As investors wait for additional clarity on trade and fiscal policy, we offer six themes we think will drive fixed income markets in the second half of the year.

We develop and regularly evaluate macroeconomic and thematic insights that drive dynamic sector allocation across our multi-sector fixed income portfolios. The following six themes reflect how we are structuring our risk profile in the second half of 2025.

1 Global policy drives growth and money flows

Increased debt funded spending on defense and infrastructure will boost global growth. Rising interest expenses and growing concerns over debt sustainability will compel central banks in developed markets to align more closely with fiscal authorities. Improved regional growth combined with the U.S. policy uncertainty will increase competition with U.S. assets, leading to a weaker dollar— but without threatening its status as the world’s reserve currency.

2 U.S. growth softens amid mixed policy backdrop

Economic growth will fall below trend in the near term as policy uncertainty curbs corporate investment and higher tariffs reduce consumption. However, tax cuts and deregulation will bolster incomes and improve efficiency, lifting growth toward potential—especially as investment expands beyond the technology sector. Over time, immigration restrictions will constrain potential growth which will be offset by AI driven productivity gains.

3 U.S. inflation eases on slower rise in wages and shelter costs

Fluid trade policies and limited corporate pricing power will prolong the transmission of tariffs to consumer prices, capping inflation’s peak but making it last longer. Softening wage growth and the normalizing shelter price increases will support the underlying downward trend in inflation, helping to anchor inflation expectations.

4 U.S. labor enters a cautious phase

Employers’ recent experiences with labor shortages have made them reluctant to let workers go, resulting in a “low hiring–low firing” environment. The unemployment rate will creep higher as economic uncertainty and margin pressure limit hiring, keeping wage growth in check. Stricter immigration policies will support wages for low-income workers, while continued AI adoption puts downward pressure on entry-level wages.

5 Central banks: Same path, different speed

The Fed will cut rates towards neutral, with softening labor market taking priority over concerns about persistent inflation. In contrast, the ECB is approaching the end of its easing cycle, constrained by a rising likelihood of fiscal support. The BOJ will remain on hold, while emerging market central banks will capitalize on easing inflation and a weaker dollar to cut rates further.

6 Golden age of income

An elevated yield structure provides attractive income to deliver positive total returns in fixed income. With declining inflation, negative correlation between rates and spread will insulate returns. Policy uncertainty will lead to bouts of heightened fixed income volatility, but the current administration’s sensitivity to bond markets will contain the magnitude and duration of such episodes.

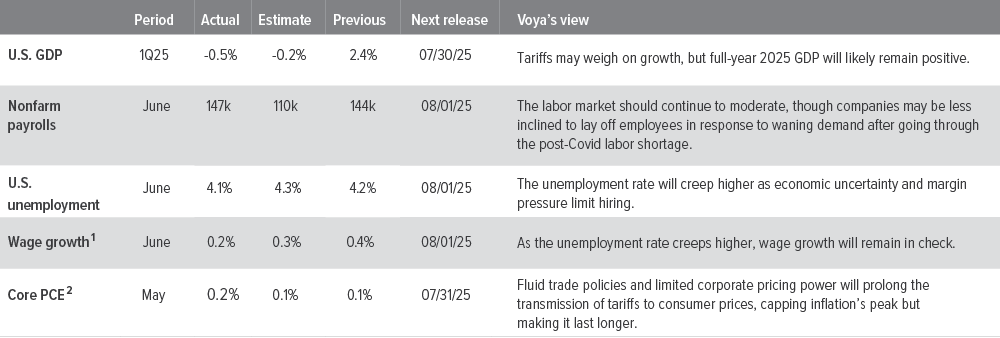

As of 06/30/25. Source: Bloomberg, FactSet, Voya IM.

