The U.S. economy is entering a rolling recovery, with housing and lower-income consumers emerging as the first sectors to benefit.

Housing re-enters the chat

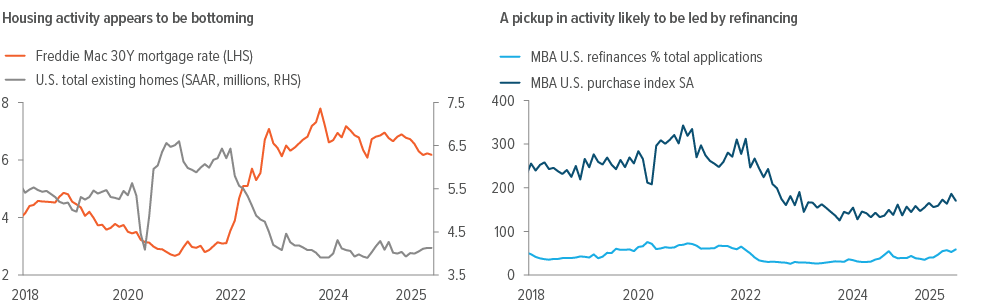

After nearly three years of suppressed activity, housing is showing early signs of recovery as mortgage rates stabilize. Recent data suggest activity is bottoming, with refinancing emerging as the initial release valve. Additionally, even modest rate stability has begun to unlock pent-up demand, particularly among existing homeowners who have delayed moving decisions. As volumes pick up, housing-related activity has the potential to ripple through consumption, construction, and household incomes—reintroducing housing as a contributor to growth.

The current housing market dynamic is one part of the rolling economic recovery that we expect to play out in 2026. Rather than a synchronized acceleration, we expect growth will advance in phases, with momentum rotating across sectors. As other parts of the economy cool or stabilize, housing activity has room to re-enter the cycle—supporting construction, home-related spending, and mobility without creating broad overheating.

Lower income consumer spending set to rise?

Another potential momentum shift is emerging at the lower end of the income spectrum, which has borne the brunt of inflation and higher borrowing costs over the past several years.

In aggregate, the U.S. consumer has remained resilient through this cycle, supported by the wealth effect from equity market appreciation and rising home values. However, higher-income households, which hold a disproportionate share of financial assets and real-estate, have been the primary beneficiaries of these gains, allowing consumption to hold up even as inflation and borrowing costs increased. As a result, consumer strength to date has been uneven, with much of the momentum concentrated at the top end of the income spectrum.

That dynamic may begin to ease. After several months of right-sizing, the slowdown in job growth should begin to plateau, limiting the downside to wage growth and supporting lower income consumers. Additionally, this year’s tax refunds are expected be abnormally large, reducing some of the pressure on spending, and allowing room for individuals to shore up their financial position.

As job growth stabilizes and larger tax refunds start hitting wallets, lower-income consumers are poised to benefit.

Looking ahead, any combination of lower rates, affordability improvements, or targeted policy support could allow lower-income consumers to re-enter the growth mix. In the context of a rolling recovery, this would represent a meaningful momentum shift, with demand broadening beyond asset-driven consumption toward segments that have lagged for much of the cycle.

Easy alpha

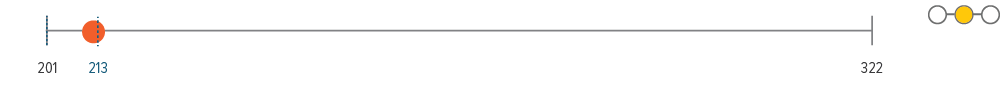

Even with a more supportive growth backdrop, the path forward for investors is unlikely to be smooth. Credit spreads remain tight, debt issuance has accelerated, and the prospect of firmer economic momentum complicates the Federal Reserve’s policy calculus. Together, these factors increase the risk of intermittent volatility, particularly in corporate credit, where valuations leave little room for error if rates, inflation expectations, or policy expectations shift.

Against that backdrop, we are maintaining a bias toward securitized credit over corporate credit and favoring shorter-duration, higher-quality assets. This positioning allows us to generate attractive income today while preserving dry powder to deploy if spreads widen. With yields still compelling across high-quality fixed income, there is no need to be hero and reach for yield in higher-volatility risk assets. In our view, the most reliable source of alpha remains yield, and patience is a virtue when markets are offering it at attractive levels.

Sector outlooks

- Overall corporate fundamentals are solid, with most companies outside of high-quality, mega-cap tech names remaining fairly conservative with leverage.

- After a reprieve in December, technicals are expected to weaken due to higher net supply (projected $800B in 2026 vs. $600B prior year), especially from tech issuers and M&A activity.

- We continue to keep IG risk low as spreads are back at historical tights, and prefer to take risk at the front end of the credit curve whre exposure to spread volatility is lower.

- Valuation and lack of upside potential continue to dampen investors’ enthusiasm for the sector, but with technical support and carry, we expect high yield to perform well in the near term.

- The magnitude of uncertainty in the market backdrop favors defensive business models and balance sheets, particularly at compressed spread levels.

- Technicals are supportive but softer than earlier in the year, with cash levels down and new issuance picking up.

- The overall carry of the senior loan sector should support performance on both a total return and excess return basis.

- Fundamentals continue to exhibit stable trends, as leverage remains well inside of recent averages, while coverage ratios have bounced off recent troughs.

- The First Brands default had a real impact on the loan market, as increased scrutiny over CLO managers has led them to become more selective and avoid “cuspy” names.

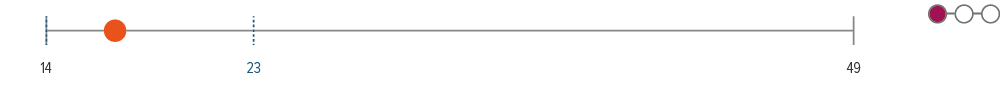

- The Administration’s announcement of GSE purchases sparked a sizable rally in spreads, however important details, including the timeline, remain outstanding.

- While follow through on purchases could provide additional support, spread levels are currently tight.

- Longer term, the fundamentals remain solid and the technical backdrop should smoothen out and benefit from lower rates.

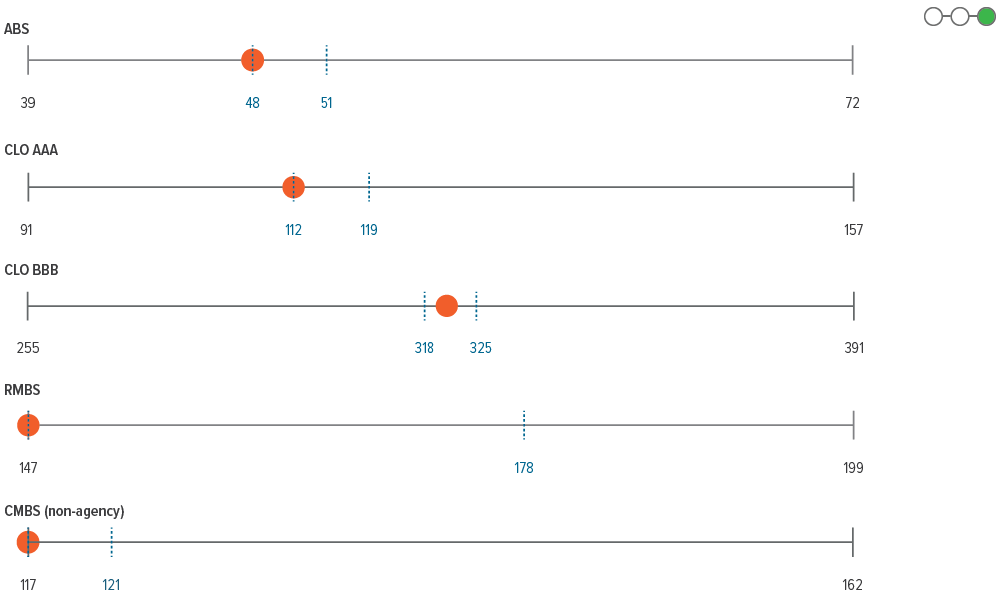

- Securitized credit continues to offer attractive relative value in the current environment.

- Consumer-oriented ABS subsectors are balancing out among income cohorts, as labor market stability and tax refunds have the potential to support lower income consumers.

- CMBS is well positioned to start the year as the new supply pipeline is considerably thinner against a backdrop of solid demand and improving fundamental outlook. That said, there are still a handful of deals that will remain under stress, regardless of the rate environment.

- Strong credit fundamentals, paired with an increase in prepayment activity continue to support RMBS.

- While investors have become more focused on credit concerns, we still view high quality CLO tranches as an attractive relative value play versus traditional corporate sectors.

- Uncertainty over U.S. trade policy and its spillover to global growth remains the key concern for emerging markets debt heading into the new year.

- The IMF estimates that EM growth is expected to decline slightly to 4% from 4.2% in 2025, with the moderation driven by China, India and Brazil.

- In hard currency, spreads are at historically tight levels, while local currency appears more attractive due to elevated real yields in certain countries.