Key Takeaways

Middle market deal: A leading helicopter transportation provider to the oil & gas and air medical industries, with a clean balance sheet and low leverage, repaid around 300 basis points above the estimated yield to maturity at the time of underwriting.

Project finance deal: A cobalt mining company, which was well positioned to benefit from growth in electric vehicle production, had its deal economics improved by our team, leading to a well-structured transaction that resulted in an IRR around 90 bp above the estimated yield to maturity at the time of underwriting.

Private placement deal: A power supplier with long-term power purchase agreements with multiple investment grade counterparties had our team lead negotiations on deal structure and documentation, which achieved structural improvements that resulted in the company prepaying at 104 cents on the dollar.

The Voya Enhanced Middle Market Credit Strategy’s allocation to higher-collateral industries is more than double the sector average. The Strategy also offers diversification of opportunity set, investing in project finance and private placement deals that many other funds can’t access. Here are some examples.

Investing through a credit-centric lens

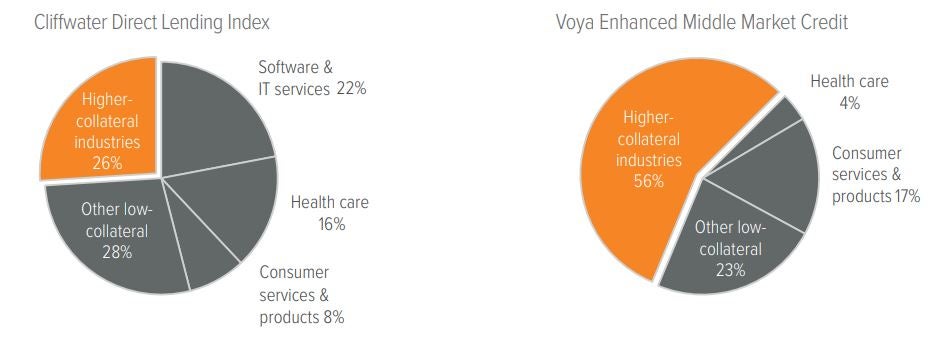

Over the decade that the Voya Enhanced Middle Market Credit (EMMC) Strategy has been running, it has invested 56% of its assets in higher-collateral industries, versus a middle market fund average of 26% (based on the $295 billion Cliffwater Direct Lending Index). Its top investment sectors are industrials, manufacturing, chemicals, and aerospace & defense. And, unlike many of its peers, the Strategy has invested 0% in software and tech (Exhibit 1).

As of 03/12/2024. Source: CDLI, Voya IM.

Given current market technicals—specifically, the prevalence of low-collateral loans in many large middle market funds—bringing a higher-collateral strategy such as EMMC into the mix can both add alpha and provide risk mitigation, with little to no overlap with existing allocations.

In fact, 44% of EMMC’s historical capital deployment has been in loan types where the mega-funds simply don’t—and in many cases can’t—participate: project finance and private placement.

To help familiarize investors with the EMMC process, we present past transactions highlighting various deal types, as well as the value the team adds and the level of collateral we prefer.