The historical underperformance of passive Agg-based bond funds isn’t a coincidence. The index’s very design puts investors at a disadvantage.

Passive investing often means accepting subpar performance

Index funds are designed to closely mirror the performance of a reference benchmark. But what happens if the index itself is flawed?

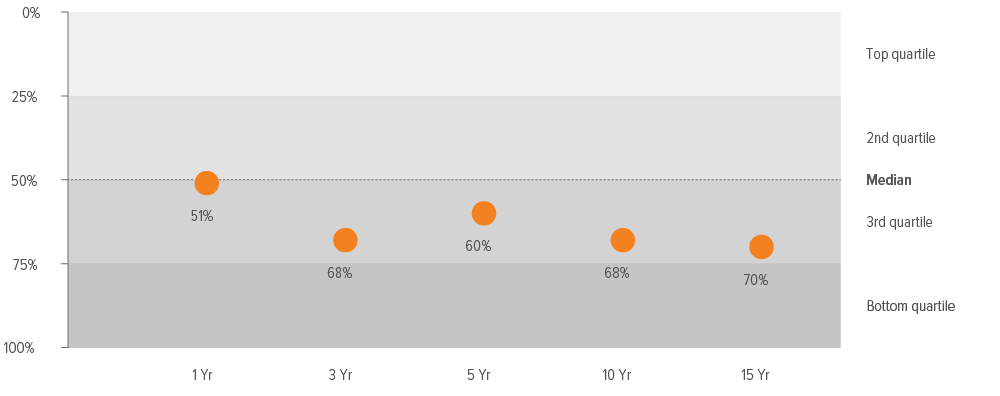

The Bloomberg U.S. Aggregate Index (Agg) gives investors a representation of the performance of the U.S. bond market, and it’s not necessarily designed to deliver an optimal return profile to investors. In fact, over the past 15 years, the Agg has consistently lagged active core and core-plus bond funds across both short- and long-term periods, falling below median (Exhibit 1). And on a three-year rolling basis since 2016, the Agg has fallen below median 73% of the time.1 In other words, if you were screening for attractive bond investments, the Agg probably wouldn’t make the cut.

As of 12/31/25. Source: Morningstar Direct. Bloomberg U.S. Aggregate Index ranking against all active funds in the intermediate core and core-plus bond categories.

3 reasons why passive bond funds fail

1 The index favors the most indebted issuers

With stock indexes like the S&P 500, weightings are often based on market capitalization. As a company succeeds and its stock price rises, it gains a larger weighting in the index. That means investors in passive equity funds tend to have higher allocations to history’s strong performers.

The Agg, by contrast, is a debt-weighted index. That means issuers with the most outstanding debt receive the largest weightings (Exhibit 2). This structure can lead to unintended risk exposures and sector concentrations that can surface at the worst possible times, such as the heavy mortgage-backed securities exposure during the global financial crisis. Passive bond strategies simply track the index, inheriting its flaws and missing opportunities to sidestep risk.

2 Limited opportunity set restricts passive funds

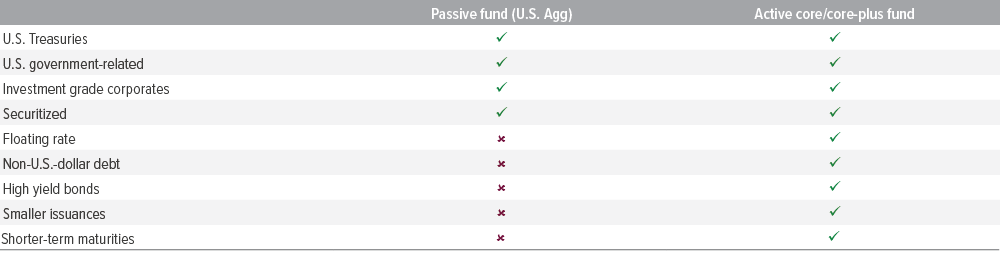

The Agg excludes entire segments of the bond market that can enhance returns and add diversification. It includes only U.S. Treasuries and government-related issues, investment grade corporate, and securitized sectors, such as mortgage- and asset-backed securities (Exhibit 3). Because passive funds must track the index, they miss opportunities such as floating-rate debt and smaller issuances. Active managers can access a broader range of sectors, giving them more flexibility to seek out pockets of value and manage risk dynamically.

Source: Voya IM. For illustration purposes only.

3 Active bond funds are already pretty cheap

Passive investing is built on the idea of delivering market-like returns at very low cost. Both equity and fixed income index strategies typically charge only a few basis points. The fee gap between active equity and active fixed income strategies is meaningful. Active core and core-plus bond funds have a median fee of 57 bp, compared with 83 bp for the large blend equity category (Exhibit 4).

As of 12/31/25. Source: Morningstar Direct. Data show expense ratio for the Morningstar U.S. large blend equity and U.S. intermediate core/ core-plus bond categories

Because the difference between fixed income active and passive fees is narrower, active bond managers have a smaller performance hurdle to clear—making the case for passive fixed income less compelling.

Active management can control risk

Active bond managers have demonstrated an ability to outperform by navigating changing market conditions, exploiting market inefficiencies, and avoiding the pitfalls of index construction. They do this by actively making decisions around:

- Sector allocation and rotation

- Security selection and credit underwriting

- Duration and yield curve management

These decisions not only add alpha, but also help insulate portfolios during periods of volatility or market stress—an advantage passive strategies cannot offer.

Bottom line

Active bond management offers meaningful advantages over passive strategies, which are constrained by index flaws, limited opportunity sets, and persistent below-median performance.

Investors may achieve more resilient fixed income results with a manager who has the flexibility to adjust risks, seek broader opportunities, and navigate changing conditions.

A note about risk: Bonds are subject to market, issuer, credit, prepayment, extension and other risks, and their values may fluctuate. Indexes are unmanaged and not available for direct investment.