Key Takeaways

Commercial real estate developers are facing a reduction in financing options as regional banks continue their retreat from the space.

While the loans dragging down New York Community Bank are unrelated to construction, we expect banks to remain on the sidelines in this market for much of 2024 if not beyond.

In this environment, alternative lenders such as Voya are able to sign up three-year construction loans that combine unusually high yields with conservative loan to cost ratios.

The exodus of regional banks from the commercial real estate market has created an unusually attractive opportunity in construction lending, where a lack of liquidity is driving yields up while keeping loan to cost low.

Regional banks have historically been the source for loans of up to $50 million for construction projects. These banks provide inexpensive construction loan debt in exchange for some level of recourse and substantial deposits at the bank by the developer. With the reduced amount of bank competition in the construction market, Voya’s real estate team is able to sign up loans featuring both near double-digit yields and conservative underwriting parameters.

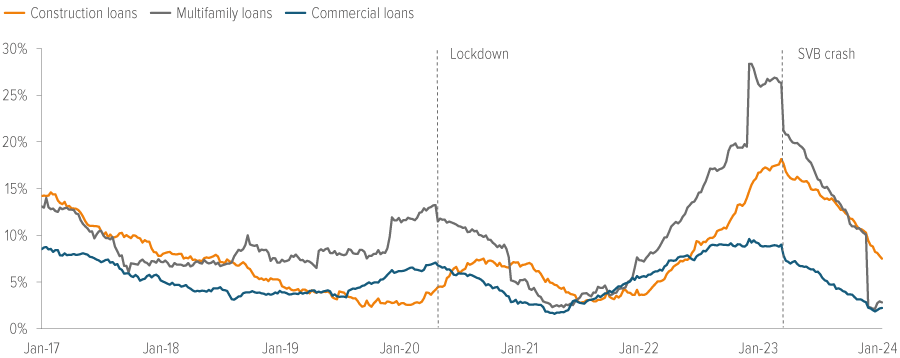

As of 01/17/2024. Source: Federal Reserve Board; Voya IM.

As banking liquidity ebbs, investment opportunities surge

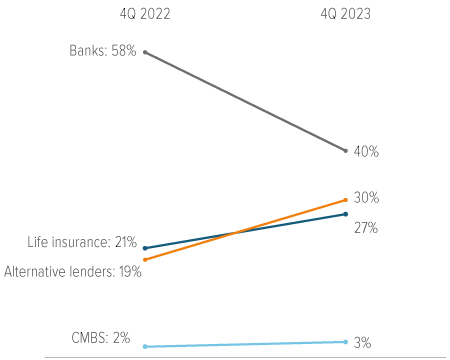

March 2023’s triple whammy of regional bank failures sent the entire sector into turmoil and drove most banks to immediately and significantly pull back on what had been, until then, a bonanza of new loan activity (Exhibit 1). This has caused impacts across the commercial real estate lending market, where banks represent 49% of outstanding non-agency lending. Banks’ share of commercial real estate loan originations cratered from 58.3% in in 4Q22 to 39.5% in 4Q23, and insurance companies and alternative lenders nimbly stepped in and filled that gap for fixed-rate acquisition loans and refinancings.1

The construction lending market, however, has both suffered more from banking sector dislocation— banks account for 60% of all construction financing activity—and has seen fewer alternative sources of liquidity emerge.2

As of 02/07/24. Source: CBRE Research.

Construction financing: It’s a lender’s market

When borrowers have fewer financing options, the dynamic shifts to favor lenders. This construction loan financing gap is creating opportunities to secure favorable terms and pricing on three-year construction and development finance.

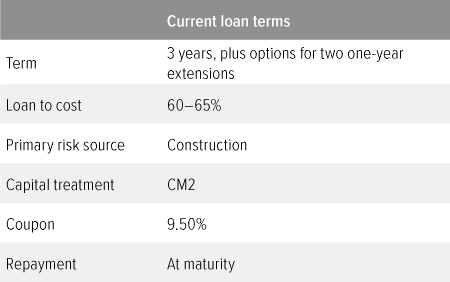

A construction loan is a three-year floating rate financial solution that advances developers—usually merchant builders—cash to build their project. The three-year loan allows the borrower to construct the property, lease the asset, and exit through a sale or re-finance. The loan typically comes with the option of two single-year extensions to allow additional leasing time, if needed. In the current low-liquidity market, Voya has been able to achieve coupons of 9.5% and a conservative loan to cost of 60–65% (Exhibit 3).

The biggest risk with construction lending is the construction process itself. When underwriting loans such as these, Voya’s real estate team looks carefully at the builder’s track record and experience, as well as the attractiveness of the location. The team also conducts an in-depth analysis to determine supply/ demand dynamics and leasing velocity in that market.

As of 02/06/2024. Source: Voya IM.

We are also highly selective about what types of projects we are willing to pursue. We see the most compelling loan opportunities in industrial, low-rise and garden-style multifamily, and grocery-anchored retail. These types of projects tend to be both faster and less complicated to build, reducing construction risk. These asset classes have also been well liked by Voya on the commercial mortgage side for decades due to continued favorable market dynamics.

Two recent deals underscore the compelling terms lenders can command in the absence of bank capital:Case study 1: A $20 million industrial property project in Orlando, FL Voya recently provided a loan of up to $20 million for the construction of a 425,000 square foot industrial property located west of Orlando, FL, along the Florida Turnpike. The loan proved a lucrative opportunity, with the sponsor having secured a pre-negotiated sales contract to sell the completed building to a global investment bank and asset manager for a predetermined price, effectively eliminating lease-up risk. The project was completed ahead of schedule and under budget with no change to the sales price. Case study 2: A $41 million industrial property project near the Port of Savannah, GA Voya provided up to $41 million for the construction of a 504,000 square foot industrial property located near the Port of Savannah, Georgia. The strategic location of the property in a thriving industrial submarket, along with the experienced sponsor focused on properties near the port, signaled a promising investment. A low basis of $81 per square foot (as compared to vacant sale comps over $100 per square foot) made the loan even more attractive. |

Given the ongoing disruption in the regional banking sector, we believe this construction financing gap will persist over time. We expect to see a large amount of compelling development projects over the next couple of years, allowing for a strong pipeline of attractive construction lending opportunities.

Participation for investors is available both within Voya’s open-ended, commingled fund and in separately managed accounts (SMAs). For insurance investors participating through an SMA, it is also worth noting that construction loans have a favorable capital treatment of CM2.

Voya’s real estate finance team has a long history of offering both consistent innovation and attractive risk-adjusted returns to its institutional clients. Our team would welcome the opportunity to discuss how construction loans could add value to your portfolios.

A note about riskAll investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. Investments in commercial mortgages involve significant risks, which include certain consequences as a result of, among other factors, borrower defaults, fluctuations in interest rates, declines in real estate values, declines in local rental or occupancy rates, changing conditions in the mortgage market and other exogenous economic variables. All security transactions involve substantial risk of loss. The strategy will invest in illiquid securities and derivatives and may employ a variety of investment techniques such as using leverage, and concentrating primarily in commercial mortgage sectors, each of which involves special investment and risk considerations. |