Variable-rate senior secured commercial and industrial (C&I) loans can enhance diversification and potentially lower risk in a rising-rate environment.

Highlights

- Banks with more diversified loan books are in better shape to withstand current volatility (and future periods of industry stress).

- Variable-rate, short-duration C&I loans provide a sound investment in a rising-rate environment.

- A carefully selected portfolio of these senior C&I loans (acquired to meet or exceed bank policy) can be a strategic complement to existing bank portfolios.

Recent banking troubles underscore the importance of gap management

Banks have been resilient through the pandemic — until a few weren’t. Some institutions failed to incorporate fundamental economics and core asset/liability gap management banking principles, and the fallout may have far-reaching impact, including consequential new regulation. The collapse of these banks is grabbing global headlines and raising concerns about broader risk in the regional and community banking system.

Recent struggles in the banking industry are likely to accelerate consolidation, a trend that we have helped our community bank clients navigate in recent years. How does industry consolidation affect our bank clients? How can we help them compete? What are the consequences of a shrinking small community bank market within rural communities? And how can banks add loan growth efficiently, and with heightened risk awareness and stewardship?

While the ultimate fallout of recent bank collapses remains to be seen, two things are certain:

- Banks with more diversified loan books are in better shape to withstand this period of volatility. The banks that have come under the most pressure have concentrated positions in low-yielding (lower than current market rates), long-duration securities and loans with fixed rates. When interest rates rose sharply (raising and shifting the yield curve), assets subject to mark-to-market values plummeted — trouble escalated from there.

- Banks that managed their securities’ maturities to address potential interest rate movements mitigated their AOCI positions and the potential impact on available equity and liquidity.

Over the past several years, we have worked with many community banks to incorporate variable-rate C&I loans (otherwise known as senior loans) into their overall book of loans. Senior syndicated loans are an established asset class and represent a core capital market that is active and growing. In the current environment, we believe these loans are even more compelling for banks looking to diversify their portfolios and minimize exposure to interest rate risk.

Variable rates minimize interest rate risk

Senior secured loans are floating rate, which means their coupons reset each quarter along with prevailing interest rates. As a result, senior loans have low sensitivity to changes in interest rates.

Historically, the prevailing market rates were determined by US Libor. However, this rate index is in the process of being phased out and replaced by a secured overnight financing rate (SOFR).

Below are additional features of senior secured loans:

Large corporate borrowers

- Borrowers in the senior loan market are typically national or large regional companies.

- Nationally syndicated loans help finance large transactions, such as the corporate acquisitions and mergers you see in the financial press.

- Large borrowers have some inherent advantages over smaller ones, including operations spanning multiple economic regions, large customer bases, deep supply chains, access to multiple public and private capital markets, and staying power in tough times.

- The loan terms are generally five to seven years.

- Loans amortize in whole or part, and they generally have strong, proven cash flows and attractive interest coverage ratios.

- Although many borrowers are leveraged at levels higher than their investment grade counterparts, the debt is typically secured by a first lien on all assets.

Origination process

- The loans are generally originated by the largest banks in the country.

- The origination process involves a sponsor (or borrower) that initiates the transaction with an agent bank. That bank structures and negotiates the transaction — ultimately setting pricing and timing — and then gathers a syndicate of other banks (some fulfilling administrative activities) and institutions to complete the transaction.

- The institutions that acquire large portions (known as “assignments”) of the transaction include larger commercial banks, asset managers and other institutional investors.

Robust secondary market

- Once a primary loan transaction has closed, senior loans trade in a very active and deep secondary market — banks can acquire the loan from one of the syndicating banks, or an institution can divest a loan that it previously acquired. In other words, there is always a liquidity outlet.

