While the Fed wants to cut rates, an uneven decline in inflation delays action—but remember the trend matters more than the “when.”

We have warned about getting too caught up in month-to-month inflation numbers. Now, with three consecutive months of hotter-than-expected CPI readings, market commentary around when the Fed will cut rates has intensified.

Remember, all else being equal, the Fed inherently leans towards dovish policies. And while we have seen slight upticks in recent inflation readings, we remain in a solid growth environment with inflation well off its peak. As long as we remain in this trend, the backdrop is favorable for spread assets and the Fed will be inclined to ease monetary policy. In our view, nothing in recent data will compel the Fed to abandon their plans to shift to a less restrictive policy.

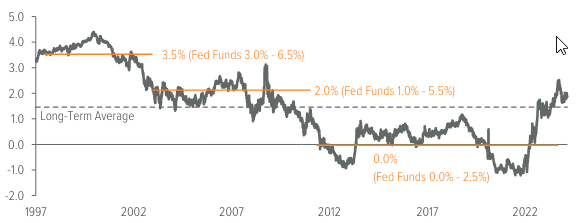

Source: Bloomberg Index Services Limited and Voya Investment Management. Long-Term Average for the period 1/31/97–3/31/24.

Last month, we highlighted the silver lining for bond investors in this environment: For those worried they missed out on the opportunity to allocate to fixed income late last year (before the previous decline in rates), this recalibration in the market offers a second chance.

It’s also worth reminding investors that the changing whim of monetary policy is no longer the sole measuring stick for opportunities and risks. We have entered a new interest rate regime with real yields that are not only positive but also above their long-term historical average (Exhibit 1). This presents attractive carry opportunities and also leaves fixed income well positioned to deliver the broader portfolio ballast many investors expect. In other words, for the first time in 15 years, fixed income is a competitive asset class again.

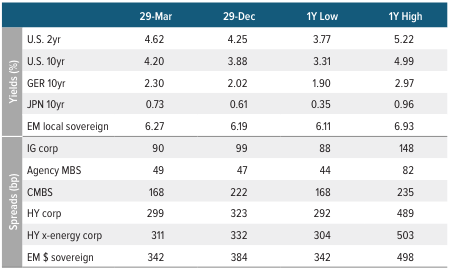

As of 3/31/24. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

Sector outlooks

Investment grade corporates

- Investment grade (IG) corporate spreads are tight, and yield driven investors can keep them there.

- Attractive yields and solid fundamentals have led to strong demand for IG credit, keeping spreads tight despite record new issuance.

- Looking ahead, fundamentals remain solid as corporate earnings are expected to expand throughout 2024.

- From a positioning standpoint, banking valuations remain attractive but timing is crucial given the elevated supply. Within industrials, we are leaning away from sub-sectors with elevated M&A risk.

High yield corporates

- The high yield market continues to deliver positive excess returns due to attractive carry and supportive market technicals.

- The lack of meaningful outperformance in lower quality high yield segments suggests that investors are willing to own the carry of the asset class but fearful of tail risk.

- From a positioning standpoint, we are overweight builders/building products, healthcare/pharma and energy. We are underweight technology and financials, as well as media/telecom companies with structurally challenged business models.

Senior loans

- Senior loan fundamentals have held up better than expected, especially among higher quality issuers.

- There is increased demand for refinancing transactions for cap structures that were previously financed in the private credit markets, reversing last year’s trend. Loans priced at par and above experienced a notable increased from 21% in February to 39% by the end of March.

- Total refinancing volume increased to $21 billion from $19.8 billion in February. Meanwhile, repricing activity picked up as well this month, reaching a total of $55 billion (the second highest volume in the past three years).

- From a positioning perspective, we continue to avoid consumer reliant issuers with weaker credit profiles, particularly those with a discretionary offering and exposure to a low to mid-tier consumer, which should face the most downward earnings pressure in the near term.

Agency mortgages

- While the next report will likely show prepayment speeds increased in March, the general backdrop for prepayments is expected to remain muted due to a slow housing market and dampened refinancing activity.

- The performance of agency mortgages will be closely correlated with overall volatility and rate directionality in the near term.

- Longer-term, fundamentals and the supply environment favor the asset class for 2024.

Securitized credit

- Fundamentals have improved across much of the securitized credit market and the near-term outlook remains favorable across most sub-sectors.

- CLOs: We prefer tier 1 managers with strong underlying collateral pools of loans. We also favor shorter spread duration transactions (especially on positions with lower credit quality).

- CMBS: With stronger underwriting, tighter spreads and attractive yields, new issues offer opportunity. Meanwhile, legacy issues carry legacy risk due primarily to weaker underwriting and more exposure to troubled property sectors like office.

- ABS: We favor consumer-related forms of ABS, and are largely avoiding commercial sectors like aircraft, timeshare, container lease and railcar lease. Within consumer sectors, we focus on higher-quality consumer pools given income inequality dynamics of recent years.

- Non-agency RMBS: We prefer 2.0 forms of mortgage credit, which refers to loans originated and/or structured in the post 2008 crisis regulatory regime. We have a bias toward the following sub-sectors: Prime Jumbo, CRT and higher quality forms of non-QM loans. Within the legacy portion of the portfolio (<20% and declining), we favor deals branded as being collateralized by higher quality borrowers, and those that are actively receiving principle paydowns.

Emerging market debt

- Emerging market (EM) debt absolute yield levels remain attractive relative to historical levels.

- While China’s latest policy response appears to have stabilized the country’s economic activity, housing and private sector confidence remain weak and additional stimulus is unlikely.

- In our view, EM corporates are more attractive relative to the broader EM market and their U.S. peers, particularly among lower-rated issuers. We continue to find the most attractive opportunities in Latam corporates.

A note about risk The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |