Yes, workforce participation by women faces structural barriers. But here’s a thought experiment: Harnessing the full potential of working women could drive faster GDP growth and productivity, alleviate wage pressures and address the growing labor supply challenge as the U.S. population ages.

During Women’s History Month, the evolving role of women in our economy comes into focus. As inflation remains a top concern for investors and policymakers, it is worth exploring how women can influence this crucial economic factor over the long term.

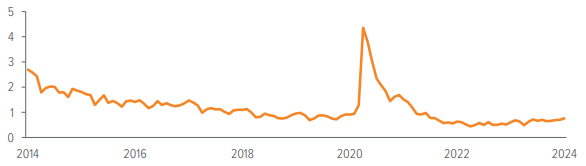

Inflation has partly been aggravated by a strong labor market, with unemployment stubbornly hovering around 3.7%. (4% is typically considered full employment.) One factor is the scarcity of workers to fill available job openings (Exhibit 1). While the ratio of unemployed individuals to job openings spiked during the pandemic, job openings have consistently exceeded the available workforce since then. Various factors have contributed to this labor shortage, including government policies and increased retirements during the pandemic. Notably, an under-the-radar group that’s been steadily growing in the workforce: women.

Historically, women’s labor force participation tends to decelerate during economic recoveries, often taking two to five years to regain pre-recession levels.1 The period following the pandemic’s economic contraction has tracked this trend.

As of 1/31/24. Source: U.S. Bureau of Labor Statistics, St. Louis Fed.

Women are closing the employment gap

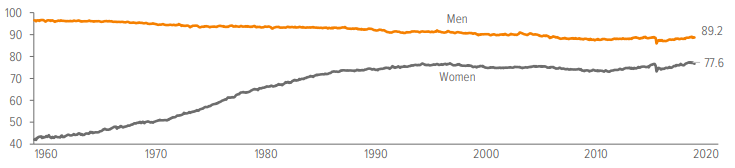

Over the past six decades, there has been a significant increase in women’s employment rates, which is gradually catching up with that of men’s. (Exhibit 2).

As of 12/23. Source: St. Louis Fed, Organization for Economic Co-operation and Development.

From 1960 to 2000, women’s activity increased 82%—roughly 1.5-2% per year. However, since 2000, both men and women’s participation rates have experienced a slight decrease. This decline can be attributed to the retirement of the baby boomer generation and the dearth of teens and young adults to compensate for the decrease in workforce participation.

However, the downward trend reversed last year, when women not only reached but surpassed their previous peak. Men’s participation rate also saw a slight increase during this period.

Despite women achieving a new high, a sizeable gender gap in the workforce still exists. Currently, only 77.6% of prime-aged women participate in the labor force, which is considerably lower than the 89.2% participation rate among men in the same age group.2

Women workers drive economic prosperity

Studies have consistently demonstrated that when more women participate in the workforce, economies flourish. For instance, the Council of Economic Advisers has found a direct connection between an increase in the share of working adults, achieved through a rise in the women’s labor participation rate, and a subsequent surge in economic prosperity.3

Similar research suggests that closing the U.S. gender gap in labor force participation—aligning women with men—could boost the country’s gross domestic product growth (GDP) to an impressive 5%.4 Simply halving the gap would add about 3.8 million more workers to the U.S. workforce, alleviating some of the pressure from an aging population.5

It’s a good reminder of the important role women play in fostering long-term economic progress.