Strong track record of low defaults

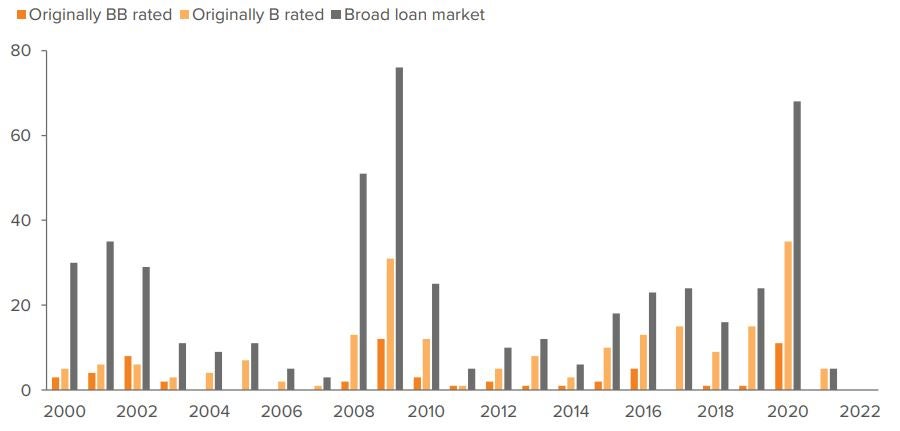

The chart below shows incidences of default by broad rating cohort in the US loan market since 2000. For context, the orange bars are generally considered “bank-appropriate” credit risk. The light orange bars are riskier. The gray bars represent all default incidence in the market.

As of 12/31/22. Source: Morningstar LCD.

Senior loans’ track record of low defaults is due, in part, to their senior secured status. The loans have the most senior claim on all the issuer’s assets in the event of bankruptcy.

To be fair, a loan that is stressed may sell at a market price below par. But if a bank employs best practices and looks to divest a loan at an early sign of stress, there is a good chance it can sell near par and avoid that potential problem. Compare that scenario to a loan the bank has acquired from another bank and now wants to sell. Just about the only option is to sell the loan back to the original bank, which may or may not want it.

How community banks can benefit from senior loans

When you consider these loans in terms of risk-adjusted returns, a syndicated portfolio compares well to a typical local C&I small market portfolio. In addition, these loans are much more efficient to originate and service.

Traditionally, this asset class was the domain of the large money center banks, and they kept it to themselves. These banks, driven by volume and efficiency, would invite other banks that could take large, efficient positions in these loans and help the transaction to complete its syndication smoothly. Community banks have had difficulty accessing the syndicated loan market due to the size and scale required to sustain a corporate lending function within their institutions. That’s changing.

Firms like Voya work directly with the agent banks to consolidate all the borrowers’ data, such as agent information memoranda, and third-party industry, borrower and economic data. Voya analysts re-underwrite the transactions to bank-like standards for their client banks. The institutions that acquire these loans also analyze and re-underwrite them to their own standards — meaning any given transaction has many analysts and attorneys going through the structure. Rating agencies also review and rate these transactions. Regulators review the transactions during the Shared National Credit exams.

Within this spectrum, there is a clear and large “bank-appropriate” volume of loans within the market. While a “black swan” event may occur, even then, when examining how these transactions weathered the past several years relative to a regional middle-market portfolio, this market remains a good place to have C&I exposure. The relative value and efficiencies of senior loans, combined with liquidity and flexibility that banks simply do not have with a local C&I portfolio, indicate these loans are earning assets that community banks should consider.

A carefully selected portfolio of senior loans acquired to meet or exceed bank policy can be a strategic complement to existing bank portfolios. Regulators will favorably consider a loan purchase program that demonstrates conservative quantity and credit structure, thorough risk identification, risk mitigation, and aggressive monitoring.

However, before a community or small regional bank makes the leap, there are several factors to consider. Among them: Are your growth and asset mix (particularly loan types and concentration) consistent with your credit policy? Are there other lending opportunities in your market, and are they available within your footprint? Do you have the internal resources to assess and manage corporate lending?

We welcome the chance to explore these questions with you. To learn more about the opportunity in senior loans, please contact Voya Investment Management.

About the Authors

Randy Cameron

(385) 715-2513

During his more than 30 years in the industry, Randy Cameron has become a thought and practice leader in community, regional and national banks in the development of commercial relationships and portfolios.

A credit executive for more than 25 years, Randy has broad experience, industry leadership and skills in building teams and systems to deliver disciplined credit cultures in banks intent on achieving loan growth. Randy has developed, structured and managed large complex national credits, capital market credit products and regional middle market relationships.

Dave Wood

(385) 715-2512

Dave Wood’s career in banking spans more than 30 years and ranges from Money Center to Large Regional to Community banks. As a commercial lender he has negotiated and booked complex, multi-faceted transactions for multinationals to core working capital and term credits to local businesses while working for financial institutions on both coasts.

As a training executive, he trained hundreds of bankers in beginning and advanced applications of commercial lending, accounting and trade finance. He has extensive experience as a senior credit administrator working with principal, marked to market and counterparty risk exposures. As a credit policy executive he managed policy development, exposure definition & aggregation systems.