Retirement readiness is a major challenge for many plan participants. SECURE 2.0 helps plan sponsors provide their participants with the tools and resources they need to meet this challenge. This legislation, along with its predecessor SECURE Act, provides sponsors more flexibility when it comes to offering retirement income products and services, as well as expanding access to them for participants.

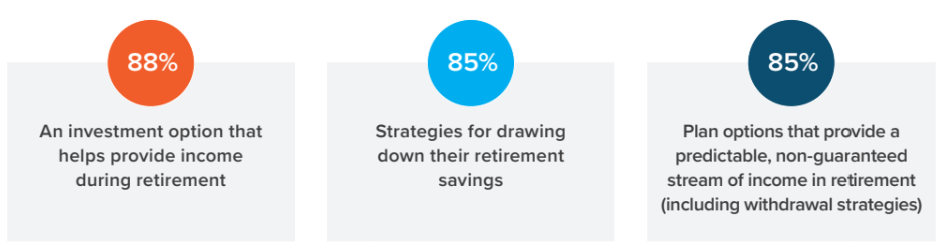

For sponsors, plan design is no longer about simply focusing only on helping participants build their savings. Assisting participants with income planning as they enter the decumulation stage is now equally important, especially because many workers lack confidence in this area. Voya IM’s recent original research shows that participants are interested in

Furthermore (and not surprisingly), 87% of participants say they agree or strongly agree with this statement: I want help converting my savings into income in retirement, so that I don’t outlive my savings.

Based on this data, it’s clear that participants need help creating a retirement income strategy—so how can sponsors set them up for success in this area?

What makes a successful retirement income strategy?

We believe a successful retirement income strategy should include two types of income:

- Flexible retirement income from withdrawals from retirement plans and other sources that have the potential to continue growing their earnings to keep up with inflation. This income should offer the flexibility to alter payment streams to accommodate changing goals and needs and isn’t guaranteed by the government, insurance companies, or employers. Of course, this flexibility means there is the potential for such accounts to decrease in value.

- Guaranteed lifetime income (similar to the paycheck participants have grown accustomed to earning over their lifetime of working) that is protected against investment risk and guaranteed to never run out for the participant (and sometimes for their spouse or beneficiary). Sources include Social Security benefits, pension plans, and fixed annuities. Guarantees in the form of longevity insurance can also be useful for those concerned about outliving their assets. An investment option that helps provide income during retirement Strategies for drawing down their retirement savings Plan options that provide a predictable, non-guaranteed stream of income in retirement (including withdrawal strategies)2

Consider adding income options through plan design

Many plans tend to fall short when it comes to providing income-generating options to retirees and pre-retirees. In our view, there is no one-size-fits-all solution to helping participants feel retirement-ready. Instead, plan sponsors may want to consider seeking a multi-faceted solution that combines recordkeeping, investments, technology, communications, and risk management.

To support participants as they transition from the accumulation to the decumulation phase of retirement, we believe plan sponsors should consider a plan design that allows:

- Systematic withdrawals to allow retirees to create an automated income stream

- An expanded investment menu for retirees or those approaching retirement that includes additional fixed income options, lower volatility equity options, and other strategies, such as managed accounts, in-plan annuities, and managed payout funds

- Intelligent withdrawal solutions that integrate a diversified multi-asset fund that balances growth and stability with a technology interface that helps retirees create automated income streams based on their needs and preferences

- A qualified default investment alternative (QDIA) into which plan sponsors can default participants over age 50 that can help support their transition from accumulation to decumulation

- Rollovers into the plan to allow retirees to consolidate their assets, simplify account management, and make it easier to calculate withdrawals and required minimum distributions

- Partial distributions to allow retirees more income flexibility

Offering these options in your DC plan may give pre-retirees and retirees reasons to keep their assets in the plan rather than taking it out in a lump sum. Older participants tend to have higher account balances and retaining those assets can help the plan manage costs and keep participant-paid expenses low.

Workers are looking to their employers for guidance in retirement planning. We believe these solutions should increase participants’ confidence in creating a realistic income strategy and improve their retirement readiness. How can plan sponsors help participants feel retirement-ready?