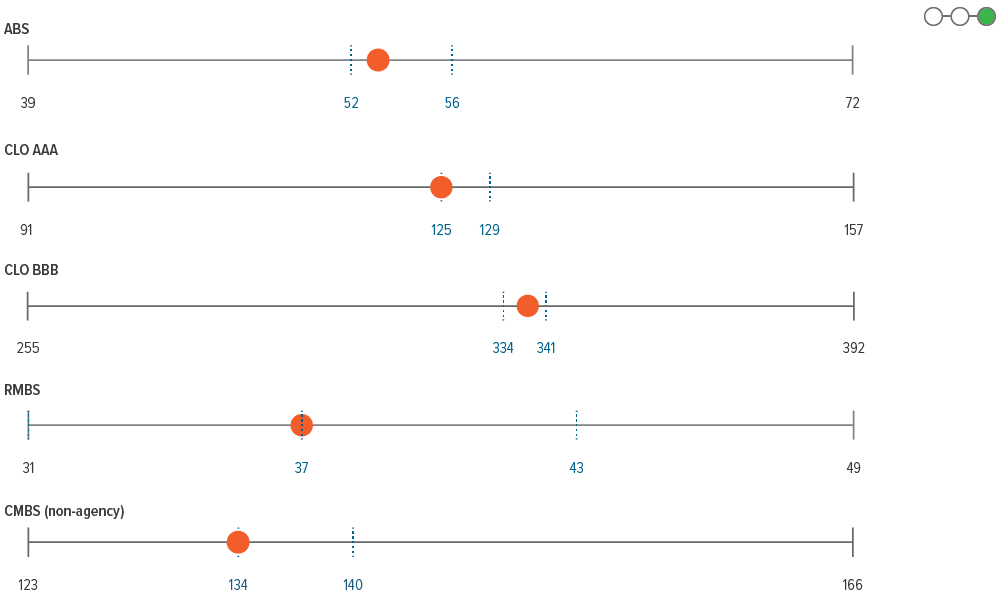

As of 06/30/25. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

Sector outlooks

- While corporate fundamentals remain strong, we believe technicals, macroecononmic factors and valuations should have a larger impact on investment grade corporate spreads.

- Looking ahead to 2Q25 earnings season, the tech sector is expected to grow earnings, while energy is expected to lag.

- We remain underweight BBBs and favor higher quality names in this environment. From a sector perspective, we are overweight financials and utilities and underweight industrials, where we are leaning away from sectors with exposure to M&A risk, trade policy uncertainty.

- With more clarity on fiscal policy, uncertainty around tariffs is back in focus as the primary driver of sentiment in the high yield space.

- From a technical perspective, factoring in fallen angels, there was a significant net supply surplus in June.

- While corporate balance sheets entered the tariffinduced uncertainty in a solid position, businesses and consumers are likely to respond with lower spending, hiring and investment until future trade policy is more clearly defined.

- The loan market had another solid month, as broader risk sentiment continued to firm on the back of stable economic data and easing geopolitical concerns.

- We remain focused on the secondary effects of tariffs, as we are more concerned with how policy uncertainty and sentiment could affect business investment or consumer behavior.

- We expect downgrades will remain elevated in the near term given the increased concentration of lower-rated issuers in the market that are susceptible to downgrade risk.

- Supply for agency mortgages is expected to remain muted for the remainder of 2025 as elevated rates lead to lower cash-out refinancing and subdued housing market activity.

- While carry remains attractive, large, fast-money trades continue to have the potential to create volatility in the near term.

- Longer-term, we believe strong fundamentals and a limited new supply backdrop should support mortgage returns going forward.

- Recent spread moves in the securitized market have favored subordinate parts of the capital structure, a characteristic of risk-on markets with deep liquidity, and correlated with risk-on moves in other markets.

- As other fixed income sectors richened over the course of June, ABS is again offering relative value on a risk adjusted basis.

- While spreads have retraced commercial real estate fundamentals continue to improve, and CMBS remains attractive in our view.

- Strong mortgage credit fundamentals and improved valuations should enable RMBS to overcome pockets of weakness emerging in the housing market.

- Weakening technicals and fundamentals make the CLO space susceptible to underperformance. We maintain a heavy bias toward high-quality managers and strong underlying collateral pools.

- Elevated real yields and softer domestic conditions suggest many EM central banks have room to continue cutting rates, but external factors may limit their flexibility.

- Corporate fundamentals remain resilient, and financial policy remains prudent.

- EM corporates are expected to be indirectly impacted by tariffs through global growth, inflation, and commodity prices. We expect direct impacts to be limited.

Glossary of terms OAS: option-adjusted spreads ABS: asset-backed securities CMBS: commercial mortgage-backed securities RMBS: residential mortgage-backed securities CLO: collateralized-loan obligations PCE: personal consumption expenditure YTM: yield to maturity |

A note about risk: The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.