Is now the time to reduce the cash allocation in your portfolio? History shows that the best entry points for bonds are often before the Fed starts cutting rates.

After a long summer break, the return to school can make September feel like a new beginning, even for the grownups. It can also be a good time to re-evaluate your asset allocation.

Over the past two years, interest rate hikes and economic uncertainty have pummeled investors, pushing many to overweight their portfolio to the perceived safety of cash. (As of early September, investors had parked $5.6 trillion in money market funds.1)

Cash might seem like a good place to hang out while interest rates are still high. But those lofty yields can disappear once the Federal Reserve starts cutting rates, and history shows that the best entry points for bonds are often before that first rate cut happens.

So break out your spiral-bound notebook and No. 2 pencil…it’s time for a crash course on why it's time to consider moving some of that cash back into bonds.

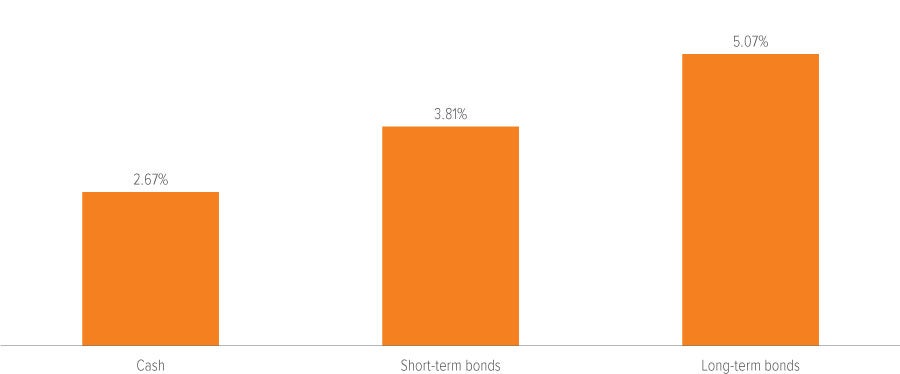

1. Think long term

Students may be tempted by immediate gratification, but such thinking can ultimately limit results. This also applies to investors. Looking back to 1990, the Bloomberg U.S. Aggregate has produced nearly double the annual return of cash, as measured by short-term T-bills (Exhibit 1). Bonds have also had a high success rate of outperformance, beating cash in 98% of rolling 5-year periods prior to 2022 (94% of all periods).3 In other words, the current state of cash yield supremacy is both unprecedented and unsustainable.

As of 06/30/23. Source: Bloomberg Index Services Limited, Voya IM. Cash: Bloomberg U.S. Treasury Bellwethers 3M Index; short-term bonds: Bloomberg U.S. Aggregate 1–3Y Index; long-term bonds: Bloomberg U.S. Aggregate Index. Past performance is no guarantee of future results.

2. Tardiness can be costly

Students who wait until the last minute to hand in assignments often get lower grades than those who act earlier.2 Similarly, waiting on the (all-cash) sidelines to see what happens next with interest rates can come at a cost of missed returns.

During the last four rate-hike cycles, the peak point in the 10-year Treasury bond yield has occurred before the Fed began cutting rates. Because bond prices rise when yields fall, investors who held out for rate cuts to start may have actually left money on the table. Increasing allocations to longer-term bonds now may help mitigate that opportunity cost associated with staying on the sidelines in cash for too long.

As of 09/01/23. Source: Bloomberg Index Services Limited, Federal Reserve, Voya IM.

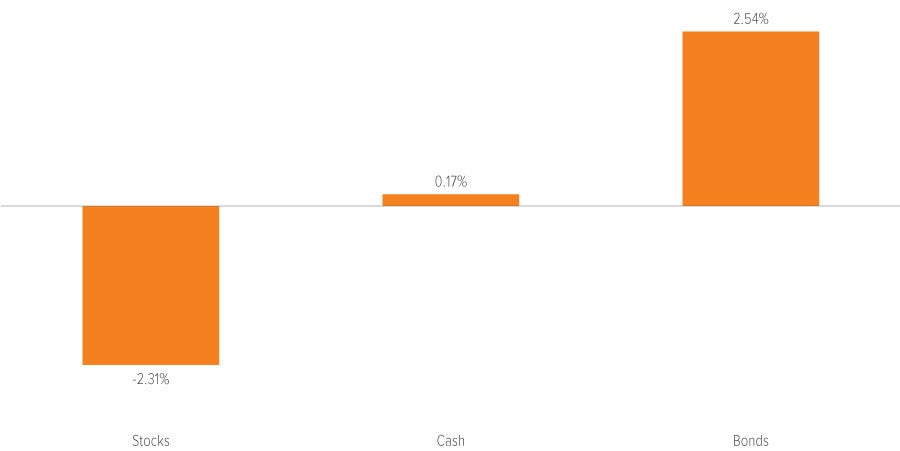

3. Balance is important

Taking a combination of challenging classes and fun electives can help provide balance for students. Likewise, bonds often help to offset the unpredictability of stocks, potentially creating a more balanced investment experience.

Exhibit 3 illustrates the important role bonds play during stressful times. During a bumpy week in March 2023, the failure of several U.S. regional banks led the stock market to retreat. Bonds proved resilient, whereas cash offered little upside. Within a diversified portfolio, bond exposure can help smooth out dips when stocks struggle.

Source: Bloomberg Index Services Limited, S&P, ICE BofA, Voya IM. Stocks: S&P 500 Index; cash: Bloomberg U.S. Treasury Bellwethers 3M Index; bonds: Bloomberg U.S. Aggregate Bond Index. Past performance is no guarantee of future results.

Participation counts

We’ll spare you the pop quiz. The truth is that current yields on bonds should make portfolio decisions easier. You don’t need to be an A student in market timing. Just show up to class.

The Fed is likely to keep interest rates high until it sees more significant cracks in the economy, particularly the labor market. However, while cash offers attractive yields today, history teaches us that bonds offer better long-term return potential and can be more effective as portfolio diversifiers.

Risks of investing

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.