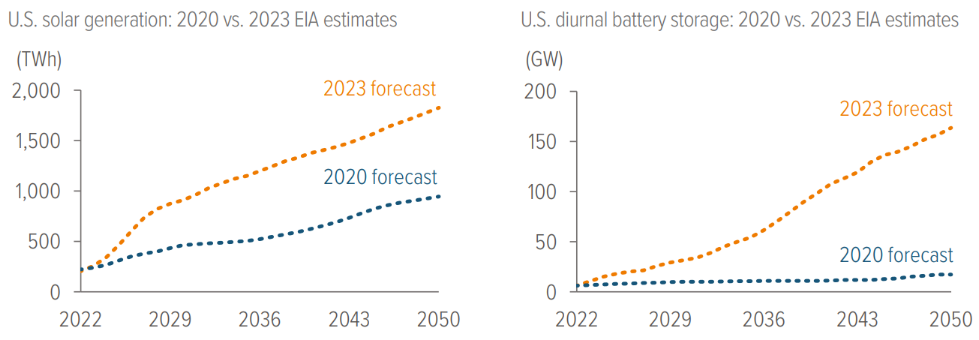

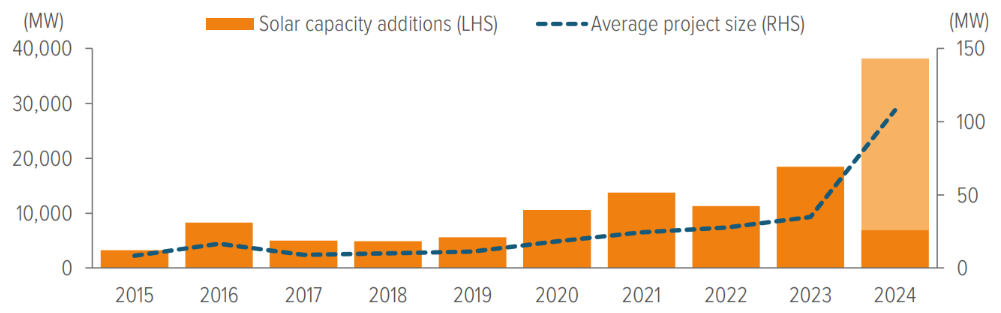

One of the best ways for the U.S. to cope with its sudden power shortfall is solar. A solar project spends, on average, only 25 months in its construction stage—the time from getting its interconnection permit to becoming operational.8

The best way to deal with solar’s intermittency (sun goes down) is adding battery storage to solar projects. That makes it much more expensive (solar + storage projects are topping $1 billion these days), but utilities are convinced that this is the future.

Pretty much everyone’s convinced this is the future except Sam Altman, but we’ve all got that one friend who’s weirdly into nuclear power.

As of 06/15/24. Source: Energy Information Administration, 2020 and 2023 Annual Energy Outlook forecasts.

The EIA forecasts that 50% of all generation capacity in 2030 will be from renewables. Right now, only about 25% of generation capacity comes from renewables—meaning we have a mere 470 GW to build between now and then.9

As of 06/15/24. Source: Energy Information Administration.

We have to build generation and transmission capacity ASAP, and everyone involved knows it. If you drink every time data centers are mentioned on a utility earnings call, you’ll put yourself in the hospital. Data center CEOs are forecasting that we’re going to run out of power in 18-24 months—while also emphasizing clients’ preference for renewable power sources.10

That’s it. That’s the opportunity. And this isn’t a nice-to-have. This is a “we build capacity fast or the grid falls over” situation.

Voya has an energy transition team with 30 years of experience in the sector and a bunch of great deals behind them. They’re taking 1.5-to-7-year senior secured debt at the construction stage of projects (i.e., after the interconnection permit is obtained), they’re more nimble than the mega-funds, and they’re coming in a little earlier (better yields)—plus they source their own deals, so they’re usually getting origination fees. They’re also really charming to talk to.

Why us? Why not just go with the biggest fund in the market? Well, when you’re a $7 billion fund, you don’t have the staff to look at deals in the $50-150 million range. You rely on syndication or take only the very largest deals. (Or you buy out our deals once the projects are operational and sponsors want to refinance at a lower rate; that happens.)

Plus, our team is laser-focused on this specific energy transition opportunity, which represents one of the purest plays on this generational change in the power market.

What about investing in data centers? We’ve had multiple data center deals come across our investment grade, energy transition and commercial mortgage desks. The general impression from all three teams is that the deals we’ve seen were far too strongly priced and had no downside protection against data offtakers canceling their contracts.11 Is it possible we just haven’t seen the right deal yet? Of course. But power remains our preferred way to play this boom. |

Yes, it also comes in investment grade

I’m supposed to be talking about our energy transition strategy, but you all know how dear investment grade private credit is to my heart. If you’re wondering whether there are attractive energy stories in the investment grade market on the back of this AI and data center boom, I am pleased to say: yes, absolutely.

Just this past quarter, our investment grade energy & infrastructure team put money into a portfolio of U.S. wind, solar and storage assets; an overseas LNG liquefaction facility; and the securitization of a bunch of U.S. natural gas wells, among several other compelling deals. Their Spring 2024 Energy & Infrastructure Quarterly is a must-read primer on a market that has woken from a 10-year coma just in time to run headlong into growing pains.

The investment grade energy & infrastructure team’s conclusions on the broader U.S. energy market are as follows:

- Power prices will rise.

- Existing generation assets of all kinds will benefit.

- While the outlook for existing natural gas projects will improve greatly, we do not see a groundswell of interest in developing new ones.

- Renewable project financing pipelines should remain healthy.

- There is potential for greater frequency and size of transmission projects outside of the traditional utility framework.

- Grid reliability will get worse before it gets better.

- Utility regulators in high-demand markets will face greater challenges, and we expect difficult rate cases and more uncertainty around allowed equity returns and credit quality.

- Reconsideration of new nuclear capacity remains the wild card.

Looking at that list, would you buy public bonds issued by a regulated utility right now? Or would you prefer a nice, bankruptcy-remote senior secured project finance deal with great collateralization and strong covenants? It’s a clear choice to me.

The only thing you really need to figure out is whether you want your power play to be investment grade or unrated—or a little of both.

A note about risk The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |