American workers are suffering from a decline in confidence that they will be sufficiently prepared for retirement — and they’re looking to their employers for help.

This year, Voya Investment Management’s biennial Survey of the Retirement Landscape online survey included defined contribution plan participants for the first time to better understand their perspectives on issues such as retirement readiness, investing, and financial confidence.

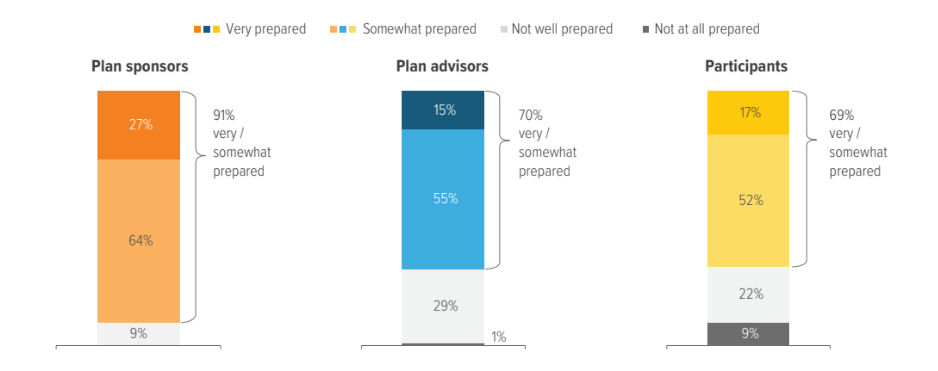

We discovered a gap between participant feelings versus plan sponsor and plan advisor perceptions when it comes to retirement readiness. Only 69% of participants said they feel very or somewhat prepared for retirement, while 91% of sponsors and 70% of advisors believe that participants fall into those two categories.

Participants are worried about generating income in retirement

Retirement income planning is a major concern for participants, as many expressed doubts about their ability to save for retirement due to inflation, the economy and not being able to save enough.

Nearly 90% of participants said they are somewhat or very interested in retirement income solutions and an investment option that helps provide income in retirement so they can maintain their current standard of living.

A retirement income solution can potentially improve participant retirement readiness

A multi-pronged plan design solution that combines recordkeeping, investments, technology, communications, and risk management may help participants feel more retirement ready.

Plan sponsors may want to consider some or all of the following features that can support participants as they transition from the accumulation to the decumulation phase of retirement.

- Systematic withdrawals to allow retirees to create an automated income stream.

- An expanded investment menu for workers nearing retirement that includes additional fixed income options, lower volatility equity options and other strategies, such as managed accounts, in-plan annuities, and managed payout funds.

- Intelligent withdrawal solutions that integrate a diversified multi-asset fund that balances growth and stability with a technology interface that helps retirees create automated income streams based on their needs and preferences.

- A qualified default investment alternative (QDIA) into which plan sponsors can default participants over age 50.

- Rollovers into the plan to allow retirees to consolidate their assets, simplify account management and make it easier to calculate withdrawals and required minimum distributions.

- Partial distributions to allow retirees more income flexibility.